By Ellesmere Zhu

The US market has been playing a domineering role in the development of the e-cigarette industry. According to The Blue Book for Chinese E-cigarette Industry Export 2022, the US e-cigarette market share is expected to make up some 65% of the world’s total in 2022.

However, things become tricky when it comes to e-cigarette wholesale and retail in the US, where excise taxes are made by federal, state, and local governments and are not uniform throughout the United States because governments differ in perception of e-cigarettes.

In Wisconsin, for instance, a “vapor product” was defined as “a non-combustible product that produces vapor or aerosol for inhalation from the application of a heating element to a liquid or other substance that is depleted as the product is used, regardless of whether the liquid or other substance contains nicotine”.

While in California, electronic cigarette means “any device or delivery system sold in combination with nicotine which can be used to deliver to a person nicotine in aerosolized or vaporized form, including, but not limited to, an e-cigarette, e-cigar, e-pipe, vape pen, or e-hookah”.

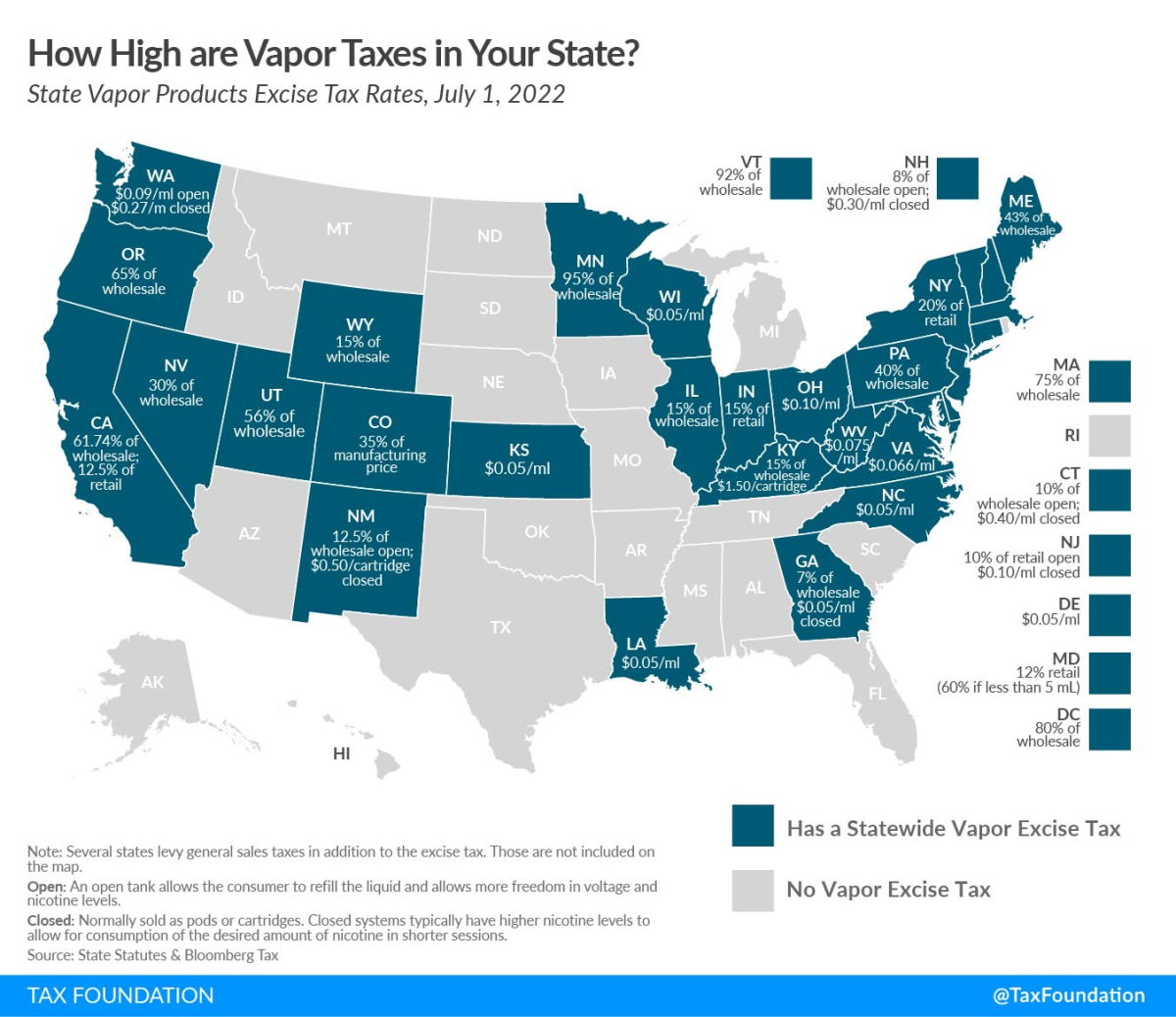

As of July 1, 30 states and Washington D.C. have imposed an excise tax on vaping products, but their methods vary from price-based (ad valorem) and volume-based (specific) to a bifurcated system that has different rates for open and closed systems.

The following map shows e-cig taxes in each state by July 1, 2022:

source: taxfoundation.org

Of those levying on wholesales, Minnesota tops the list with a 95 percent rate and Vermont follows closely at 92 percent. Delaware, Kansas, Louisiana, North Carolina, and Wisconsin all share the lowest per milliliter rate ($0.05).

In some states, excise tax policies run in the opposite direction against their regulations.

Beginning July 1, 2022, electronic cigarette retailers are required to collect from the purchaser at the time of sale, a California Electronic Cigarette Excise Tax (CECET) at the rate of 12.5 percent of the retail selling price of electronic cigarettes containing or sold with nicotine. The new tax, reports Los Angeles Times, is projected to generate $38.4 million by 2023. It’s yet to know if the estimation took the tobacco and vape flavor ban into account, but the Californian vape market is to some extent sentenced to death thanks to the ban in addition to the added levy that was already high enough. Similarly in Massachusetts, the first state barring flavored tobacco and vape products, the levy on e-cigarette wholesale is 75%.

On the contrary, New Jersey, New York, and Rhode Island, which introduced a ban on flavored e-cigarettes, imposed relatively low or even zero excise tax rates on e-cigarettes.

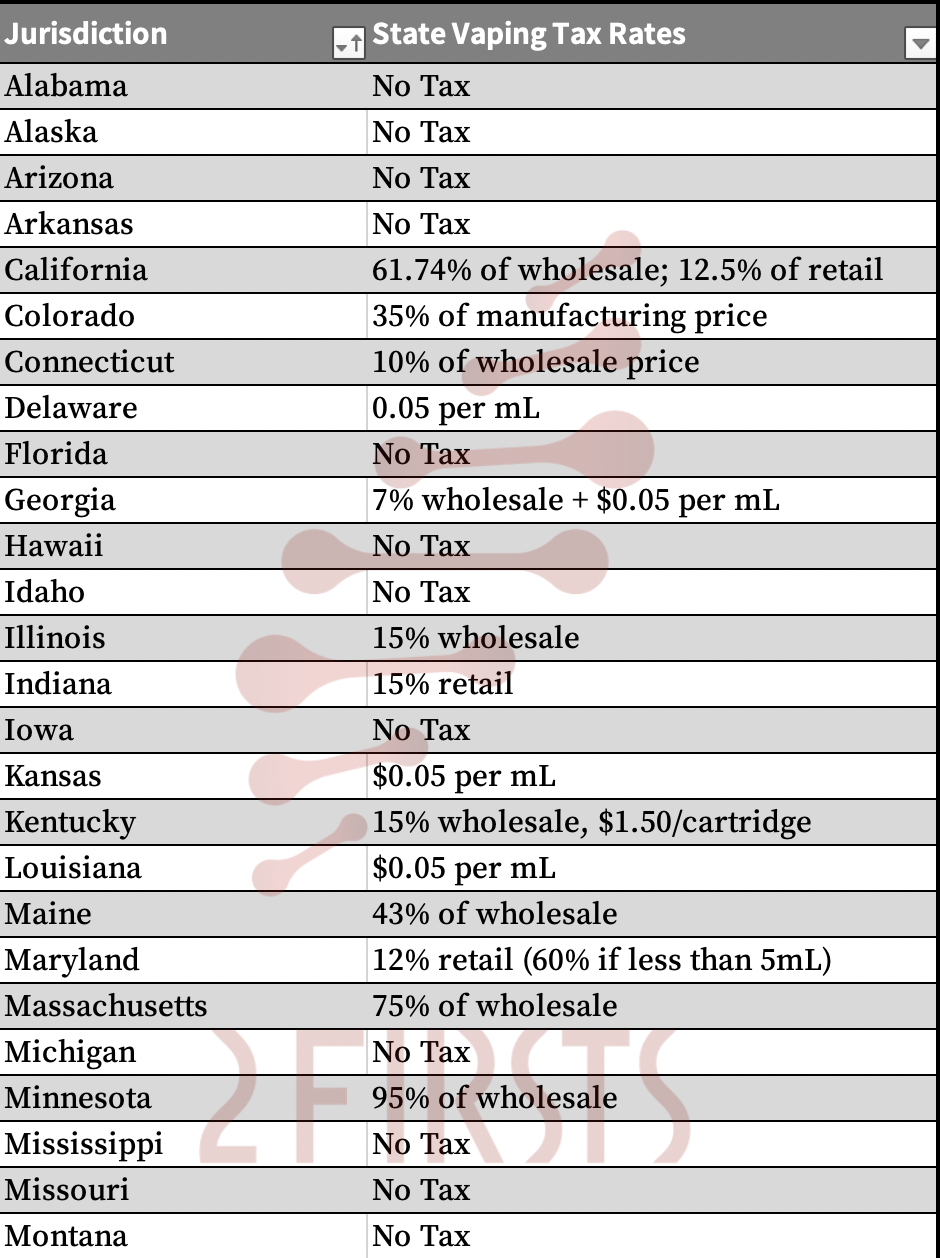

Here’s a detailed table of vaping tax rates in different states.

source: taxfoundation

Lower taxes on vaping encourage consumers to switch from traditional cigarettes, while high taxes may undermine public health by driving vapers back to smoking. A 2019 study found that 32,400 smokers in Minnesota were deterred from converting after the state implemented a 95 percent excise tax on e-cigarettes.

reference: https://taxfoundation.org/excise-taxes-excise-tax-trends/

As the global e-cigarette regulatory environment tightens, more governments are expected to regulate the industry through taxation. 2FIRSTS will follow closely for updates on this aspect. Please stay tuned.

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.