According to Korean media outlet bizwatch on April 11th, major participants in South Korea’s e-cigarette market have seen new changes in the operating profits in 2022. The operating profit of Philip Morris International (PMI) Korea has grown by 163%, while that of BAT Korea has decreased by 12%. KT&G, with an operating profit margin of 30% and a market share of 84%, remains the top player in the Korean market.

PMI's operating profit rebounds against the sluggish backdrop

In 2022, there were new changes in revenue for KT&G, PMI Korea, and BAT Korea. KT&G and PMI Korea are the top two participants in the Korean e-cigarette market, while BAT Korea has seen a growth slowdown.

Industry analysts in the Korean tobacco industry believe that as the tobacco market shifts from traditional cigarettes to e-cigarettes, the e-cigarette market will hold the key to future profits.

According to insiders, PMI Korea's sales in 2022 amounted to $5,202,441,320.00, a 21.5% increase from 2021. Operating profit increased by 162.5%, reaching $61,073,594.14. The operating profit margin increased from 5.4% in 2021 to 11.7% in 2022.

In 2022, KT&G's revenue was $27,990,801,086.00, a 5.8% increase from 2021. Operating profit increased by 3.4%, reaching $850,938,538.70, and the operating profit margin reached 30.3%.

Growth has been driven by KT&G's overseas tobacco exports and e-cigarettes, as total domestic demand for tobacco products decreased by 1% in 2022. KT&G's overseas cigarette sales amounted to $1,500,319,062.00 in 2022, a 47.2% increase from 2021. Additionally, the company's Next Generation Products (NGP) sales amounted to $66,400,484.55, a 73.9% increase from 2021.

BAT Korea's revenue in 2022 amounted to $4,090,263,786.20, a 14.3% increase from 2021. However, operating profit during this period decreased by 12% to $33,784,039.28. The operating profit margin decreased from 10.7% in 2021 to 8.3% in 2022, and net profit ($42,167,379.71) also decreased by 33.6% in 2022.

Continuous growth of e-cigarette market share

Although traditional cigarettes still dominate the Korean tobacco market with a share of approximately 85%, e-cigarettes are replacing traditional cigarettes and becoming the driving force for tobacco companies' future profits.

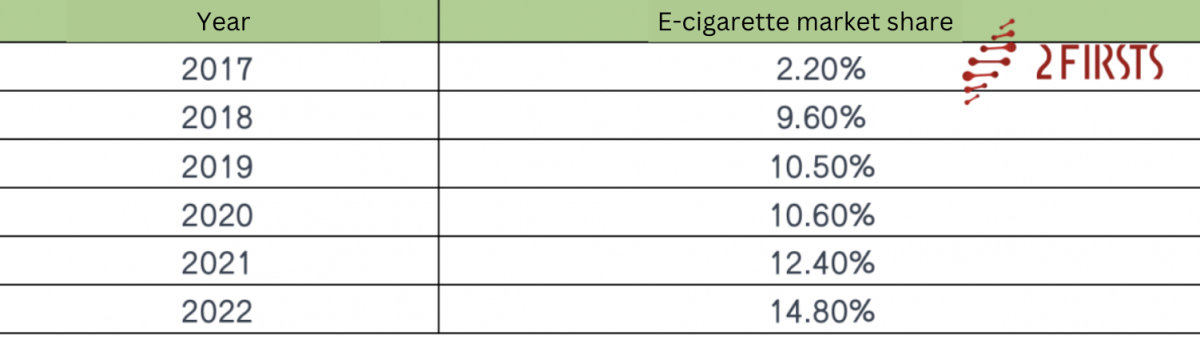

According to "2022 Tobacco Market Trends" released by the Korean Ministry of Strategy and Finance, the share of e-cigarettes in the domestic tobacco market has been increasing, from 2.2% in 2017, 9.6% in 2018, 10.5% in 2019, 10.6% in 2020, 12.4% in 2021, and 14.8% in 2022. After a period of stagnation in 2019 and 2020, e-cigarettes have been growing since 2021.

E-cigarette market share changes | Image source: 2Firsts

In 2022, KT&G had a market share of 47.5% based on convenience stores, while their e-cigarette device share reached 84%. PMI Korea has been actively targeting the e-cigarette market and, following the launch of IQOS Illuma in October 2022, released a new lineup called "IQOS Illuma One" in February 2023.

Although KT&G and PMI compete in the domestic market, they have formed an alliance overseas. In January 2023, KT&G signed a 15-year agreement to provide PMI with smoke-free products in overseas markets (excluding Korea). In exchange for marketing, distribution, and sales rights for KT&G's e-cigarettes overseas, PMI guaranteed a minimum distribution of cigarette packs to ensure KT&G's profitability.

On the other hand, BAT's market share in the Korean e-cigarette market is reportedly around 10%. The company recently launched "Glo HyperX2" in Korea to achieve a rebound, but there has been no significant change in market share so far.

An industry insider in Korea stated that "after a period of stagnation, the domestic e-cigarette market has slowly grown since 2022, and the challenge is how to further develop the market."

Also read:

[1] Last year's cigarette performance... BAT Korea failed to catch up.

[2] 2022 Korean heated tobacco demand surged 21%, cigarette demand declined by 1.8%.

References:

*The content of this article is written after the extraction, compilation and integration of multiple information for exchange and learning purposes. The copyright of the summary information still belongs to the original article and its author. If any infringement is found, please contact us to delete it.