Key points:

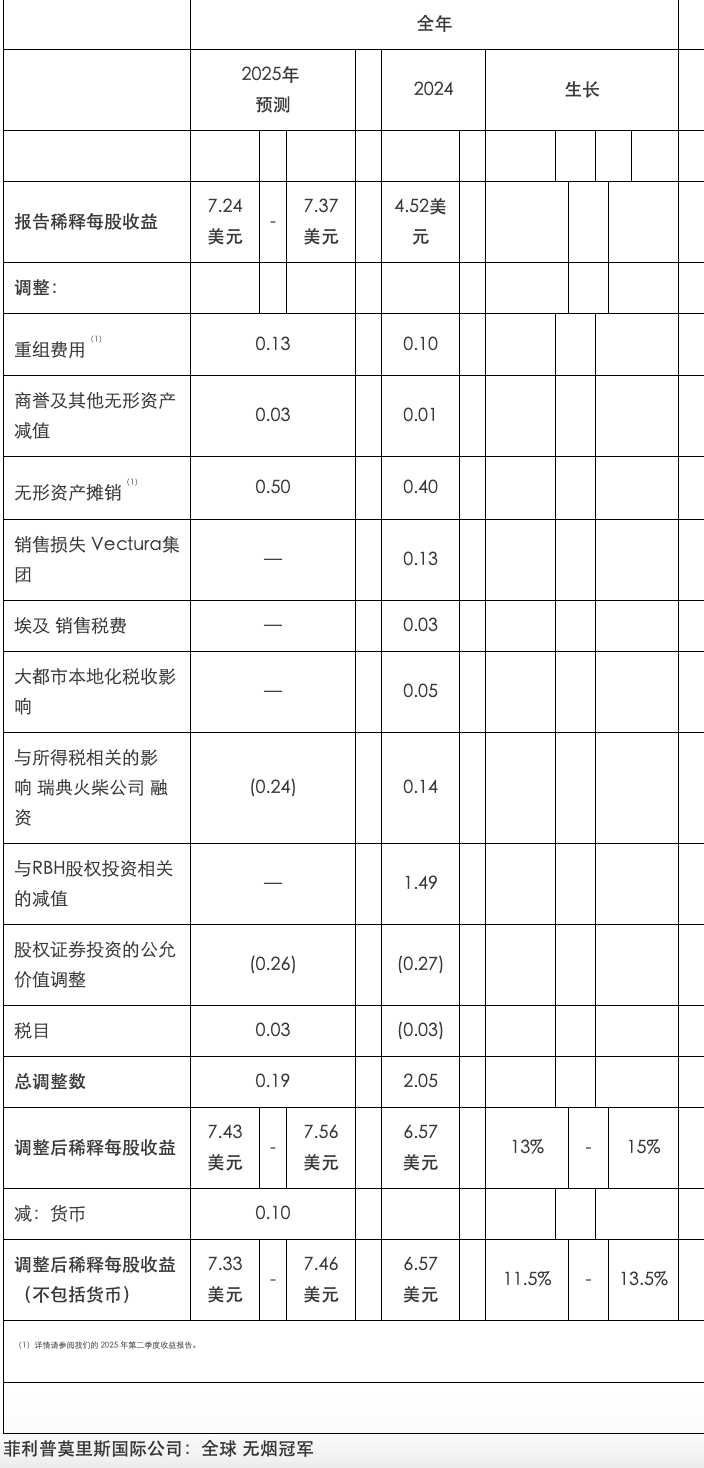

Full-year financial outlook: PMI reiterates its 2025 full-year diluted earnings per share (EPS) forecast at $7.24 to $7.37; expects adjusted growth of 13%-15% compared to 2024, the strongest performance since 2011 (excluding pandemic recovery).

Q3 business updates:

·Cigarette sales in Turkey are rebounding, while the market in Egypt is performing better than expected.

·IQOS continues to show strong growth, with VEEV and international markets' ZYN performing well.

·ZYN sales in the US are accelerating, with a growth of approximately 32% in the first 8 weeks of Q3 (according to Nielsen data).

Shipping expectations: ZYN shipments for the whole year are estimated to be between 800 million and 840 million cans, with growth in the second half of the year expected to align with sales performance, but taking into account distributor inventory adjustments.

2First, on September 3, 2025, according to a statement on the official website of Philip Morris International (PMI) on September 2, CEO Jacek Olczak delivered a speech at the 2025 Barclays Global Consumer Staples Conference, providing an overview of the company for investors.

In the summer of 2025, our product sales, including IQOS and ZYN, were strong. Despite the increasing competition in the smoke-free products sector, we are still on track to achieve our annual adjusted diluted earnings per share growth target of 13% to 15%, the strongest growth since 2011 (excluding the recovery period during the pandemic)," he stated.

Year 2025 Annual Forecast

PMI reiterated its full-year diluted earnings per share forecast for 2025, which was announced on July 22, 2025. The forecast predicts earnings per share to be between $7.24 and $7.37. Excluding the adjustment amount of $0.19 per share for 2025, this forecast represents an increase of 13% to 15% compared to the projected earnings for 2024. Additionally, excluding the favorable impact of $0.10 per share due to currency exchange rates (calculated at current rates), this forecast represents an increase of 11.5% to 13.5% compared to the adjusted earnings per share of $6.57 for 2024, as shown in the table below.

The speech also covered the business updates as of the end of the third quarter.

Sales of combustible products in Turkey and Egypt have rebounded better than expected. IQOS continues to show strong growth. International ZYN and VEEV are performing well. Philip Morris International (PMI) reported that sales momentum of ZYN in the US remains strong, accelerating further since the second quarter, with a growth rate of around 32% in the first 8 weeks of the third quarter, according to Nielsen data. PMI had previously forecasted annual shipments of 800 million to 840 million units. Now, PMI expects shipment growth in the second half of the year to be roughly in line with sales growth, as PMI intensifies commercial activities in an increasingly competitive environment, although this will be influenced by distributor and wholesaler inventory changes, including some additional normalization in the third quarter, as restocking occurred in the first half of the year and full availability was restored.

ZYN is experiencing strong sales growth in the United States, and the full-year shipment expectations may be adjusted accordingly.

According to the announcement, sales momentum for ZYN in the US market continues to strengthen. Nielsen data shows that in the first eight weeks of the third quarter of 2025, ZYN's retail sales (offtake) increased by approximately 32% compared to the same period last year, surpassing the growth rate in the second quarter, indicating a continuous rise in end consumer demand.

Previously, PMI expected that ZYN's annual shipment volume would be between 800 million and 840 million cans. With retail sales data continuing to strengthen, PMI stated that the year-on-year growth in shipments in the second half of the year is expected to be consistent with the sales growth, reflecting the company adjusting its supply pace according to consumer dynamics to better meet market demand.

It is worth noting that PMI also mentioned that the shipment volume in the third quarter will be influenced by the dynamics of channel inventory, and it is expected that a certain degree of "inventory normalization" process will occur. This statement implies that due to channel restocking operations in the first half of the year (i.e., shipments exceeding actual sales), current inventory levels are relatively healthy. Therefore, the shipment pace in the third quarter will be closer to actual retail sales, and the growth rate may tend to stabilize or even slow down compared to the first half of the year, without the occurrence of large-scale advance stocking.

The speech will be broadcasted online in an audio-listening mode only. The live stream can be accessed through the PMI official website (www.pmi.com/2025barclays) or the PMI Investor Relations mobile app (www.pmi.com/irapp). A recorded version of the broadcast will be available for six months after the event concludes.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com