Recently, 2FIRSTS conducted a comprehensive analysis of the European e-cigarette market, focusing on dimensions such as flavor, company, brand, e-liquid, and appearance. This analysis was based on official information from important logistics centers in Europe. By utilizing multiple perspectives, 2FIRSTS was able to gain insight into the future trends of the European e-cigarette market.

Official data released shows that in March, there were 319 new electronic cigarette products introduced in Europe. Disposable e-cigarettes accounted for over 85% of these new products, while pod-based e-liquids and cartridge-based e-liquid kits made up 9.6% and 7.2%, respectively.

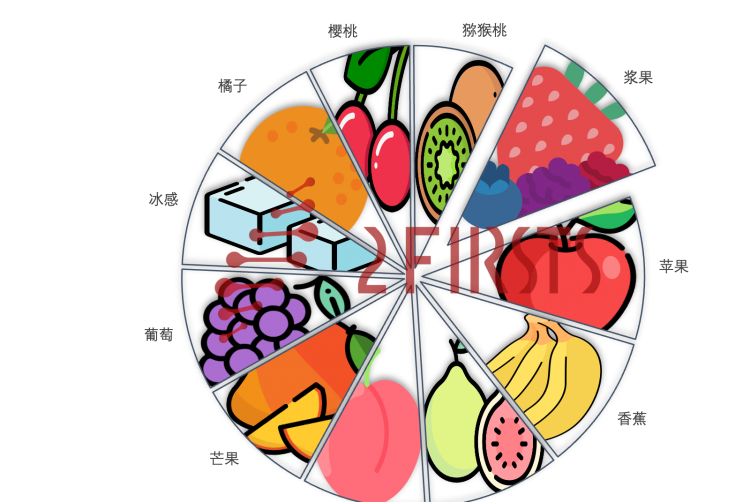

2FIRSTS has conducted an in-depth analysis of the European disposable e-cigarette market's new flavor trends from a flavor standpoint, based on this "incremental data." The data shows that the most prominent growth occurred in grape ice, watermelon ice, strawberry ice, and mango peach flavors. Mixed fruit flavors also saw an increase, including strawberry banana, strawberry, blueberry, and cherry blends, as well as kiwi passion fruit guava. Mixed berries had the largest increase, growing 10.7% year-over-year.

It is expected that by October 2023, the aforementioned flavors will become the new flavors with the highest increase in market volume in the European Bai Guan market.

Image: Distribution of mixed flavors of new electronic cigarette products in April | Data source: European Health Department whitelist, 2FIRSTS Note: The above chart only counts the number of times various flavor keywords appear simultaneously. If it is a mixed flavor of three flavors, it will be counted once in each of the two flavors.

Furthermore, there has been a significant increase in flavors such as pineapple, banana, guava, peach, mango, and grape, all with growth rates exceeding 8%. (Note: This increase refers to all flavors containing the respective fruit, including mixed fruit flavors.)

Incremental Contribution Ratio | Image source: 2FIRSTS exclusive compilation. The chart is derived from the free website http://www.flaticon.com.

2FIRSTS will continue to report on research and analysis of the European e-cigarette market. Stay tuned for updates.

The data and images in this article were compiled by 2FIRSTS based on the e-cigarette whitelist published by Belgium. Belgium is an important logistics hub in Europe, with Brussels Airport being a key port for Chinese e-cigarettes to set sail. Additionally, Belgium has established a free trade zone called Benelux with the Netherlands and Luxembourg, allowing for free flow of goods within the trade zone. Belgium requires all imported and manufactured products to be registered and recorded on their "whitelist" six months before being placed on the market. This whitelist is published by the Federal Public Service of Health, Environment and Food Chain Safety in Belgium (FPS Public Health).

Further reading:

According to a market research by 2FIRSTS, narrowing of electronic cigarette flavors is an inevitable trend as the market moves towards further segmentation.

2FIRSTS Market Research: Only Accepting White Labels and Forced Transformation - How is the Russian E-Cigarette Market Doing Under Strong Regulatory Signals?

What impact has the "e-liquid exceeding standards" incident had on the electronic cigarette distributors in Manchester, UK?

2FIRSTS recently interviewed the electronic cigarette brand Fume, which claims to be the first in Florida. The company is currently developing a new hybrid flavor.

A survey conducted by 2FIRSTS on the appearance of electronic cigarettes in Europe found that black, blue, and red are the most popular colors, while green and pink are experiencing the fastest growth.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.