Key Points:

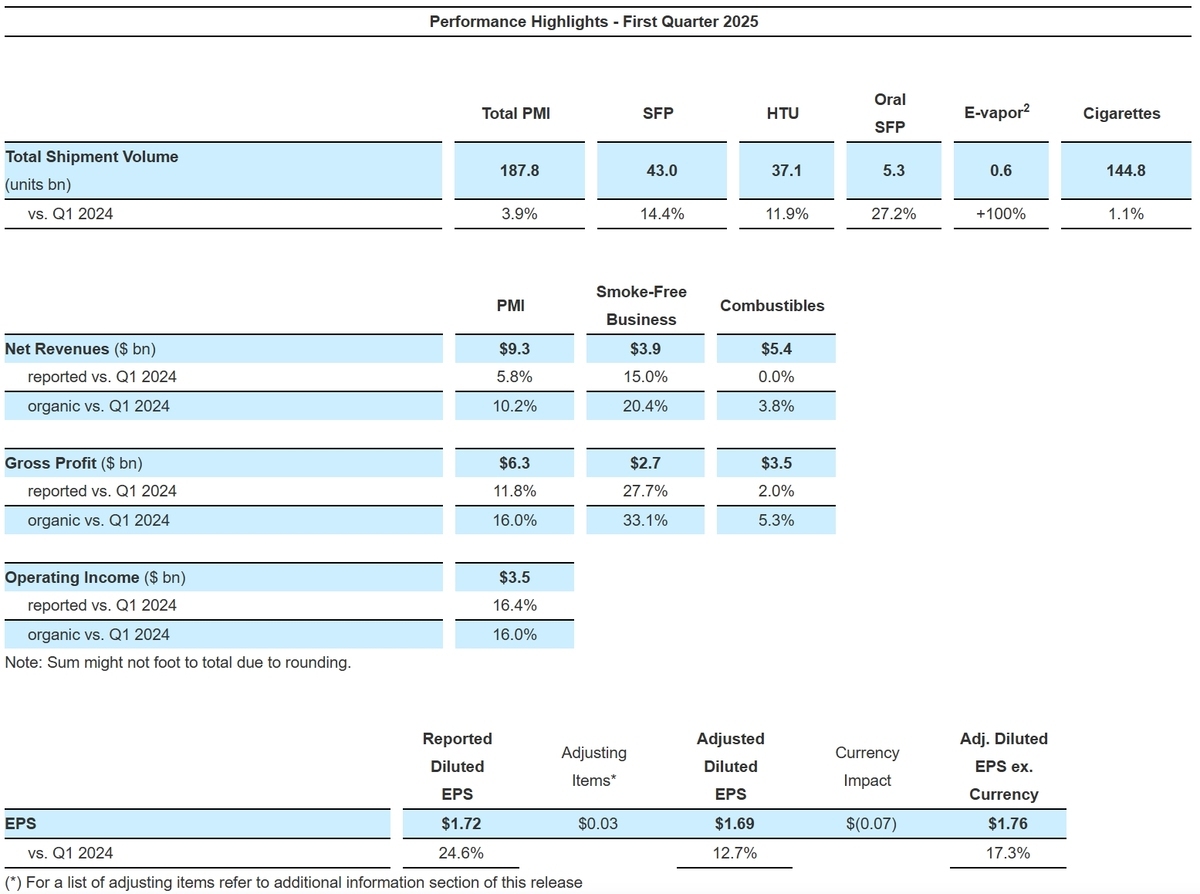

Net income reached $9.301 billion, a year-on-year increase of 5.8%; organic growth reached 10.2%, mainly benefiting from the growth in sales of smoke-free products and price optimization.

Operating profit increased by 16.4% to $3.544 billion, with adjusted profit reaching $3.79 billion and profit margin rising to 40.7%.

Smoke-free products have made a significant contribution, accounting for 42% of total net revenue and 44% of total gross profit. Shipments have increased by 14.4%, with organic growth in gross profit reaching as high as 33.1%.

IQOS continues to expand its market presence, with market share increasing to 32.2% in Japan and 11.4% in Europe. Global shipments of Heat-Not-Burn Tobacco Units (HTU) also grew by 11.9%.

ZYN Nicotine Pouches Shipments Increase by 53%: ZYN shipments in the United States exceed 200 million cans, surpassing expectations, thanks to early capacity improvements and strong demand.

On April 23, 2025, Philip Morris International (PMI) released its first quarter financial results for 2025 on its official website. The report showed that net revenue for the first quarter reached $9.301 billion, with a growth rate of 5.8%. Operating profit was $3.544 billion, an increase of 16.4%. Due to the significant growth in Q1, Philip Morris International (PMI) has raised its full-year earnings forecast for 2025.

Net income increased by 5.8% to $9.301 billion, while operating profit grew by 16.4% to $3.544 billion

·Earnings Per Share (EPS): Diluted earnings per share reported increased by 24.6% to $1.72. Adjusted diluted earnings per share were $1.69, a growth of 12.7%; excluding the impact of exchange rates, the growth rate reached 17.3%.

·Net income: Net income reached $9.301 billion, with a reported growth rate of 5.8% and organic growth rate of 10.2%. The growth was primarily driven by favorable pricing factors and a strong sales/product mix, especially an increase in sales of non-smoking products.

·Operating profit: The reported operating profit was $3.544 billion, an increase of 16.4%. The adjusted operating profit was $3.79 billion, with an organic growth rate of 16.0%. The adjusted operating profit margin increased from 38.2% in the same period last year to 40.7%.

The smoke-free business contributed 42% of the net income, while the revenue from traditional cigarette business remained stable

The smoke-free business continues to serve as a growth engine, contributing 42% of the company's net revenue and 44% of total gross profit.

Sales of smoke-free products increased by 14.4%. Net revenue reported a growth of 15.0% (organic growth of 20.4%), while gross profit reported a growth of 27.7% (organic growth of 33.1%).

Heated Tobacco Products (HTU): IQOS continues to strengthen its market position, increasing its market share in the combined market of cigarettes and heated tobacco devices by 1.0 percentage points, surpassing 9%. The global shipment volume of HTU (pod units) grew by 11.9% to 37.1 billion units.

·In Japan, IQOS's adjusted market share increased by 3.0 percentage points to reach a record high of 32.2%.

·In Europe, IQOS HTU's adjusted market share increased by 1.2 percentage points to reach a record high of 11.4%.

The shipment volume of e-cigarette (E-vapor) products such as VEEV has more than doubled, driven primarily by the European market, leading to a further expansion of profit margin.

Oral SFP (Oral Smoke-Free Products): Shipments (measured in pouches or equivalent units) increased by 27.2%, reaching 5.3 billion units. In the United States, ZYN nicotine pouch shipments increased by 53%, surpassing 200 million cans, exceeding expectations, thanks to early capacity increases and strong demand.

The volume of cigarette shipments increased slightly by 1.1%, reaching 144.8 billion units. Net revenue from cigarette business remained stable (organically increasing by 3.8%), while gross profit realized a 2.0% growth (organically increasing by 5.3%). The global brand portfolio, especially Marlboro, drove overall market share in the cigarette category up by 0.4 percentage points to 24.8%.

Outlook for the year 2025

·PMI has raised its full-year adjusted diluted earnings per share forecast (excluding currency effects).

·The diluted earnings per share for the report are expected to range from $7.01 to $7.14.

·Adjusted diluted earnings per share are expected to range from $7.36 to $7.49, representing an increase of 12.0% to 14.0% from $6.57 in 2024. After excluding the favorable currency impact of $0.10, the expected growth is 10.5% to 12.5%.

The CEO of the company, Jacek Olczak, stated, "Despite the uncertain and volatile global economic environment, we remain confident in our ability to achieve outstanding performance and predict double-digit growth in adjusted diluted earnings per share for the full year in US dollars."

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com