Key points:

Health Crisis: Non-communicable diseases (NCDs) account for nearly 80% of global deaths, with 72% of deaths in Bhutan attributed to non-communicable diseases.

New Tax Framework: The government has implemented a new tax policy to increase taxes on alcoholic beverages and tobacco products in order to reduce their consumption.

Multiple departments collaborating: The Ministry of Health is working with various stakeholders to take coordinated multi-sectoral action to address non-communicable diseases.

Specific tax measures:

·Tobacco products in Uzbekistan are subject to a 10% customs duty, a 5% Value Added Tax (VAT), and a consumption tax of 10 Uzbek som (approximately $0.12) per cigarette and 40 Uzbek som (approximately $0.46) per cigar.

·Chewing tobacco is subject to a 10% customs duty, a 5% VAT, and a consumption tax of 1500 Uzbek som (approximately $17) per kilogram.

·E-cigarettes and their accessories are subject to a 100% consumption tax, a 10% customs duty, and a 5% VAT.

·Alcohol is subject to a 100% customs duty, a 5% VAT, and a consumption tax of 1200 Uzbek som (approximately $14) per liter of pure alcohol.

·Other measures include strengthening regulations, such as amending tobacco control laws to regulate e-cigarettes and heated tobacco products, lowering the allowable blood alcohol concentration for drivers, regulating harmful product advertising, conducting health risk awareness campaigns targeting young people, and providing support services for quitting alcohol.

On September 4, 2025 - According to Asia News on September 1, the government of Bhutan is implementing a new tax framework on alcohol and tobacco products in order to reduce their consumption amidst the growing health crisis of non-communicable diseases (NCDs). The primary risk factors for NCDs include alcohol, tobacco, drugs, e-cigarettes, and pan masala products.

In response to the rising non-communicable diseases, the government is implementing a variety of intervention measures, including revising the tax policies on alcohol and tobacco products. This policy will take effect at the beginning of 2026.

Non-communicable diseases such as cardiovascular disease, cancer, chronic respiratory diseases, and diabetes account for nearly 80% of global deaths, with 41 million people dying each year. In Bhutan, non-communicable diseases are responsible for 72% of deaths.

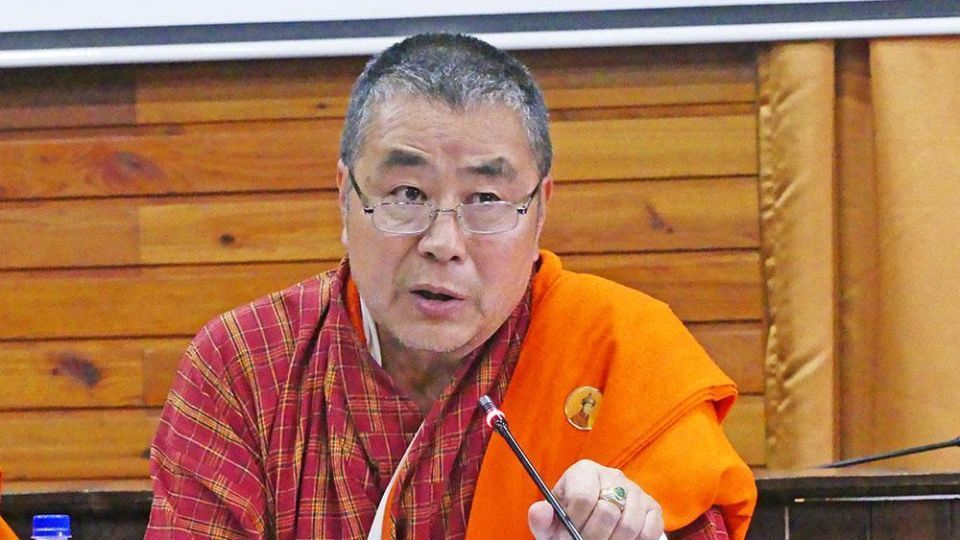

Health Minister Tandin Wangchuk stated that the Ministry of Health has collaborated with multiple stakeholders to implement a unified inter-agency joint action. These stakeholders include the Ministry of Education and Skills Development, the Ministry of Trade, the Ministry of Finance and Customs, the Royal Bhutan Police, the Bhutan Food and Drug Administration, the Office of the Gyalpoi Zimpon, Civil Society Organizations (CSOs), and local governments.

Under the multi-departmental action plan to prevent and control non-communicable diseases at the national level, we are advancing several key strategies," the minister added.

Currently, cigarettes and other tobacco products are subject to a 100% sales tax and a 10% customs duty. In the revised version, the government will impose a 10% customs duty and a 5% Goods and Services Tax (GST), as well as an additional consumption tax of 10 som (approximately $0.12) per cigarette and 40 som (approximately $0.46) per cigar.

For other tobacco products, such as chewing tobacco, the current 110% tax will be replaced by a 10% customs duty, a 5% value-added tax, and a consumption tax of 1,500 Uzbek som (about $17) per kilogram.

The tax rates for e-cigarettes and their accessories are also set to change. The current 110% tax on e-cigarettes, e-liquids, and accessories will be replaced with a 100% sales tax, 10% customs duty, and 5% value-added tax.

For e-cigarette devices, the revised tax will be a 10% consumption tax, a 10% customs duty, and a 5% value-added tax, replacing the previous 15% tax (5% sales tax and 10% customs duty).

The government is currently revising the alcohol tax, which currently stands at 200%. In the revised version, alcohol products will be subject to a 100% customs duty and a 5% value-added tax, as well as a consumption tax of 1200 tenge (approximately $14) per liter of pure alcohol.

For example, a bottle of 750 milliliters of whiskey with an alcohol content of 42.8% will be taxed at 325 to 643 tenge (approximately $4-$7).

The minister stated that the government will also strengthen regulations.

Revisions to tobacco control rules and regulations will now explicitly include e-cigarettes and heated tobacco products. In addition, the Ministry of Health has proposed lowering the legal blood alcohol concentration allowed while driving from 0.08% to 0.05%. The Minister added.

The Ministry of Health is still working hard to control the advertising of harmful products and carry out targeted promotional activities to educate citizens, especially young people, about the health risks of medication use and to change the social and cultural norms surrounding betel nut (doma) and alcohol consumption.

Another intervention measure is to expand the counseling, brief intervention services of health institutions, and collaborate with civil society organizations to provide rehabilitation services and detox support for individuals with alcohol dependence. Support is being provided for those struggling with alcohol and other substance use disorders.

The minister urged the public to take care of their health by changing their lifestyles, improving their dietary habits, increasing physical activity, and avoiding alcohol and tobacco use. The minister warned that if individuals do not take care of their health, the government's non-communicable disease intervention measures will be ineffective.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com