TPB is a company that primarily manufactures, markets, and distributes adult products in the tobacco accessories industry through its brands such as Zigzag and Stoker's. The business focuses on the United States and Canada.

The legalization of marijuana in the United States and Canada, along with the increasing awareness and acceptance of its consumption among North American consumers, has created a vast alternative smoking accessories market for TPB.

Currently, the TPB business is divided into three product brand divisions: Zigzag product division, Stoker's product division, and NewGen product division.

According to data from MSAi:

ZigZag has captured approximately 35% market share in the high-end cigarette paper market in the United States. Stoker's, on the other hand, holds a market share of nearly 30%, distributing both moist tobacco and chewing tobacco. The supplier for Stoker's chewing tobacco is Philip Morris (PM). As for NewGen, they distribute various types of vaporizers and sell them directly to their consumers.

In addition to selling these products, TPB has also invested in some marijuana production companies through this sector, such as Wild Hempettes, Docklight Brands, Inc., and Old Pal Holding Company LLC.

Currently, TPB's primary customers are Flamagas (the exclusive distributor of CLIPPER® lighters in the United States and Canada), Philip Morris (TPB's chewing tobacco supplier), and recently partnered customer VPR Brands (selling HoneyStick products in Canada).

The Pirate Bay (TPB) provides shipments to approximately 800 retailers in North America, in addition to servicing 200 secondary and indirect wholesalers in the United States. Their products are sold in over 85,000 nationwide chain stores and 95,000 independent convenience stores. There are approximately 197,000 retail points of sale in the United States alone. TPB also supplies services to approximately 25,000 traditional retail stores and newly established cannabis pharmacies in Canada, bringing the total number of retail points in North America to over 217,000. Additionally, the company directly sells to consumers through specific e-commerce websites such as Amazon and eBay.

According to Mikail Fancy, Chief Operating Officer of TPBCanada, "We are thrilled to partner with VPR Brands to bring HoneyStick to a wider audience in Canada. Our expertise in marketing, sales, distribution, and logistics, combined with the quality and innovation of HoneyStick products, is a perfect match, dedicated to providing excellent service and support to retailers and consumers.

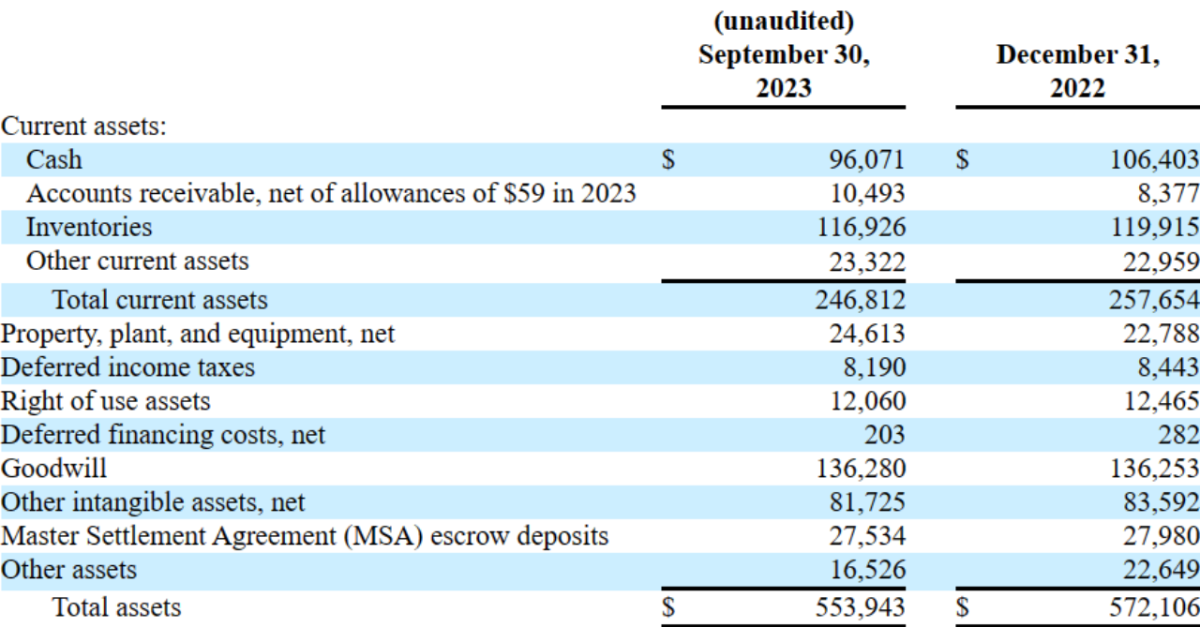

According to the financial report released by the company on September 30, 2023, TPB's balance sheet appears solid, but it also shows a relatively high leverage ratio.

Analysis of the assets:

Assets:

The Pirate Bay (TPB) currently holds approximately $96 million cash, about $10 million accounts receivable, and inventory worth $116 million. The total current assets have reached $246 million, ensuring a positive liquidity with a current ratio higher than 1. Additionally, TPB owns properties, factories, and equipment valued at $24 million and goodwill valued at $136 million, resulting in total assets of $553 million. However, the debt-to-asset ratio surpasses 1, indicating a slightly higher level of liability but maintaining a stable balance sheet.

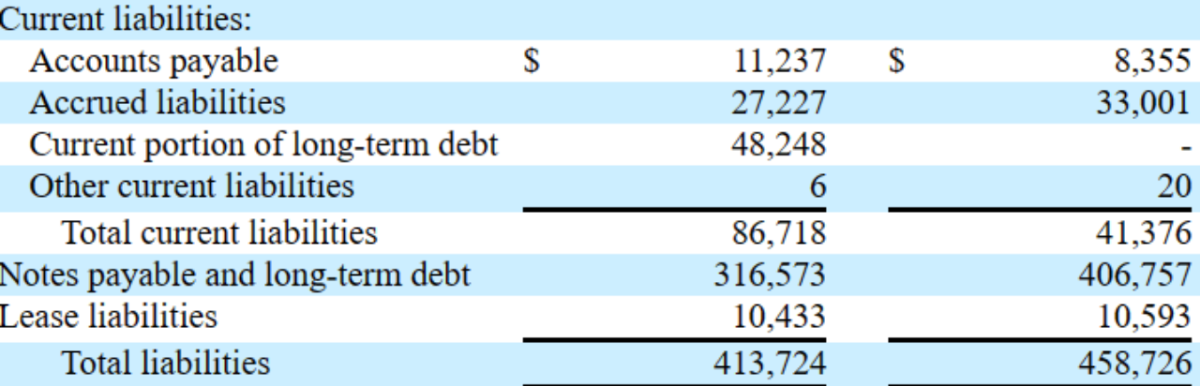

Liabilities:

TPB's accounts payable stand at $10 million, with an accrued liability worth $30 million. The company's notes payable and long-term debt amount to $379 million, resulting in a total liability of approximately $430 million.

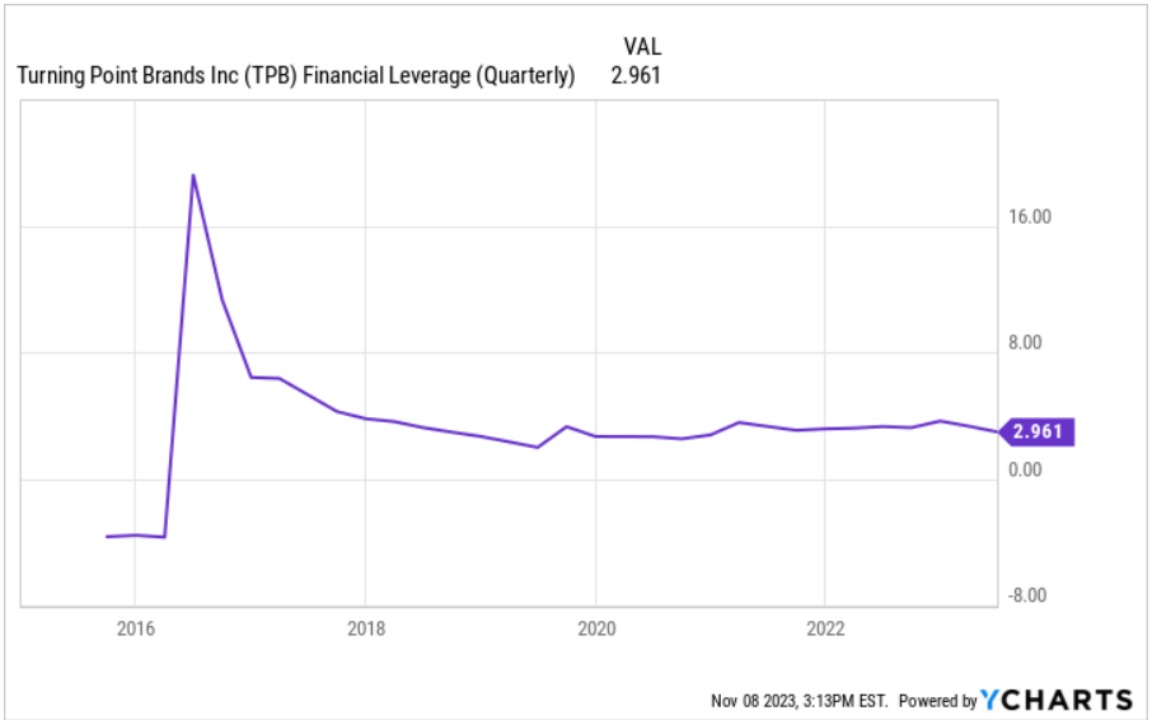

Due to the need to cope with bills, the overall leverage level is not insignificant, with a financial leverage ratio approaching 2.9 times.

Currently, TPB is actively leveraging its expertise in international distribution networks to accelerate growth. By centralizing ordering, logistics, and warehousing in one location, the company aims to streamline the retail process, ensure stable product supply, and reduce delivery time, enabling faster product delivery within its distribution scope.

TPB has solidified its significant position in the US and Canadian markets through strategic partnerships with companies such as VPR Brands and CLIPPER.

In the face of intense competition in the tobacco accessories industry, TPB continues to expand its business boundaries and accelerate its growth.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com