The 2025 AJPM Focus paper, “The Behavioral Impact of the Massachusetts Flavored Tobacco Products Ban on Cigarette Smoking Among Adults Aged ≥21 Years,” assessed the ban’s impact using 2017–2022 BRFSS data and a difference-in-differences (DiD) design. Massachusetts (ban in June 2020) served as the treatment group, and U.S. states without flavor bans served as controls. The analysis compared pre- vs post-ban changes in adult smoking rates.

Key Findings

Overall trend:

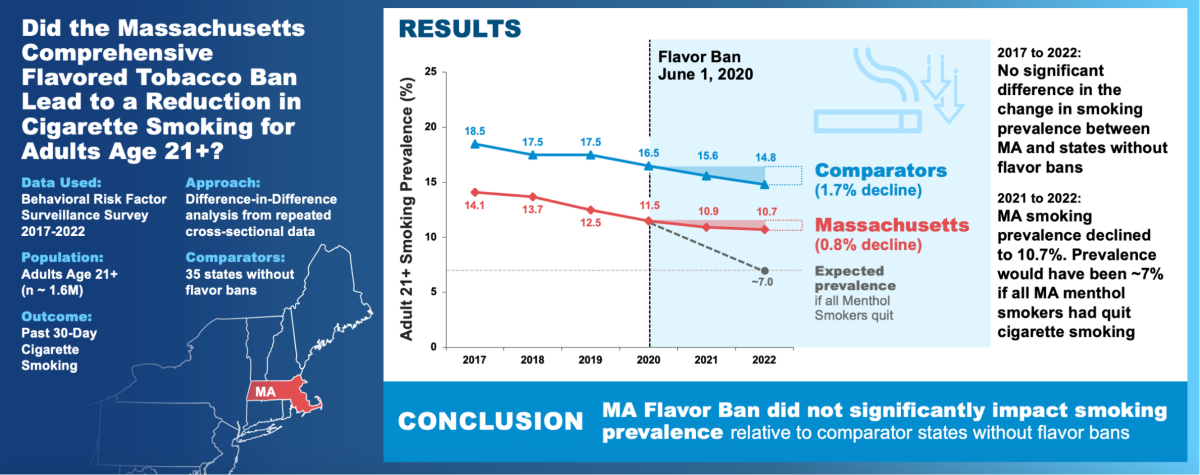

- Massachusetts adult smoking: 14.1% (2017) → 10.7% (2022)

- Comparison states: 18.5% (2017) → 14.8% (2022)

- Annual decline rates shifted: in Massachusetts, about 6%/year pre-ban slowed to 2%/year post-ban; in comparison states, about 3%/year pre-ban accelerated to 5%/year post-ban.

Primary DiD results (adjusted for demographics and year fixed effects):

- Time effect AOR = 1.05 (95% CI: 1.00–1.11, p = 0.0428)

- Treatment effect AOR = 0.89 (0.84–0.95, p = 0.0002)

- DiD estimate = 0.94 (0.85–1.03, p = 0.1621) → not significant

- Multiple sensitivity checks were also not significant (e.g., ≥25 years only: AOR = 0.91, p = 0.0599).

- Scenario consideration: If roughly one-third of menthol smokers had quit due to the ban, Massachusetts smoking prevalence might have dropped to ≈7% by 2022; such a step-change did not occur.

Conclusions

With an extended observation window through 2022 and a focus on legal-age adults (≥21), the study did not find evidence that Massachusetts’ flavor ban produced a relative additional decline in adult smoking compared with non-ban states. The authors suggest continued evaluation of initiation, cessation/substitution, DIY flavoring, and illicit supply as potential behavioral and market dynamics that may offset nominal policy effects.

Limitations (as stated by the authors)

Self-report bias; unobserved, time-varying factors (e.g., state-level COVID-19 responses; Massachusetts’ concurrent tobacco/vaping policies such as temporary EVALI-era sales suspensions, a 75% e-cigarette tax, smoke-free air laws, and funding) may have influenced smoking rates.

Article Information

Title: The Behavioral Impact of the Massachusetts Flavored Tobacco Products Ban on Cigarette Smoking Among Adults Aged ≥21 Years

Journal: AJPM Focus, 2025, 4(5):100364

Study type: Replication study; Open Access (CC BY-NC-ND)

Authors: Evan A. Winiger, Pavel N. Lizhnyak, Scott W. Drenkard, Andrea R. Vansickel (all with Altria Client Services LLC)

Disclaimer

This summary by 2Firsts is based on a publicly available academic paper and is intended to help non-research readers—especially industry practitioners, policymakers, and media—understand the findings and foster dialogue among science, policy, and industry.

Unless otherwise indicated, the methods, data, and conclusions presented reflect the original authors’ views. 2Firsts does not endorse those positions and serves only as an information channel.

Given possible limitations in our summarization, inaccuracies may exist. Readers are encouraged to consult the original paper for comprehensive details.

2Firsts welcomes constructive discussion and critical thinking. No single study answers every question; open and rational dialogue can advance tobacco harm reduction (THR) and improve consumer health outcomes globally.

Contact: info@2firsts.com

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com