October 1 of 2022 marks a new era of development for the Chinese e-cigarette industry as the new regulation came into effect. It’s been 20 years since the Chinese e-cigarette industry was born as the first e-cigarette was invented in China. According to the, 2022 Blue Cover China E-cigarette Industry Export Report jointly issued by ECCC and 2FIRSTS, the expected total size of the global e-cigarette market will exceed $108 billion by the end of 2022, while China’s total e-cigarette exports are expected to reach 186.7 billion RMB.

Shenzhen, as the hub for the global vaping supply chain and manufacturing, global e-cigarette production of 90%. Due to the nature of electronics manufacturing industries and globalized consumption, the Chinese vaping industry feels obliged to plan with a global perspective.

Southeast Asia has been named as the first stop economically and geographically, with Indonesia as the favorite of the region.

The IECIE Vape Show, once the largest vape show worldwide, moved abroad due to regulatory policies in China. It chose Jakarta, Indonesia as the first stop and hosted 100+ exhibitors.

IECIE 2022

The “preference” of Chinese manufacturing for Indonesia is also evident from a set of recent news headlines.

- Jinjia Group’s manufacturing base in Indonesia to provide integrated e-cigarette services.

- Smoore Technology Indonesia (STI), a subsidiary of one of the largest e-cigarette manufacturers, has invested US$ 80m to establish e-cigarette factories in Indonesia.

- The Indonesian factory of Zhijing Precision, an e-cigarette assembly supplier, is to be operational by 2022.

So, why is Indonesia their destination to establish overseas manufacturing bases?

Indonesia’s Advantages

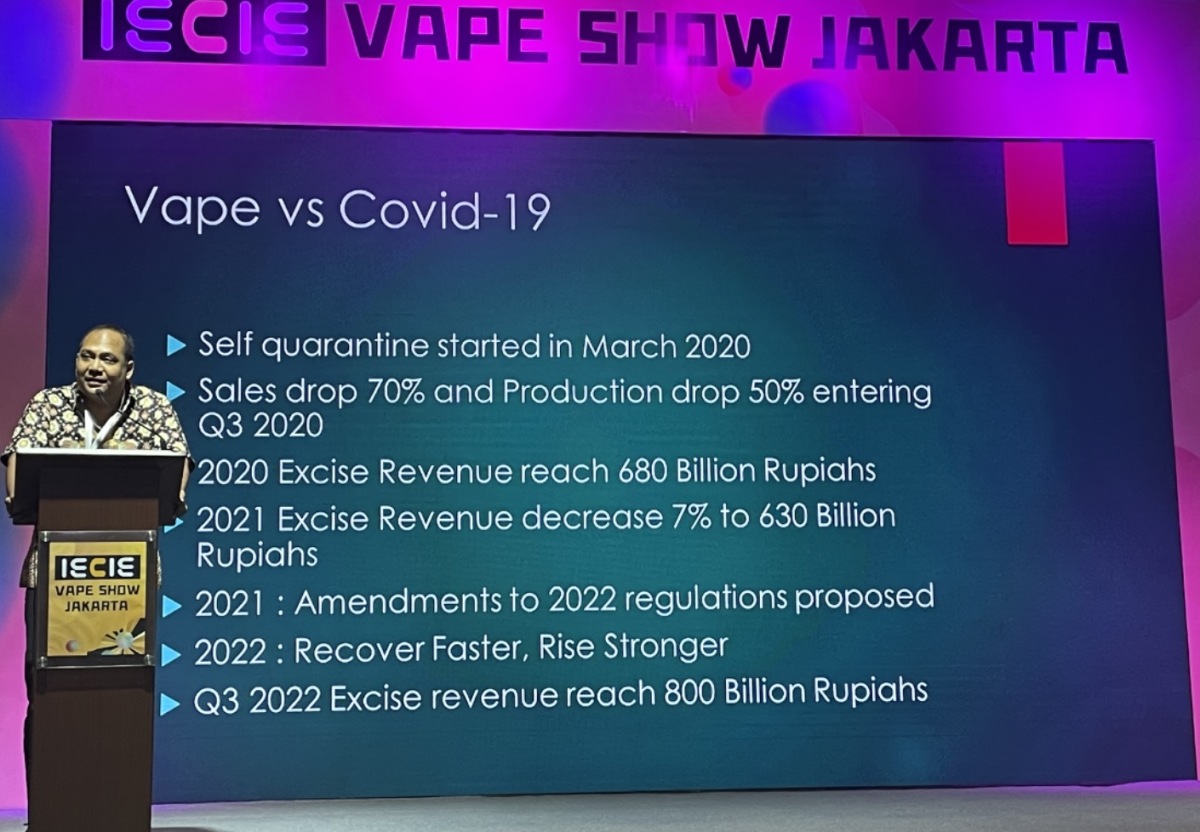

Garindra Kartasasmita, Secretary General of the Indonesian Vapor Entrepreneurs Association (APVI), mentioned in his keynote speech at the IECIE Vape Show that the Indonesian vaping market has been growing since 2013 with an annual rate of 50% except for the year 2021 when it shrank by 7% due to the covid. It is expected to rebound to 50% growth in 2022.

Garindra Kartasasmita, speaking at the IECIE Vape Show

The cost factors such as land and labor costs make Indonesia the first choice setting up abroad for e-cigarette companies, but the country also has more to offer.

Integration of Production and Sales

The ease of integration of production and sales brought by the large population is the country’s one huge advantage. Indonesia’s population is the 4th largest in the world, boasting 280 million, 40% of Southeast Asia’s total. Moreover, Indonesia has a world-leading smoking rate with the smoking population reaching 70.2 million. That is a smoking rate of 34%. The demographic structure of Indonesia makes it a great population to develop e-cigarettes. 40% of the Indonesian population is less than 35 years old, which also makes it a great market potential since the younger population has a better acceptance of e-cigarettes. The e-cigarettes produced in Indonesia have the potential to be consumed domestically, cutting the cost of shipping to other countries.

Map of Indonesia, Picture: http://www.shijieditu.net/Indonesia/

Secondly, Indonesia has relatively loose regulations on the marketing of e-cigarettes. Indonesia is the only country in Southeast Asia that allows tobacco advertising on television and in the media. Indonesia also has a place for e-cigarette bloggers and cross-category blogging such as beauty and skin care. Indonesia has the second highest number of posts on Instagram sharing vaping and related devices among all countries.

Encouragement and Support for E-cigarette Manufacturing

E-cigarettes can only be sold and imported in Indonesia if they are recommended by the Food and Drug Administration (BPOM) of the Ministry of Health, and the Ministry of Industry, additionally they must be certified with the Indonesian National Standard (SNI) certificate. In general, the policies are still friendly to Chinese e-cigarette manufacturers.

Commenting on Smoore’s plant in Indonesia, Bahlil, Indonesia’s investment minister and director of the Investment Coordinating Board, publicly stated “We need cooperation, we need jobs, we need opportunities that will make our brothers owners of our country.” And Clayton Shen, president of Smoore Indonesia, expressed his gratitude for the support of the Indonesian government, especially the tariff-free incentives granted by the Ministry of Investment for the company’s imported machinery.

Challenges ahead

Although the Indonesian market is a large pie for Chinese manufacturers, it is not easy to navigate this market.

A well-known Chinese e-cigarette manufacturer intending to build a factory in Indonesia revealed to 2FIRSTS that logistics is a problem for manufacturers, and currently no good solution is available. If the end products are filled and assembled in China and then sent to Indonesia, the time held at customs is unpredictable. “I had a batch of goods that arrived at customs at the end of last month, but they are still in customs as of the 20th of this month. If it was assembled in Indonesia and sent from the Indonesian factory, the time difference in delivery is not much different from if it were delivered from China.”

Indonesian Logistics, Photo: Network

Secondly, the lack of machinery. Another manufacturer told 2FIRSTS “There’s a critical lack of tools and machinery to keep pace with the production lines. Should factories be built here, machinery must be transported from China, which is a critical problem to tackle. It’s a misconception that the only shortage we would face is raw materials.”

The workers’ gap is also not neglectable. In addition to overcoming cultural and geographical challenges when training local workers, it’s difficult to have them adopt the Chinese style of working. An insider said “Indonesians’ casual attitude to being late is a pain in the neck. I had to create a lot of incentives to stop them from being late for work and going early to home. This is very different from the Chinese work habits.”

Migration or Spillover

To a certain level, the global industrial layout and output are because of the concentration and technology of the industry. China’s e-cigarette industry from Shenzhen to Indonesia may as well be described as “spillover,” rather than “migration”.

The biggest advantage of Shenzhen’s e-cigarette industry comes from the industry cluster and synergy. 2FIRSTS co-founder and COO Echo Guo said in a media interview that years of development not only granted the Bao’an district of Shenzhen a number of e-cigarette enterprises but also brought together supporting chains, including industrial design, molds, batteries, etc. “Here to there is a ‘two-hour traffic circle’ within the whole e-cigarette industry, with all of its subbranches cooperating closely. Even when the manufacturers and customers exchange new ideas, it would take less than two hours to get a prototype ready.”

Just because Shenzhen's e-cigarette manufacturing hub status is unshakable in the short term does not mean that the layout of the manufacturing is solidified. In fact, the past five years have seen the first round of “spillover” of the e-cigarette industry in China’s Greater Bay Area. We have seen spillover from Shajing of the Baoan district of Shenzhen to the Dongguan area and in between. This “spillover” has not affected the development of China’s electronic cigarette industry, in fact, the past five years were also a period of rapid industrial growth and improvements in the supply chain.

Shenzhen City, Photo: network

Therefore, the spillover of China’s e-cigarette industry to Indonesia can also be seen as the absorption and utilization of manufacturing resources by China’s e-cigarette industry, which has broken the boundary of the Greater Bay Area and extended to a broader region of the Asia-Pacific.

References

[1]劲嘉股份:印尼公司不需要获取国内电子烟生产许可证

[2]中国电子烟将在玛琅建造总投资数为1.12万亿印尼盾工厂

[3]电子烟出海大潮:从制造出口到品牌出口,行业已现两极分化

[4]6Wresearch_Indonesia E-Cigarette Market (2020-2026)、IJHPM_E-Cigarette Markets and Policy Responses in Southeast Asia: A Scoping Review、中泰证券《对电子烟开征消费税的国际经验》

[5]电子烟外贸商困境:无合规身份无法注册平台无法参与交易

[6]订单到底转移了多少?东南亚产业链转移的危与机 | 云帆·出海(二)

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.