Research and Markets, a consulting and research firm, released a report on the US tobacco market on Jan. 6.

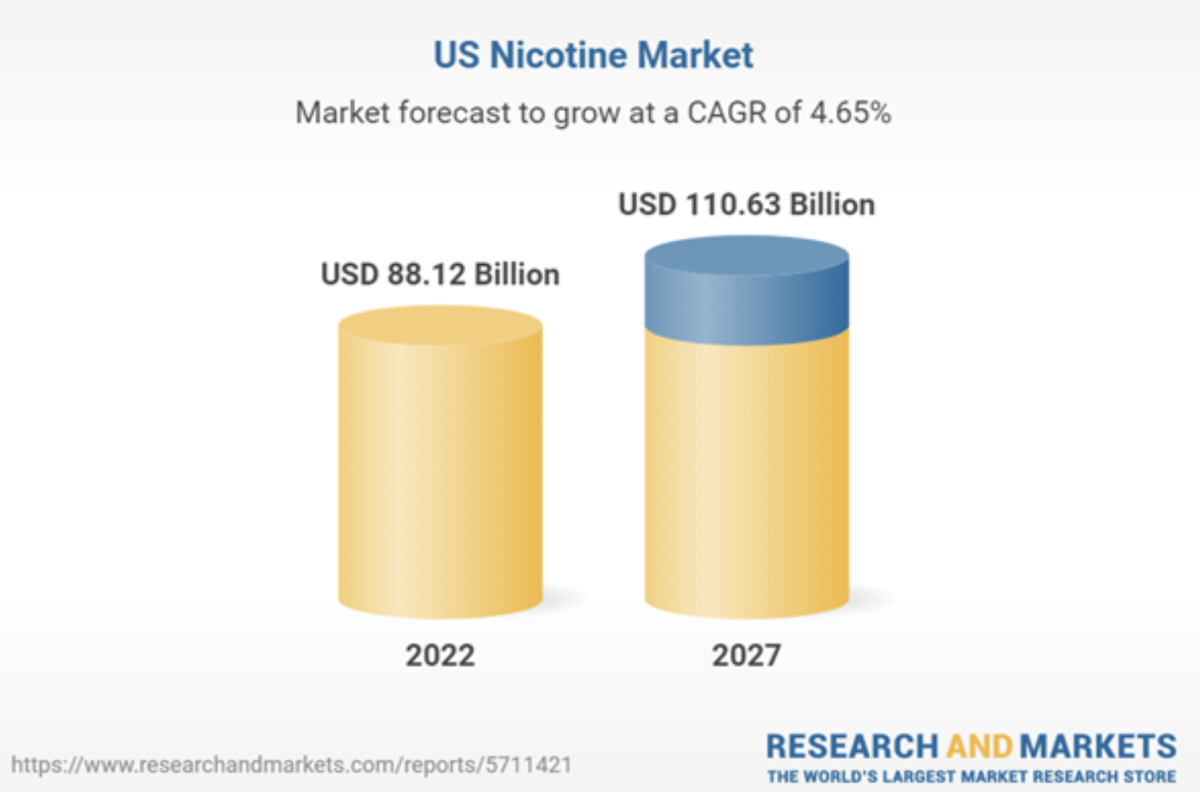

According to the report, the market size of the tobacco industry of the US reached $88.1 billion last year and is projected to exceed $110 billion in 2027 at a CAGR of 4.65%. In comparison, China's tobacco market size (cigarette and vape - since HnB is now prohibited in China) is an estimated $75.2 billion.

Market Segmentation Analysis:

- By Product: The report provides the bifurcation of the market into five segments based on the product: cigarette, vaping products, moist snuff tobacco (MST), cigar & cigarillos and nicotine pouches. In 2021, in terms of both value and volume, the cigarette segment held a major share in the market, followed by vaping products. The future of the vaping market looks promising with the rising awareness about vaping products being safer than traditional cigarettes, especially among the younger population. On the other hand, the nicotine pouches segment is expected to grow at a significant CAGR in the forthcoming years owing to the growing interest in alternative products.

- By Distribution Channel: The report provides the bifurcation of the market into into two segments based on the distribution channel: Offline and online. In 2021, offline segment held a major share in the market. Both small and large-scale companies sell their products through offline retail channels due to a large consumer base such as in grocery stores. The online channel is expected to register the highest CAGR during forecasted years owing to increase in spending on advertising and promotion by leading players operating in the market, thus offering significant growth to the segment in the forthcoming years.

Market Dynamics:

- Growth Drivers: One of the most important factors impacting the US nicotine market is the growing number of smokers and upsurge in working population. As the lifestyles are centered around work and offices, stress and anxiety levels are growing among working individuals, which leads to growing consumption of stress relieving agents such as nicotine. Furthermore, the market has been growing over the past few years, due to factors such as rising income of individuals, growing popularity of e-cigarettes, shift towards next generation products, peer influence on youngsters, increased investment in research and development (R&D) and many other factors.

- Challenges: However, the market has been confronted with some challenges specifically, stringent regulations, increasing taxes on tobacco products, harmful effects of nicotine, etc.

- Trends: The market is projected to grow at a fast pace during the forecast period, due to various latest trends such as increasing influence of social media, escalating influence of partying and pop culture, strong penetration of organized retail network, rising popularity of tobacco free oral nicotine etc. The rising popularity of partying and pub culture among millennials and working-class communities has especially fueled the demand for flavored and unflavored cigarettes. Furthermore, Social media is also being increasingly used to create awareness related to health benefits of switching to e-cigarettes and vapor products from combustible smoking. This has risen the accessibility and reachability of individuals towards different brands, thereby increasing the demand for non combustible nicotine products, which is estimated to help in the market expansion of nicotine in coming years.

Competitive Landscape:

The US nicotine market is concentrated due to the presence of a relatively small number of market participants. Altria is the market leader in Tobacco products and held a dominant share of the total nicotine industry.

The key players in the US nicotine market are:

- British American Tobacco P.L.C. (BAT)

- Turning Point Brands Inc.

- Altria Group Inc. (Altria)

- Scandinavian Tobacco Group

- Imperial Brands PLC

- Philip Morris International Inc. (PMI)

- Swedish Match AB

- JUUL Labs, Inc.

- Swisher

- Vector Group Ltd.

Altria is the US market leader with through its leadership in the cigarettes and MST segment. The Altria's share is expected to decline during forecasted years due to an unfavorable shift within the market to segments where Altria under-indexes, such as vaping, and some loss of share within the cigarettes and MST segments.

The Vapor category has experienced rapid changes in share and market leadership, with JUUL's leadership position eroded since its 2019 peak by strong BAT share gains led by Vuse Alto. On the other hand, JUUL by comparison is expected to witness its value share of the market to rise by 2025 despite losing share in the US vaping segment.

*The content of this article is written after the extraction, compilation and integration of multiple information for exchange and learning purposes. The copyright of the summary information still belongs to the original article and its author. If any infringement is found, please contact us to delete it.