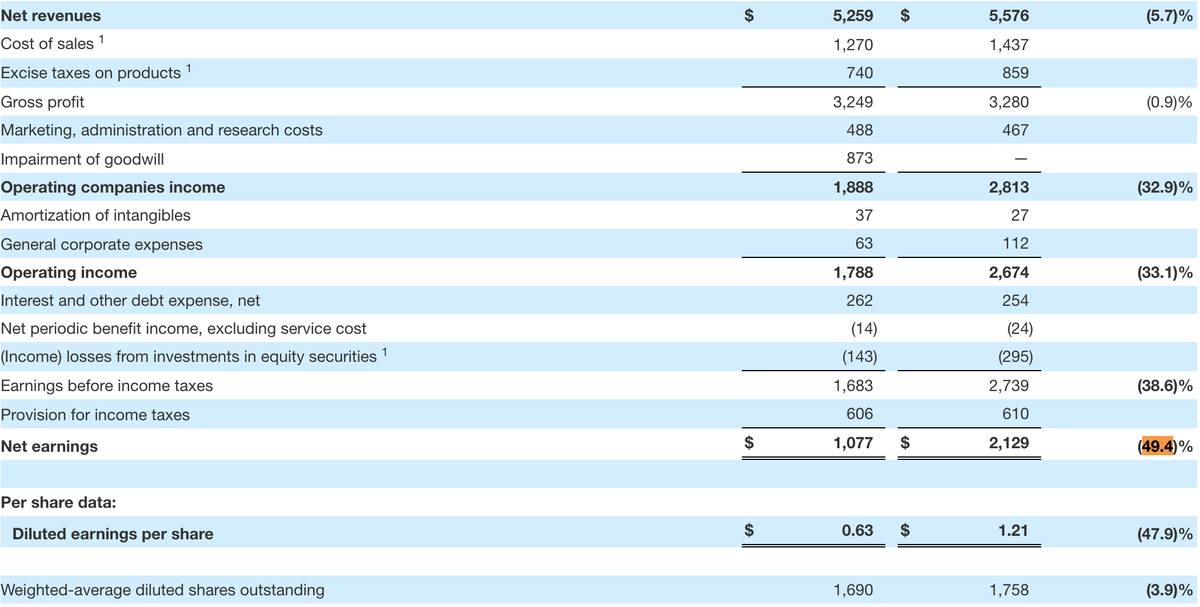

【2Firsts】On April 29, 2025, Altria Group, an American tobacco company, announced its financial performance for the first quarter of 2025. The net revenue for the first quarter was $5.259 billion, a decrease of 5.7% compared to the same period last year; the net profit was $1.077 billion, a significant decrease of 49.4% compared to the previous year.

Key financial data

·Revenue Decline: Net revenue for the first quarter was $5.259 billion, a 5.7% decrease year-over-year. Net revenue after excluding consumption tax was $4.519 billion, a 4.2% decline year-over-year. The decline in revenue was primarily driven by lower shipment volumes in the combustible tobacco products division.

·Net profit decrease: During the reporting period, the company's net profit was $1.077 billion, a significant decrease of 49.4% compared to the same period last year. The main reason for the decrease in net profit is the decrease in operating company income (OCI), which includes non-cash impairment expenses of $873 million for the e-cigarette (e-vapor) reporting unit's goodwill, as well as costs related to the acquisition of NJOY.

Department Performance Analysis

Oral Tobacco Products:

· Net revenue was $654 million, an increase of 0.5% compared to the previous year. Net revenue growth remained at 0.5% after deducting consumption tax.

·Adjusted operating cash income was flat compared to last year at $435 million. The positive impact of pricing increases was offset by a decrease in shipment volume, changes in product mix (higher proportion of on! nicotine pouches), and increased promotional spending.

·Total shipment volume decreased by 5.0% to 175.4 million cans. The modern nicotine pouch brand on! performed well, with a 18.0% year-on-year increase in shipment volume to 39.3 million cans. on! increased its market share in the overall oral tobacco market in the US to 8.8% (up 1.8 percentage points year-on-year), and in the nicotine pouch segment to 17.9% (up 0.5 percentage points year-on-year).

New tobacco products and others (AllOther - primarily including NJOY e-cigarettes):

·NJOY (e-cigarette): NJOY consumables (pods, etc.) reported a 23.9% year-on-year increase in shipment volume to 13.5 million units. However, shipment volume of NJOY devices decreased significantly by 70% year-on-year to 300,000 units. NJOY consumables increased their retail market share in multiple channels and convenience stores in the US by 2.4 percentage points, reaching 6.6%.

·ITC Ruling and Discontinuation: The US International Trade Commission's import ban and cease-and-desist order on NJOY ACE products will take effect on March 31, 2025. Retailers can still sell existing inventory, but NJOY has stopped shipping ACE products to wholesalers. As a result of this, Altria made a $873 million non-cash impairment charge to its e-cigarette reporting unit in the first quarter.

Smokeable Products:

·Net revenue was $4.622 billion, a decrease of 5.8% compared to the previous year. Net revenue decreased by 4.1% after deducting consumption tax.

·Adjusted OCI increased by 2.7% to $2.518 billion, primarily due to higher pricing and cost control, partially offset by a decrease in shipment volume.

·Domestic cigarette shipment volume reported a 13.7% decrease to 142.04 billion sticks, attributed to overall industry decline (due to growth of illegal e-cigarette products and consumer disposable income pressures), retail market share losses, and calendar differences. The retail share of Marlboro decreased by 1.0 percentage point to 41.0%.

Altria reiterated that its adjusted diluted earnings per share for the full year of 2025 will be between $5.30 and $5.45, representing a 2% to 5% increase from the 2024 baseline of $5.19. This guidance excludes the recent expenses related to the amortization of intangible assets, which have been considered as special projects. The company stated that this guidance takes into account the current economic environment, tariff impacts, enforcement of the illegal e-cigarette market, and assumes that ACE products will not return to the market within the year.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com