At 11 o'clock on the afternoon of April 5th, the organizers of the Spanish new tobacco exhibition EVO NXT held a forum on the European Union's nicotine pouch market analysis at the exhibition venue.

The main speakers at this forum are CEO Jonas Lundqvist of the Nordic Nicotine Pouches Alliance (NNPA.EU) and editor-in-chief Robert Casinge of pouchforum.eu.

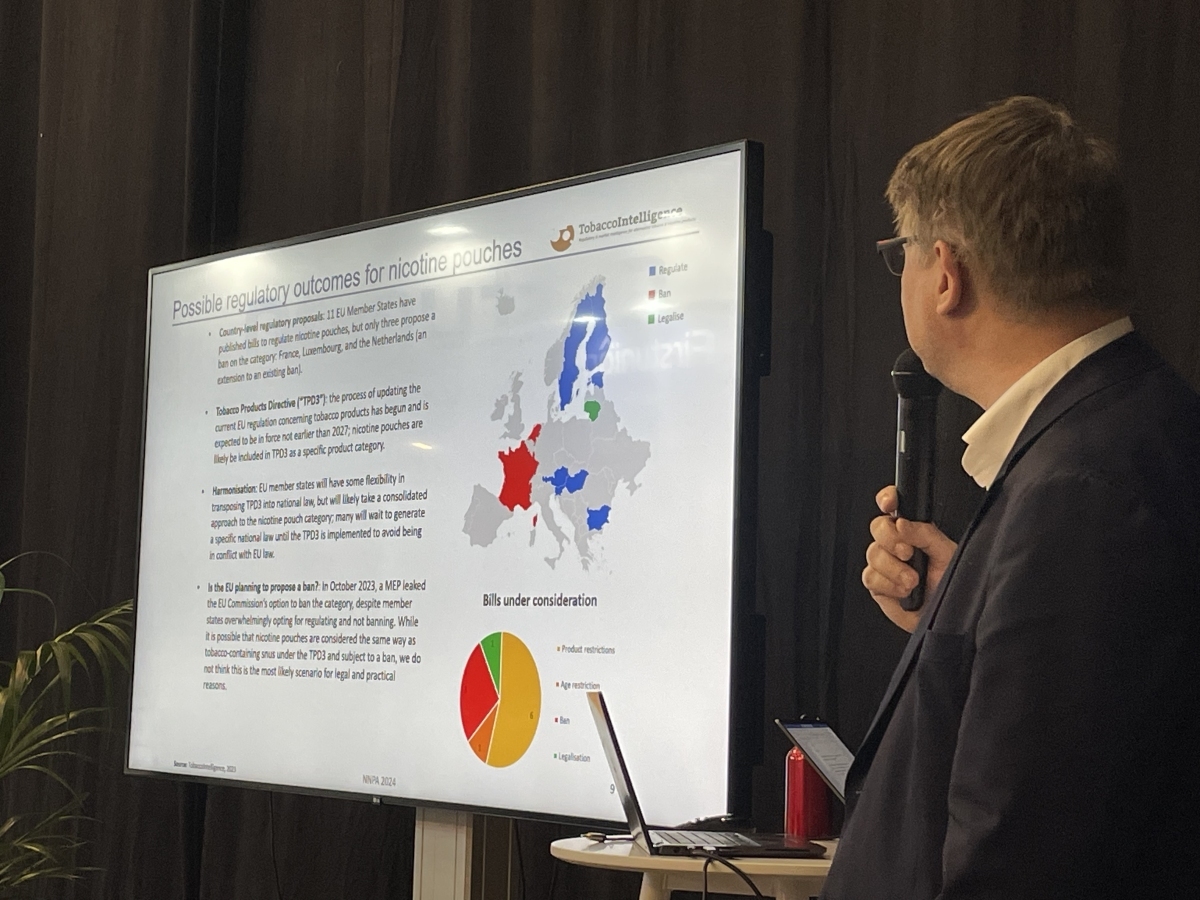

Henry Kissinger pointed out that the attitudes of EU member states towards nicotine pouches vary, but the overall trend is towards regulation rather than prohibition. Currently, 11 EU member states have announced legislation to regulate nicotine pouches, but only France, Luxembourg, and the Netherlands have opted for a ban. The update to the EU Tobacco Products Directive (TPD3) is underway and is expected to come into effect in 2027, with nicotine pouches potentially being included.

European Union member states have some flexibility in transposing the TPD3 into national law, so the regulation of nicotine pouches may vary. It is expected that many countries will wait until TPD3 is implemented before creating specific national laws to avoid conflicts with EU law.

Although the European Commission is inclined to ban nicotine pouches, according to TPD3, nicotine pouches may also be considered in the same manner as tobacco snuff and subject to restrictions. It is expected that the majority of countries will choose to regulate rather than ban them.

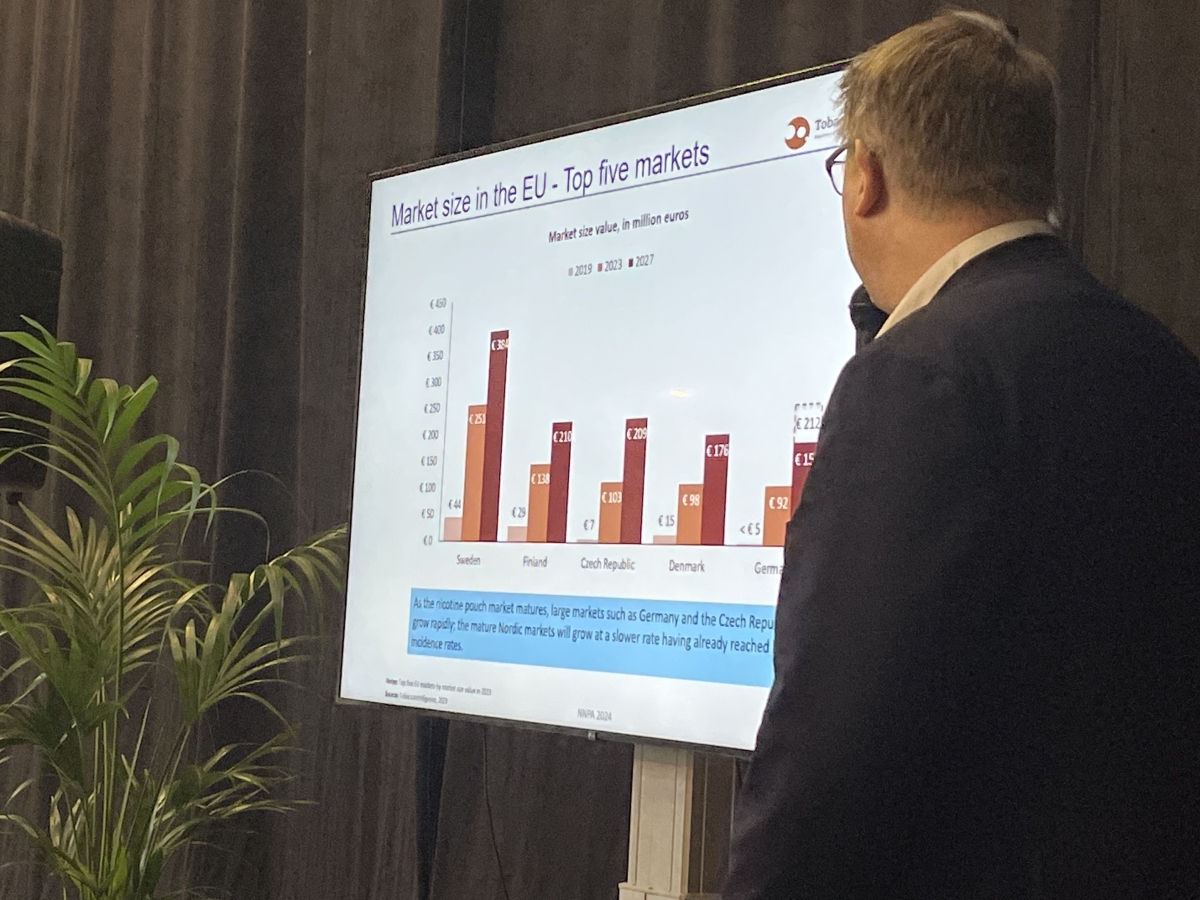

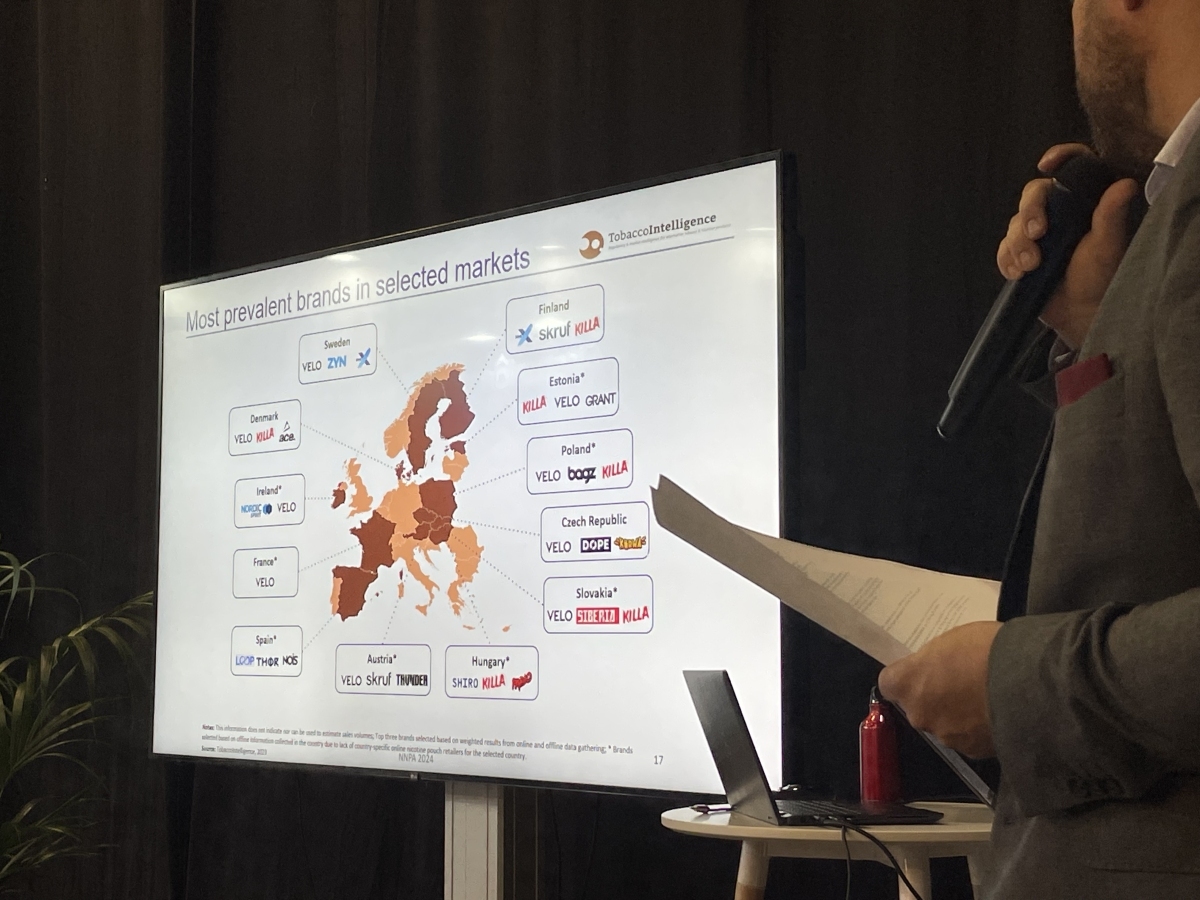

The EU nicotine pouch market is enormous, with the top five markets being Sweden, Finland, Czech Republic, Denmark, and Germany. However, the most popular brands vary across different markets, for example in Sweden Velo and Zyn are popular, in Finland Skruf and Killa are popular, in Czech Republic Velo and Dope are popular, in Denmark Velo, Killa, and Ace are popular, in Spain Nos, Thor, and Loop are popular, and in Austria Velo, Skruf, and Lyft are popular.

As the nicotine pouch market matures, large markets like Germany and the Czech Republic are growing rapidly, while mature markets in Northern Europe will grow at a more stable pace.

The trends in nicotine pouch products include new intake forms, such as gum and film, as well as new packaging and taste experiences.

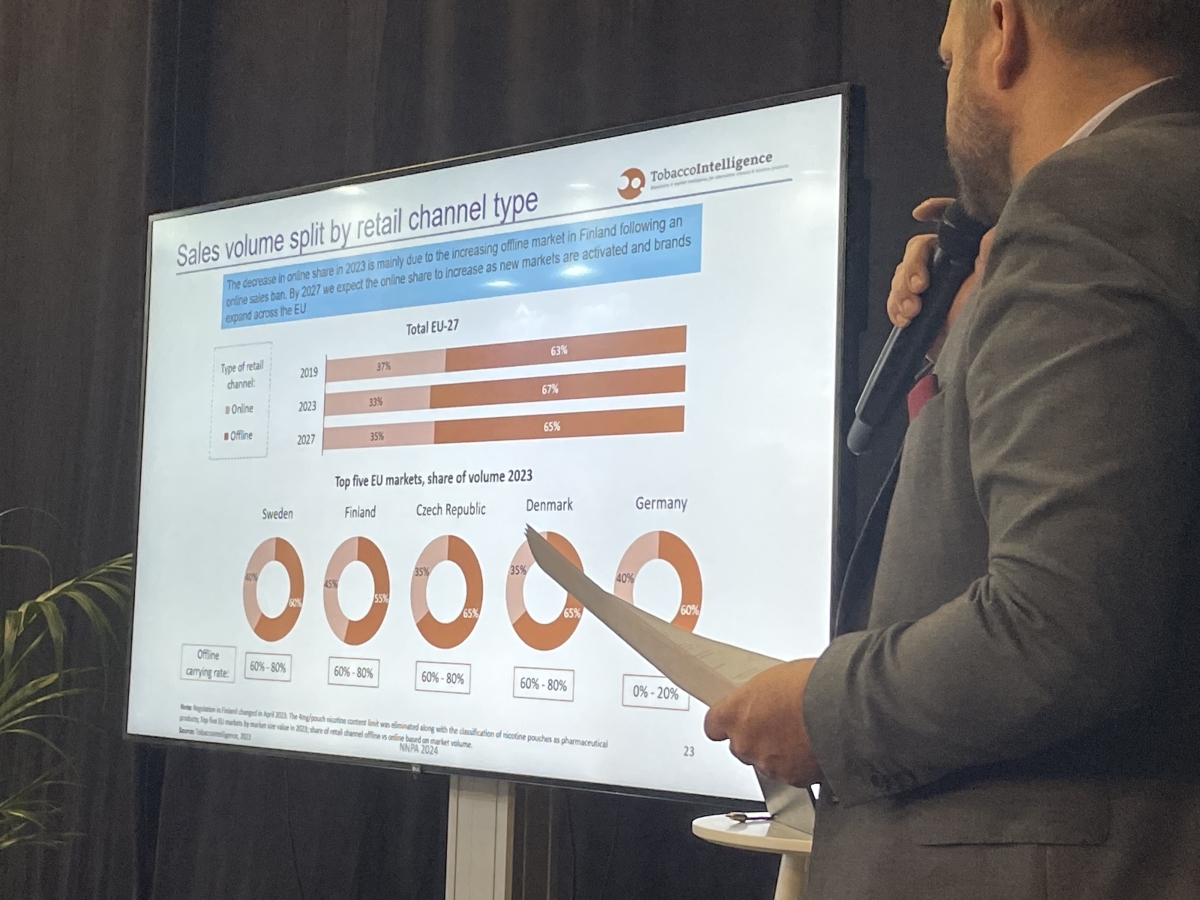

In terms of sales channels, the proportion between online and traditional channels is approximately 1:2.

Outside of the Nordic countries, countries with large populations and high smoking rates, such as Poland, France, and Spain, have seen the fastest growth in the use of nicotine pouches.

In 2023, the EU's share of online nicotine pouch sales declined, mainly due to Finland imposing a ban on online sales. It is expected that by 2027, with the emergence of new markets and the expansion of brands in the EU, the online market share will increase once again.

Kissinger concluded that although nicotine pouches are an important alternative to traditional tobacco products with better economic benefits and lower prices (except in the Czech Republic), they face strong regulatory threats. Currently, most supporters are from the public and expert levels, while governments in the European Union still hold negative attitudes at the policy-making level, calling for bans or strict regulation.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com