Press Release:

This article is limited to the research of the global atomization industry and does not involve any brand or product recommendations.

This article is for reference only in the research of the global atomization industry development, and does not involve any capital market evaluation or investment advice. This article should not be used as a basis for any investment.

This article focuses solely on the business sector and does not touch on any regulatory policy comments.

Beware of the risks of debt in the e-cigarette industry. With businesses slowing down and debt crises looming, how will the struggles of individual companies impact the entire industry supply chain?

2FIRSTS2FIRSTS ZHU Lihong

In early 2024, prominent European e-cigarette brand AromaKing's debt crisis came to light, involving multiple contract manufacturers and logistics companies, with default amounts totaling more than 100 million RMB. (For more details, see 2FIRSTS report: European e-cigarette brand Aroma King exposed for owing huge sums to Chinese suppliers)

In response to 2FIRSTS, Aroma King admitted that due to issues with quality control, the brand has suffered financial losses and is currently undergoing restructuring.

The e-cigarette industry has long been proud of its outstanding cash flow. An e-cigarette entrepreneur recalled to 2FIRSTS that overseas customers would even line up outside the factory with cash in hand, waiting for their orders. The factory would only ship out products after full payment was made. As a result, this industry never lacks money, doesn't need to borrow, and doesn't rely on financing.

However, the debt issues represented by Aroma King have gradually come to light, sounding an alarm for the entire e-cigarette industry. As a core company in the industry chain, once a "leader company" in the chain has debt problems, its impact may quickly spread to the entire supply chain, triggering a series of chain reactions.

Apart from the regulatory risks faced by e-cigarettes, a new debt risk is emerging.

Investment is declining, profits are shrinking: Defaults and credit crisis highlighted.

Investment frenzy recedes, era of high investment comes to an end.

Over the past few years, the e-cigarette market has attracted a large amount of capital inflow due to rapid growth and huge profit potential, once viewed as a "gold mine" for investors.

A representative from an investment firm that has invested in multiple e-cigarette companies revealed that their initial decision to enter the e-cigarette industry was primarily due to the huge potential for growth in the market, the health benefits of the products, high profit margins, and the relatively lenient regulatory attitude of governments towards e-cigarettes.

However, with the changing market environment, this situation is starting to reverse.

A senior e-cigarette industry investor told 2FIRSTS:

The era of high investment in e-cigarettes is now over. Since last year, there has been a noticeable decrease in capital investment in e-cigarettes, and this trend is becoming increasingly evident this year.

Furthermore, sources familiar with the matter disclosed that some investors had invested in e-cigarette companies two years ago, hoping to profit during the licensing application stage. However, many of these investments have been withdrawn through redemptions and other means over the past two years, causing these companies to face cash flow shortages.

The person in charge of project investment at a listed company also admitted that, compared to e-cigarettes, they are more inclined to invest in the HNB field because e-cigarettes have a "low barrier to entry and limited development prospects.

Profit halved, end of high-growth era.

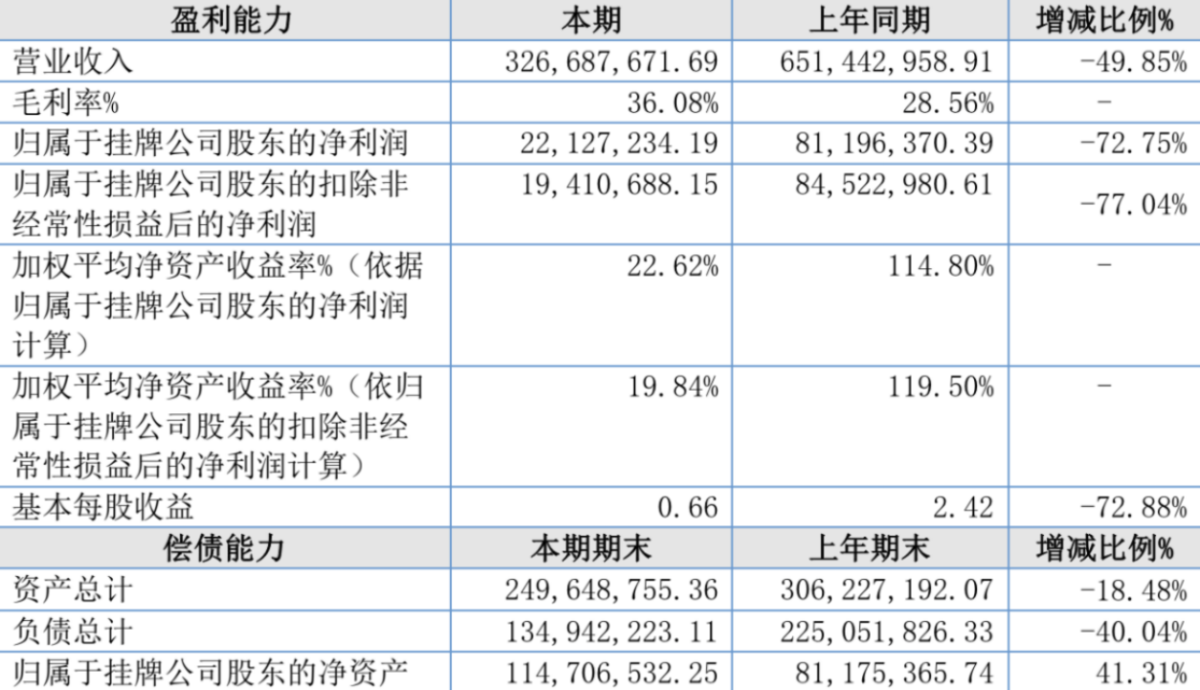

Apart from being seen as having "bleak development prospects", e-cigarette companies that were once considered to be "high-profit" are now facing a serious decline in profits. For example, in the 2023 financial reports of several listed companies, Itsuwa's net profit decreased by 72.75% year-on-year, and Tianchang Group's net profit decreased by over 60%.

At the same time, the profit margins at the end of the e-cigarette supply chain are also facing serious compression. A cotton wick supplier once revealed to 2FIRSTS that cotton wick prices have plummeted by nearly fifty percent in the past year. Similarly, suppliers of other key components such as batteries, oil tanks, etc. have also been complaining, as their profits are declining due to an overly competitive market.

This year, investment and financing activities have significantly decreased, profits have sharply declined, and the e-cigarette industry is no longer a guaranteed profitable business.

Selling the factory, selling the license, reluctantly exiting under pressure.

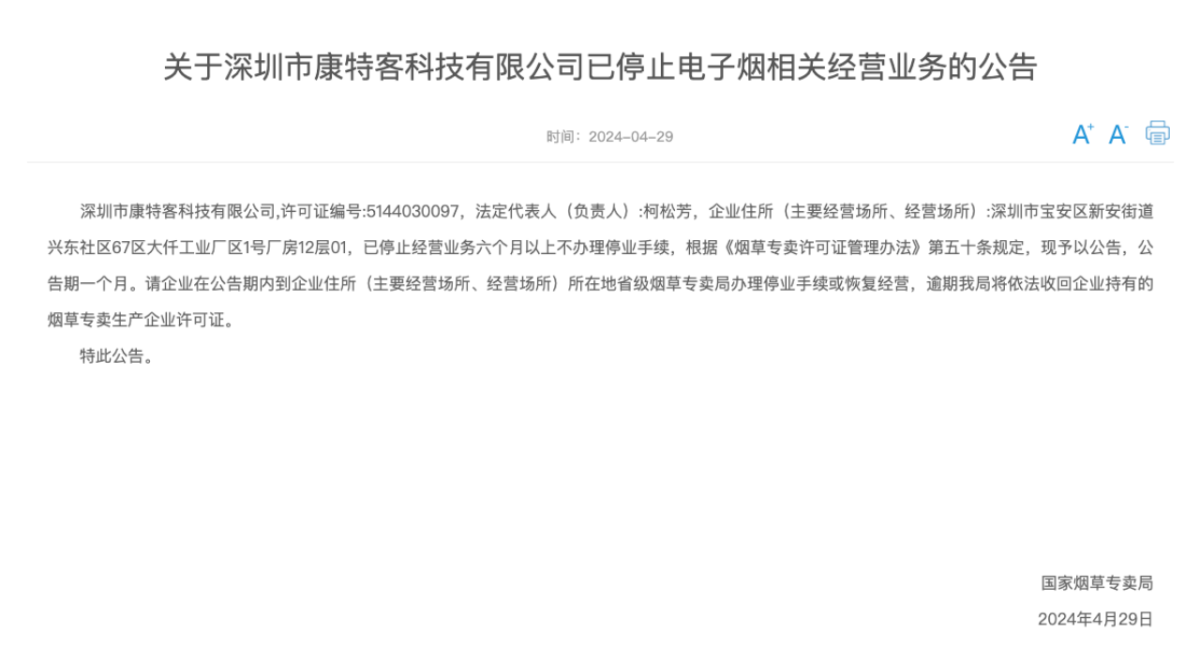

On April 29, the State Tobacco Monopoly Administration issued an official announcement stating that Shenzhen Contec Technology Co., Ltd. failed to conduct business activities for over six consecutive months and did not complete the relevant closure procedures. The company is now required to either complete the closure procedures or resume operations at the Tobacco Monopoly Bureau within the specified period in the announcement. If it fails to comply with the requirements by the deadline, the State Tobacco Monopoly Administration will revoke its tobacco monopoly production enterprise license in accordance with the law.

Not only has the first case of "suspension of certificate" appeared recently in the e-cigarette industry, but there has also been a phenomenon of trading around "licenses," commonly known as "selling factories and selling certificates." Under the pressure of multiple factors, some small and medium-sized e-cigarette companies have fallen into a loss trap and can only choose to exit the market in helplessness.

A senior professional with over 10 years of experience in the e-cigarette industry told 2FIRSTS that in 2022, there was a trend of factories selling licenses together with their products at relatively high prices, allowing buyers to enter the market early. However, since the second half of last year, this practice has become less profitable and even faced the embarrassing situation of no one willing to take over the packages.

Chain owner" faces obstacles as industry chain debt crisis becomes apparent.

In addition to the "selling factory and selling license" scheme, some e-cigarette companies are also deeply mired in debt, struggling to survive. Take Aroma King for example, the company's debt issues have led to significant arrears with contract manufacturers, logistics providers, and trading partners, among them owing a contract manufacturer in Shenzhen up to 80 million yuan in unpaid bills. This large debt has resulted in the contract manufacturer being unable to pay its employees' salaries on time for several months, severely impacting the company's operations.

Furthermore, this event has also triggered panic within the industry about a debt crisis, casting a shadow over the future development and financial stability of the e-cigarette industry as a whole.

Compliance Pressure, Market Competition: Enterprise Debt Risk Under Multiple Pressures

Once considered a rising industry, why is the e-cigarette now facing such an awkward situation?

Consignment, credit terms, and other models have triggered an increase in cash flow risks.

In Itsuwa's financial report, it accurately reveals the reasons for the current predicament of the e-cigarette company from a market perspective. It states that the main reason for the decline in revenue is the impact of e-cigarette policies, with domestic restrictions on the sale of flavored e-cigarettes other than tobacco flavor leading to intensified competition in overseas markets.

In Itsuwa's mid-year report for 2023, they gave a more specific reason: the market competition was fierce in the first half of 2023. Some e-cigarette companies adopted a fast-moving consumer goods sales model, delivering goods directly to stores and promoting them locally, implementing a method of shipping before payment and paying commissions.

A Morning Consult survey shows that a quarter of adults frequently use e-cigarettes during the pandemic. Stricter regulations are being implemented.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com