Key Takeaways

- Results vs. guidance: Performance for the fiscal year to Sept 30 is in line with the guidance given with the May interim results.

- Buyback size & timeline: New £1.45bn share repurchase to run through October 2026.

- Revenue & profit trends (constant FX): Net revenue for Tobacco + NGP expected to grow at a low single-digit rate; NGP net revenue up 12%–14%; adjusted operating profit growth similar to last year’s 4.6% (previously guided to around the mid-single-digit range).

- Shareholder returns: Next fiscal year’s total returns (buybacks + dividends) expected to exceed £2.7bn.

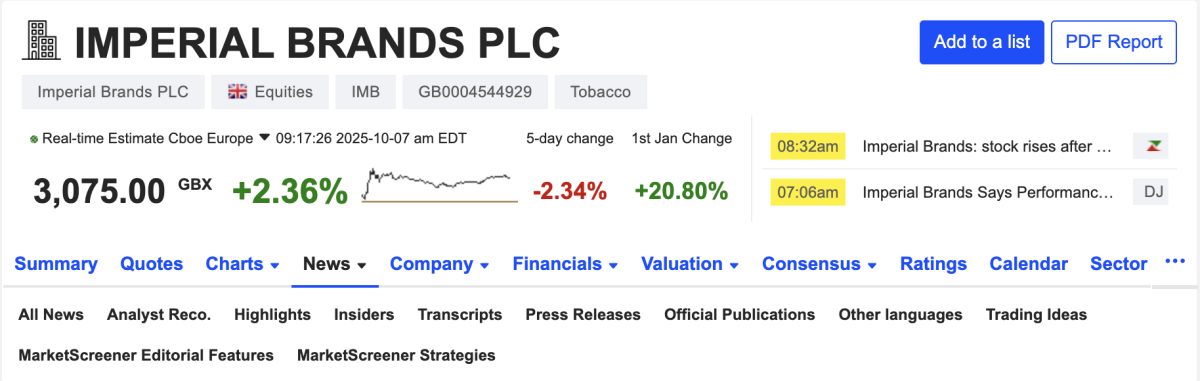

2Firsts, Oct 7, 2025 — According to a MarketScreener report on Oct 7, Imperial Brands plc (IMB) said its fiscal-year results to Sept 30 are consistent with guidance issued alongside its May interim results. The company also announced a new £1.45bn share buyback to be completed by Oct 2026, and said total shareholder returns (buybacks plus dividends) are expected to top £2.7bn in the next fiscal year.

Key Operating Details

Guidance alignment: Management says FY performance matches the May guidance.

Revenue (constant FX): Net revenue for Tobacco and “Next-Generation Products” (NGP—e-vapor, heated tobacco, and oral nicotine) is expected to grow at a low single-digit percentage; within that, NGP net revenue is expected to rise 12%–14%.

Profit (constant FX): Group adjusted operating profit growth is anticipated to be similar to last year; the FY2024 figure was +4.6%, and prior guidance pointed to “around the midpoint of mid-single-digit” growth.

Capital allocation: £1.45bn buyback through Oct 2026; total shareholder returns next fiscal year expected to exceed £2.7bn.

As of early London trading (late morning UK time), Imperial Brands was up about +2.7%, among the FTSE 100’s notable gainers.

Context & View

Imperial reiterated its dual-track strategy: legacy tobacco provides stable cash flow while NGP maintains low-to-mid-teens growth (12%–14%). The new buyback extends the company’s shareholder-return policy and aligns with its medium-term target for adjusted operating profit growth in the mid-single digits. Note: growth rates, buyback size, and timelines reflect the company’s disclosures today; market pricing is time-sensitive, and intraday figures are not quantified in the report.

Image source: MarketScreener.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com