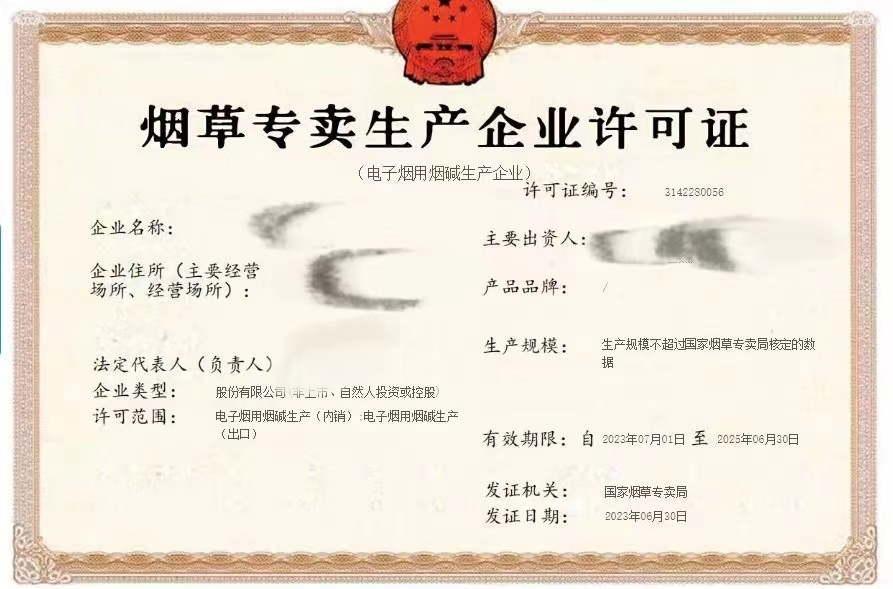

Recently, the new "Tobacco Monopoly Production Enterprise License" (Nicotine Production Enterprise for Electronic Cigarettes) has been gradually approved and issued. Many nicotine manufacturing enterprises have successfully obtained the new license, including Hubei Heno Biological Engineering Co., Ltd. (hereinafter referred to as "Heno").

Founded in 2011 and headquartered in Hubei, Heno is a natural nicotine manufacturing enterprise. According to the "Safety Production License," Heno has a production capacity of 1,000 tons per year. According to the "Tobacco Monopoly Production Enterprise License," Heno's production scale accounts for about 40% of the country.

Recently, 2FIRSTS in Shenzhen, George Liu Qizhou, the co-founder and CEO of Heno Bio, gave an interview to . During the interview, he introduced the development of the nicotine industry and expressed his insights on the future development of nicotine enterprises and the emerging trends of nicotine products.

The entry threshold for the nicotine industry is extremely high, and the market is concentrated in China.

George Liu explained that global nicotine supply is mainly concentrated in China and India, with China being the main center for nicotine production. China is the largest country in the world for tobacco planting, and India accounts for one-third of China's tobacco planting area, giving China a natural advantage in raw material supply. Currently, there are 12 licensed nicotine companies in China, and the country's approved production capacity for nicotine in 2022 is over 200 tons.

The domestic nicotine industry is closely related to traditional tobacco companies and is an extension of the traditional tobacco industry chain. George Liu explained that nicotine is derived from the extraction of tobacco waste generated by traditional tobacco companies. It is positioned at the lowest end of the traditional tobacco industry chain but at the highest end in the new tobacco industry chain. Therefore, nicotine manufacturing becomes a crucial link connecting traditional tobacco companies with new tobacco companies, playing a significant role in the entire tobacco product chain.

As the core component of electronic cigarette products, producing nicotine in China requires four licenses: "Safety Production License," "Tobacco Monopoly Production Enterprise License," "Pollution Discharge Permit," and "Local Standard for Natural Extracted Nicotine." The high threshold makes nicotine manufacturing a "moat" in the new tobacco industry.

Regarding the main market for nicotine, George Liu stated that before 2018, nicotine was mainly exported to Europe, America, and Southeast Asia for use in biomedicine, biopesticides, new materials, and other fields. However, since 2018, with the rapid development of the domestic electronic cigarette market, China has become the main market for nicotine, supplying mainly to new tobacco companies. For example, since 2018, more than 90% of Heno's business is in the domestic market.

Since June 2022, the industry regulations have been officially implemented, and the regulatory system has been fully established. Nicotine manufacturing companies can only supply products to 66 licensed aerosol production companies.

The price of nicotine has experienced ups and downs and is currently relatively stable.

As a major consumer of nicotine, the domestic nicotine price has gone through periods of depression, soaring, and stability. George explained that when Heno entered the market around 2011, the price of nicotine was about 500 RMB per kilogram. By 2021, the price had increased by about 10 times to reach 5000 RMB per kilogram.

The reason for the drastic increase in nicotine prices, according to George, is related to the overall market supply and demand situation. Around 2021, the rapid development of the new tobacco industry led to a significant increase in the demand for nicotine, driving up its price.

In addition, George Liu mentioned that the price of nicotine is also affected by regulatory policy adjustments. Since the implementation of regulations in 2022, the nicotine price has returned to a relatively reasonable range, and it is expected to remain stable in the future.

Regarding the international market's nicotine prices, George stated that the prices in the UK and the US are relatively stable, currently around 300 USD per kilogram. He believes that this stability is due to the fact that the nicotine industry originated in the UK and the US, and these two countries have had a hundred years of experience, making the industry relatively mature and prices more stable. In contrast, China's nicotine industry has only 20 years of development history and is currently subject to various factors, leading to relatively unstable prices.

Natural nicotine dominates, more controllable than synthetic nicotine

Nicotine in the market is divided into two categories: natural nicotine and synthetic nicotine. Natural nicotine needs to be extracted and separated from tobacco waste, while synthetic nicotine is produced through chemical synthesis.

According to a survey by the data consulting agency Global Info Research, natural pure nicotine products dominate the market, accounting for about 99% of the total market production. However, due to the higher cost of synthetic nicotine products, they only account for about 4% of the global market size in terms of revenue in 2021.

Regarding the differences between synthetic nicotine and natural nicotine, Liu believes that the main difference lies in controllability and uncontrollability.

He explained that natural nicotine has a history of 100 years of application in four major areas: biomedicine, biopesticides, new materials, and tobacco products. Its impact on the human body has been tested for a long time, and its risks are within a controllable range. However, synthetic nicotine was invented relatively late and is a chemical solution generated for new tobacco products. The understanding of its real harm to the human body is still limited.

Liu talked about the rise of synthetic nicotine, "After 2019, China began to gradually control the production of nicotine products, resulting in a tight supply of nicotine in the market. At the same time, with the rise of foreign electronic cigarettes, the demand for nicotine in the market has been increasing. To meet market demand, researchers invented synthetic nicotine technology and applied it to the market. In addition, due to its ability to avoid some countries' regulations and taxes, synthetic nicotine has gradually attracted market attention."

Zero-nicotine products are a "false proposition," more optimistic about the development of nicotine pouches

Regarding the development of new tobacco products, Liu was asked about his views on zero-nicotine electronic cigarette products and nicotine pouches.

Regarding zero-nicotine electronic cigarette products, George straightforwardly stated that it is a "false proposition." He believes that without nicotine, the business model of such products would not exist. Zero-nicotine products lack addictiveness, and consumers will not develop a dependence on them. Without demand, there won't be repeat purchases. If consumers are only seeking taste stimulation, they can choose to buy chewing gum instead. Therefore, he believes that zero-nicotine products are short-term actions by manufacturers to circumvent regulatory policies and are not suitable for long-term consumerism. Overall, he does not see zero-nicotine products as a good business.

As for nicotine pouches, George is optimistic about their development. He mentioned that in 2022, the global market share of nicotine pouches reached 8 billion RMB. In terms of product layout, nicotine pouches have been listed as the third-largest SKU by the four major tobacco companies. In terms of usage, nicotine pouches are different from the lung inhalation of electronic cigarettes. They are taken in through the oral mucosa and produce a reaction in the stomach, enriching the variety of nicotine products. Based on these points, Liu is very positive about the development prospects of nicotine pouches.

He also mentioned that nicotine products need innovation. Currently, nicotine lozenges have attracted attention, and in the future, there may be new forms of products that can be inhaled through the nose or applied to the skin. These are new manifestations of industry progress.

How can Chinese nicotine companies break through in the overseas market?

Liu mentioned that with the implementation of regulations in 2022, the demand for nicotine in China has decreased, and nicotine manufacturing companies need to seek overseas markets.

He also candidly admitted that nicotine companies face some difficulties in going abroad. The main competitors of nicotine manufacturing companies in the overseas market are companies from India, and the current problem is the phenomenon of price inversion. In addition, domestic requirements for safety, environmental protection, and monopoly policies have led to increased raw material costs for domestic nicotine companies, reducing their competitiveness in overseas markets. These two main reasons make it relatively difficult for Chinese nicotine companies to enter the overseas market.

Regarding how the domestic nicotine industry can break through overseas, Liu said that the domestic nicotine industry has two major advantages. First, China has the advantage of the entire industry chain in the nicotine industry, which can offset the disadvantage of raw material prices. Second, national policies encourage nicotine companies to go overseas in compliance.

Based on these two advantages, nicotine companies need to focus on research and development and innovation, promote the development of more complementary products in the industry chain, and improve the competitiveness of the domestic nicotine industry in overseas markets.

Furthermore, Liu revealed that Heno is actively seeking opportunities to collaborate with overseas pharmaceutical companies. For this purpose, they have invested over 100 million RMB in applying for ESG system certification and a "Medicine Production License," with the plan to complete the certification this year.

He believes that in addition to developing new products to drive the industry chain, it is also necessary to ensure the quality of products and produce them with requirements higher than the industry standard to enhance the company's competitiveness in both domestic and international markets.