In March, the stock prices of several e-cigarette related businesses listed on the Hong Kong stock market, such as Smoore International (6969.HK) and China Boton (3318.HK), have experienced significant increases. China Boton, in particular, saw its stock price soar from an opening price of 0.95 on March 12 to a closing price of 1.93 on March 22, effectively doubling its market value and approaching one billion Hong Kong dollars. (Note: As of the time of writing, China Boton's stock price on the morning of March 27 has fallen back to 1.670)

Will e-cigarette companies like Fonton, which is a leading representative, experience a bottoming out rebound in the capital market in the future? 2FIRSTS conducted a research analysis on Fonton's latest performance report and its recent years.

Overview of China Boton

Boton Group, founded in 2005 with a focus on tobacco flavorings, successfully went public on the Hong Kong Stock Exchange in the same year. It was the first Chinese flavor and fragrance company to be listed in Hong Kong. With a long-term commitment to expanding horizontally in the flavor and fragrance industry, Bodun Group now covers tobacco, food, and daily use fragrances. In 2015, the company acquired Jirui and Ince-cigarette, marking its official entry into the e-cigarette market.

After successfully acquiring Jirui e-cigarette, its e-cigarette division has experienced rapid growth in performance, increasing from 1.54 billion yuan in 2016 to 11.65 billion yuan in 2022, with a compound annual growth rate of 40.1%, contributing to the continued growth of revenue.

It is worth noting that Botton has always maintained a good relationship with China Tobacco. The first domestic HNB tobacco product "Kuanzhai Kung Fu" in China was developed by China Tobacco Sichuan and manufactured by Botton's Huizhou factory. It has been launched in foreign markets. The domestically produced IQOS device GS5.0 is also a product of cooperation between Botton and China Tobacco.

However, the operating profit margin of the e-cigarette sector is lower than that of the flavor enhancer sector. The rapid increase in the e-cigarette sector's market share has caused China Boton's overall gross profit margin to gradually decline in recent years.

Highlights of the Financial Report

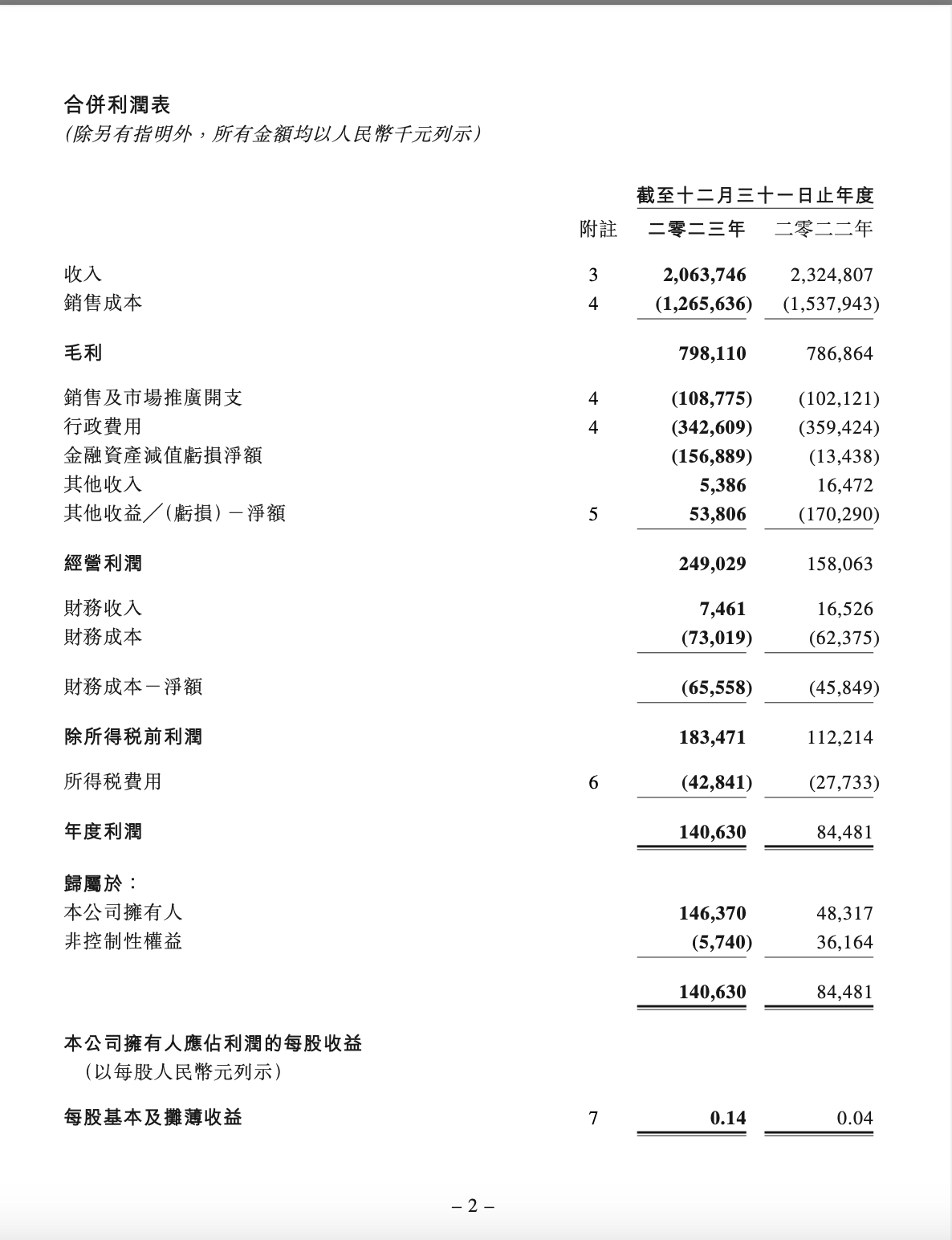

In 2022, the company achieved a net profit attributable to shareholders of 0.48 billion yuan, a sharp drop of 73.67% compared to the previous year. The net profit margin for the year was 3.6%, leading many to question whether its profitability is not as strong as its revenue performance.

From a detailed analysis of the various business segments, the company's decline in performance during the period was mainly attributed to the drag of e-cigarette products. The revenue contribution from this segment in the first half of the year decreased by a significant 41.2% compared to the same period last year.

Potton, a Chinese e-cigarette company, attributes the decline in revenue from its e-cigarette business to new policies and tax rates implemented by the Chinese government on different e-cigarette products. Additionally, the company has allocated a significant amount of manpower and resources to comply with these regulations, resulting in increased costs and expenses.

In the financial report released on March 22, covering the fiscal year ending on December 31, 2023, Bolton reported a total annual revenue of 2.064 billion yuan. The company's net profit attributable to owners reached 146 million yuan, a year-on-year increase of 202.94%. Earnings per share stood at 0.14 yuan.

As of the fiscal year ending on December 31, 2023, the company's net profit was approximately 141 million RMB, a year-on-year increase of 66.5%. According to the report, this increase was mainly due to the profit from selling two Korean subsidiaries of the group during the fiscal year; and a decrease in the provision for litigation claims offset by the net loss of impairment of financial assets. The company's net profit margin for the year also increased from 3.6% in the previous year to approximately 6.8%.

Compliance-driven Rebound?

Tighter regulations and the implementation of a consumption tax have put pressure on the e-cigarette industry in the short term. This is a key factor contributing to the declining performance of China Boton, Smoore International in the first half of 2022 and 2023.

A senior industry insider from a sponsoring institution revealed to 2FIRSTS that the e-cigarette concept had previously experienced a surge in value and then returned to normal levels. This was partly in response to tightened policies and partly a natural part of the industry's development process. However, from a long-term perspective, the implementation of regulatory policies and the establishment of a regulatory framework for e-cigarettes in China will promote the industry's entry into a period of orderly development. Strengthened regulation will also benefit the industry by eliminating inferior and illegal small businesses, signaling a positive trend for the overall market's future healthy growth.

The performance and stock price of China Boton in the future will be worth paying attention to in order to see if they can capitalize on the opportunities in the industry and rise accordingly.

2FIRSTS will continue to monitor the performance of e-cigarette related companies and sectors in the capital market.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com