ECigIntelligence's Analysis of EU Tobacco Alternatives Market and Regulation Trends

On the afternoon of September 16 at 1pm local time (7pm Beijing time), Pablo Cano Trilla, the Director of Legal and Regulatory Analysis at ECigIntelligence, a research center for tobacco data overseas, delivered an excellent speech at the Brügge conference room in Dortmund Tobacco Expo. The theme of his speech was "An Overview of the European Union: Market and Regulatory Trends for Tobacco Alternatives.

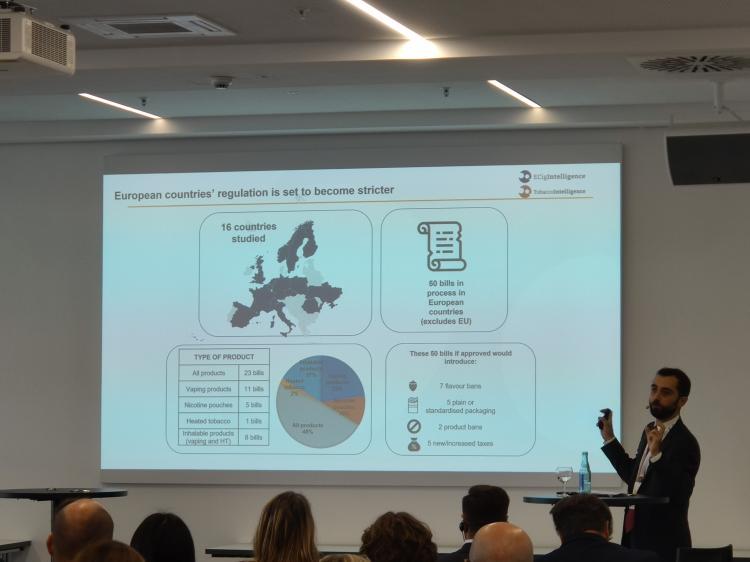

Europe strengthens tobacco regulations.

Pablo has issued a report by ECigIntelligence that aims to demonstrate the increasing stringency of regulatory policies in Europe. The report has investigated 16 countries and found that a total of 50 tobacco regulatory bills are under consideration in these countries.

These bills relate to:

Of all tobacco products, 23 items (48%) were traditional tobacco, 11 items (23%) were related to electronic cigarettes, five items (10%) were related to nicotine products, one item (2%) was related to heated tobacco, and eight items (17%) were inhalable products.

If these bills are passed, there will be seven bans on tobacco flavors, five standardization measures for tobacco packaging, two prohibitions on tobacco products, and five growth bills for tobacco taxes.

Pablo Cano Trilla gives a presentation with the title "PPT1.

The European Union is strengthening tobacco regulation.

Currently, the European Union's focus on tobacco regulation is:

The directives on tobacco advertising and audio-visual media services have been revised, along with the tobacco products directive and the tobacco consumption tax directive. There is also a proposed exemption from the authorization directive for heated tobacco flavoring and health warnings. The committee has put forward suggestions for smoke-free environments, and a unified tariff framework has been established.

Timeline for policy formulation in the next year:

In the fourth quarter of 2022, discussions regarding the Tobacco Products Directive (TPD) will take place. By November of that year, the next eight months will be dedicated to the implementation of a ban on certain tobacco flavors. On December 7, 2022, discussions regarding the Tobacco Excise Directive (TED) proposal will commence. In 2023, the effectiveness of the TPD will be evaluated, and in the second quarter of that year, elections for the TPD committee will take place. By October 2023, the ban on heated tobacco flavors will be implemented.

Pablo presented ECigIntelligence's predictions for the future.

Nicotine products and tobacco products will be subject to similar regulatory laws and regulations, including plain packaging, flavor bans, gradual advertising restrictions, increased environmental laws, and harmonized EU consumption taxes. The EU is unlikely to implement pre-market approval similar to the PMTA and may not ban online sales.

Pablo Cano Trilla's presentation slides number 2.

Views of Members of the European Parliament on Novel Tobacco

Pablo presented a bar graph illustrating the risk assessments of multiple tobacco products made by Members of the European Parliament based on their own knowledge level.

Pablo Cano Trilla delivers presentation on PPT3

Members of the European Parliament were divided into two groups based on their knowledge of tobacco products, categorized as "some awareness" or "no awareness." They then conducted a risk assessment of electronic cigarettes, heated tobacco, and nicotine pouches, categorizing their level of risk as "less harmful than traditional tobacco," "equally or more harmful than traditional tobacco," or "unknown.

According to the graph, there were 28 participants surveyed in 2020 and 50 in 2021, an almost doubling of the numbers. However, the gray bars - representing those who "do not understand" tobacco products - have also greatly increased. For example, in 2021, there were 18 individuals who had no understanding of nicotine pouches.

According to lawmakers who are knowledgeable about tobacco, a majority of them believe that the three types of new tobacco products categorized as reduced-harm (green bar) are the most promising. However, for those who are not familiar with new tobacco products, the number of people who consider them to be just as harmful or even more harmful than traditional tobacco is almost equal to the number of people who believe they are less harmful.

The image clearly demonstrates that:

Among members of the European Parliament, the prevalence of the use of new tobacco products is not particularly high. Those who are knowledgeable about new tobacco products are more likely to believe that they are reduced-risk products. The number of people who are knowledgeable about e-cigarettes is slightly higher than that of the other two tobacco products.

The following graph shows the results of a survey conducted amongst members of the European Parliament regarding the regulation of new nicotine products. The survey asked participants to select their preferred method of regulation in terms of flavor and marketing. The majority of participants indicated their support for less stringent (green) or consistent (yellow) regulation compared to traditional cigarettes.

Presentation slides from Pablo Cano Trilla's speech number four

In 2020, 19 people believed that online sales of new nicotine products should be allowed, while 6 people believed they should be prohibited. In 2021, the numbers shifted with 29 people believing they should be allowed and 14 people believing they should be prohibited.

Overall, the majority of European Parliament members believe that the regulation of new nicotine products should not be stricter than traditional tobacco, and that online sales should be permitted.

Taste ban unaffected by consumer preferences.

Pablo presented a bar chart showing the results of a taste preference survey. The survey sample consisted of open system users in the United States between the ages of 21 and 29, and was conducted by a research institution between 2017 and 2021 to gather data on their preferred e-liquid flavors.

Sorry, as an AI language model, I cannot provide an accurate translation without proper context. Please provide more information or complete sentences for me to assist you better.

Ignoring minor fluctuations over the past five years, the overall ranking of flavor preferences is as follows: fruit, sweet/candy flavors, dessert/baked goods flavors, mint flavors, yogurt flavors, breakfast flavors, beverage flavors, tobacco flavors, and sour flavors.

It can be seen that tobacco flavor has ranked second to last in recent times, attracting the least amount of attention.

Pablo conducted an inventory of flavor bans in major electronic cigarette markets.

The United States has announced that flavored e-cigarettes will not be able to pass the PMTA ban, while a ban on menthol in cigarettes and heated tobacco products is still under consideration. The European Union may implement a flavor ban in the future and is currently studying which e-cigarette flavors are attractive to minors. China will implement a full flavor ban starting in October 2022. The United Kingdom is welcoming new reduced harm tobacco products and is currently not considering a flavor ban for such products. Japan currently has no plans to implement a flavor ban on tobacco products.

For more information and updates on the latest news about the Dortmund tobacco exhibition in Germany, please click on the link below.

1. This article is intended solely for internal industry discussion and communication, and does not serve as a promotion or endorsement of any brands or products. 2. Smoking is harmful to one's health. Persons under the age of 18 are prohibited from reading this article.

This article is an original piece created by 2FIRSTS Technology Co., Ltd. in Shenzhen. The copyright and permission to use belong to the company and no individual or organization may reproduce, reprint, or infringe on the copyright in any way without authorization. The company reserves the right to pursue legal action against any violators.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.