In order to eliminate illegal imports of vapes and make vapes traceable, Russia introduced mandatory digital signs, or "Honest Mark", for vapes and juice in November 2022 as a way to regulate vapes and increase taxes from vapes.

This "Honest Mark" system has attracted much attention from Chinese vape practitioners. As a new regulatory model for the Russian vape market, how many times will vapes be taxed to enter the Russian market after the implementation of the "Honest Mark"? How will the various types of vape be taxed? Where will the various tax rates be collected?

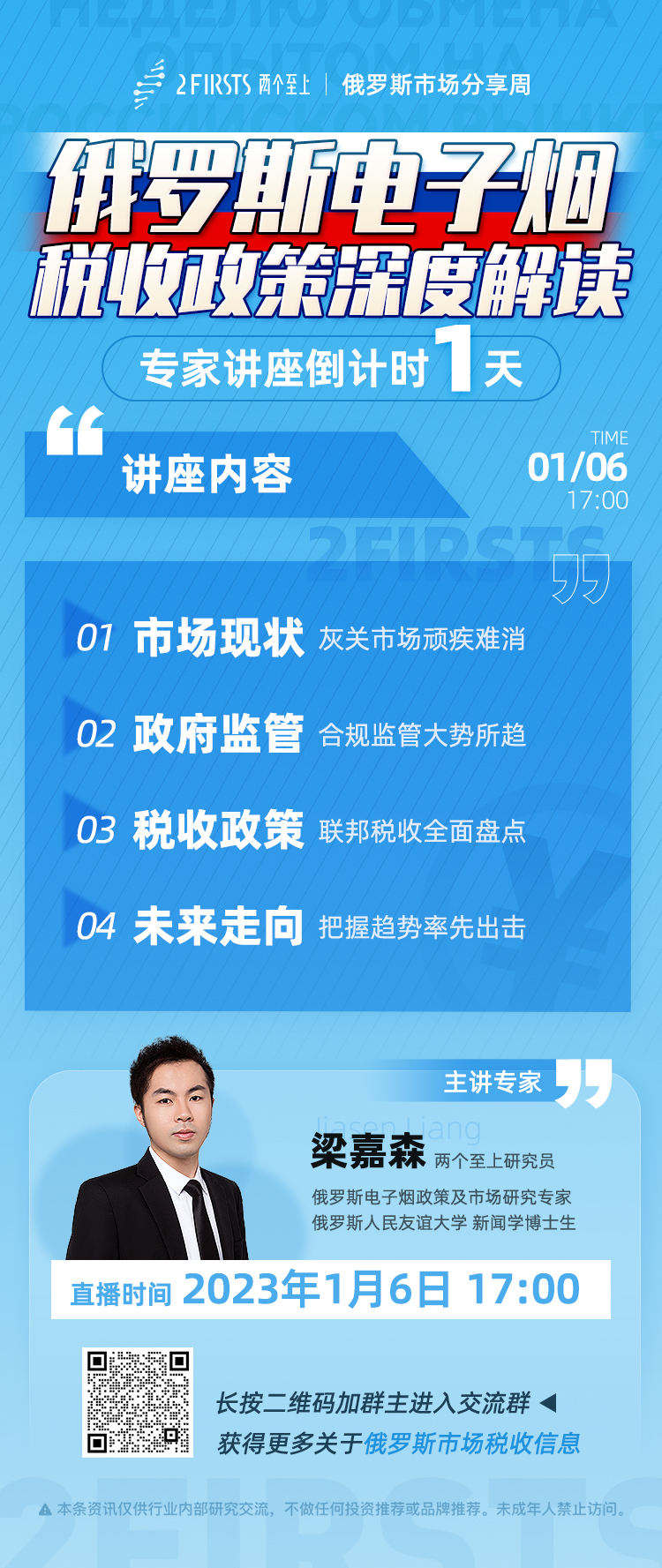

In response to various questions about the Russian vape market in terms of regulatory policies, 2FIRSTS have invited Jason Liang, expert on vape policy and market in Russia, to give us a special live lecture on "In-depth Interpretation of Tax Policy on Vape in Russia" for the most timely and practical information.

Lecture Information

Theme: In-depth Interpretation of Tax Policy on Vape in Russia

Time: 5:00 p.m., January 6 (Friday)

Lecturer: Jason Liang

Agenda:

1. Tobacco Pricing Principles

Maximum and minimum retail price of tobacco products; calculation method; and articles of law.

2. Russia's Consumption Tax on Vape

Calculation method for consumption tax; the law on consumables; the procedure for calculating consumption tax and prepaid consumption tax; the future trend of consumption tax.

3. Value Added Tax

3 VAT rates; Calculation method for VAT.

4. Vape Tariffs

Interpretation of the Eurasian Economic Union and Russia's vape tariffs.

After the lecture, there will be a Q&A session for discussion and communication. Look forward to your active participation.

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.