Key Points:

·Profit Core: E-cigarette liquid is the highest contributing sub-category to profits, with a total average weekly profit of £32.34, surpassing pods, nicotine pouches, and devices.

·Best-Selling Product: "Elux Legend Nic Salts Triple Mango" has become the product with the highest average weekly single store profit in the market, with its high sales rate and £7.49 weekly profit.

·Brand Dominance: The Velo brand dominates the nicotine pouch market, while major tobacco companies such as BAT and JTI's brands like Vuse and Iqos are also performing well in their respective categories.

·New Flavor Trends: As the disposable e-cigarette ban takes effect, consumer preferences are shifting from traditional mint and tobacco flavors to more popular fruit flavors.

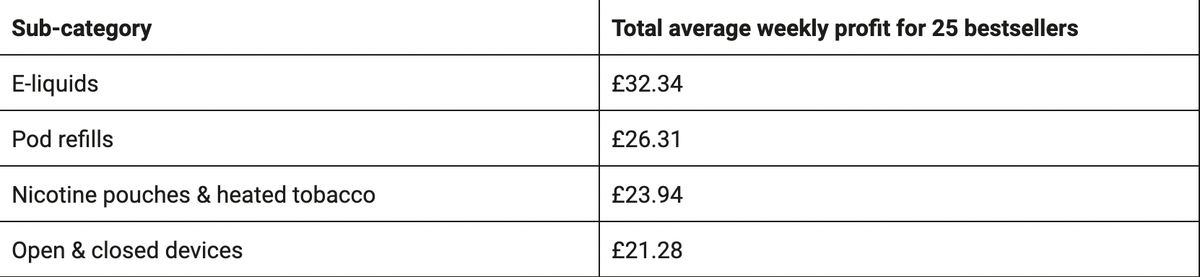

According to a report by Better Retailing on August 7th, the "2025 Buying Guide" in the UK analyzed the performance of retail stores in the four main sub-categories of "next-generation nicotine products (new tobacco products)" - e-cigarette e-liquid, pod refills, nicotine pouches and heated tobacco, and open and closed devices. The report compiled and analyzed sales and profit data for top-selling products in each sub-category (e.g. the top 25 best-selling products in a certain sub-category).

Profit margins are highest in e-cigarette liquid.

The "2025 Purchasing Guide" report reveals that, in terms of average weekly profit, e-cigarette liquid is the product that brings in the highest profits for stores.

Ranked number one: "E-liquids" (e-cigarettee-liquid) tops the list with a total average weekly profit of £32.34.

Ranked second: "Pod refills" ranked second with a profit of £26.31 per week.

Ranked third, "Nicotine pouches & heated tobacco" ranks third in profit at £23.94 per week.

Ranked fourth: "Open & closed devices" (referring to the e-cigarette devices themselves) came in last place with a weekly profit of £21.28.

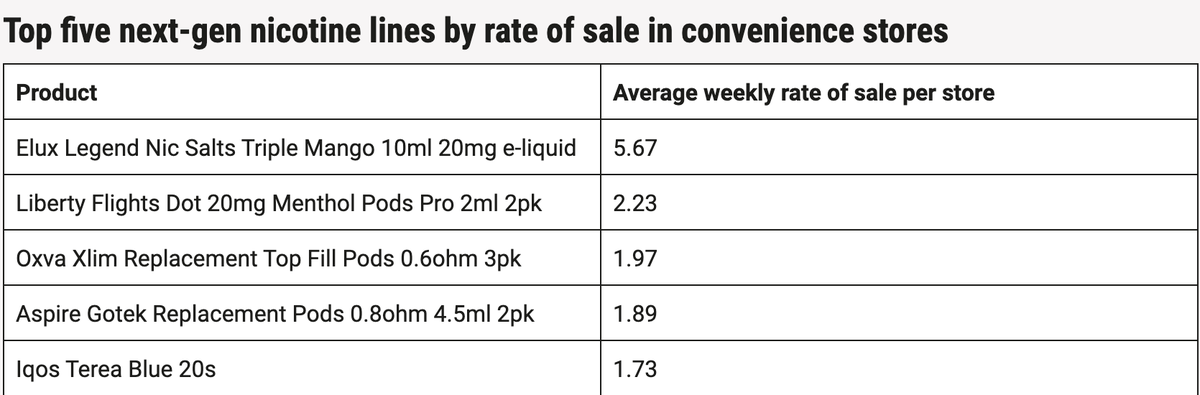

The report also showcased the top five next-generation nicotine products in convenience store sales rankings.

According to sales data, the top-selling vaping products are as follows:

1) Elux Legend Nic Salts Triple Mango 10ml 20mg with a sales rate of 5.67

2) Liberty Flights Dot 20mg Menthol Pods Pro 2ml 2pk with a sales rate of 2.23

3) Oxva Xlim Replacement Top Fill Pods 0.6ohm 3pk with a sales rate of 1.97

4) Aspire Gotek Replacement Pods 0.8ohm 4.5ml 2pk with a sales rate of 1.89

5) Iqos Terea Blue 20s with a sales rate of 1.73.

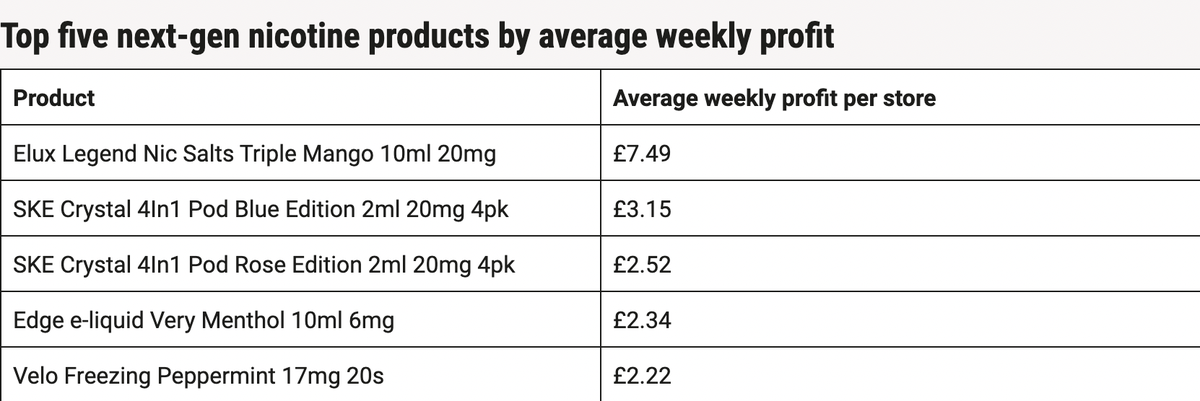

The report displayed the weekly average per store profits for five next-generation nicotine products.

Ranking first: e-liquid|"Elux Legend Nic Salts Triple Mango 10ml 20mg" takes the top spot at £7.49 per week.

Ranked second: pod | "SKE Crystal 4in1 Pod Blue Edition 2ml 20mg 4pk" holds the second spot with a profit of 3.15 pounds.

Ranked third: pod | "SKE Crystal 4in1 Pod Rose Edition 2ml 20mg 4pk" ranks third with a profit of £2.52.

Ranked fourth: e-liquid | "Edge e-liquid Very Menthol 10ml 6mg" comes in fourth place with a profit of £2.34.

Ranked fifth: Nicotine pouch | "Velo Freezing Peppermint 17mg 20s" ranks fifth with a profit of £2.22.

Velo and Nordic Spirit dominate the nicotine pouch market.

The report states that, despite many top products in the category coming from lesser-known professional manufacturers, it is also important to pay attention to the next generation nicotine products offered by major tobacco companies brands, such as Vuse, Velo, Nordic Spirit, Iqos, and Blu.

Vuse's 1.9ml 18mg Ice Menthol pods in a pack of 2 are the sixth best-selling pod refill nationwide, bringing an average profit of 77 pence (approximately 0.96 USD) per week to stores. Meanwhile, Blu's 2ml 20mg Cherry pods in a pack of 2 are the 12th best-selling product in the category, with Vuse's 18mg Golden Tobacco flavor ranking 13th.

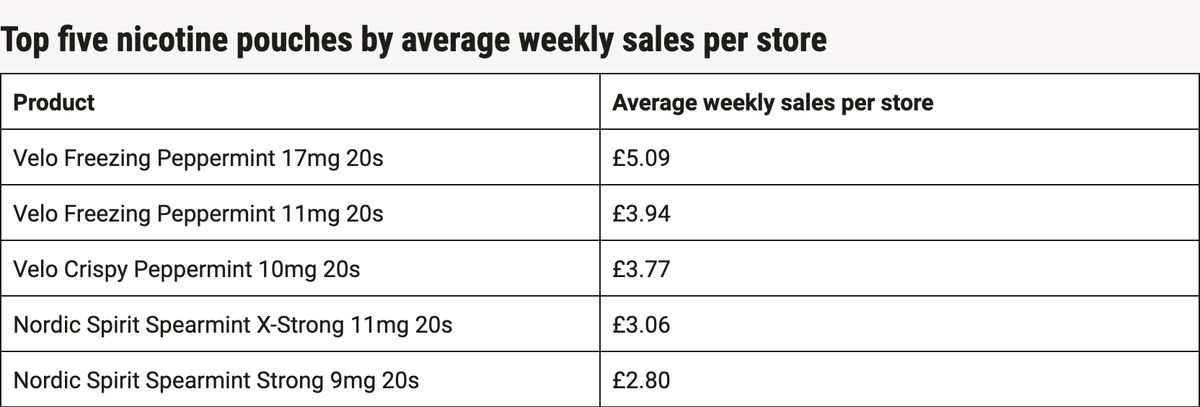

In the nicotine pouch market, the Velo and Nordic Spirit series dominate.

Top three products:

The top-selling product is "Velo Freezing Peppermint 17mg 20s" with weekly sales of £5.09. It is followed by "Velo Freezing Peppermint 11mg 20s" with sales of £3.94, and "Velo Crispy Peppermint 10mg 20s" with sales of £3.77.

The products ranking fourth and fifth are:

The Nordic Spirit Spearmint X-Strong 11mg 20s ranks fourth in sales at £3.06.

The Nordic Spirit Spearmint Strong 9mg 20s ranks fifth in sales at £2.80.

In the next generation of nicotine products, major tobacco brands BAT and JTI are leading the way.

In terms of heated tobacco, IQOS is the only brand listed in the top 25 best-selling nicotine pouches and heated tobacco products in the "2025 Purchasing Guide." The best-performing product is the Iqos Terea Blue with 20 pods, with an average weekly sales revenue of £11.34 (approximately $15) and an average weekly profit of £1.08 (approximately $1) per store.

Products with fruit flavors are becoming increasingly popular.

In previous years, mint flavor dominated in these different categories, followed by tobacco flavor. After the ban on disposable e-cigarettes took effect, it is worth noting that fruit-flavored products are becoming increasingly popular.

Data shows that some consumers are shifting towards alternatives to traditional nicotine, but they are looking for a flavor similar to disposable e-cigarettes.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com