Key Points

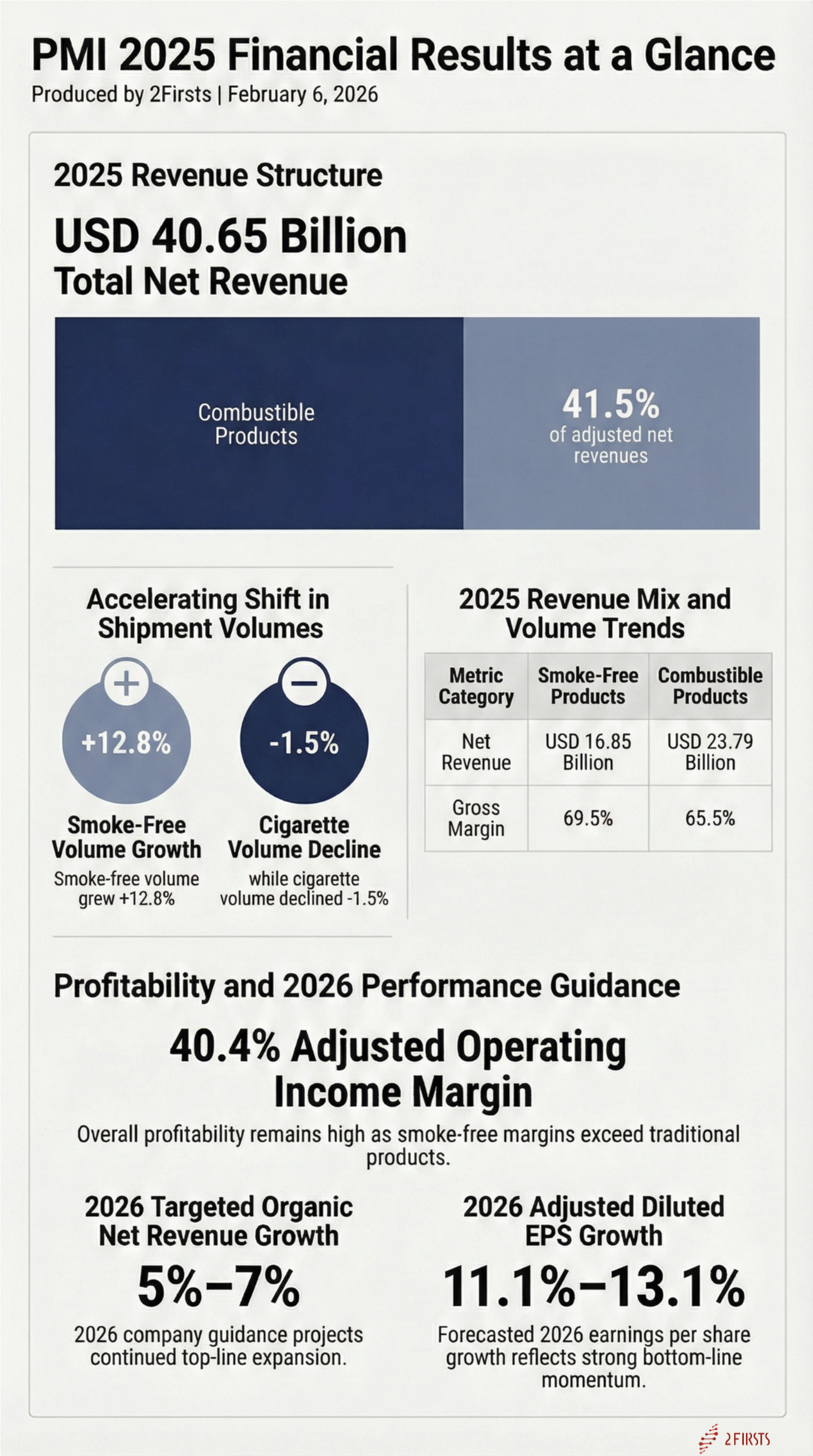

- Smoke-free products accounted for 41.5% of PMI’s adjusted net revenues in 2025, up from 38.7% in 2024, according to company disclosures.

- Net revenue growth (+7.3%) outpaced total shipment volume growth (+1.4%), reflecting changes in product mix as cigarette volumes declined and smoke-free shipments increased.

- Smoke-free product shipments rose 12.8%, while cigarette shipments fell 1.5% in 2025, based on PMI earnings materials.

- Combustible products remained the larger revenue base, generating $23.79 billion in net revenues, supported by pricing.

2Firsts, February 6, 2026

Philip Morris International Inc. (PMI) reported its fourth-quarter and full-year 2025 results on February 6, showing that smoke-free products accounted for 41.5% of the company’s adjusted net revenues, compared with 38.7% in 2024, according to the company’s earnings release and investor presentation.

The results were released alongside a webcast scheduled for 9:00 a.m. EST on February 6.

PMI defines smoke-free products as including heated tobacco products, oral nicotine products and e-vapor products.

Revenue Growth Driven by Mix Rather Than Volume

PMI reported total net revenues of $40.65 billion in 2025, up from $37.88 billion in 2024. Over the same period, total shipment volumes increased by 1.4% to 786.5 billion units.

The contrast between modest total volume growth and higher revenue growth reflects changes in product mix, with smoke-free products expanding both in volume and revenue contribution, based on the company’s disclosures.

Cigarette shipment volumes declined 1.5% to 607.4 billion units, while smoke-free product shipments increased 12.8% to 179.1 billion units.

Smoke-Free Products Approach Half of Revenue While Combustibles Remain the Larger Cash Base

Smoke-free product net revenues reached $16.85 billion in 2025, compared with $14.66 billion a year earlier, raising their share of adjusted net revenues to 41.5%.

By comparison, combustible product net revenues totaled $23.79 billion in 2025, up from $23.22 billion in 2024, according to the earnings release.

The figures indicate that while smoke-free products account for a growing share of revenues, combustible products continue to represent the larger absolute revenue base.

Profitability Profile Highlights Diverging Margins

PMI reported a smoke-free gross margin of 69.5% in 2025, compared with 65.5% for combustible products. Smoke-free products accounted for 42.9% of the company’s adjusted gross profit for the year, according to the presentation.

Adjusted operating income margin increased to 40.4% in 2025 from 38.8% in 2024, reflecting changes in revenue mix and pricing, based on PMI’s non-GAAP reconciliation.

Source: PMI Earnings Slides – Q4 2025 [FINAL]

Product Categories Show Different Scaling Dynamics

Heated tobacco products remained the largest smoke-free category by volume, with heated tobacco unit shipments increasing by 11.0% in 2025. PMI reported more than 35 million IQOS users by year-end.

In oral nicotine products, U.S. ZYN shipments reached 794 million cans, up from 581 million in 2024, while international nicotine pouch volumes excluding the Nordic markets more than doubled.

E-vapor volumes increased to 3.3 billion equivalent units, although they remained smaller in absolute scale compared with heated tobacco and oral products.

Regional Data Illustrates Uneven Progress Across Markets

In Europe, smoke-free products accounted for more than 50% of PMI’s total regional net revenues in the fourth quarter of 2025, according to the presentation.

In Japan, heated tobacco products represented a majority of industry volumes for the year, while in the Americas region, smoke-free net revenues increased 18.1% to $2.69 billion, driven primarily by oral nicotine products.

Outlook Anchored on Continued Mix Shift

For 2026, PMI expects organic net revenue growth of between 5% and 7% and adjusted diluted EPS growth of 11.1% to 13.1%, according to its presentation materials.

For the 2026–2028 period, the company targets organic net revenue compound annual growth of 6% to 8% and organic operating income growth of 8% to 10%, with operating cash flow of approximately $45 billion over three years.

Cover image source: PMI Earnings Slides – Q4 2025 [FINAL]