Key Points

- Despite regulations and competition, the global nicotine market remained strong in 2024, with 3.5 trillion legal units consumed worldwide (excluding China) and a total value of about $582 billion.

- Cigarette use is slowly declining, while vaping, nicotine pouches and heated tobacco products are growing, with RRP users increasing by 8.7% during the review period.

- By 2029, nicotine pouches are projected to account for 10% to 15% of total equivalent nicotine consumption in the U.S. market.

- Major trends include reduced public visibility of nicotine use; market polarization; greater adoption of alternative nicotine formats; intensifying regulatory pressures; growth of illicit trade in tightly regulated markets; and expansion beyond nicotine, including herbal, cannabinoid and synthetic stimulant products.

- Economic factors are encouraging multiple product use and price-sensitive choices, while interest in functional benefits (stress relief, cognitive enhancement) is growing.

- The industry is expected to stay adaptive and innovative, balancing regulation and competition while exploring new delivery methods and product categories to maintain consumer appeal.

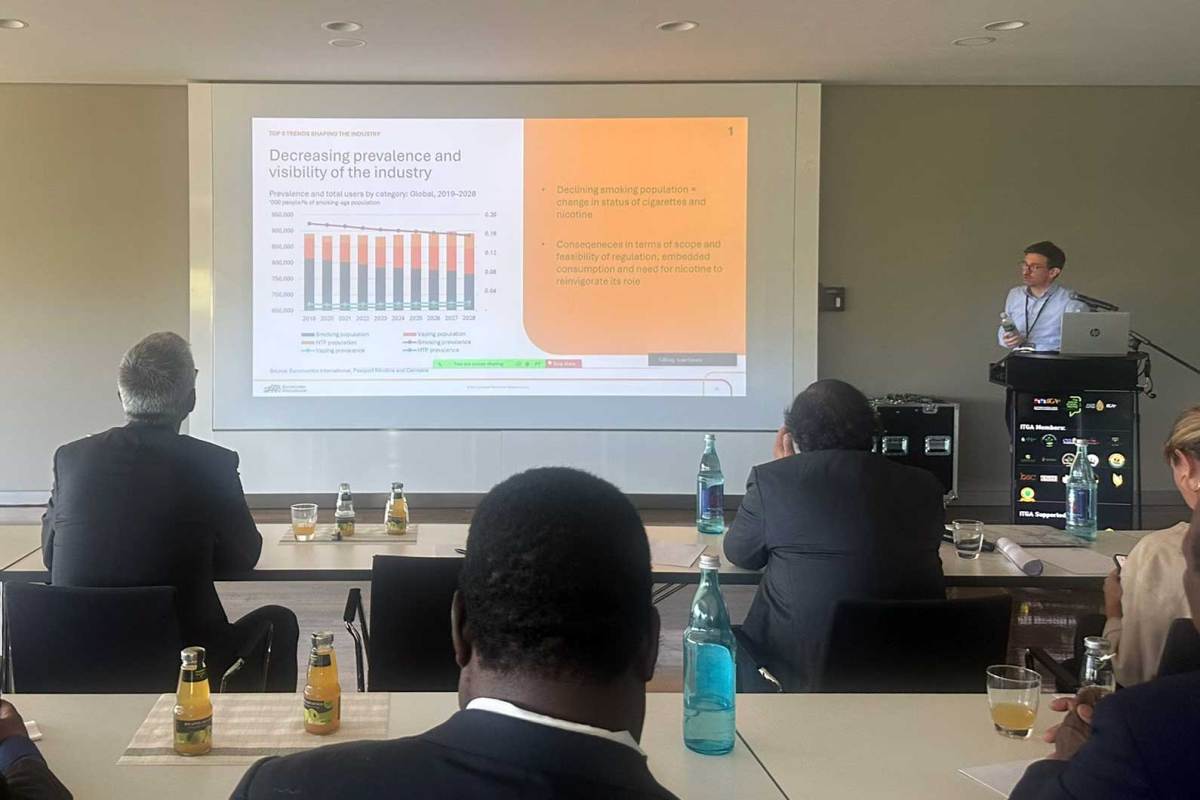

2Firsts, September 29, 2025 (By Taco Tuinstra) — Despite numerous regulatory and competitive challenges, the global nicotine business remains remarkably resilient, according to Euromonitor International. In a presentation during the International Tobacco Growers Association’s annual general meeting on Sept. 19 in Dortmund, Germany, Shane MacGuill, Euromonitor’s global lead for tobacco and cannabis, highlighted key trends and examined the outlook for both combustible cigarettes and next-generation products.

State of the Industry

Total worldwide legal nicotine consumption, excluding China, reached 3.5 trillion units in 2024, with cigarettes dominating at 2.7 trillion sticks but steadily declining. Notably, reduced risk products (RRPs) such as vaping devices, nicotine pouches and heated tobacco products have been gaining ground, though cigarettes retain a dominant share at more than three out of four legal nicotine units. The industry’s overall value stood at $508 billion for cigarettes and $74 billion for RRPs in 2024. While the number of smokers decreased by 1.6 percent during the review period, the number RRP population jumped by 8.7 percent, according to Euromonitor. Going forward, the market intelligence company expects cigarette volumes to continue shrinking as RRPs gain prominence.

Five Trends Shaping Nicotine

In his presentation, MacGuill identified five trends in the global nicotine business:

1. Declining prevalence and visibility: Smoking rates are dropping globally, and visibility of nicotine use is diminishing due to tighter regulations and shifting societal norms. Measures such as Milan’s ban on outdoor smoking illustrate this shift, pushing consumption out of public view and reinforcing negative perceptions of smoking.

2. Consumption polarization: Value disparities are widening within nicotine categories. Economy brands are capturing substantial market share as price remains a top concern for consumers, fueling a move towards poly-usage and “downtrading,” especially during economic uncertainty.

3. Alternative consumption methods: The landscape is expanding with more consumers adopting alternative nicotine products. Innovations in flavors and delivery forms drive this shift, especially in markets like the U.S., where nicotine pouches could constitute between 10% and 15% of all equivalent volume by 2029.

4. Regulatory pressures: Legislation continues to shape the industry, with future regulation likely to address product characteristics, sustainability and compliance. Enforcement is increasingly critical, as law-abiding face fierce competition from illicit operators. In Australia, which has the world’s most expensive cigarettes and one of its strictest regulatory frameworks, illegal tobacco products now account for an outsized share of the market, according to MacGuill.

5. Beyond nicotine: Demand for function-driven products and novel stimulants is rising. Major companies are exploring herbal remedies, cannabinoid-infused products and synthetic analogues, reflecting consumer interest in stress relief, cognitive enhancement and tailored health solutions. In the United States, cannabis use will soon be more likely among consumers than cigarette smoking, MacGuill noted.

Future Outlook

Nicotine’s appeal is being reimagined functionally, with a focus on delivery, flavor and consumer needs. Regulatory, competitive and consumer forces will continue to diverge, while economic factors encourage downtrading and multiple product usage, according to Euromonitor. Although “endgame” measures for tobacco control remain a topic of debate, overall market resilience and innovation suggest a nuanced, adaptive future for global nicotine consumption.

Cover Image is generated by ChatGPT