On February 20, Aspire, an e-cigarette and CBD product company, submitted a registration statement for listing on the US stock market. The company plans to list on the Nasdaq stock exchange, provide a maximum offering price of $9 per share, and expects to raise $155.25 million (17.25 million shares). The registration book introduces the company's current operating conditions, risk factors, equity structure, and other main information.

Business Unit

Aspire's parent company is an atomized electronic cigarette and CBD manufacturer. The charts below show the 2015-2020 revenue of all vapor products and the 2021-2024 forecast.

From the table, the main business of this sector in the early days (2015-17) was closed vaping systems. Then closed systems began to emerge and in 2019, closed retail revenue was $9.688 billion, surpassing the closed electronic cigarettes ($8.392 billion).

The company predicts that the closed type will continue to dominate the market in the future, and the sales of the entire vaping e-cigarette sector will reach 66.8 billion US dollars in 2023.

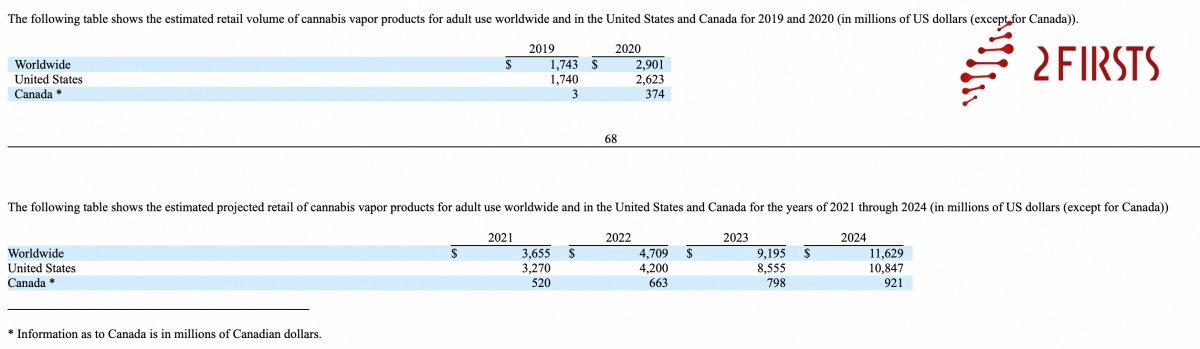

The company has also developed the CBD market in the United States and Canada since 2019. Estimated in 2023, the turnover of CBD products in the US and Canada will contribute 9.195 billion US dollars (as shown in the figure below).

In addition, the company also undertakes the OEM/ODM business of electronic atomization systems.

Market Distribution

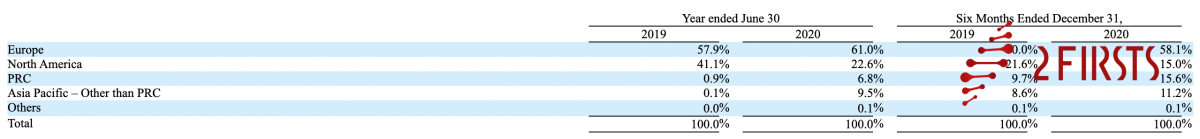

According to Aspire's registry, the company's main market is Europe. In 2020, the Europe market performance accounted for 61% of the company's total performance, followed by the US at 22.6%. In addition, the market development in the Asia-Pacific region has achieved remarkable results, rising from 0.1% in 2019 to 9.5%.

Risk Factors

The registration book lists the risk factors that the company may face as follows:

- Existing and newly promulgated laws, regulations, and policies may create barriers to the company's business operations in the future and may further have a significant adverse impact.

- Currently, the company can legally sell only one product in the US, Nautilus Prime, which accounted for less than 11% of the company’s US revenue. As a result, the company can no longer sell products in the US that accounted for more than 89% of the company's US revenue for the year ended June 30, 2020. The inability to sell such products in the United States resulted in lower sales in the United States for the six months that ended on December 31, 2020.

- The market for marijuana vaping products is still immature, with the vast majority of sales in the United States. It is not guaranteed to expand in the United States or globally.

- A recent joint statement from the SEC and PCAOB, a proposed rule change from Nasdaq, and a bill passed by the US Senate all require additional and stricter requirements for assessing auditor qualifications for companies in emerging markets standards, especially non-U.S. auditors who are not subject to PCAOB inspection. These developments may add uncertainty to the company's offering.

- If the evidence establishes or studies suggest that the use of vaping or cannabis products poses long-term health risks, such products could decline substantially, negatively impacting the company's business, financial condition, and results of operations.

- The company's business is subject to inherent risks and uncertainties, including regulatory developments, medical discoveries, and market acceptance of vaping devices.

- The company faces liability and user complaints arising from sales and products, which may significantly affect the company.

- Misuse or abuse of a company's products can lead to potential adverse health effects, subjecting the company to complaints, product liability claims, and negative publicity.

- The company faces competition in the vaping industry, including larger, better-known companies with significantly larger market shares, and Aspire may not be able to compete effectively.

- In addition, events such as large-scale outbreaks of epidemics, natural disasters, and misconduct by employees or distributors may affect the company's interests and reputation, adversely affecting its business operations.

Reference: Aspire's registration with SEC

*The content of this article is written after the extraction, compilation and integration of multiple information for exchange and learning purposes. The copyright of the summary information still belongs to the original article and its author. If any infringement is found, please contact us to delete it.