Having lost on three years’ betting agreement, Sikary, in the first half of 2023, suddenly performed extremely well, emerging as the "dark horse" in e-cigarette industry.

In mid-July, Sikary's parent company, Shenzhen Yinghe Technology Co Ltd (Yinghe, 300457.SZ), attracted much attention for its e-cigarette business, with its stock price rising more than 30% cumulatively for three consecutive trading days. Yinghe Technology immediately issued an announcement that the company's operations have not undergone significant changes. Even so, investors are still pouring in, and many seem to be bullish on Sikary's e-cigarette business.

On August 25, the first half of 2023 financial report released by Yinghe Technology demonstrated the bright performance of Sikary: Sikary's revenue exceeded 1.4 billion yuan in the first half of the year, with a year-on-year growth of up to 1,477.33%. This amazing growth rate has once again attracted the attention of the e-cigarette industry and investors.

Sikary's revenue grew nearly 15-fold in the first half of 2023, while at the same time, the e-cigarette industry is no longer in full swing as it was in previous years. Even industry leaders like Smoore (HKEx: 06969) and RELX (RLX.US) experienced a serious downturn in the first half of 2023. Against this backdrop, this report card from Sikary looks particularly impressive.

How did this newcomer to the e-cigarette business rise to prominence so quickly?

Four years of Disappointment Followed by a "Fortune"

A review of Sikary's history reveals that the company, founded in 2013, did not receive much attention until 2018. It wasn't until September 2018 that Yinghe acquired 51% of Sikary through a capital increase of $48.27 million.

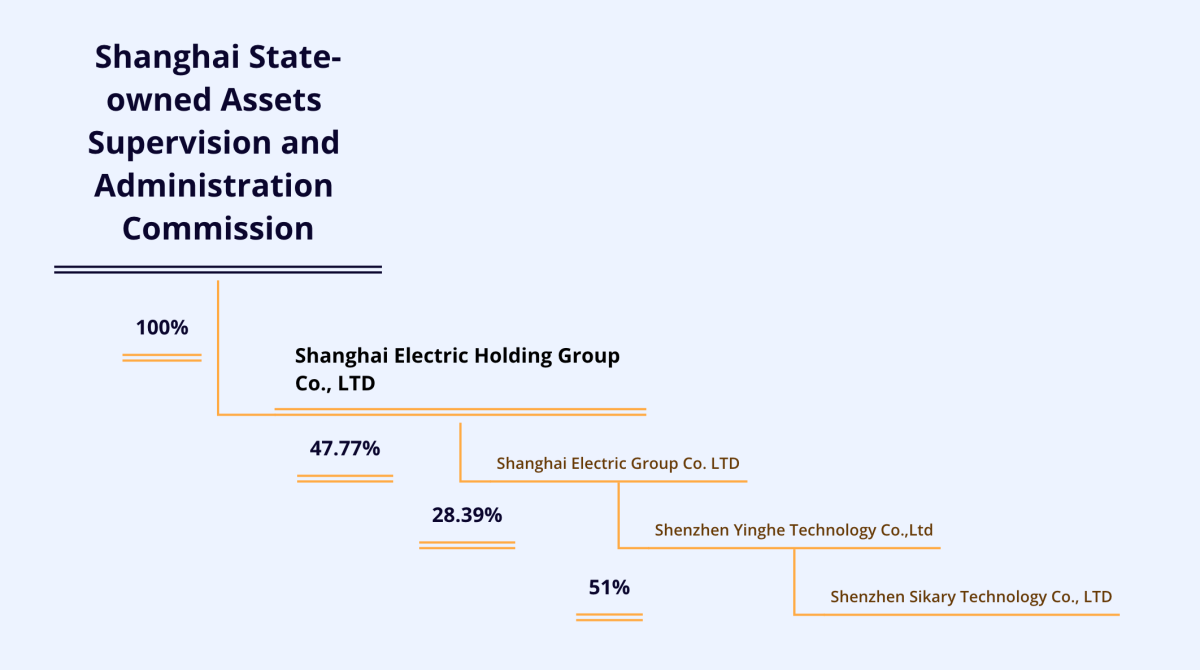

It is worth mentioning that the largest shareholder of Yinghe Technology is Shanghai Electric Group Corporation (Shanghai Electric, 601727.SH), and the controlling shareholder of Shanghai Electric is Shanghai Electric Holding Group Corporation, which is under the Shanghai Municipal State-owned Assets Supervision and Administration Commission (SASAC).

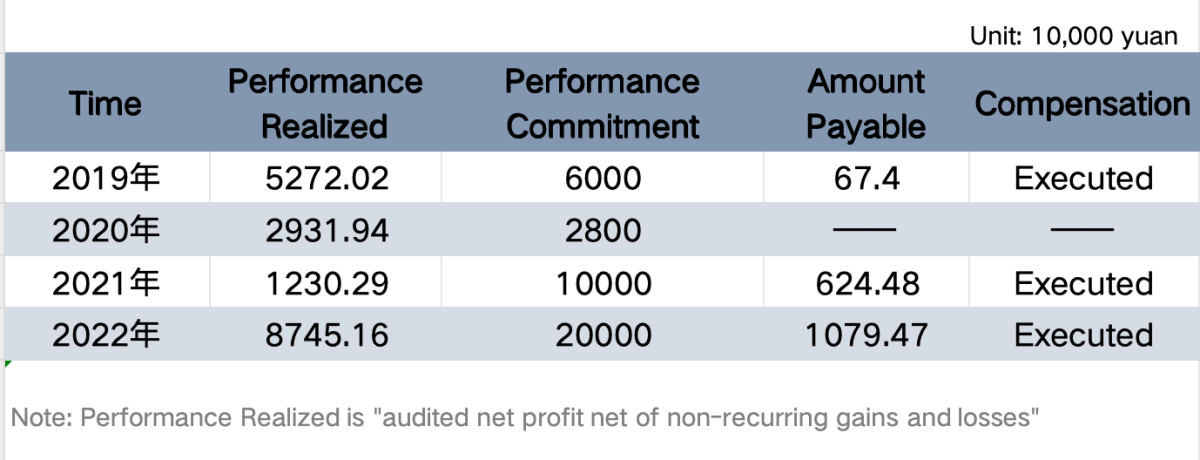

In the equity transaction between Sikary and Yinghe Technology, the parties entered into a performance commitment agreement. According to the agreement, Sikary committed that its audited net profit in 2019, 2020, 2021 and 2022 shall not be less than 60 million yuan, 28 million yuan, 10 million yuan and 20,000 million yuan.

However, from 2019 to 2022, during which time Sikary has not been able to deliver on its performance promises, except for 2020.

Sikary's specific performance for 2019 through 2022 is set forth below:

Industry insiders familiar with Sikary revealed to 2FIRSTS that this betting agreement nearly bankrupted Sikary. As a result, at the end of 2022, Sikary intends to re-search for an investor to buy back the shares in the hands of WinHub and terminate this betting agreement.

Into 2023, however, Sikary's results suddenly skyrocketed, with net profit reaching $417 million in the first half of the year alone, not only exceeding the company's full-year net profit of $87.45 million in 2022, but even far exceeding the company's profits over the last four years combined ($182 million).

What exactly did Sikary go through in the meantime? Why did the company's results suddenly skyrocket in the first half of 2023?

To answer this question, you need to understand Sikary's history and business overseas.

"Life-saving" Products

The launch of the SKE Crystal Bar in the UK in 2021 was a "lifesaver" for Sikary.

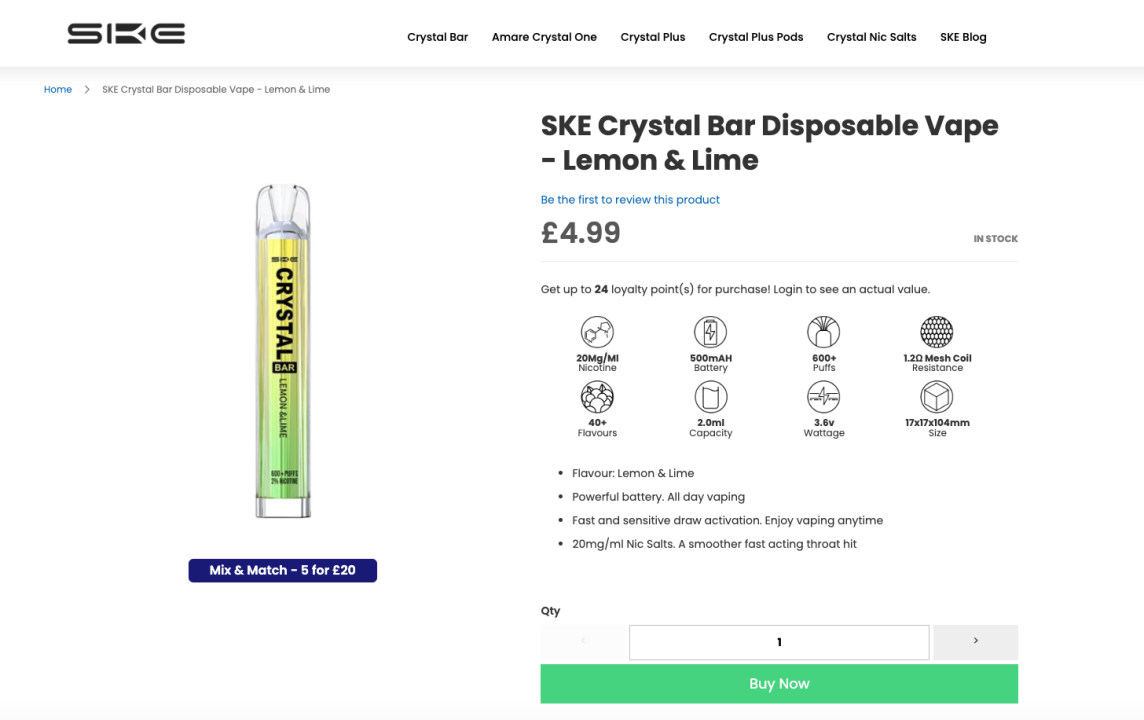

SKE Crystal Bar is a disposable e-cigarette product that is unique in that it is made with crystal material for its appearance, showing a dazzling gradient color that is clearly different from other e-cigarette products, which is what makes it so remarkable. The number of vaping puffs is 600, with a variety of flavors such as lime and cherry.

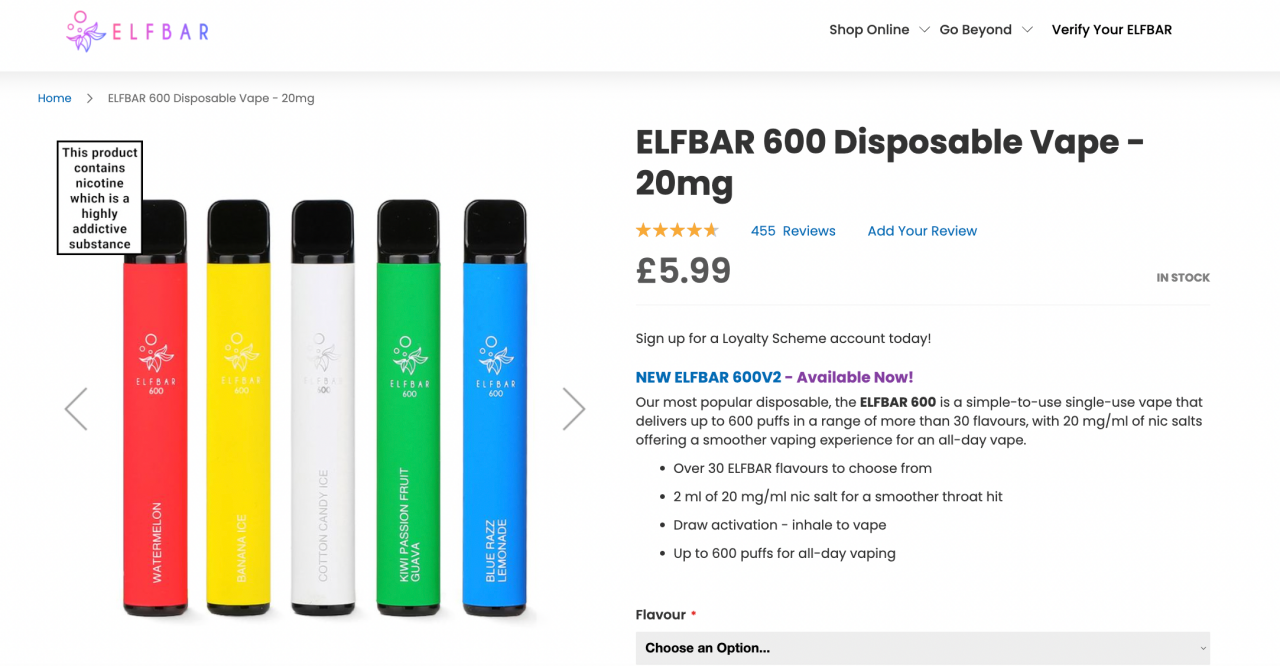

Currently, the SKE Crystal Bar is priced at £4.99, or about RMB 44, on the official Sikary website; dealer retail prices range from £4.49 to £7.99, or about RMB 40 to 71. The ELFBAR 600, on the other hand, is priced at £5.99, or about Rs. 53, on the official website; dealer retail prices range from £4.99 to £7.99, or about Rs. 40 to Rs. 71, which is basically the same as the SKE Crystal Bar's price.

It is worth noting that as soon as the SKE Crystal Bar was launched, some industry insiders predicted at the show that the product would be a "hit". This prediction came true a year later - the SKE Crystal Bar became Sikary's most popular product.

2FIRSTS observed during their October 2022 research of the UK market that SKE Crystal Bar was very high on the load rate. The shelves, next to ELFBAR and GEEK BAR, are almost always stocked with SKE Crystal Bar products.

The success of the SKE Crystal Bar is further confirmed by data analysts Nielsen. According to Nielsen, in January 2023, SKE Crystal Bar was ranked among the top 10 disposable e-cigarette sales in the UK, at number seven.

Nielsen data shows that 138 million disposable e-cigarettes will be sold in the UK in 2022, with Sikary sales alone exceeding 30 million units. The BBC mentioned in a report that Nielsen's data excludes sales by independent retailers and e-cigarette stores, and that Sikary's actual sales in 2022 could be more than 100 million units.

According to another Sikary insider, Sikary's best-selling product, the SKE Crystal Bar, was even able to achieve sales of more than 10 million per month. A logistician who has a long-term cooperation with Sikary's European distributors also confirmed to 2FIRSTS that the shipment of SKE Crystal Bar is very high.

Winning on Social Media

When exploring the reasons for Sikary's soaring performance, some foreign media outlets, as well as some industry insiders, attributed it to Sikary's superior ability in social media promotion.

However, there have also been criticisms in the British media that Sikary has relied too heavily on social media to appeal to a younger demographic. in late August, the BBC issued an article accusing Sikary of using Discord, a British instant messaging platform, for promotional purposes. Discord is said to have started out as a gaming platform with a large number of users under the age of 18.

In addition to the strong promotional power of social media, in two supreme conversations with industry insiders, more people believe that the more important reason for Sikary's rise is its success in penetrating the UK's distributor channel.

When it comes to Sikary's sales channels in the UK, it's important to mention its head of UK sales, Zhang Jinghan.

A senior e-cigarette industry practitioner told 2FIRSTS that Zhang Jinghan used to work for e-cigarette company FirstUnion, but was poached by Sikary in 2021 and appointed as sales director in charge of the UK market.

One longtime investor told 2FIRSTS that Jinghan Zhang received a "Special Contribution Award" from within the company at Sikary's 2022 annual meeting, which explicitly highlighted her outstanding performance. This also gives us a better idea of how Sikary's business is performing in the UK.

The award mentioned that Zhang Jinghan joined SKE in 2021, and during the period from 2022 to May 2023, she helped transform the company into a self-branded e-cigarette provider, laying the foundation for the company's sustainable development.In 2022, when the industry changed drastically and the company's development faced a transition, she utilized her own business resources and branding ability to launch SKE Crystal Bar 9298, a series of products that have become famous in the UK, and achieved year-on-year sales revenue doubling. 9298 series of products, an instant success, to achieve sales revenue doubled year-on-year. 2023 January - April, SKE (Sikary) has jumped to the top four among the United Kingdom disposable e-cigarette brands, and enjoys the brand reputation in many countries in Europe.

"Ebb and Flow" with ELFBAR?

The advantages of social media and overseas channels have helped Sikary to rank among the top ten in the UK. The further outbreak of Sikary is considered by most industry insiders and investors as having an inextricable relationship with another well-known e-cigarette brand, ELFBAR.

In February 2023, ELFBAR, the UK's number one e-cigarette brand, was exposed for excessive vaping oils in its products, resulting in over 70% of supermarkets in the UK taking ELFBAR's products involved off the shelves.After ELFBAR was taken off the shelves, sales of Sikary's SKE Crystal Bar rose rapidly, taking some of the market from ELFBAR.

On March 30th, when the 2FIRSTS visited and researched the e-cigarette distribution channel aggregation center in Manchester, UK, an Indo-Pakistani distributor said that since ELFBAR was taken off the shelves due to the problem of excessive tobacco oil, they could only promote SKE's products as a substitute for ELFBAR.

A long-term cooperation with Sikary's European distributors of logistics business to 2FIRSTS revealed that ELFBAR part of the product was off the shelves during its long-term cooperation with a large Dutch distributor was Sikary "pry" away. It is rumored that this distributor used to rely on ELFBAR to start, in the United Kingdom and the Netherlands have business, was Sikary successfully "pry" away, and is now purchasing 3,000 to 4,000 boxes of goods per month from Sikary (each box contains 200 or 300 products).

In April 2023, SKE Crystal Bar leapt to become the UK's fourth-ranked disposable e-cigarette brand, according to Nielsen. This is up three places from January, behind ELFBAR, ELUX and VUSE GO, and ahead of GEEK BAR, IVG Bar and Hyppe.

Although some SKE Crystal Bar products also suffered two UK withdrawals in mid-March and mid-April due to excessive vape oils, this has not affected its subsequent development.

Nielsen data from August 2023 shows that Sikary is now the second largest e-cigarette brand name in the UK.

The combination of data and industry opinion suggests that ELFBAR's sudden "accident" has indirectly contributed to Sikary's rise to the next level.

Can High Growth Myth Continue?

So it seems that the success of the "dark horse" Sikary can not be separated from the product, promotion, channels and occasional events and other factors, and whether such success can be maintained?

Sikary's main market, the United Kingdom, is currently mired in uncertainty over whether disposable e-cigarettes will be banned. One investor said, "If disposable e-cigarettes are banned in the U.K., then Sikary's peak moment is now."

However, it should be pointed out that Sikary not only occupies a leading position in the UK e-cigarette market, but according to 2FIRSTS understandings, Sikary is also the leading brand in the disposable e-cigarette market in the Netherlands; in addition, in July 2023, Sikary also entered North America, the Middle East and other markets one after another, and launched the SKE Crystal series of products in these markets; in addition, according to the information on the recruitment website, Sikary is also actively expanding into markets including Japan and Korea, Spanish-speaking regions, German-speaking regions, Russian-speaking regions, New Zealand, the Americas, and Southeast Asia.

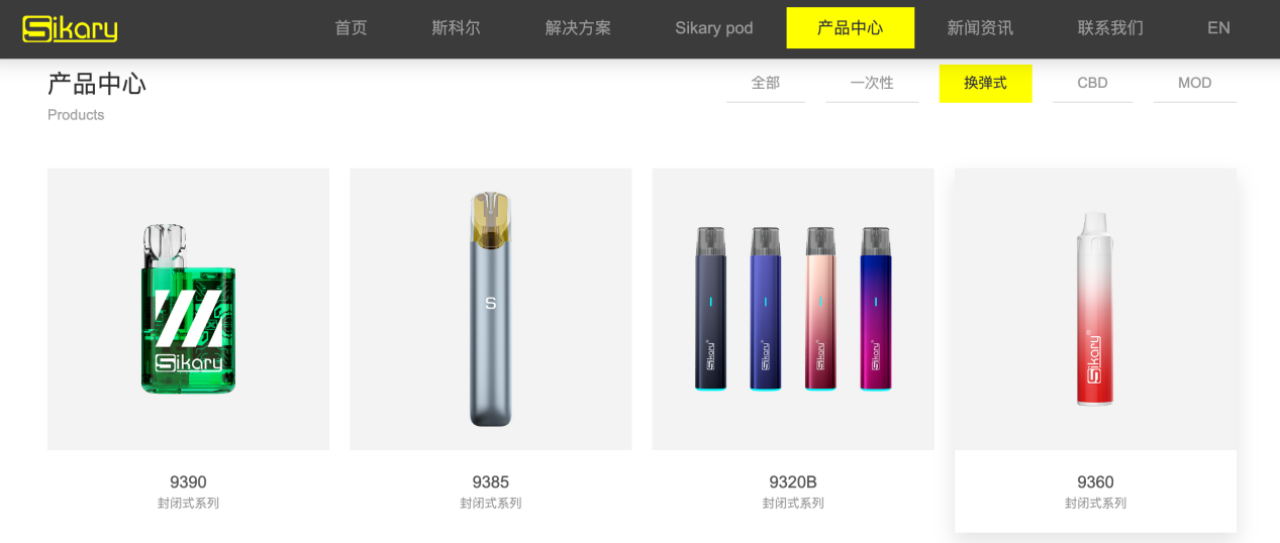

At the same time in a wide range of market development, 2FIRSTS through the official website of the Sikary learned that Sikary has also launched a variety of cartridge replacement e-cigarettes and CBD products, to broaden the company's product line into a number of tracks.

However, Sikary's bullet-changing products seem to have failed to meet expectations in terms of sales.

According to sources familiar with the matter, one of Sikary's bullet-changing products has the same appearance as the popular SKE Crystal Bar. However, despite being on the market for more than half a year, the bullet-changing product has failed to get a "decent" order.

It appears that the channel dominance of the SKE Crystal Bar product in the marketplace has not been realized with Sikary's bullet changing products.

Some investors are concerned that if the UK does ban disposable e-cigarettes, Sikary may struggle to maintain its current market share. They argue that refillable products are the specialty of established manufacturers such as Smoore and FirstUnion, and that it would be difficult for a "young" e-cigarette maker like Sikary to get a piece of cake.

However, some senior practitioners in the e-cigarette industry have also pointed out that leading disposable e-cigarette companies have a natural market advantage in joining the pod system market, as they are able to capture market share quickly.

E-cigarette industry super "dark horse" Sikary, whether it is a flash in the pan, or continue to maintain high growth, yet to be verified by time.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com