Disclaimer

• This article is intended for industry researchers only.

• The content of this article is solely for industry research purposes; references to manufacturers, brands, and products mentioned herein do not constitute any form of advertisement or promotion.

• The views expressed in this article are solely those of the interviewee.

In 2024, IQOS celebrated its 10th anniversary, marking a new chapter in the global development of heated tobacco products. Beyond Philip Morris International (PMI), other international tobacco giants, the China National Tobacco Corporation (CNTC), and China’s NGP(Next-Generation Products.) supply chain have also intensified their focus on this sector. As a result, 2025 is poised to become a landmark year for the global growth of next-generation tobacco products.

What trends will shape the future of next-generation tobacco globally? What opportunities and challenges lie ahead? To address these questions, 2Firsts engaged with Euromonitor International, a globally renowned market research firm. Representing the organization, Senior Consultant Raphael Moreau shared Euromonitor International’s insights with 2Firsts.

Key Insights and Analysis from Raphael Moreau:

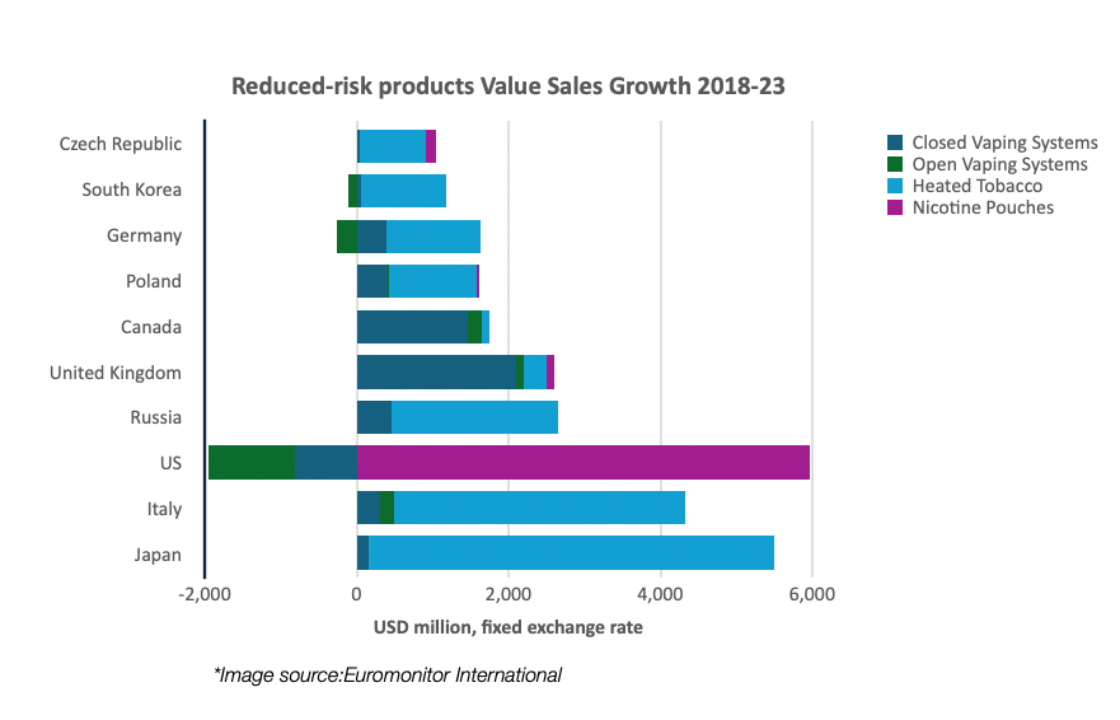

• Global: Heated tobacco products have rapidly overtaken e-vapour products in value sales. In 2023, global sales of heated tobacco reached $34.5 billion, a significant increase from $29.6 billion in 2022.

• United States: IQOS is expected to achieve nationwide availability by the second half of 2025. This development positions the U.S. as a major driver of global growth in heated tobacco sales.

• Europe: Regulatory policies are accelerating the emergence of alternative products, such as tobacco-free heated tobacco sticks. Companies are leveraging diversified product portfolios to continuously meet consumer demands.

• Asia: Asia remains the cornerstone of innovation in heated tobacco products. Innovations in device features and stick flavors have not only enriched the consumer experience but also driven robust market performance.

• Competitive Landscape: PMI’s IQOS retains its leadership position; however, new entrants like Japan Tobacco International (JTI) are challenging IQOS’s dominance through strategies such as competitive pricing.

• Growth: In developed markets, growth is primarily driven by health-conscious consumers adopting reduced-risk alternatives. In emerging markets, growth benefits from improved accessibility due to localized production and strategic distribution initiatives.

• Regulation: Rising taxes and regulatory challenges pose significant obstacles to the future development of heated tobacco products. Companies must balance strategic innovation with regulatory compliance to achieve sustainable growth.

IQOS: Redefining the Heated Tobacco Market

As IQOS celebrates its 10th year, it stands as a revolutionary player in the reduced-risk product category. With global sales reaching billions and a strong foothold in Europe and Asia, IQOS has reshaped smoking habits. Yet, its success is tempered by complex regulations and intensifying competition.

"Heated tobacco products have rapidly overtaken e-vapour products in value sales," says Raphael Moreau, Senior Consultant at Euromonitor International. "In 2023, global sales of heated tobacco reached USD 34.5 billion, up from USD 29.6 billion in 2022." IQOS, as the dominant player, has significantly contributed to this growth, offering an alternative to traditional cigarettes.

Regional Dynamics: Successes and Challenges

(1) United States: Overcoming Delays, Unlocking Opportunities

The U.S. stands as a distinctive outlier among developed nations due to its limited adoption of heated tobacco products. This absence has been largely attributed to a prolonged patent dispute between British American Tobacco (BAT) and Philip Morris International (PMI), which stalled IQOS’s commercialization until 2024.

“With the dispute between the two companies resolved in February 2024, the path has been cleared for IQOS to enter the U.S. market, pending full FDA approval,” explains Raphael Moreau, Senior Consultant at Euromonitor International. “Following test launches in select cities later this year, IQOS devices are expected to achieve nationwide availability by the second half of 2025, potentially positioning the U.S. as a major driver of global growth in heated tobacco sales.”

This resolution not only ends years of delay but also signals a turning point for PMI. The U.S. market, with its untapped potential, offers a strategic opportunity to elevate global adoption of innovative tobacco alternatives. As awareness of reduced-risk products grows, IQOS has the potential to set a new benchmark for the industry, solidifying its leadership in a critical market while driving worldwide expansion.

(2) Europe: Robust Adoption Amid Evolving Regulations

In contrast to the U.S., Europe has embraced heated tobacco products with notable enthusiasm. According to Raphael Moreau, Senior Consultant at Euromonitor International, “heated tobacco has been widely adopted by consumers, particularly in Germany, Italy, and Poland.” These markets have emerged as key drivers of the category's success in the region.

Yet, regulatory challenges are reshaping the landscape. The European Union’s ban on flavored heated tobacco sticks, which took effect in late 2023, could hinder further growth. Moreau highlights the significance of this policy shift: “This ban may dampen growth in the category, especially in markets where flavored products have been central to consumer appeal.”

To navigate these restrictions, companies are pivoting towards alternative offerings. PMI’s introduction of Levia, a tobacco-free heated tobacco stick, represents a notable example of adaptability. First launched in the Czech Republic in 2024, Levia has since expanded to major markets, including Germany. Moreau underscores the potential impact of these innovations: “The emergence of tobacco-free heated tobacco stick variants, such as PMI’s Levia, may help sustain growth momentum despite regulatory headwinds.”

This adaptability highlights the resilience of the heated tobacco industry in Europe. While regulatory shifts present undeniable hurdles, the ongoing evolution of product portfolios demonstrates a clear commitment to meeting consumer demand and sustaining the category’s trajectory.

(3) Asia: A Global Innovation Powerhouse

Asia has established itself as a cornerstone of innovation for heated tobacco products, spearheaded by dynamic markets such as Japan and South Korea. Japan, the Pioneering market of IQOS with its debut in Nagoya a decade ago, continues to be an epicenter for groundbreaking developments in this category.

In early 2024, PMI unveiled its IQOS Iluma i in Japan, incorporating advanced features such as a touchscreen interface and a pause function, further enhancing the product's appeal. According to Raphael Moreau, Senior Consultant at Euromonitor International, "Asia serves as a hotbed for innovation, particularly in device features and stick flavors. These advancements are pivotal in sustaining strong consumer engagement." The launch of unique flavor profiles, such as PMI’s TEREA Oasis Pearl for IQOS, further underscores Japan’s role as a strategic testbed, with the flavor seeing widespread adoption and bolstering sales upon its nationwide release.

Innovation has not only enriched consumer experiences but also fueled robust market performance. Moreau highlights, “Strong innovation strategies in Japan and South Korea drove double-digit growth in value sales across both markets in 2023.” This growth trajectory underscores the region's unparalleled ability to blend cutting-edge technology with localized consumer preferences, solidifying Asia’s prominence as a global leader in the heated tobacco industry.

By leveraging its innovation-driven momentum, Asia is poised to continue shaping the future of heated tobacco products, both regionally and globally, demonstrating the transformative power of aligning technological advances with market-specific insights.

Heated Tobacco’s Power Struggle: Leadership, New Players, and the Pricing Game

The global heated tobacco market remains a battleground of innovation and competition, with Philip Morris International (PMI) maintaining its leadership position despite intensifying challenges from both established and emerging players.

“PMI has retained its global dominance in heated tobacco with the IQOS ecosystem through the Heets and TEREA brands, capturing a 71% volume share in 2023,” noted Raphael Moreau, Senior Consultant at Euromonitor International. However, he acknowledged that the company faces mounting competition, particularly from British American Tobacco (BAT) and its Glo brand.

PMI’s branding strategy has been instrumental in reinforcing its premium market positioning. Moreau highlighted the company’s innovative retail initiatives: “PMI has strengthened its premium image by opening dedicated stores in prime locations. Their minimalist design echoes the ethos of Apple stores, aligning seamlessly with the sleek aesthetics of IQOS devices.”

Meanwhile, Japan Tobacco Inc. (JTI) is gaining traction. “In Japan, JTI has carved out a significant presence in heated tobacco, ranking second with a 13% market share in 2023, driven by its Mevius sticks for the Ploom devices,” Moreau said. Building on this domestic success, JTI has expanded into European markets with the launch of the Ploom X Advanced in 2024.

JTI’s aggressive marketing and pricing strategies have accelerated its growth. “High-profile marketing at points of purchase and heavy discounting have helped JTI challenge PMI’s dominance,” Moreau explained. The Ploom X Advanced debuted at under JPY1,000 (USD7) in Japan and GBP19 (USD25) in the UK, underscoring JTI’s commitment to capturing market share through competitive pricing.

As the competitive landscape intensifies, pricing wars are becoming a defining characteristic of the industry. Moreau pointed out that “aggressive pricing is a key factor, especially during new product launches,” signaling a shift toward affordability as companies aim to expand their consumer base.

Balancing Growth and Regulation: The Future of Heated Tobacco

Despite the fierce competition and pricing pressures, the heated tobacco market remains poised for robust growth. Moreau projects a compound annual growth rate (CAGR) of 11% from 2023 to 2028, attributing this to the category’s widening appeal in developed markets and its increasing availability in emerging regions.

“Growth in developed markets is driven by the growing adoption of reduced-risk alternatives among health-conscious consumers,” Moreau explained. “Simultaneously, emerging markets are seeing improved accessibility, thanks to localized production and strategic distribution initiatives.”

However, the road ahead is not without hurdles. Rising taxes and regulatory challenges loom large. “The industry faces mounting pressures, including higher duties and restrictive legislative measures,” Moreau warned. He highlighted the EU’s flavored heated tobacco ban, implemented in late 2023, as a significant regulatory shift that could dampen category growth in key markets.

To navigate these obstacles, companies must focus on innovation and adaptability. As Moreau emphasized, “The ability to innovate—whether through new product formats, device features, or flavor variants—will be critical for sustaining growth and overcoming regulatory headwinds.”

By balancing strategic innovation with regulatory compliance, the heated tobacco industry has the potential to chart a path of sustained expansion, meeting evolving consumer demands while addressing the complexities of a changing regulatory environment.

————————————————————————

About Euromonitor International:

Euromonitor International leads the world in data analytics and research into markets, industries, economies and consumers. We provide truly global insight and data on thousands of products and services to help our clients maximise opportunities, and we are the first destination for organisations seeking growth. With our guidance, our clients can make bold, strategic decisions with confidence. We have 16 offices around the world, with 1000+ analysts covering 210 countries and 99.9% of the world's consumers, and use the latest data science and market research techniques to help our clients to make sense of global markets.

————————————————————————————————————

2Firsts welcomes additional information or comments. Please contact us at info@2firsts.com or connect with 2Firsts CEO Alan Zhao on LinkedIn.

Cover image source: IQOS official website