Disclaimer

1.This article is based on publicly available information, field investigations, and reader-submitted leads.

2.All data, images, and examples are for reference only and do not constitute business advice or definitive conclusions.

3.For questions or feedback, please contact the 2Firsts editorial team at info@2firsts.com.

Nicotine Pouch Black Market Accelerates: Counterfeit Brands, Regulatory Vacuum, and Cross-Border Arbitrage

From $1 Counterfeits on Chinese E-Commerce Platforms to a 974% Increase in UK Seizures, Global Regulation Remains Lacking

By 2Firsts

Section 1: Introduction & Investigation Trigger

Illegal Nicotine Pouch Seizures Surge 974% in the UK – A Global Black Market Emerges

On 17 April 2025, UK-based media Conveniencestore reported that illegal nicotine pouch seizures by local Trading Standards surged by 974% over the past year. This alarming rise, uncovered through a Freedom of Information request led by Vape Club, highlights a rapidly expanding black market for nicotine pouches across the UK.

Despite growing concerns, nicotine pouches remain under-regulated—there are currently no binding rules on advertising, product strength, or minimum purchase age.

Dan Marchant, director of Vape Club and founding member of the UK Vaping Industry Association (UKVIA), warned:

“Nicotine pouches are now the latest product being exploited by criminal gangs… A lack of enforcement leads directly to a flourishing black market, just like we saw with disposable vapes.”

The surge in illegal pouch seizures underscores a troubling trend: as regulatory gaps persist, especially in international trade and border enforcement, counterfeit and illegal pouches are increasingly trafficked across jurisdictions.

Against this backdrop, 2Firsts launched a multi-month investigation in late 2024 into the shadow supply chains behind counterfeit nicotine pouch products. Through platform monitoring, supplier interviews, logistics tracing, and legal analysis, this report exposes how unauthorized brands like ZYN and VELO are being sold in bulk on Chinese B2B platforms for as little as $1 per can—and exported into global markets with minimal oversight.

Section 2: Counterfeit Product Supply Chains and Platform Strategies

How the Counterfeit Network Works

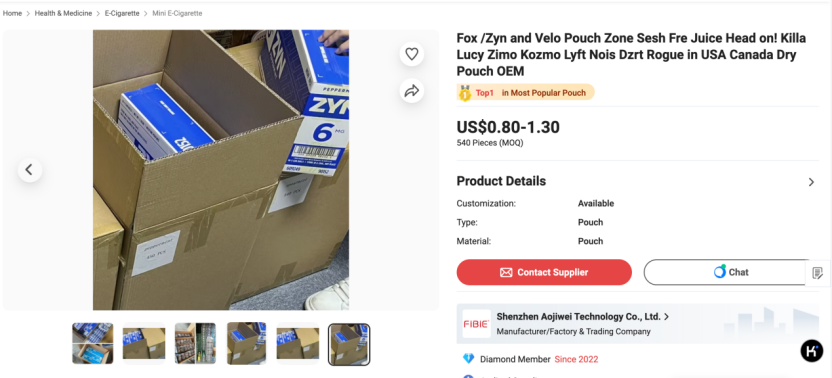

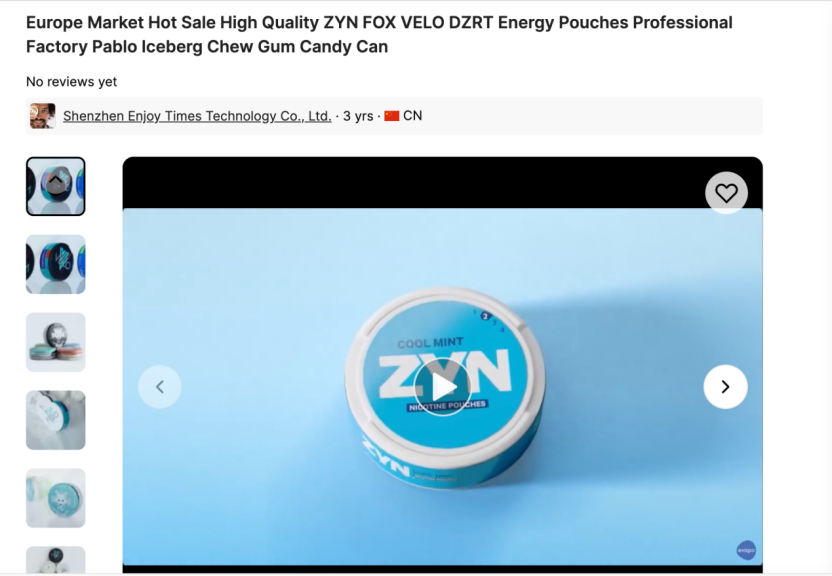

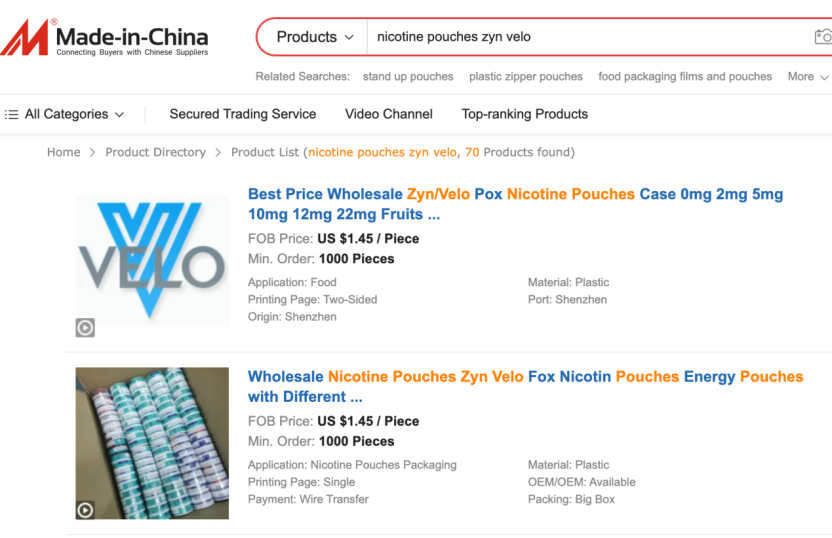

Through platform monitoring and user-provided leads, 2Firsts identified a thriving network of unauthorized nicotine pouch vendors operating on Chinese B2B platforms like Made-in-China.com and Alibaba International.

When accessed using a domestic IP address in China, most listings remain hidden. However, switching to a foreign IP and searching for terms such as “nicotine pouch” “ZYN” or “VELO” produces a dramatically different view: dozens of listings appear, often with packaging and branding closely mimicking internationally known products.

Many of these listings directly display ZYN or VELO logos and packaging photos, while some vendors use ambiguous terms such as “can” or “tin” to suggest they're only selling containers—though images clearly show finished products. Some pages even include manufacturing videos and claim OEM (white-label) capabilities.

After 2Firsts communication with vendors confirms that these products are intended for export, mainly to North America and Europe, and not for domestic sale in China. Prices hover around $1 per can, with minimum orders typically set at 540 cans per carton and larger discounts for higher volumes.

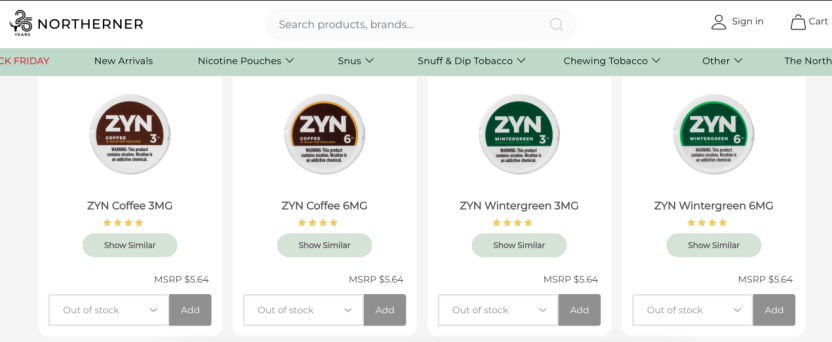

In contrast, official retail prices for ZYN on U.S. platforms are approximately $5.64 per can—and often out of stock. This pricing gap fuels gray-market demand.

Section 3: ZYN and VELO Brand Expansion – Global Demand and Capacity Investments

Surging Demand, Strained Supply: ZYN’s Expansion Moves

In 2024, Philip Morris International (PMI) experienced explosive growth in the oral nicotine pouch category. ZYN, its flagship smokeless brand, saw a 42% increase in Q4 shipment volumes, helping PMI post a 22% annual growth in oral nicotine products.

This momentum triggered a wave of supply-side investments. PMI announced a $232 million expansion of its flagship ZYN factory in Owensboro, Kentucky, adding over 450 jobs and projecting a $277 million annual economic impact. By April 2025, over 370 new positions had already been filled.

In addition to expanding its Kentucky plant, PMI announced a $600 million investment in a new ZYN factory in Colorado, expected to begin operations by 2026. The move underscores PMI’s long-term confidence in oral nicotine products and its commitment to boosting supply amid persistent shortages in the U.S. market.

One ZYN pouch typically contains 20 mini-sachets, each designed to last around 30 minutes. The smoke-free, battery-free convenience, along with discreet use and influencer-driven appeal, has helped fuel consumer loyalty.

Offline Counterfeits Exposed

Beyond online channels, fake nicotine pouches have also entered offline retail. A 2Firsts industry source reported buying VELO at Dubai International Airport duty-free, only to realize post-purchase that the product was counterfeit—a discovery confirmed through testing and usage.

VELO’s Challenge: Wet Pouches, Lower Prices, and a Retail Push

Not to be outpaced, British American Tobacco (BAT) has doubled down on its U.S. strategy for VELO, its rival oral pouch brand. In December 2024, BAT launched VELO Plus, a new line featuring “wet” pouches, synthetic nicotine, and seven flavors. Priced as low as $2.99 per can—a 60% discount compared to ZYN on a per-pouch basis—VELO Plus quickly grabbed attention.

Within 12 weeks of launch, VELO Plus captured 5.4% national market share, driving VELO’s overall share to 10% in early 2025. BAT confirmed that VELO Plus accounted for 70% of VELO’s U.S. volume by Q1 2025, with top markets including New York and California. BAT also announced an expansion of its Tobaccoville operations center, adding 300 jobs to support the VELO Plus line.

Section 4: Why Do Counterfeit Nicotine Pouches Flourish? Regulatory Gaps Across Jurisdictions

Fragmented Regulations: A Global Blind Spot

One of the key reasons counterfeit nicotine pouches can circulate internationally is the lack of harmonized regulation across jurisdictions. Most countries have yet to establish clear, category-specific rules for oral nicotine pouches—particularly those containing synthetic nicotine, which falls outside traditional tobacco definitions.

In the European Union, current Tobacco Products Directive (TPD) regulations do not explicitly cover nicotine pouches made from synthetic nicotine. As a result, many EU markets consider them unregulated, even though sales are booming. At the 2024 EVO NXT conference in Spain, regulatory expert Robert Casinge confirmed that a new TPD update may include nicotine pouches, but implementation is unlikely before 2027.

In the United Kingdom, oral nicotine pouches are not treated as smoking cessation tools and fall under General Product Safety Regulations (GPSR) instead of tobacco-specific laws. A voluntary standard, PAS 8877:2022, provides basic requirements around nicotine content, pH, and labeling, but enforcement remains weak.

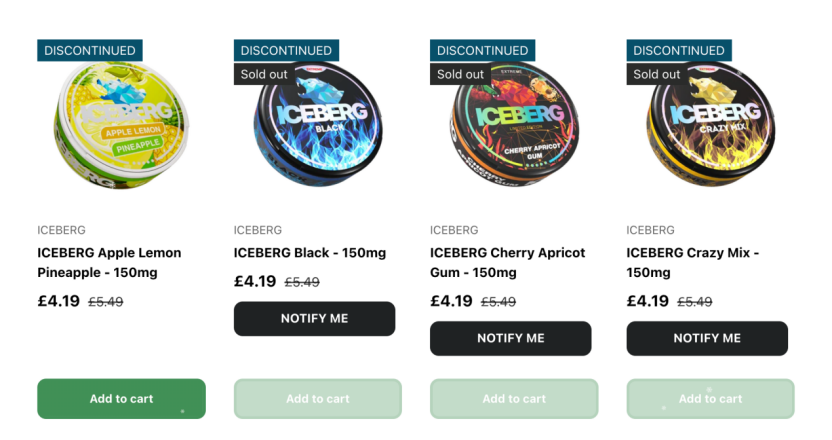

Online platforms in the UK sell pouches with extremely high nicotine concentrations—up to 150 mg. A peer-reviewed study in Frontiers in Pharmacology found that 30 mg pouches already produced the strongest side effects, including nausea and increased heart rate. The study warned: “Very high doses of nicotine pouches may be addictive.”

In China, the legal framework is ambiguous.

Technically, nicotine pouches are not classified as either medicinal or tobacco products under current law. While they resemble moist snuff in function, they are not clearly included in the regulatory scope of either the State Tobacco Monopoly or the National Medical Products Administration. This ambiguity allows production and export to operate in a legal vacuum.

The U.S. Tightens Control: ZYN Becomes First Authorized Pouch

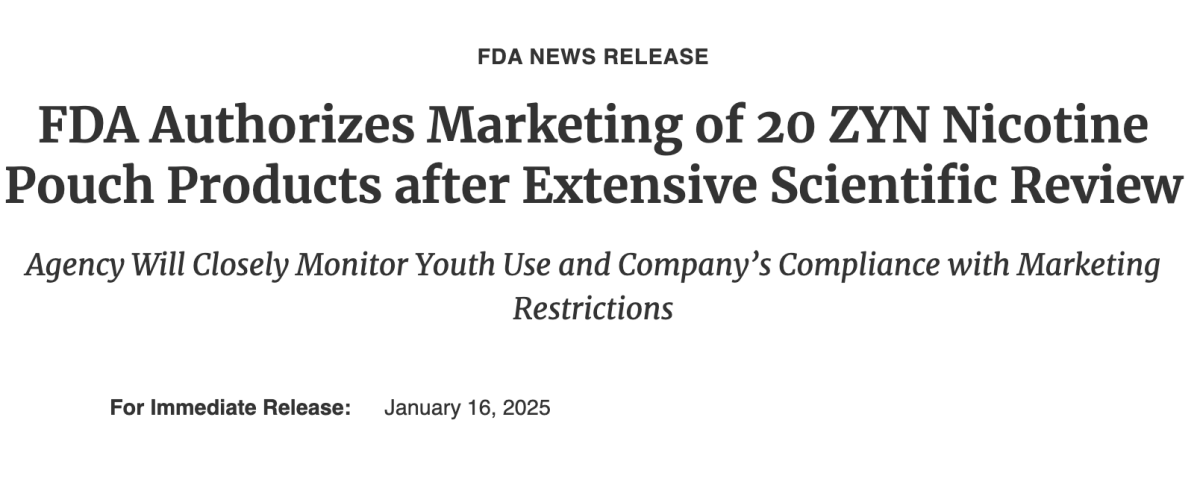

In contrast, the United States has taken significant steps to regulate nicotine pouches. In January 2025, the FDA officially approved 20 ZYN products through the PMTA pathway. These included 10 flavors and two nicotine strengths (3 mg and 6 mg). The FDA concluded that these products posed significantly fewer health risks compared to cigarettes or moist snuff and could help adult users switch.

To prevent youth access, the FDA imposed strict marketing rules:

● No youth-oriented advertising

● No actors under 35 in promotional materials

● No symbols or themes appealing to minors

● Age-verification for all digital content

Although youth use remained low in 2024 (only 1.8% of middle and high school students reported using nicotine pouches), the FDA emphasized that failure to comply with restrictions or increased youth use could result in revoked authorization.

Section 5: Inside China’s Gray Zone – Manufacturing, Legal Loopholes, and Weak Oversight

An Opaque Export Engine: Imitation Over Innovation

According to interviews with industry insiders, China has developed a complete upstream-to-downstream counterfeit nicotine pouch supply chain, primarily centered in cities like Shenzhen and Dongguan.

Factories typically manufacture unbranded “white-label” pouches. These are passed to downstream entities who affix counterfeit logos of ZYN, VELO, or other international brands, and then shipped overseas by trading companies via B2B platforms.

Mr. A described it as “a coordinated chain: one group handles production, another does packaging and labeling, and another manages export logistics.” Most of the final products are not sold domestically but exported, often without any official authorization or compliance documentation.

Ms. C, a product inspector, raised concerns about hygiene and safety: “Most factories do not meet cleanroom standards. There’s visible dust and a risk of cross-contamination.”

Mr. B, who supplies raw materials, admitted: “We sell ingredients without knowing the final product’s form or where it’s used. The buyer is often not the manufacturer.” This disconnection weakens traceability and accountability.

Insiders estimate that over 50% of nicotine pouch exports from China are counterfeit or white-labeled products imitating global brands.

Legal Ambiguity: Caught Between Tobacco and Medicine

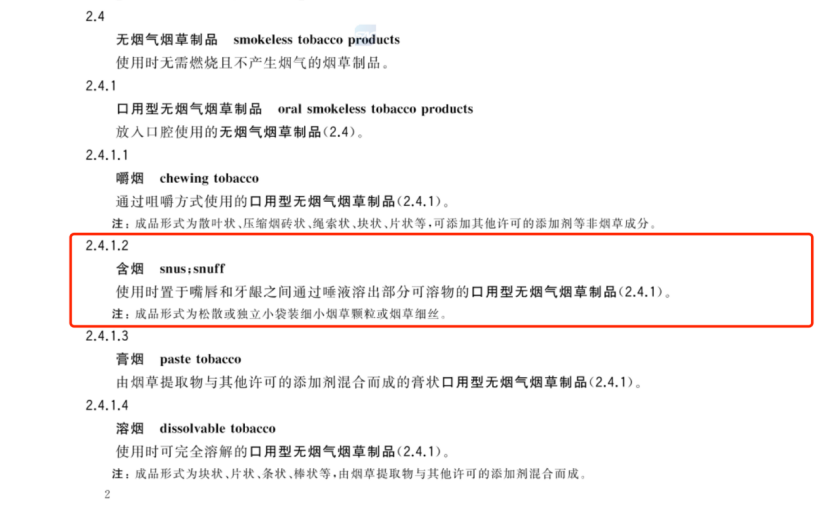

Under China’s current regulatory framework, nicotine pouches occupy a gray area. The national standard GB/T 18771.2–2015 defines moist snuff products that are placed between the lip and gum and release soluble substances via saliva as “smokeless tobacco,” which would place nicotine pouches under tobacco regulations in theory.

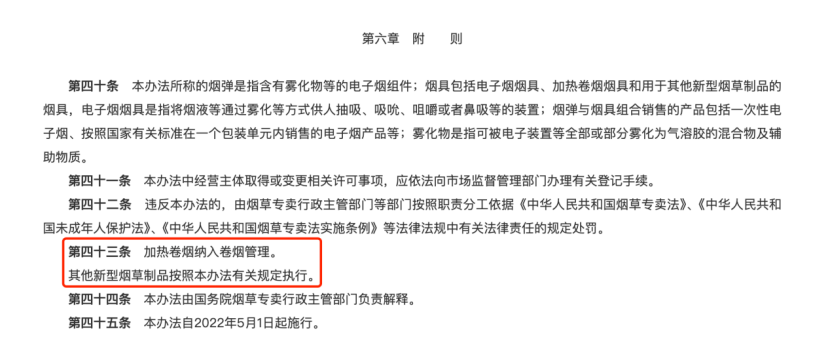

The 2023 revision of the “Regulations for the Implementation of the Tobacco Monopoly Law” and the “Administrative Measures for Electronic Cigarettes” state that new tobacco products should be managed similarly to cigarettes. However, in practice, there is no dedicated registration, export approval, or oversight channel for nicotine pouches.

Mr. A noted: “They can’t be registered as drugs, and they can’t be registered as tobacco. So manufacturers just keep quiet and export quietly.”

Due to limited staffing and investigative capacity, enforcement agencies largely rely on complaint-based action. “Unless someone reports a company, enforcement rarely steps in,” Mr. A added.

Proposed Legal Reform: Include Nicotine as a Controlled Substance

To address regulatory ambiguity, Mr. A proposed that nicotine—both natural and synthetic—be formally incorporated into the tobacco monopoly law.

“If synthetic nicotine is regulated like tobacco-derived nicotine, it would clarify management of electronic cigarettes, heated tobacco, and nicotine pouches.”

Until such legal reforms are enacted, many small-scale manufacturers will continue operating in legal limbo, profiting from high overseas demand and weak domestic enforcement.

Section 6: Trademark Enforcement Challenges and Legal Remedies in China

Enforcing Trademarks in a Market You Don’t Enter

Despite ZYN and VELO being well-established brands in the U.S. and Europe, enforcing their trademarks in China remains difficult. According to legal analysis shared with 2Firsts, both brands face hurdles in trademark registration and retention.

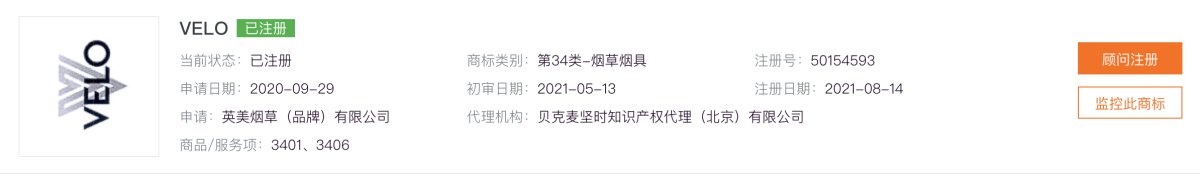

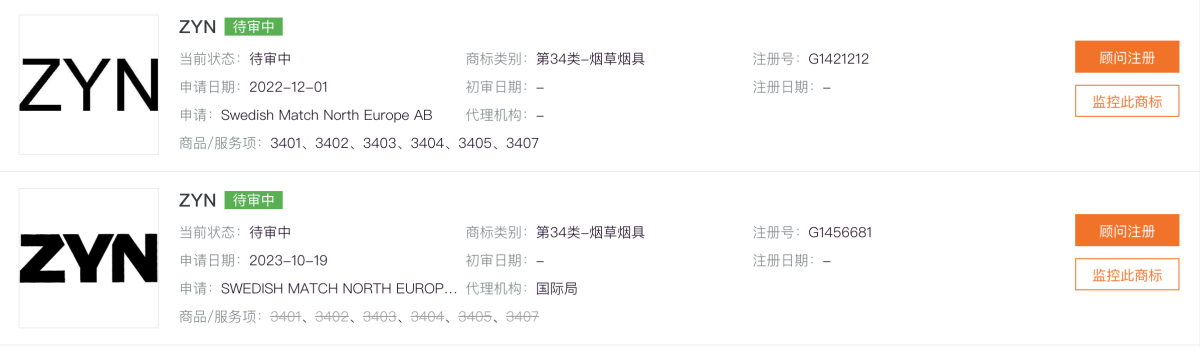

VELO successfully registered its Class 34 (tobacco products) trademark in 2021. ZYN applied in 2022 but has not received approval.

Even if registered, enforcement faces another challenge: under Chinese Trademark Law, if a registered trademark is not used for three consecutive years in mainland China, it can be canceled due to non-use.

Since ZYN and VELO are not produced or sold domestically, they are at risk of invalidation. This creates a legal paradox: brands that do not operate in China may lose trademark protection, while counterfeiters exploit that absence with little legal risk.

Civil Lawsuits: High Bar, Limited Deterrence

According to Article 64 of China’s Trademark Law, a rights holder must provide proof of domestic use to claim compensation in civil litigation. Without such evidence, counterfeiters may escape with minimal or no penalties.

A compliance advisor told 2Firsts, “Infringers know ZYN and VELO can’t prove use in China, so they assume the legal risk is low.”

Criminal Enforcement: The Role of Article 213 of the Penal Code

To strengthen deterrence, some international brands are turning to criminal prosecution.

Under Article 213 of the Criminal Law of the People’s Republic of China, manufacturing or selling counterfeit registered trademarks constitutes a criminal offense.

Lawyer Tang Shunliang of Tiantong Law Firm explained that rights holders may submit formal complaints to local law enforcement with supporting evidence. If successful, the complaint can trigger police investigations and prosecution—offering stronger deterrent effects than civil litigation.

However, this process requires engaging local counsel familiar with illicit tobacco enforcement and conducting preliminary investigations.

“It’s complex and resource-intensive, but when done properly, it works,” Tang noted.

Section 7: Conclusion – The Diverging Futures of Compliance and Counterfeit

As global demand for nicotine pouches continues to rise, the market is splitting into two distinct paths: one driven by science, compliance, and long-term strategy; the other by opportunism, legal ambiguity, and short-term profit.

Leading global companies such as Philip Morris International (PMI) and British American Tobacco (BAT) are investing heavily in the compliant path. They are building factories in Kentucky and North Carolina, expanding into new markets like Pakistan, securing FDA authorizations, and creating closed regulatory loops that combine clinical validation, legal marketing frameworks, and youth protection protocols.

By contrast, a parallel system—centered around China's informal supply chain—is thriving on low production costs, brand imitation, and loose export controls. These operators leverage B2B platforms to bypass regulation entirely, offering mass production with little regard for product safety, scientific credibility, or intellectual property rights.

2024 marked a turning point: ZYN became the first nicotine pouch brand approved under the FDA’s PMTA framework. Governments worldwide began recognizing nicotine pouches as a distinct category requiring regulatory oversight. This sets the stage for an era of tightening controls and growing accountability.

Whether China becomes part of the global compliance architecture—or continues to act as the epicenter of unregulated supply—will depend on its legislative reforms, factory transitions, and how exporters respond to mounting scrutiny. For manufacturers seeking long-term viability, the age of “quiet arbitrage” is ending.

Cover Image Credit: AI Generation