Special Statement:

This article is for internal research and communication within the industry only and does not recommend any brands, products, or investments.

Minors are prohibited from accessing.

Editor's Note:

In 2023, the global e-cigarette industry has undergone profound changes.

With disposable e-cigarettes achieving market penetration globally over the past two years due to their "convenience," in 2023, low-barrier markets for e-cigarettes in countries such as the United States, the United Kingdom, the European Union, Russia, and others have neared saturation. The market has entered a phase of competition over existing market share, and some brands have had to seek development in "high-barrier markets" such as the Middle East, South Africa, and South America. On the other hand, regulatory authorities in major markets have expressed a clear determination to strengthen regulation, with some policies already entering the legislative or regulatory process. These changes in the regulatory environment have further raised the threshold for market competition.

In this context, global e-cigarette brands have shown a "Matthew effect" style differentiation: some brands are becoming more influential, gradually resembling the global major brands and flagship products in the traditional tobacco industry; while others are finding it increasingly difficult to survive in the competition and can only maintain market share through credit sales.

Based on brand competitiveness, 2FIRSTS classifies global e-cigarette brands into three categories: "Global Giants," "Global Challengers," and "Regional Hidden Champions." Through the "2023 Global Annual Brand Series Report," 2FIRSTS will analyze the transformation paths and business logic of these brands.

As the saying goes, "If you want to know the future, just look back at the past." 2FIRSTS believes that the coverage of 2023 e-cigarette brand cases will provide insights for the industry's future development, driving the global industry towards higher quality.

Feel free to share your opinions or provide feedback on the article by contacting: alan@2firsts.com.

2FIRSTS Editorial Dept.

December 2023

Global Annual Brand Article Series 2023

RELX International Stalling

-- Can capital power help RELX take the lead in the global e-cigarette market?

Leona Zhu

RELX International, a prominent company, has experienced a significant slowdown or decline in its operations.

Why has Utime hit a roadblock in international expansion? Can capital acquisition help Utime outpace global competition in the market?

On December 5th, RELX Technology (hereafter referred to as "RELX" or "the company"), the parent company of RELX vaping products, announced its acquisition of two leading e-cigarette companies in Southeast Asia and North Asia for a total consideration of $25 million. These acquisitions signify RELX's aim to expand its presence in the international market.

The move by RELX to terminate its existing non-compete agreement with Relx Inc. (Relx International) on December 16, 2020, was already evident from the financial report released in November. According to RELX Technology's third-quarter financial report, the company took this step to fully capitalize on the potential growth opportunities in the international market.

This means that RELX may expand its presence and make significant moves in the international market.

From the perspective of RELX's business layout, its business can be mainly divided into two parts: domestic and international. The domestic business is primarily focused under the well-known brand "RELX" and is fully managed by the RELX startup team. On the other hand, the international business is mainly represented by the "RELX" and "waka" brands, operated independently by the specially established company "RELX International". However, the reality is that RELX's performance in the international market is not as outstanding as it initially was in the domestic market.

After three years of independent operation, RELX suddenly terminated its non-competition agreement with RELX International and subsequently acquired two overseas e-cigarette brands. The industry is speculating whether RELX is preparing to take over the international business and make a strong move into the global market.

Get up Early to Miss the Late Show

On Queen Street in London, inside an e-cigarette store, the display case with the "RELX" logo actually showcases other brands of e-cigarettes. In other stores, the display case for RELX is simply left idle in a corner. This is the scene witnessed by 2FIRSTS (a journalist or news outlet) on the streets of England.

"The sales performance of RELX's products is far from satisfactory," a store employee candidly revealed.

This can perhaps be seen as a reflection of the situation of RELX products in the European market.

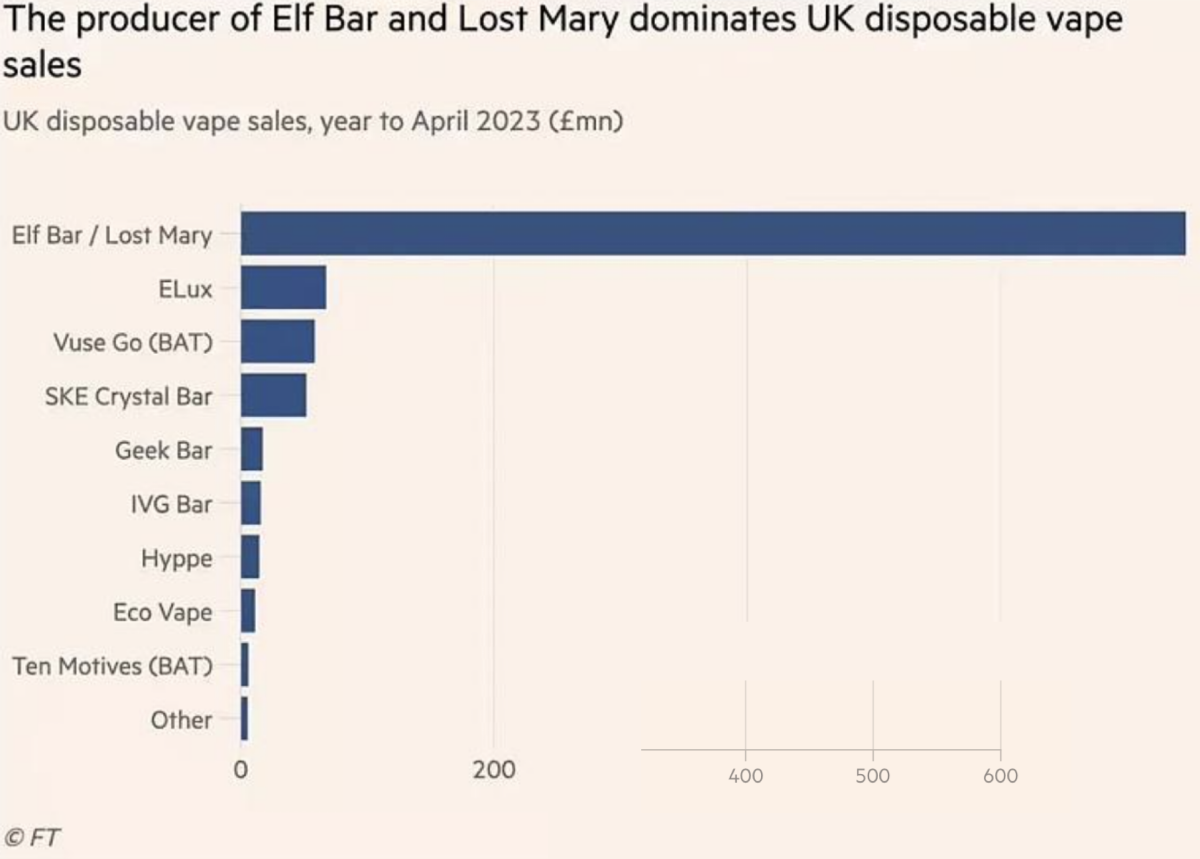

In the latest ranking of the top 10 e-cigarette brands in the UK market for April 2023, released by renowned data agency Nielsen, both waka and RELX, subsidiaries of RELX, were noticeably absent. This list clearly indicates a high concentration of leading brands in the UK e-cigarette market, with these top brands occupying the majority of market share. In contrast, brands ranked seventh and below have limited market shares and relatively low brand awareness, let alone those brands that did not make it to the list.

According to media reports, RELX's overseas business has expanded to 52 countries and regions. As mentioned earlier, in the overseas market, RELX International primarily focuses on the RELX and waka brands. RELX continues to concentrate on pod-system products, maintaining its traditional product line. Additionally, there are also a small number of disposable products, such as RELX MagicGo. On the other hand, waka specifically targets the disposable e-cigarette market.

Therefore, when discussing the business of RELX International, it is important to separate the disposable and pod system markets. Many e-cigarette practitioners from different regions have expressed that "RELX" indeed holds a leading position in the global pod system market in most areas. However, considering that the current global e-cigarette market is primarily dominated by disposable products, the pod system only occupies a small market share. Therefore, the performance of RELX International in the global market, with a focus on disposable e-cigarettes, better reflects its overall situation.

So, how has waka performed in the overseas market? After conducting on-site visits, surveys, and seeking information from various sources, 2FIRSTS has found that waka has not achieved good results in most markets.

In fact, Waka's situation is similar to that of the United Kingdom in markets such as the Middle East, the European Union, South America, and the Australasia region. Several local e-cigarette industry professionals have informed 2FIRSTS that Waka's products are rarely seen at the market's end.

Clearly, the business of disposable e-cigarettes does not seem to be going too well for RELX International.

According to public records, RELX was founded in 2018 and quickly emerged as a leading brand in the domestic e-cigarette market. However, RELX did not rest on its laurels and instead set its sights on a global scale.

RELX's overseas exploration began in 2019. In 2021, RELX officially established a new company called "RELX International" dedicated to overseas operations. In December 2021, a report by the media on Du Bing, the CEO of RELX International, revealed that the company's employees come from 22 countries and regions around the world, with over 40% of them being local employees.

According to data from Aiqicha, the earliest registration of the Waka trademark can be traced back to November 30, 2022. However, at the Dortmund Tobacco Exhibition in September 2022, 2FIRSTS observed Waka's presence. At that time, Waka's booth was right next to RELX's booth. On-site staff stated that Waka was launched in March 2022 and is a subsidiary brand of RELX International.

Based on this information, it can be speculated that before March 2022, RELX primarily promoted its pod-system product RELX in overseas markets, and only began entering the disposable product market after that time.

The disposable e-cigarette quickly gained popularity in the European and American markets in 2020, while Yookeen was busy dealing with the surge in the domestic refillable market. However, by 2022, when the domestic e-cigarette market in China faced strict regulations, Yookeen was forced to shift its focus to the overseas market, only to find that the disposable product market had already been dominated by ELFBAR, VUSE, and some regional brands such as HQD and IGET.

The delayed entrance of RELX into the disposable market has exacerbated the challenges of capturing a share in this industry.

Major Setback: Channel King Mode Malfunction

Can RELX replicate its success model in the overseas market, which also heavily relies on channels, and quickly rise to become a leading player, just like it did in China?

Let's start by discussing the business model of RELX in China. An e-cigarette industry insider familiar with RELX's situation informed 2FIRSTS that during its early stages, RELX faced difficulties in accessing domestic sales channels. As a result, they adopted a strategy of establishing their own channels. This involved renting storefronts in shopping malls and setting up counters to sell their products, or establishing their own exclusive stores in cities at different levels.

By employing this approach, RELX has managed to establish an exclusive distribution channel and secure a prominent position in the domestic e-cigarette market. With the growing recognition of the RELX brand, it has successfully attracted numerous agents to join and effectively conquer the domestic market.

RELX International has successfully replicated this model in Southeast Asia, particularly in Malaysia and Indonesia, in the pod system market. Relx specialty stores can be seen everywhere in high-end shopping malls and busy streets in Indonesia.

Some analysts attribute RELX International's success in certain Southeast Asian regions not only to its self-built channels but also to the widespread presence of the Chinese community in these countries. Due to its success in the Chinese market, RELX enjoys a strong reputation within the Chinese community, making its success in markets with a significant Chinese population seem more natural.

Dr. Gao Yang, a Ph.D. in Advertising from the Communication University of China, also pointed out that when a brand succeeds in a specific regional market, its experience and brand momentum can create a halo effect, providing potential opportunities for transplantation into other target markets.

However, Indonesia is just one example. In fact, in the main battleground for e-cigarettes—Europe and the United States—RELX stores are virtually non-existent.

Is RELX International not attempting to replicate this model in the European and American markets, or is this approach not feasible?

Regarding this, an unnamed analyst told 2FIRSTS that there are significant differences between the European and American markets and the Southeast Asian markets. First, the self-built sales channel model in the European and American markets requires higher population density. Second, in regions with a lower proportion of Chinese residents, RELX lacks the brand halo effect. Third, store costs and operating expenses in Europe and the United States are relatively high, and RELX may not have sufficient financial support. Finally, there are many countries in Europe and America, each with different policies and strong competition, making it extremely challenging to overcome these issues one by one.

Therefore, entering the mainstream e-cigarette market in Europe and America through self-built channels appears to be challenging.

A senior industry professional involved in the British e-cigarette market stated that in Europe, self-built channels require a comprehensive set of hardware and software facilities to be successful. According to their observations, only VUSE, a product under British American Tobacco (BAT), has set up dedicated counters in the UK market.

It was suggested that when Chinese e-cigarette brands expand into global markets, they generally choose to cooperate with local channel partners who possess the necessary conditions for success. The cooperation models between e-cigarette brands and channel partners vary. For example, in the well-known ELF BAR brand's early days in the European market, it adopted a strategy of offering credit terms to channel partners and establishing deep partnerships by distributing products on a large scale. Another renowned brand, HQD, attracted channel partners in the Russian market by offering substantial profits when entering that market.

Dilemma of Compliance

As is well known, "gray market products" occupy a significant share of the global e-cigarette market. Gray market products refer to illegal products involved in activities such as smuggling, exceeding standards, tax evasion, and illicit listing. Due to relatively lenient enforcement in some countries, many e-cigarette companies generally explore opportunities for development in both "gray market" and "compliant market" simultaneously.

However, as a subsidiary of the publicly-listed company Wuxi AppTec, RELX International must strictly comply with the relevant constraints and regulations of a publicly-listed company. Therefore, it cannot venture into the "gray market" like other companies and can only seek development in compliant markets.

This means that RELX International has missed out on many potential market opportunities. For example, in countries like Australia, where disposable e-cigarettes are banned, and in Brazil, where e-cigarettes are completely prohibited. Furthermore, in the UK market, where illegal high-nicotine products are squeezing out compliant ones, RELX International can only observe without taking action.

As competitors have been achieving great success in the "gray market" while some regulatory leniency exists in certain countries, RELX International's corporate background has become a limiting factor for its overseas market development.

Regarding the U.S. e-cigarette market, products must undergo PMTA (Pre-Market Tobacco Product Application) to be legally sold. However, obtaining PMTA approval is an extremely challenging task, and even brands that invest millions of dollars may not necessarily succeed. Currently, only a few companies have obtained PMTA approvals. Reuters reported that RELX has invested millions of dollars in PMTA applications since 2020 and is still awaiting FDA approval.

However, due to the relatively lax enforcement of e-cigarette regulations in the United States, many brands have flooded the market, making it the largest e-cigarette market globally.

While competitors thrive in the American market, RELX International can only watch from the sidelines and experience frustration. Nevertheless, insiders familiar with the U.S. e-cigarette market have revealed that there are limited RELX products available in the Los Angeles market. According to the packaging information of these products, they seem to be imported from Southeast Asia through unconventional channels.

Drafting to Overtake—What Are the Chances?

Of course, despite its numerous inconveniences, RELX International is doing its best to compete in international markets.

2FIRSTS found that several products under the WAKA brand have different appearances but generally follow the characteristic of "simplicity." Although WAKA's performance in several overseas markets was not outstanding, the WAKA soPro PA10000 was an exception.

The WAKA soPro PA10000 is a disposable e-cigarette product with 10,000 puffs, featuring WAKA's classic black-and-white color scheme and adopting "dual-coil" technology (with two heating elements), allowing users to switch between "single-coil" and "dual-coil" modes.

After its launch in Russia, this product received positive market feedback and achieved impressive sales.

Many industry professionals believe that the success of the WAKA soPro PA10000 is primarily due to its unique "dual-coil" technology. In "dual-coil" mode, users can experience a stronger vapor when inhaling, releasing denser and larger amounts of smoke. In

"single-coil" mode, the experience is similar to that of a regular e-cigarette.

Some consumers have provided feedback, saying, "The WAKA soPro PA10000 has a strong kick. Taking a puff in the morning can quickly wake you up, which aligns with the preferences of Russian consumers."

In fact, "dual-coil" technology is not a creation of RELX International. A seasoned professional in the e-cigarette industry pointed out that "dual-coil" technology originally came from the e-cigarette contract manufacturing company MEIZU, and it was promoted in the United States by GEEKBAR PULSE. RELX International adopted this technology in the Russian market earlier than other brands and successfully turned it into a "hot-selling product" in that market.

However, in the e-cigarette market, having a strong product alone is not enough to make it a hit; channel partners are also crucial. An e-cigarette industry insider familiar with RELX International stated that RELX International also motivated its channel partners to sell its products in Russia through significant incentives.

Based on the performance of the WAKA soPro PA10000 in the Russian market, it appears that RELX International's strategy has worked.

Moreover, RELX's expansion into overseas markets does not seem limited to just the RELX and WAKA brands.

On July 10th of this year, China's Boton announced a successful sale of the Korean e-cigarette brand "BUBBLEMON." The buyer is a wholly-owned subsidiary of Sunnyheart Inc., a company registered in the Cayman Islands, with "Wang Ying" as the ultimate beneficial owner.

Industry insiders have speculated that this acquisition may be related to RELX because the founder of RELX is named "Wang Ying," which is homophonic with "Wang Ying."

In addition, as mentioned at the beginning of the article, on December 5th of this year, RELX announced the acquisition of two e-cigarette brands in Southeast Asia and North Asia for $25 million. This is the first move by RELX after announcing the termination of the "non-competition agreement" with RELX International in the third-quarter report this year.

Some opinions suggest that, apart from globally renowned brands like ELFBAR, most e-cigarette brands have not yet established sufficient influence in international markets and lack lasting appeal to users. Therefore, RELX's strategy of entering overseas markets by acquiring foreign e-cigarette brands may not be particularly wise.

Others believe that the main purpose of RELX's acquisition of foreign brands may be to leverage the channels already established by those brands to promote its own products. After all, acquiring brands is a more convenient way to expand channels than building them from scratch.

Cai Fangyi, Chief Analyst of the Light Industry at Changjiang Securities Research Institute, pointed out that considering the increasing saturation of the overseas e-cigarette market, most markets have already seen mature brands emerge.

Therefore, it is a reasonable strategic choice to expand the market through acquisitions. Given that RELX holds a large amount of cash, making acquisitions is a natural choice. The termination of the "non-competition agreement" with RELX International may also be aimed at using funds more flexibly in the international market.

At the same time, Cai Fangyi also said that by simultaneously operating two brands in the international market, RELX can more effectively break into global markets one by one.

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.