During the period from January to June 2023, China exported disposable e-cigarettes to the United States with a value of approximately $1.1 billion, accounting for around 74% of China's total e-cigarette exports to the US. The average monthly export value was approximately $183 million. However, the average price per kilogram of disposable e-cigarette products decreased from $45.84 in January to $39.18 in June. This decline in average price indicates a narrowing profit margin, suggesting that the US e-cigarette market is not as lucrative as people may believe.

As competition intensifies in the disposable e-cigarette market and supply exceeds demand due to incomplete absorption of export volume in the first half of the year, what is the current market situation in the United States, the world's largest e-cigarette market? Is there still substantial room for future development? How will companies respond to market competition? To address these questions, 2FIRSTS had a conversation with industry experts in the e-cigarette industry in the United States.

Middlemen Pocket Most Profits

A major characteristic of the current competition in the e-cigarette market in the United States is the low profit margin, with a significant portion of the profits being taken by distributors.

Robert, an e-cigarette brand agent in the U.S., informed 2FIRSTS that in today's American market, competition among e-cigarette companies is not only limited to their peers but also extends to traditional tobacco companies. This presents significant pressure for e-cigarette brand manufacturers. Smaller brands not only have to compete against traditional tobacco companies but also face the challenge of intermediaries who are constantly squeezing their profit margins.

Robert revealed that often it is the distributors who pocket the lion's share of the product profits, leaving only a meager portion for the manufacturers.

Andy, a sales representative for a domestic brand in the United States, echoed similar sentiments to 2FIRSTS, stating that currently in the US, the accounts receivable cycle for e-cigarettes can stretch up to three months.

Andy stated:"The risk lies entirely with the channel partners, and without access to the accounts, it is impossible for us to continue operations in the United States."

Andy recently visited offline e-cigarette stores in cities across the United States. He observed that distributors' warehouses were filled with a plethora of e-cigarette products, most of which had been sent to them without receiving payment first. "They sell whatever they can move, but if it doesn't sell, you won't get a refund even after three months," Andy said helplessly.

If wholesalers in the region do not actively promote the product, it will pile up or remain unsold in the warehouse, rendering sales efforts ineffective.

Due to an oversupply in the market, e-cigarette products in the United States are no longer as popular as they were a few years ago when there were limited options available and consumer demand was rapidly increasing. Nowadays, distributors are facing stiff competition due to a wide array of products, leading to an advantage in the downstream distribution channels.

Robert believes that the current phenomenon of product stockpiling is causing significant transaction pressure for distributors and manufacturers. This is because these upstream participants do not actually receive payment, and the shipment and sale of goods are not directly linked. "The manufacturers directly pile the goods on them, so they don't pay for them. In terms of inventory, it is still a situation of accumulation without actual transactions," describes Robert.

He believes that the current operation of this market is irrational. After receiving e-cigarette samples, distributors distribute them to downstream retail stores, and only when distributors truly endorse the products do they place real orders. Robert considers this as "genuine orders.

"If you don't provide him with the samples, he completely ignores you, unless your product has a particularly low price."

Innovative Products are More Popular

Another characteristic of the e-cigarette market in the United States is its high homogeneity. Many e-cigarette products have a striking similarity in appearance and functionality, making it more difficult for consumers to make a choice. In order to stand out in the fierce competition, some e-cigarette brands have introduced numerous innovative products.

Robert explained that even for products that have already been released, if they possess relatively novel features that appeal to consumers, they can stand out. "American consumers are more interested in innovative products. For example, adding an LCD screen to an e-cigarette is something we knew about half a year ago, but now consumers consider it to be a novel feature," Robert said.

An E-cig product with screen|Source: vapesee

This has actually brought opportunities to the industry - making minor adjustments and innovations to existing products seems to offer more appealing choices, thereby gaining a larger market share. In the future, with advancements in technology and changing consumer demands, the e-cigarette market may see more possibilities for innovation.

Emerging Brands Rising through Marketing

Starting from March 2023, due to stricter regulation by the Food and Drug Administration (FDA) in the United States, some e-cigarette brands that were previously popular have been taken down from the market. This has opened up some market space, prompting certain brands to increase their distribution and marketing efforts.

First and foremost, it is important to acknowledge that the current e-cigarette market in the United States offers over 9,000 different devices, with nearly 6,000 of them being disposable products. The market is saturated with products, but what is lacking is a unique selling point beyond just taste and appearance. Some new brands have realized that in order to establish a strong presence in the market, it is not enough to offer products that cater to the target audience; they also need to have distinctive brand characteristics.

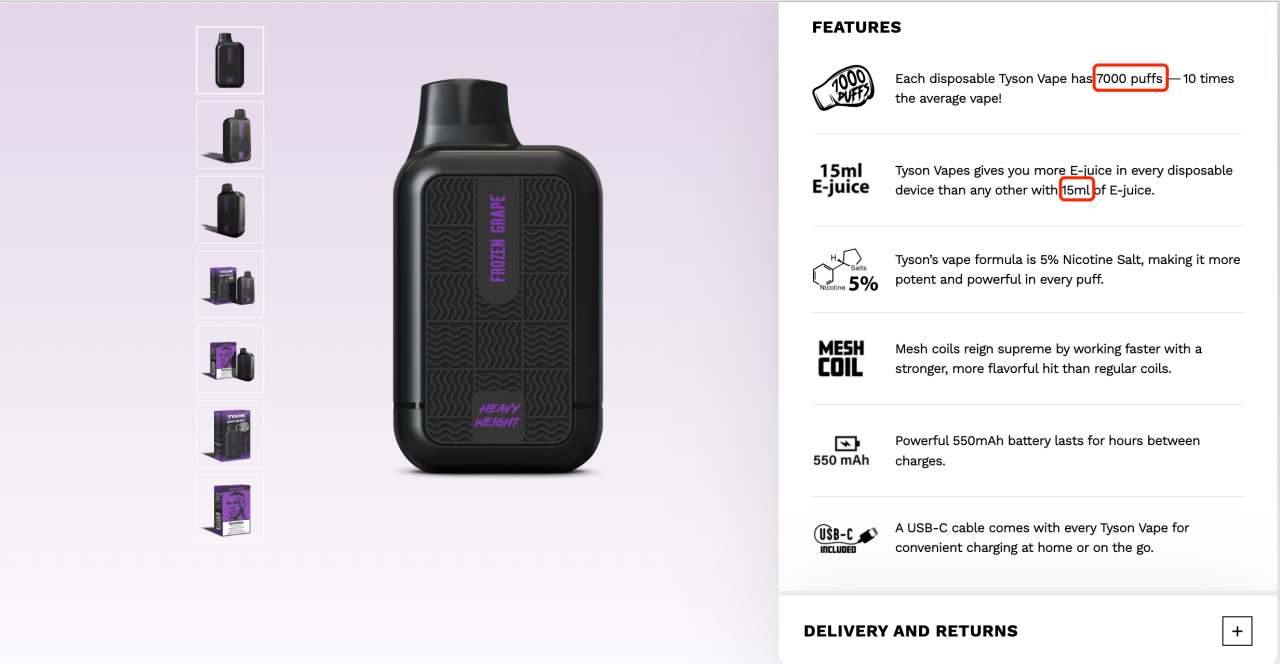

For instance, TYSON VAPE, a brand of e-cigarette, claims to be "created by the greatest heavyweight boxer in history, former world champion Tyson" by deepening its association with the renowned fighter. The official website of the brand also highlights Tyson's global influence.

Tyson demonstrates a vape | Source: TYSON VAPE

"Presented by boxing legend Mike Tyson, ensuring the highest level of quality and innovation."

The TYSON 2.0 VAPE, its flagship product, is a disposable e-cigarette with a capacity of 7000 puffs and a 15ml e-liquid capacity.

World celebrities + Great marketing numbers: TYSON VAPE, a well-known e-cigarette brand, has been actively participating in e-cigarette exhibitions both in the US and overseas as it continues to grow. By adjusting its positioning and entering the offline market, TYSON VAPE has gradually gained recognition in the US market.

TYSON VAPE in vape store | Source: YouTube

According to Andy's observation, TYSON VAPE has adopted a highly diverse marketing strategy in the offline market. With a significant initial investment and events such as competitions, the brand emphasizes the product's durability and "champion" attributes. The design of the product revolves around this theme, featuring a 7000mAh capacity and a black, textured exterior for a rough and rugged feel.

TYSON 2.0 VAPE|Source: Official website

Andy was impressed with the product and saw Tyson Vape's distribution capabilities in offline stores. He stated, "Almost every household has their products, and many customers have their products."

Based on current results, celebrity brands combined with significant marketing efforts are capable of achieving widespread distribution across retail channels. Another newly introduced product by Lost Vape, known as the Orion Bar, is actively being distributed in the American market. This disposable product also emphasizes a high mouth count, offering 7,500 puffs and containing 18 milliliters of e-liquid.

Orion bar|Source: Official website

Robert believes that the emerging brands that have been making a strong push this year are still following market trends and focusing on effective channel distribution. On one hand, they need to visit physical stores to understand new products and hot-selling items in the market. With the technological differences between e-cigarette products being equalized, stronger and more unique marketing strategies have become the inevitable choice for different brands to adapt to market changes.

In the future, as the market environment continues to evolve, there may be more emerging brands making a name for themselves in the e-cigarette market. However, it remains to be seen whether this promotion method, which relies on celebrity influence coupled with hefty marketing campaigns, can be sustained.

Competition from Traditional Tobacco

The FDA is tightening regulations on e-cigarettes, requiring manufacturers to obtain approval in order to continue selling their products in the United States. However, the impact of this requirement on offline retail stores does not seem to be significant.

Robert believes that the regulatory measures taken by the FDA have limited impact on the e-cigarette market in the United States. The majority of retail owners are unlikely to proactively pay attention to FDA announcements; they are more concerned about the sales performance of the products themselves.

But Robert also mentioned that after top brands in the United States received an "import alert" from the FDA, Renault Tobacco sent out notification letters to all wholesalers and retailers. This demonstrates that competition between companies is not limited to the quality of the product itself. "The letter from Renault Tobacco informed everyone that the FDA has made this decision to ban this brand, and that's when everyone realized it was a serious event," said Robert.

He also noted that Renault Tobacco's e-cigarette products reach sales locations that emerging e-cigarette companies find difficult to access through their traditional tobacco channels.

"No matter which gas station or convenience store you go to, you can see Renault's products."

Quality Products to Gain Returns in Low-tier Market

In the current era of increasingly stringent regulations, what lies ahead for the e-cigarette market in the United States? Industry experts believe that profit margins will further shrink, but there are still untapped development opportunities in the American market, with certain segments yet to be explored.

Andy admitted that the sales terminal of the disposable market in the United States had already reached saturation. Product supply is no longer an issue, but the overall slowdown in demand, coupled with recent oil price increases in the United States, has squeezed consumption of entertainment products.

He learned from a retail store in the market terminal that e-cigarette stores in Illinois are no longer allowed to have testing samples on display on the tables, as they fear being fined by the enforcement agencies, who come for inspections every two weeks.

Wholesale gasoline prices rose by 19% in the past 3 months | Source: Wall Street Journal

Tighter regulation adds to economic pressure, Andy told 2FIRSTS, "and profit margins will be squeezed further."

This has also changed the landscape of distributors and distribution channels to some extent. Now distributors are faced with more choices, and these choices are occupying the downstream distribution channel advantages of the e-cigarette market.

Robert believes that the United States, as the world's largest market for e-cigarettes, is bound to be difficult for new brands to enter, but he believes that there are still many opportunities.

"If you have a good product, investing in low-tier market is worth it. Spend time, effort and money, and the market will reward you."

Andy believed that under the fierce competition in the US e-cigarette market, brands and channels have become more cautious.

Once the inventory is overstocked, it will bring no small trouble to dealers and suppliers, after all, the consequences of capital loss need to be taken into account.

E-cigarette brands trying to achieve long-term growth in the United States may need to find new strategies in product innovation, marketing and cost control to remain competitive. Adaptation and innovation will be key to keeping the business robust.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.