2FIRSTS conducted an in-depth analysis of the European e-cigarette market, focusing on various aspects such as flavors, companies, brands, e-liquids, and appearance, based on the official data from major European logistics hubs. The study aimed to gain insights into the emerging trends in the European e-cigarette market from multiple perspectives.

According to the official data, there were 319 new e-cigarette products introduced in Europe in March, with disposable e-cigarettes accounting for over 85% of the total. Refillable e-liquid cartridges and e-cigarette device-liquid sets accounted for 9.6% and 7.2%, respectively.

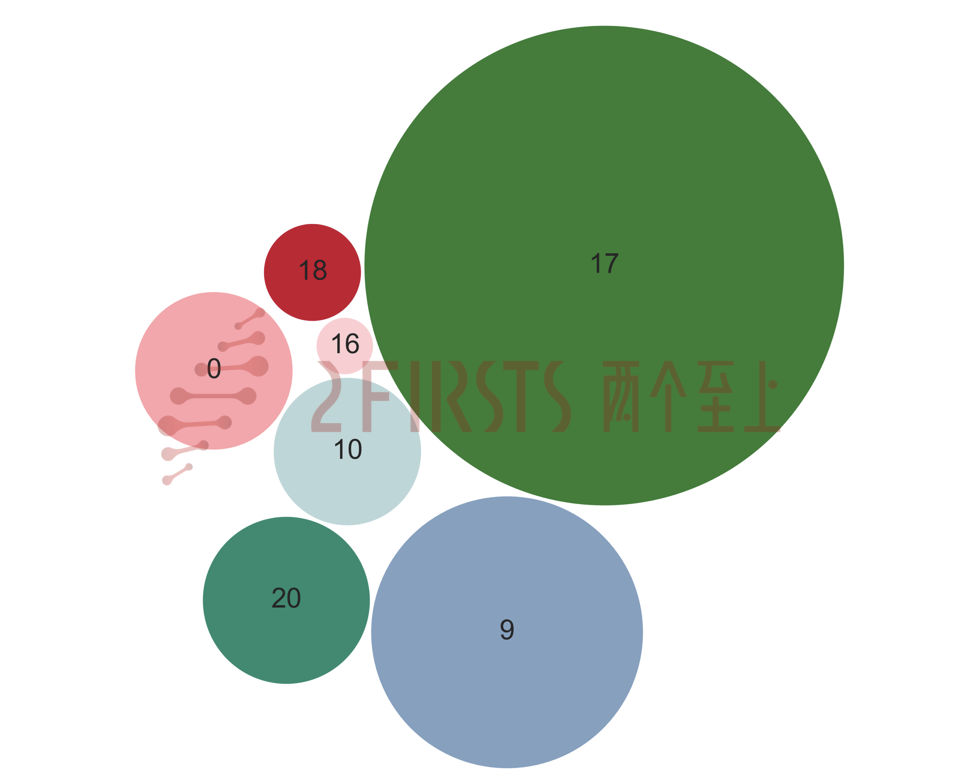

Based on this "incremental data," 2FIRSTS deeply analyzed the nicotine content trends of the newly added disposable e-cigarettes in the European market from the perspective of "nicotine content." The data results show that the 20mg/ml category still had the highest increase in March. The highest growth rate was observed in the 17mg/ml category, with a year-on-year increase of 75%, largely contributed by Heaven Gifts (ELFBAR) and JOYETECH. The 9mg/ml category saw a year-on-year growth of 24%, mainly driven by JOYETECH.

2FIRSTS analyzed the reasons for the highest growth rate in the 17mg/ml category. The non-compliance of e-liquid content in the UK is likely to impact other European countries, leading to stricter e-cigarette testing in Europe. Therefore, e-cigarette products using 20mg/ml e-liquids under the 2ml content regulation face a dilemma between complying with volume and nicotine content.

As a result, e-cigarette companies must choose e-liquid specifications with lower nicotine concentrations, such as 17mg/ml, to avoid non-compliance issues while adhering to regulations and ensuring a good product experience.

2FIRSTS will continue to report on the European e-cigarette market research and analysis, so stay tuned.

Also read:

China Customs Data: E-cig Export Soars 96% YoY

Fruit-flavored Vapes Dominate EU Market

450 Brands White-listed in Belgium, Reflecting EU Market Landscape

All data and images in this article are derived from the e-cigarette whitelist published by Belgium. Belgium is an important logistics hub in Europe, and its Brussels airport is a crucial air gateway for Chinese e-cigarettes. Belgium, along with Luxembourg and the Netherlands, has established the Benelux free trade area, allowing goods to circulate freely within the trade zone. Belgium requires all imported and manufactured products to be registered and recorded in the Belgian "whitelist" six months before they go on the market. The whitelist is published by the Belgian Federal Public Service for Health, Food Chain Safety, and Environment (FPS Public Health).

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.