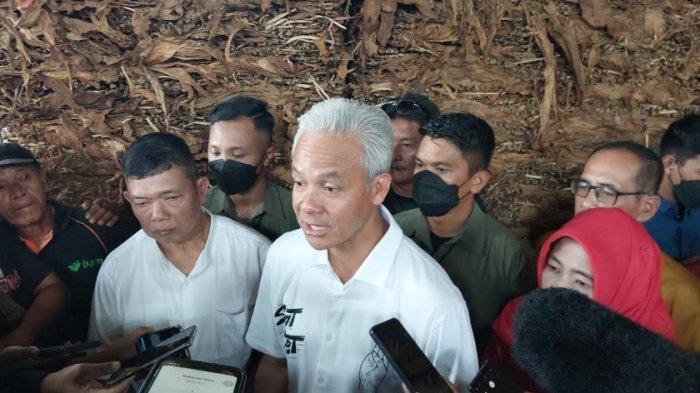

According to an article by Indonesian media outlet Tribunnews on December 27th, Indonesian presidential candidate Ganjar Pranowo has expressed the need for Indonesia to establish its own tobacco center.

Gan Ya, during his visit to tobacco farmers in Central Java, expressed his viewpoint that he hopes there will be a region that can develop into a global tobacco hub. "Temanggung has already become an iconic city for tobacco worldwide, and the srinthil variety we are discussing is only produced in Temanggung, commanding a very high price," commented Gan Ya.

As a result, Gan Ya believes that Central Java is the best location for setting up a tobacco center, both domestically within Indonesia and globally.

I believe that we need to establish a tobacco center in Indonesia, and the ideal location would be Central Java," said Ganja.

Gan Ya also added that if Indonesia could have its own tobacco center, tobacco production could be expanded by further researching other uses of tobacco. He further emphasized that by incorporating downstream processing into the research process, tobacco could be used for various purposes, which calls for a dedicated research hub to facilitate its development rather than terminating it.

Ganjar Pranowo, a member of the Indonesian Democratic Party and former governor of Central Java province, has successfully won re-election in the province's recent elections.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com