On September 16 at 13.00 local time (19.00 BST), Pablo Cano Trilla, Director of Legal Analysis for Tobacco Intelligence at ECigIntelligence, gave a fascinating presentation entitled "EU Overview: Market and Regulatory Trends in Tobacco Substitutes" in the Brügge room at the Tobacco Fair in Dortmund.

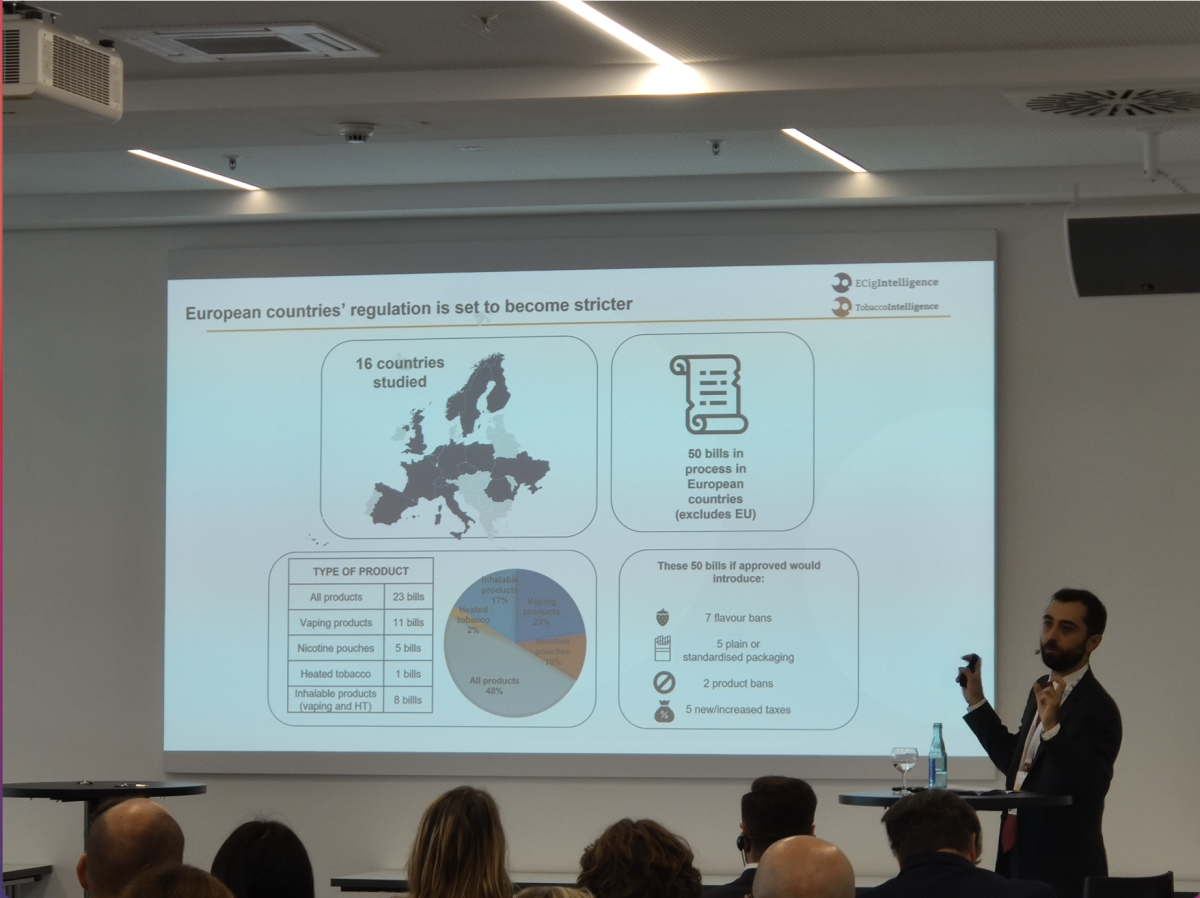

European Countries' regulation is set to become stricter:

Pablo has conducted a survey for ECigIntelligence that tries to demonstrate that European regulatory rules will grow more strict. The paper analyzed 16 nations and found that 50 tobacco control laws are pending in these countries.

Among these bills:

23 cases of all products (48%)

11 cases for vaping products(23%)

5 for nicotine pouches (10%)

1 case for heated tobacco (2%)

8 cases for inhalable products (17%)

If these bills are passed, there would be 7 tobacco flavor ban bills, 5 tobacco packaging standardization bills, 2 tobacco product bans, and 5 tobacco tax increase bills.

The first slide of Pablo Cano Trilla's presentation

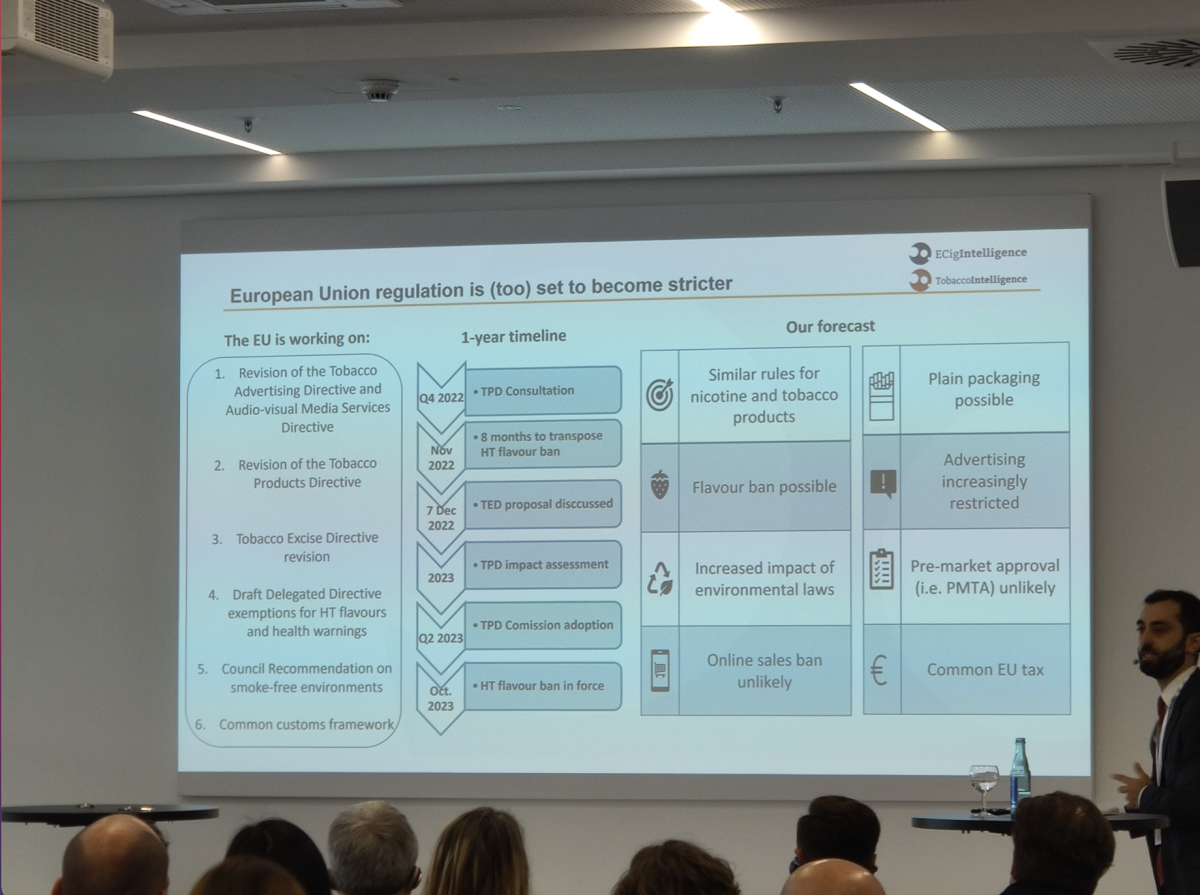

European Union regulation is set to become stricter:

The current priorities for tobacco regulation in the EU are:

Revision of the Tobacco Advertising Directive and the Audiovisual Media Services Directive.

Revision of the Tobacco Products Directive.

Revision of the Tobacco Excise Tax Directive.

Draft delegated directive exemptions for HT flavors and health warning

Council recommendations on smoke-free environments.

common customs framework.

Timeline for policy development in the coming year.

Q4 2022, TPD consultation → November 2022, 8 months to transpose HT flavor ban → December 7, 2022, discussion of TED, proposal begins → 2023, evaluation of TPD effects → Q2 2023, TPD commission adoption → October 2023. Implement the ban on heated tobacco flavors.

Pablo addressed the future forecasts of ECigIntelligence:

The introduction of equivalent legislation and regulations for nicotine-containing and tobacco-containing products.

Incorporation of plain packaging.

The enforcement of flavor bans is possible.

Progressive limitations on advertising.

Increasing the impact of environmental laws.

EU is unlikely to establish premarket authorization similar to the PMTA.

Pre-market approval unlikely

Online sale ban unlikely

Common EU tax

The second slide of Pablo Cano Trilla's presentation

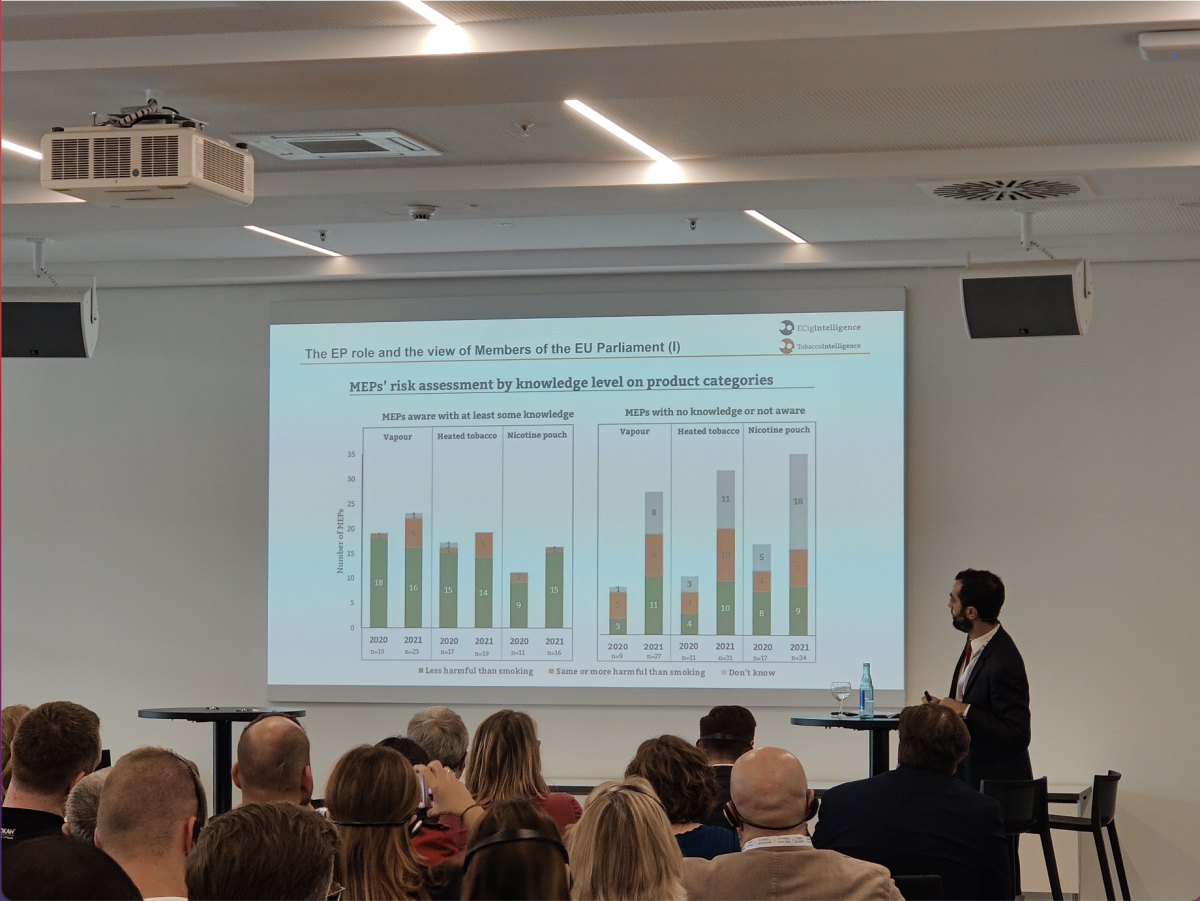

The view of members of the EU Parliament on emerging Tobacco:

Pablo showed a bar chart of "MEPs' risk assessments by knowledge level on product categories".

The Third slide of Pablo Cano Trilla's presentation

This graph demonstrates:

The incidence of new cigarettes among MEPs is not excessively high.

Those MEPs who know about new tobacco are more inclined to consider it a harm-reduction product.

Slightly more people are aware of electronic cigarettes than the other two varieties of tobacco.

Members of the European Parliament were divided into two groups based on their knowledge of tobacco products "have some knowledge" and "don't know", and then the risk assessment of electronic cigarettes, heated tobacco, and nicotine pouches, risk level of "less dangerous than conventional cigarettes" The risk evaluation of e-cigarettes, heated tobacco, and nicotine pouches is "less dangerous than conventional tobacco," "the same or more harmful than traditional tobacco," and "similar to or more harmful than traditional tobacco." "I do not know

According to the graph, 28 legislators will engage in the survey in 2020 and 50 legislators will participate in 2021, virtually doubling the number. But the amount of gray bars - that is, the number of individuals who "don't know" about tobacco products - has also climbed dramatically; in 2021, for instance, 18 percent of people don't know anything about nicotine pouches.

The majority of legislators who know something about tobacco believe that the three new types of tobacco are less harmful than traditional tobacco (green bars), while those who know nothing about new tobacco believe that it is "as harmful or more harmful than traditional tobacco" and "less harmful than traditional tobacco." The amount of persons who are unaware of the dangers of new tobacco is comparable to or greater than that of traditional tobacco users.

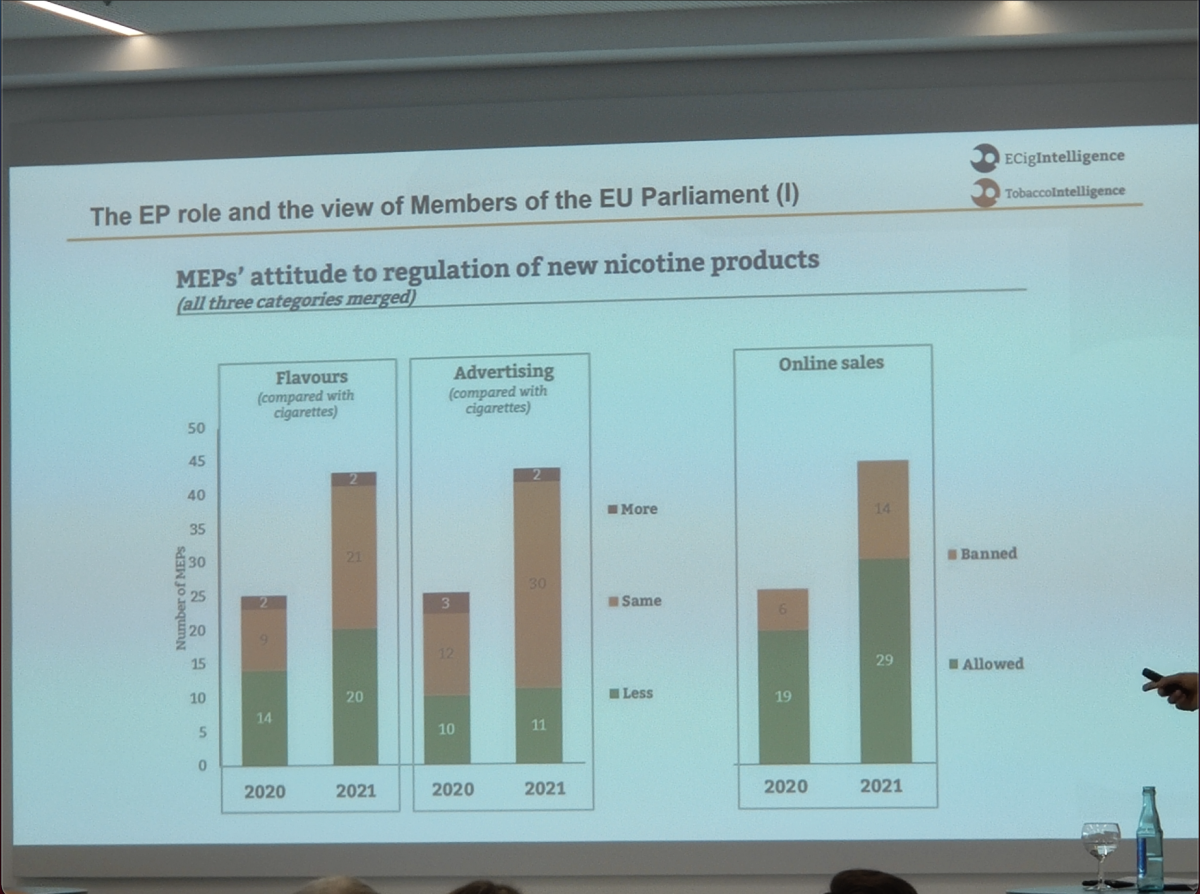

A survey of MEPs' perspectives on how to govern new nicotine products is depicted in the graph below. The clear majority feel that, of the two types of regulation, taste, and marketing, new nicotine products should be controlled "less" (green) and "more consistently" (yellow) than traditional cigarettes.

The fourth slide of Pablo Cano Trilla's presentation

In 2020, 19 MEPs believe the online sale of new nicotine products should be permitted, while 6 MEPs believe it should be prohibited; in 2021, 29 MEPs believe the online sale of new nicotine products should be permitted, while 14 MEPs believe it should be prohibited.

In general, the majority of MEPs feel that new nicotine products should be regulated similarly to traditional tobacco and that their internet sales should be permitted.

Flavor bans despite consumer preferences:

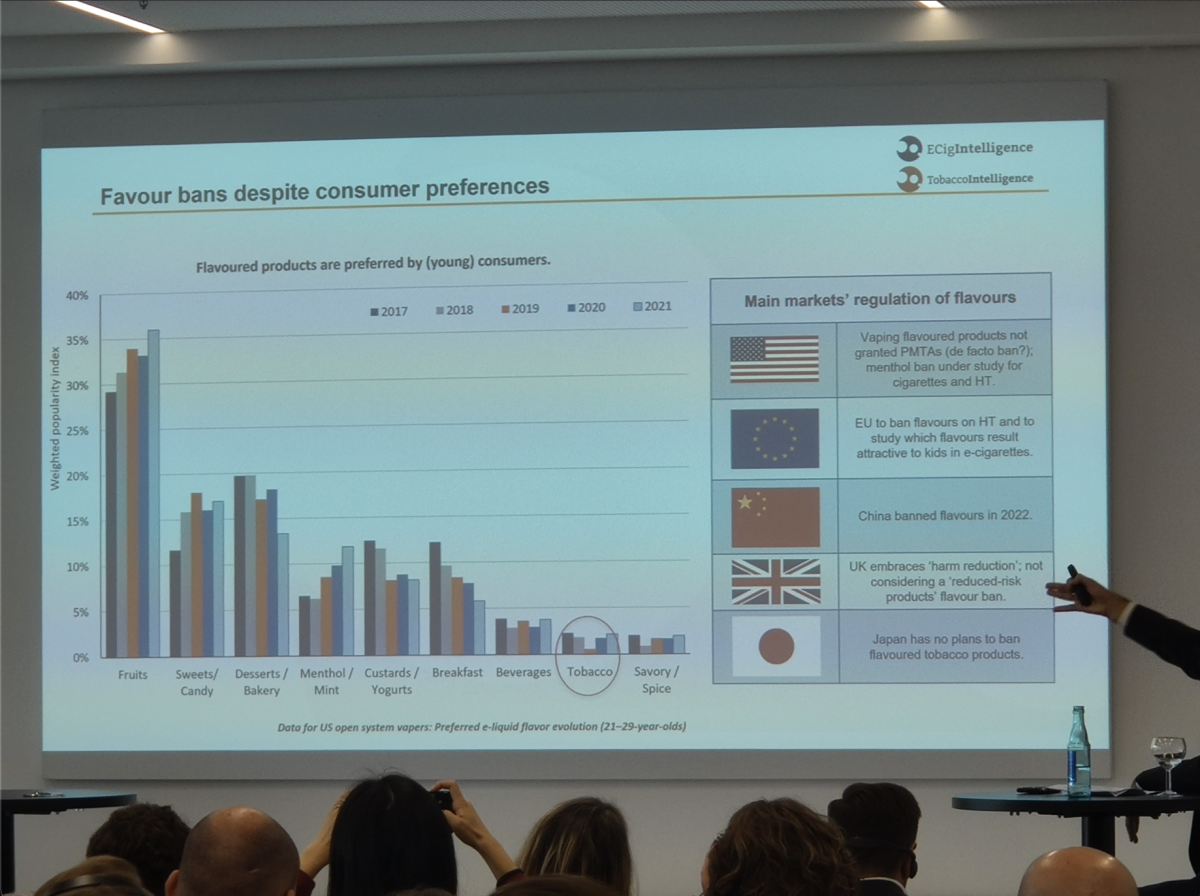

Pablo provided a bar graph of the flavor preference survey results. The survey sample consisted of e-cigarette users (aged 21 to 29) in the United States, and the institution aimed to determine their preferred vaping oils between 2017 and 2021.

Ignoring the slight fluctuations over the five-year period, the flavor preferences are broadly ranked as follows: fruit, sweet/candy flavor, snack/baking flavor, mint flavor, yogurt flavor, breakfast flavor, beverage flavor, tobacco flavor, and sour flavor.

As can be seen, the tobacco flavor occupies the second-to-last position.

Pablo analyzed the flavor bans in the major e-cigarette markets:

US: The PMTA ban will not apply to flavored e-cigarettes in the United States; menthol prohibitions on cigarettes and heated tobacco are being explored.

EU: The EU may implement a ban on flavored e-cigarettes in the future and is now investigating which flavors appeal to youngsters.

CHINA: China will prohibit all flavored vaping beginning in October 2022.

UK: The United Kingdom encourages new harm-reduction tobacco products and is not currently considering a restriction on flavoring for these products.

JAPAN: Japan has no present intentions to implement a ban on flavored cigarette products.

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.