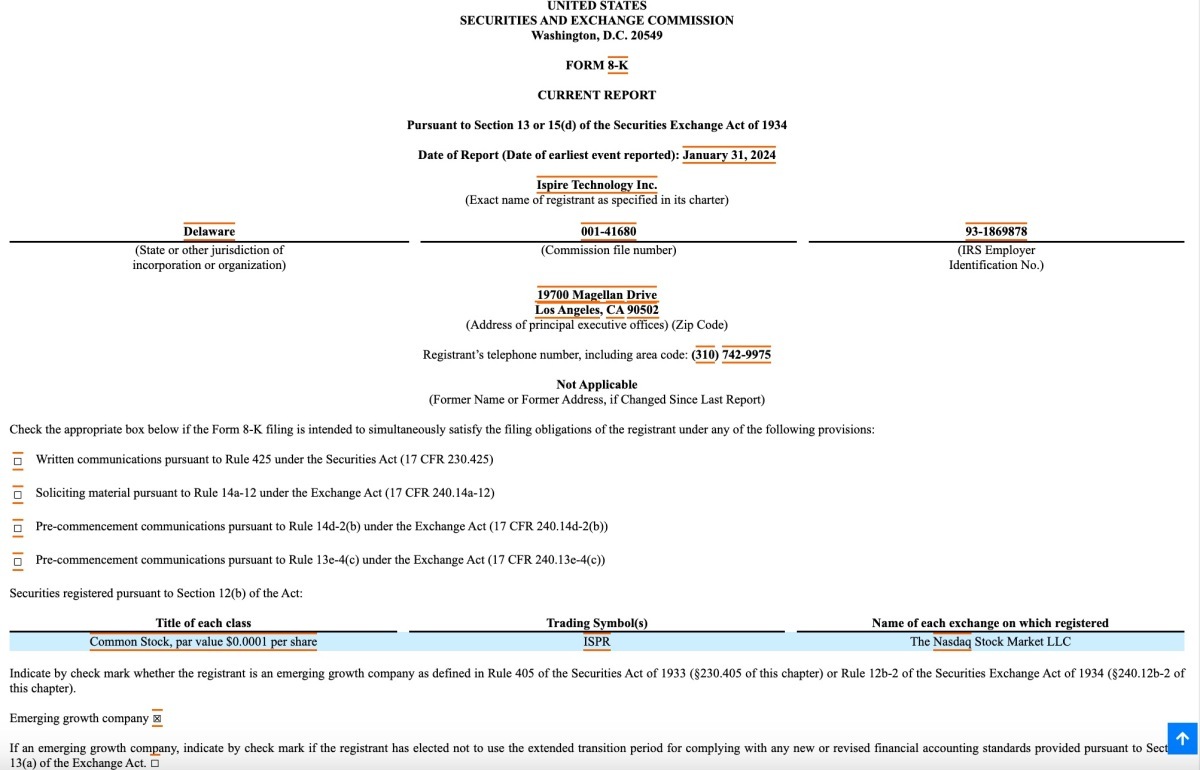

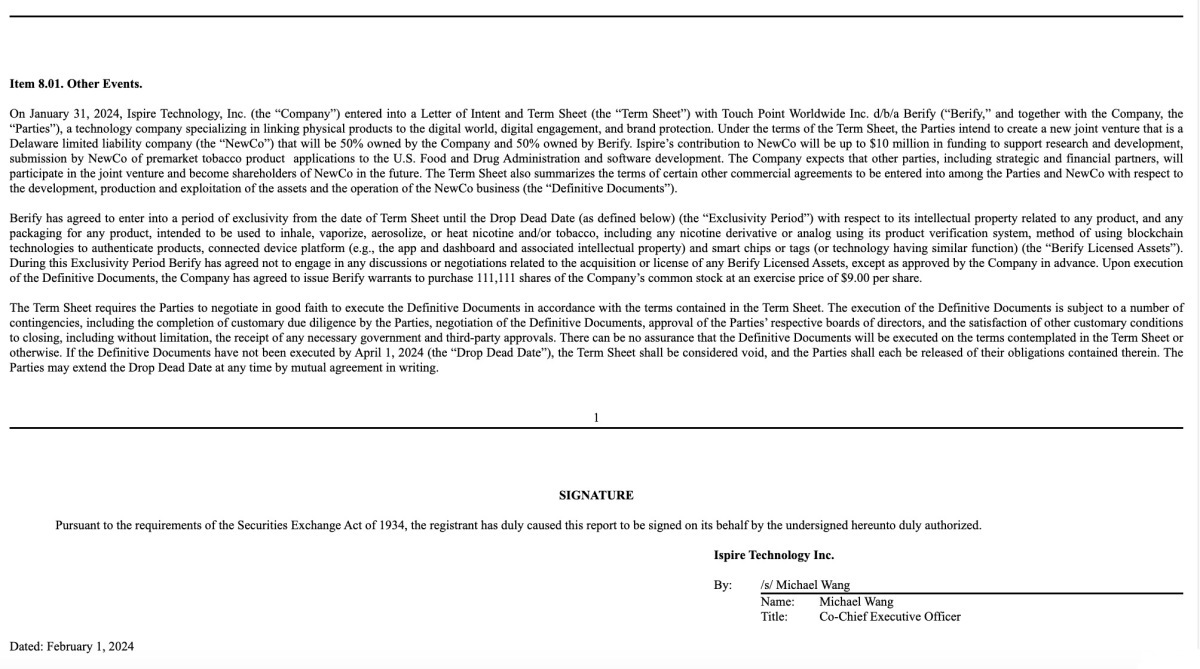

According to a press release by the U.S. Securities and Exchange Commission on February 1st, on January 31st, Ispire Technology, Inc. (hereinafter referred to as the "Company") signed a letter of intent and term sheet (hereinafter referred to as the "Term Sheet") with Touch Point Worldwide Inc., also known as Berify (hereinafter referred to as "Berify"), a technology company specializing in linking physical products to the digital world, digital interaction, and brand protection.

According to the terms outlined in the agreement, all parties intend to establish a new joint venture company known as "NewCo" in the state of Delaware. Ispire and Berify will hold 50% ownership each in NewCo. Ispire will invest a total of $10 million in NewCo, which will be utilized to support the pre-market tobacco product application submitted to the US Food and Drug Administration, as well as for software development.

Berify agrees to an exclusive period where its intellectual property related to products used for inhaling, vaporizing, atomizing, or heating nicotine and/or tobacco, as well as any packaging related to its product authentication system, blockchain technology for product identification, connected device platforms (such as applications and dashboards), and smart chips or tags (or similar technologies) (referred to as "Berify licensed assets") will be exclusively held by Berify. During this period, Berify agrees not to engage in any discussions or negotiations related to the acquisition or licensing of Berify licensed assets without prior approval from the company. Upon the finalization of the agreement, the company agrees to issue warrants to Berify for the purchase of 111,111 shares of the company's common stock at an exercise price of $9.00 per share.

The clause states that negotiations should be conducted in good faith, with the aim of implementing the provisions outlined in the term sheet into a final agreement. The signing of the final agreement is subject to various uncertainties, including the completion of customary due diligence by all parties, negotiations on the final agreement, approval by the respective boards of directors, and the fulfillment of other customary closing conditions, including but not limited to obtaining any necessary government and third-party approvals. There is no guarantee that the final agreement will be signed in accordance with the provisions set forth in the term sheet or in any other manner. If the final agreement is not signed by April 1, 2024 (referred to as the "deadline" hereafter), the term sheet shall be considered void, and all parties will be released from the obligations contained therein. The deadline may be extended at any time by mutual agreement in writing.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com