Key Points:

·The EU is considering raising taxes on certain tobacco products to 258%.

·This move could bring in approximately 15.1 billion euros ($17.5 billion ) in additional tax revenue for the EU.

·The plan also includes taxing e-cigarettes.

According to a leaked internal impact assessment document obtained by the European edition of "Politician" magazine on the 13th, the European Commission plans to increase the tax rate on hand-rolled cigarettes by 258%, while regular cigarettes will see a 139% hike.

A report has indicated that the European Commission has proposed three tax reform plans, with a preference for implementing the plan with the highest tax rates in order to increase tax revenues by approximately €151 billion ($175 billion). If this plan is implemented, the tax rate for cigarettes will increase from €90 ($104) per 1000 cigarettes to €215 ($249), and the tax rate for hand-rolled tobacco will increase from €60 ($69) per kilogram to €215 ($249). Additionally, the tax rate for cigar products known as "leaf-rolled tobacco" will steeply rise from €12 ($14) per kilogram to €143 ($166), a 1092% increase.

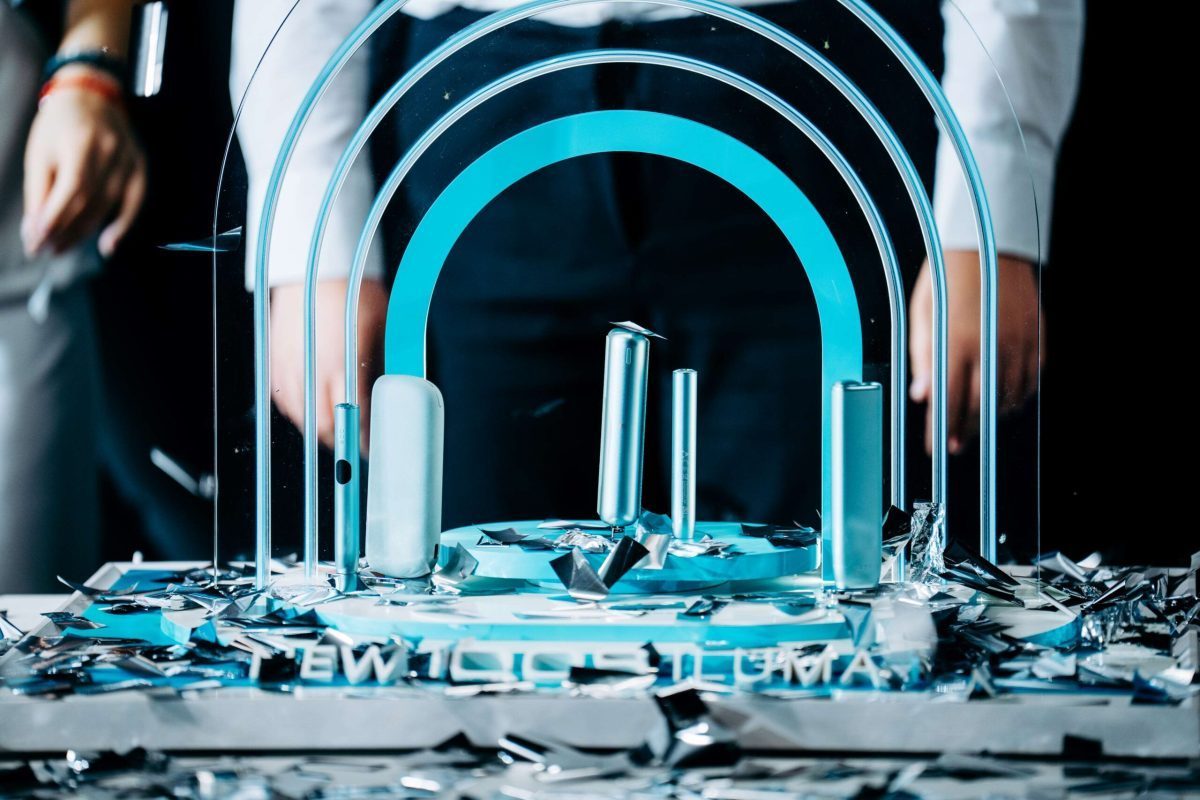

The tax reform plan also involves e-cigarettes, with a tax of €0.36 (USD 0.42) per milliliter imposed on e-liquid with a nicotine concentration exceeding 15 milligrams per milliliter, and a tax of €0.12 ($0.14) per milliliter on products with concentrations below this standard.

The European Commission emphasized in a document that raising tobacco taxes and prices has long been proven to be the most effective measure in reducing overall tobacco consumption. The current minimum tax rate has not been effective in reducing tobacco consumption. In the past decade, a decrease in tobacco consumption of approximately 40% has been attributed to tax policies.

In addition, the European Commission has faced pressure from member states to amend the Tobacco Excise Directive (TED) due to the increasing use of new tobacco products such as e-cigarettes, especially among young people and adolescents. The TED, established in 2011, sets the minimum tobacco tax rates, which member states use as a basis to determine their own tax rates.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com