South Korea’s E-Cigarette Landscape: Growth Drivers, Product Categories, and Market Dynamics

South Korea’s tobacco market was valued at $11.3 billion in 2023, segmented as:

• Traditional Cigarettes: 73.1%

• Heated Not Burn (HNB): 19.0%

• Open Pod E-Cigarettes: 4.9%

• Closed Pod E-Cigarettes (Disposable, CVS): 2.5%

While traditional cigarettes still dominate, alternatives are capturing consumer attention. Open pod systems, which feature customizable e-liquids, are increasingly favored by younger users for their diverse flavors and discreet nature. “The appeal of ‘less smell’ and variety makes open pods a fast-growing category,” explains Kim. Closed pod systems, including disposable e-cigarettes, offer unparalleled convenience and are gaining traction among users seeking simplicity.

However, the market’s diversity goes beyond products. South Korea’s consumers are highly discerning, driven by a mix of health awareness, technological curiosity, and a preference for premium experiences. As Kim puts it, “This isn’t just a shift in products—it’s a redefinition of smoking culture.”

Barriers, Opportunities, and the Rise of Online Retail in South Korea

Barriers to Entry and Local Challenges

Breaking into South Korea’s e-cigarette market isn’t for the faint-hearted. “Entering the CVS market requires significant capital investment,” says Kim, citing the costs of taxes, promotions, and store entry fees. As a result, global giants like RELX and BAT dominate, with RELX’s Bubblemon (2019) and BAT’s VUSE (2023) leading the closed pod segment. However, even these brands collectively account for less than 2% of the total tobacco market, leaving ample room for local innovation.

The Rise of Online Retail

While South Korea boasts 4,000 vape shops, their focus on low-cost products often leads to dissatisfaction among quality-conscious consumers. Kim points out: “Online retail is where the real transformation is happening. Consumers are increasingly turning to trusted e-commerce platforms for reputable products.”

The shift to online channels is a response to consumer demand for transparency, ease of purchase, and a wider selection. For brands, it also offers an opportunity to bypass traditional retail constraints and connect directly with customers.

Navigating Regulatory Challenges: From Nicotine Policies to Youth Protection

South Korea’s regulatory framework is a double-edged sword. On one hand, it ensures consumer safety; on the other, it poses significant challenges for businesses.

Natural vs. Synthetic Nicotine

The government has tightened regulations on natural nicotine products, implementing higher taxes and stricter sales controls due to health concerns. Meanwhile, synthetic nicotine remains largely unregulated but is gaining popularity. Kim warns, “As synthetic nicotine consumption grows, future taxation and regulatory scrutiny are inevitable.”

Emerging Legislation

Proposals to classify synthetic nicotine as a cigarette product could restrict advertising and online sales while imposing rigorous safety and ingredient checks. Kim emphasizes, “Adapting to these changes isn’t optional—it’s essential. Compliance is critical to building and maintaining consumer trust.”

Youth Protection Measures

Efforts to safeguard youth include stricter advertising rules and enforcement of age verification technologies. “This is a market where technology and regulation intersect,” notes Kim. Brands that embrace innovative solutions to prevent underage access may gain regulatory and market advantages.

Consumer Trends in South Korea: Preferences, Demographics, and Changing Behaviors

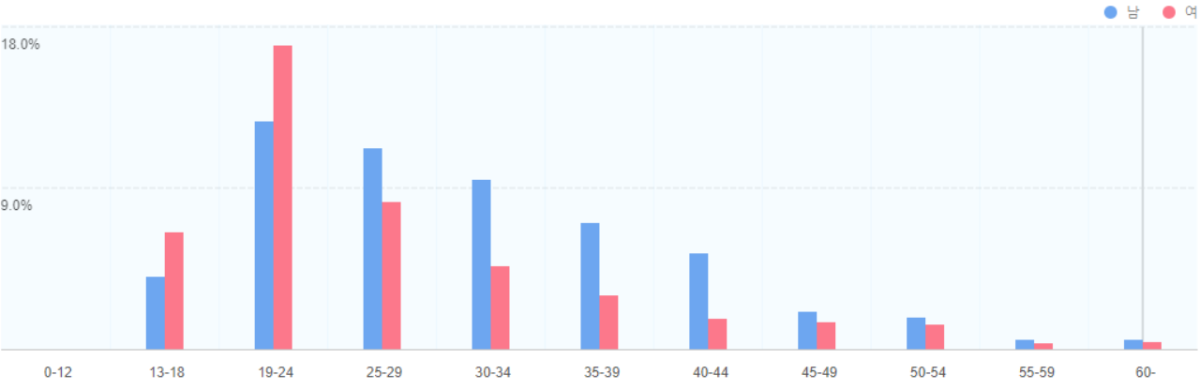

South Korean consumers are redefining what it means to smoke. According to a 2022 survey, 25% of women in their 20s searched for e-cigarettes online, highlighting a demographic shift. “Young women are using e-cigarettes as a discreet way to manage their smoking habits,” Kim observes. This group, along with health-conscious young adults, forms the core of the market’s growth.

Demand for Customization

The appeal of cooling effects, varying nicotine levels, and a wide range of sweet and fruity flavors reflects the sophisticated palate of Korean consumers. Kim highlights Connected Korea’s response: “We’re focusing on delivering products that cater to these unique preferences, ensuring both quality and satisfaction.”

Connected Korea’s Strategy: Innovations Driving Competitive Advantage

Expanding Product Portfolios

Connected Korea Inc has made a name with its flagship e-liquids, HYPERMIX and SEOUL JUICE, praised for their rich, fruity flavors. The company is also preparing to enter the disposable e-cigarette market, targeting local CVSs, duty-free shops, and international markets.

Personalization Through Technology

One of the company’s most exciting innovations is “Mix-craft,” a DIY e-liquid blending device. “Mix-craft allows users to create personalized recipes, offering a platform where they can share and monetize their creations,” says Kim. This initiative taps into the growing demand for customization and community engagement.

Prioritizing Compliance and Trust

In an industry shaped by regulation, Connected Korea Inc positions itself as a leader in compliance. “Meeting safety standards isn’t just about following rules—it’s about building trust with our customers,” Kim emphasizes.

Conclusion: A Transforming Market Poised for Growth

The South Korean e-cigarette market is at a crossroads, driven by evolving consumer expectations, regulatory scrutiny, and technological innovation. As traditional smoking gives way to safer alternatives, companies that can anticipate and adapt to these changes will thrive.

Sam Kim offers a final thought: “This isn’t just about products; it’s about creating a better, safer, and more enjoyable experience for consumers. The companies that succeed will be those that truly understand and respond to the needs of this unique market.”

About Connected Korea Inc:

Connected Korea Inc is an e-cigarette manufacturer based in Seoul, South Korea, dedicated to providing unique Korean flavoured vape oils, all designed and manufactured in South Korea to strict ISO, USP and TPD standards. The company's brand "SEOUL JUICE" has expanded to the UK and European markets.