On November 12th, Scandinavian Tobacco Group A/S released their financial report for the third quarter of 2024, which included the Mac Baren brand in their full-year performance expectations.

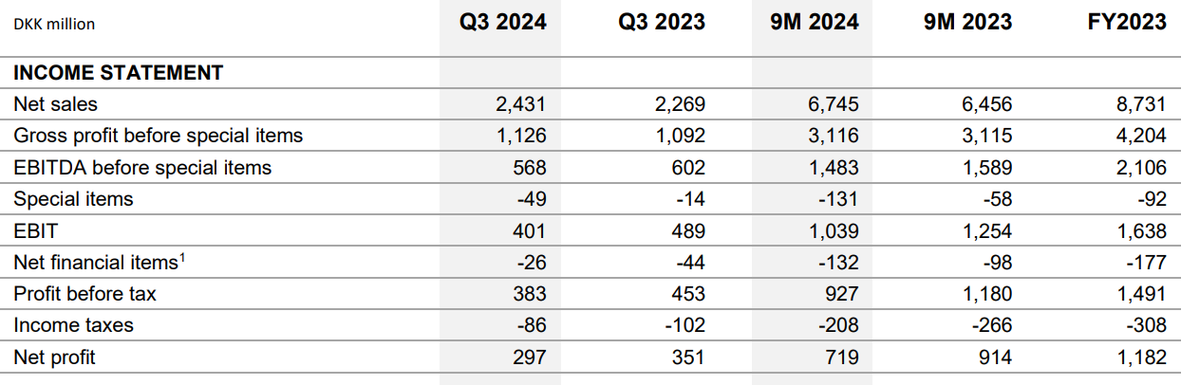

The report shows that the company's net sales grew by 7.1% in Q3, reaching DKK 2.4 billion ($340 million). Excluding currency fluctuations, organic net sales decreased by 0.1%.

The cessation of third-party nicotine pouch distribution in the U.S. negatively impacted growth by 1.0%. Growth in machine-made cigars, smoking tobacco, and next-generation products (NGPs) was partially offset by a decline in hand-rolled cigars and accessories.

NGP brand XQS saw a 72% increase, but due to the absence of nicotine pouch distribution, category growth was reduced to 2%.

The company expects the integration of Mac Baren to be fully effective in the 2027 fiscal year, bringing annual synergies of 150 million Danish Kroner (21.36 million US dollars). In order to achieve the targeted cost synergies, it is expected that there will be a special cost impact of 150 million Danish Kroner in cash.

Key highlights from the report include:

- Net sales of DKK 2.431 billion ($340 million) with organic growth of -0.1%.

- Mac Baren's net sales totaled DKK 159 million ($22.64 million), with EBITDA before special items of DKK 30 million ($4.27 million) and an EBITDA margin of 18.8%.

- For the first nine months of 2024, net sales grew by 4.5% to DKK 6.7 billion ($950 million), with organic net sales growth of 0.9% and an EBITDA margin of 22.0% (down from 24.6%).

The CEO of the company, Niels Frederiksen, said: “With the acquisition of Mac Baren, we are in 2024 on track to surpass DKK 9 billion in net sales for the first time ever and we expect the Mac Baren acquisition to deliver significant synergies as we implement the integration plan."

"In the third quarter market share in machine-rolled cigars in Europe stabilized and began to improve and in particular France showed promising progress. XQS performed well in both Sweden and in UK as well as in Denmark where the brand has recently been introduced," he said.

"The remainder of the Growth Enablers also delivered growth. We remain committed to enhancing shareholder returns and we are about to complete our current share buyback, after which we will have returned almost DKK 1.5 billion to shareholders over the course of 2024”.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com