Key Points:

·Regulatory gap: Synthetic nicotine e-cigarettes, unclassified as tobacco, avoid taxes and regulations, reaching schools and other spaces.

·Youth crisis: Usage among high school students has spiked, worsened by lax age verification in unmanned stores.

·Tax losses: Uncollected taxes over four years exceed 3.3 trillion won; taxing synthetic nicotine could generate ~930 billion won annually.

·Policy moves: Parliament is reviewing amendments to the Tobacco Business Act to classify synthetic nicotine as tobacco, subjecting it to labeling, advertising restrictions, and taxation.

·Controversy: Calls grow to regulate "nicotine analogs" (e.g., methylnicotine) to prevent new loopholes.

2Firsts, September 8th - according to bizwatch, Synthetic nicotine-based liquid e-cigarettes, blamed for youth smoking, exist in a legal loophole in South Korea. Not classified as tobacco under current laws, they evade taxes and sales rules, even reaching schools. Legislative efforts in parliament have long stalled due to vested interests, fueling concerns over this gap.

Synthetic nicotine—chemically made, not extracted from tobacco—falls outside the Tobacco Business Act, which only regulates natural, tobacco-derived nicotine. Classified as industrial products, these synthetic nicotine items are freely distributed, dodging taxes and oversight.

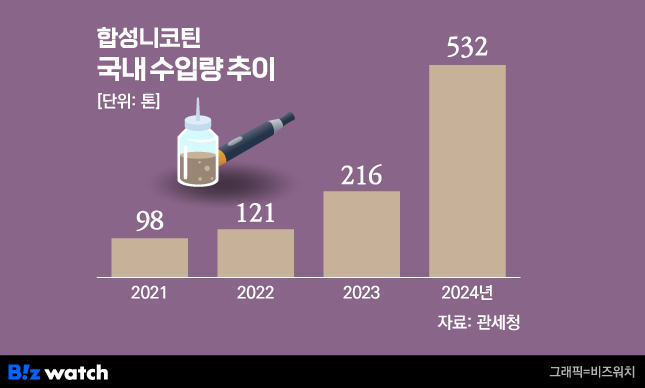

synthetic nicotine imports rose from 98 tons (2021) to a projected 532 tons (2024), with e-liquid imports up 39.5% last year and 8.5% in Q1 2024. Most e-cig firms now use synthetic nicotine, with users preferring closed-system or disposable products amid shrinking smoking areas.

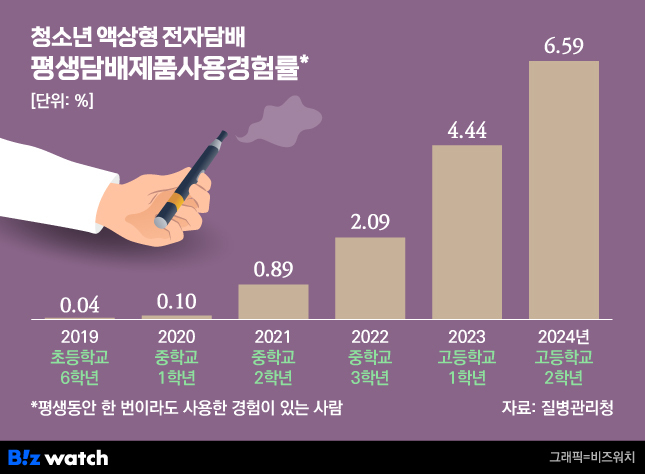

Widespread online and unmanned store sales (with ineffective adult checks) enable youth abuse. High school users of liquid e-cigarettes jumped from 0.1% (2020) to 6.59% (2024), per a health survey.

Parliament amended the Education Environment Protection Act (banning school-nearby e-liquid vending machines) and will strengthen harmful ingredient disclosures under the Tobacco Harm Prevention Act from November.

Natural e-liquids face a 1,799 won/ml tax (about $1.35/ml), but synthetic ones are exempt. This, despite higher raw material costs, makes synthetic options cheaper, widening tax gaps—uncollected taxes over four years hit 3.3895 trillion won (about $2.55 billion), with potential annual revenue of 930 billion won (about $700 million) if taxed.

Government and parliament now aim to regulate synthetic nicotine, with Tobacco Business Act amendments (expanding "tobacco" to include nicotine, including synthetic) under review, supported by ruling and opposition parties. The health minister and finance ministry plan equal regulation to cigarettes, backed by the e-cig association.

If passed, synthetic nicotine e-liquids would face labels, ad restrictions, online sales bans, and taxes. However, calls are growing to also regulate "nicotine analogs" like methylnicotine, which mimic nicotine but evade classification. Industry insiders note global precedents (U.S., Australia, Europe) and urge regulating pseudo-nicotine to protect public health, beyond just expanding scope.