In March 2024, China Tobacco (Hong Kong) released its annual performance report for 2023, detailing the overall performance for the year and highlighting key indicators for the new tobacco sector over the past year. 2FIRSTS conducted a review of the highlights of the annual report.

Steady Progress in New Tobacco Business Sector

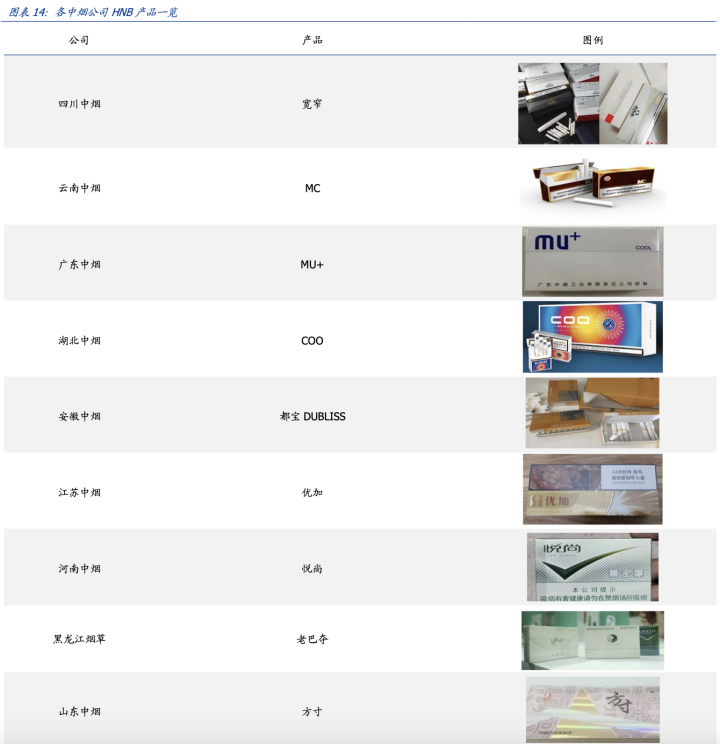

China Tobacco International (HK) began exporting new tobacco products in May 2018, primarily targeting the Asian market, such as South Korea. These new tobacco products include HNB tobacco products. In 2023, the sales revenue of China Tobacco International (HK) from new tobacco products reached 129,979 million Hong Kong dollars, accounting for 1% of the group's total annual revenue of 11,836,221 million Hong Kong dollars in 2023, an 18% increase from the new tobacco sales revenue of 110,133 million Hong Kong dollars in 2022.

However, it is worth noting that the overall proportion of the new tobacco sector in 2022 was 1.3%. In other words, in the past year, the proportion of new tobacco in China Tobacco International (HK) business has slightly decreased on a basis of basically holding steady. At the same time, even though the gross profit margin of the new tobacco sector has increased (4.4%) compared to before, it still lags behind core business sectors such as the cigarette export business sector with a gross profit margin of 13.57%.

The decline in numbers does not mean a neglect of novel tobacco products. Since its listing in Hong Kong in 2019, China Tobacco International (HK) has been consistently exporting novel tobacco products to global markets for five years. This is still highlighted in the 2023 annual report, showcasing the company's continued focus on this sector.

Gaining Momentum to Catch up with 3 Major Giants

At the same time, when compared with its industry peers, China Tobacco International (HK) is also showing strong growth momentum in its new tobacco products.

In 2023, the export quantity of China Tobacco International (HK) new tobacco products was 677,310 thousand units, an increase of 174,920 thousand units, representing a growth of 35% compared to the previous year. The operating income was 130.0 million Hong Kong dollars, an increase of 19.8 million Hong Kong dollars, representing an 18% growth. The gross profit was 5.7 million Hong Kong dollars, an increase of 2.5 million Hong Kong dollars, representing an 80% growth compared to the previous year.

China Tobacco International (HK) attributed its performance growth in the annual report to the following three factors:

Firstly, due to an increase in order demand. Over the past year, China Tobacco International (HK) has intensified efforts to expand international market channels and customers, seizing opportunities in emerging markets and deepening expansion in key markets.

The second reason is that the product has strong competitiveness. In the past year, China Tobacco International (HK) has strengthened the coordination of production, supply, and marketing. It has developed competitive products in response to changing market demand.

The third point is the increase in profit margin. A rich product portfolio and ongoing optimization of business structures have driven the increase in profit margin.

A comparison of the annual reports of the other three major tobacco companies reveals that China Tobacco International (HK) may not match the absolute export quantities of its competitors (PMI 125.2 billion, BAT 29.7 billion, and JTI 8.8 billion), but it surpasses the closest competitor JT by more than two billion. Additionally, its 35% increase in shipment volume is three times higher than the highest of the three, PMI at 11.8%. Furthermore, its growth in revenue and gross profit is significantly ahead as well.

Compliance Expansion Goal for Promising Future

In addition to new tobacco products, including traditional cigarettes and other service businesses, China Tobacco International (HK) as a whole also achieved excellent results. In 2023, China Tobacco International (HK) achieved a revenue of HK$11.836 billion, an increase of 42.19% year-on-year; achieved a gross profit of HK$1.088 billion, an increase of 34.96% year-on-year; and achieved a net profit of HK$599 million attributable to equity holders of the company, a significant increase of 59.72% year-on-year, exceeding previous profit forecast expectations.

When discussing the future development strategy of the export business of new tobacco products, China Tobacco International (HK) has clearly outlined several directions: strengthening monitoring of international market dynamics and demand research, focusing on key market expansion and accelerating the development of new markets, continuously promoting product upgrade iteration, optimizing supply chain models, improving market response capabilities, and expanding the scale of sales of new tobacco products.

Meanwhile, China Tobacco International (HK) emphasized the importance of "strengthening the protection of their own brand intellectual property rights." This may indicate that the group will launch more new tobacco brands in the future, which is worth keeping an eye on in the industry.

Similarly, in terms of corporate social responsibility, China Tobacco International (HK) emphasized the strengthening of its volunteer team, organizing activities such as community visits, tree planting, and coastal clean-ups to establish a positive external image. This also demonstrates the group's focus on local compliance and its commitment to further accelerate its overseas expansion in the future.

2FIRSTS will continue to monitor the international expansion of China Tobacco International (HK) and its new tobacco sector.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com