Key points:

· Tobacco is central to Malawi’s economy. It contributes over 50% of Malawi’s foreign exchange earnings and approximately 12% of its GDP.

· The 2025 season has been characterized by higher output but lower grower profitability. Farmers are expected to sell 175 million kg of tobacco in 2025. However, average prices have dropped to $2.48 per kg and production costs have risen by over 10%.

· The season began with dry spells, but later good rainfall helped the crop recover, improving both quality and quantity compared to the 2024 season, which was hampered by El Niño conditions.

· Malawi’s reliance on a single crop exposes it to climate volatility and global price fluctuations. In 2021/2022, poor weather led to a dramatic drop in production (85 million kg), slashing national income to $185 million despite favorable per-kg prices.

· Stakeholders are encouraging farmers to adopt supplemental crops like legumes (e.g., soybeans), but challenges remain due to low productivity and lack of support infrastructure.

· While demand for burley tobacco remains stable due to limited global competition, next-generation nicotine products pose a long-term threat as they use less leaf.

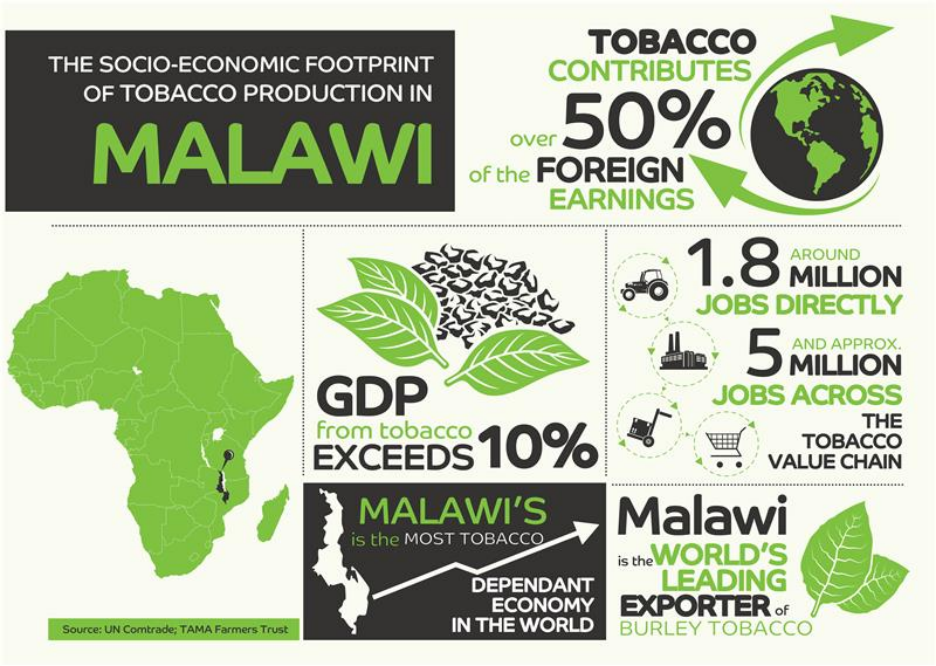

[Taco Tuinstra, 2Firsts] It’s hard to exaggerate the significance of tobacco to Malawi, the world’s leading exporter of burley and host to the International Tobacco Growers Association’s (ITGA) recent Africa regional meeting. According to the ITGA, the golden leaf contributes more than 10% to the nation’s economy and accounts for over half of its export earnings, bringing in the precious foreign currency required to import the products and services that the poor and landlocked country does not produce at home. The tobacco industry employs 1.8 million people directly and approximately 5 million throughout the value chain.

These numbers make Malawi the world’s most tobacco-dependent economy. Unfortunately, such heavy reliance on a single commodity also creates vulnerability. Visit the countryside in April/May, and you will see how people’s lives change when the tobacco markets open. Flush with cash, tobacco grower will boost their local economies, paying school fees, investing in their farm operations and acquiring consumers goods. If the markets fail, however, there may be poverty in the villages, as happened in 2022, when unfavorable climate conditions during the growing season resulted in the lowest volume in a decade.

This year is looking good in terms of volume, with stakeholders expecting farmers to sell 175 million kg, including 160 million kg burley, 13 million kg flue-cured Virginia and 2 million kg dark-fired tobacco before the end of August, when the markets close. Nonetheless, farmer profitability has been down from last season due to higher production cost and lower per-kg leaf prices.

2Firsts caught up with Nixon Lita, CEO of the TAMA Farmers Trust, which promotes the interest of tobacco growers in Malawi, to discuss the current marketing season and the industry’s attempts to ensure a sustainable future.

The Crop

2Firsts: How is the quality of the leaf that has been brought to the market so far this year in Malawi?

Nixon Lita: Quality is improving for all tobacco types largely as a result of intensified technical assistance being provided by buying companies.

2Firsts: How does the anticipated volume compare to last year?

Lita: There is a big improvement in both quality and quantity this year, for example, as of 18 July, the weight sold was 162 million kg—already above that of 2024.

2Firsts: What weather conditions prevailed during the growing season?

Lita: Dry spells dominated the early crop months of December and first half of January; good rains followed, which led to recovery of the crop as the reaping season closed for 2025. By comparison, the 2024 season was characterized by El Nino weather, dry spells for much of the season, resulting in a stunted crop that led to a low production as compared to hectarage devoted.

2Firsts: How many farmers grew tobacco during the most recent growing season, and how does that compare to the previous year?

Lita: In the growing season of 2024/2025 about 43,000 entities registered for production and are active on the market so far. In the previous season, 2023/2024, a total of 40,824 entities grew and participated in the tobacco market.

What explains the change in the number of growers?

Lita: The number of farmers increased in the current year as a result of attractive prices that were offered last year, 2023/2024.

The Market

2Firsts: Please compare the burley marketing season that is currently underway to that of last year.

Lita: The average price paid to date this year for burley tobacco is $2.48 per kg, down from $2.91 during the previous marketing season. The difference is explained by higher supply this season; competition has been reduced as each buyer is assured of meeting targets.

2Firsts: How much do you expect Malawi to earn from tobacco exports this year?

Lita: Looking at the present levels of competition we expect the market to earn about $450m this year. This compares to earnings of approximately $396 million during the previous marketing season. Despite the lower prices of 2025, tonnage produced is higher, hence the higher market earnings expected this year.

2Firsts: What is the global demand-supply situation for burley tobacco? Is Malawi well-positioned to compete?

Lita: There are few burley producers globally—most countries concentrate on Virginia tobacco—and that makes Malawi to compete favorably as a trusted source.

2Firsts: Please comment on the cost of production. How has it changed since last year; what were the contributing factors?

Lita: The cost of production has gone up by 10.59% compared to 2024 on average for tobacco crop. The increase can generally be attributed to the changes in micro and macro-economic environment in the country, thus leading to a general increase of commodity prices including farm inputs.

With a lower selling price this season it means farmers are making a lower profit as compared to 2024.

Mitigating Risk

2Firsts: Please quantify the importance of tobacco to Malawi’s economy in terms of employment, export earnings and GDP.

Lita: Tobacco is the biggest export commodity for Malawi contributing in excess of 50% of forex earnings and contributing about 12% to national GDP.

With an estimated number of 50,000 farming groups/clubs involved in production per year that translates to about 500,000 individuals directly employed in tobacco production per year for a population of about 20 million. Further employment is created in the support businesses created by tobacco like transportation, input supply, processing factories.

2Firsts: What risks does such heavy dependence on a single crop present? Please provide a concrete example.

Lita: It’s a big risk as Malawi’s economy is exposed to effects of global price fluctuations and also bad weather seasons that lead to low production. For example, a bad season of 2021/2022 produced only 85 million kgs, almost half of traditional production levels thus leading to a low national income of $185 million despite good prices.

2Firsts: How are you helping farmers diversify their sources of income?

Lita: With improved technology dissemination farmers are able to improve their yields and thus able to produce same tonnage on a reduced hectarage, thus releasing land for other crops. With this development farmers are being encouraged to take up other cash crops like legumes.

2Firsts: What are the most promising supplemental/alternative crops to tobacco? What hurdles must be overcome to realize the potential of those crops?

Lita: Legumes are promising with an assurance of local and export markets, with soya leading the pack. The biggest challenge is low productivity (kg/ha) especially with smallholder farmers, as such farmers always come back to tobacco after a trial of a year or two, having noted relatively lower margins.

Unlike tobacco, which is well supported with production technologies, extension advice/technology transfer and even government policy, such initiatives are not available with legumes. As such there’s need for authorities to look at these other crops also and ensure support that would lead to yield improvement and thus better farm margins.

2Firsts: How has the rise of next-generation products impacted demand for Malawi leaf? Is Malawi’s style of tobacco suitable for heat-not-burn devices or other new products?

Lita: Next-generation products use less leaf, so there will likely be a negative impact on demand in the coming years. However, we haven’t felt this effect yet, as we have been unable to meet demand in recent years. At the moment, we have not been actively involved in heat-not-burn or other new products related issues.

Ensuring Sustainability

2Firsts: Please comment on your initiatives to promote good agricultural practices and discourage bad ones such as child labor.

Lita: Over the years we have been working with government to change policy and regulations so that we improve in crop traceability and thus compliance to the global industry demands and it is pleasing to note that we have been given full support.

Malawi’s Tobacco Industry Act has been revised twice in the last five years—most recently in 2024—to accommodate developments relating to labor issues and also responding to other pertinent questions like environment.

In recent years, over 80% of crop sold is under contract arrangement that ensures continued supervision of production by buyer and thus ensure good practices are followed from nursery to sale stages.

The process has been supported by the government, buying companies and other like-minded agencies like ECLT [the Eliminating Child Labour in Tobacco Foundation, an organization committed to combat the root causes of child labor in tobacco-growing communities].

2Firsts: How do you view the future of Malawi tobacco? What are the greatest challenges? And what steps must be taken to ensure its viability going forward?

Despite the increasing pressure from anti-tobacco lobbyists there is still a good future for Malawi tobacco as long as farmers continue to work on emerging issues relating mostly to decent labor conditions, environment and such.

There is a need for farmers to produce just enough to meet demand, otherwise over-production brings low prices and thus disrupts the livelihoods of tobacco producers forcing others to quit or go bankrupt.

ITGA and 2Firsts Partnership

Founded in 1984, the International Tobacco Growers’ Association (ITGA) is a non-profit organization established by representatives of tobacco growers from multiple countries worldwide. It aims to advocate for growers, balance regulatory objectives with farmers’ livelihoods, and promote sustainable agricultural practices.

2Firsts is a global leading media and consulting organization specializing in the next-generation tobacco products (NGP) sector. It is committed to connecting the global industry chain through professional reporting, in-depth research, and compliance services, advancing tobacco harm reduction (THR) and industry sustainability.

In April 2025, ITGA and 2Firsts officially signed a memorandum of understanding during the ITGA Americas Regional Meeting held in San Salvador de Jujuy, Argentina, launching a strategic partnership. Their collaboration covers four core areas, supporting global growers and facilitating cooperation and transformation between traditional and next-generation products while promoting global market communication and shared development:

· Official Media Partner: 2Firsts becomes ITGA’s official media partner, participating in and reporting on global meetings and activities to enhance industry influence.

· Co-Organizing Conferences: Both parties will jointly organize the ITGA Asia-Pacific Regional Meeting to create a high-quality dialogue platform focusing on cultivation, trends, and policy changes.

· Greater China Representative: 2Firsts serves as ITGA’s exclusive local contact representative in Greater China (Mainland China, Hong Kong, Macau, and Taiwan), facilitating deeper regional cooperation.

· Joint Research & Publications: The two will co-develop and release industry blue books and market research reports, providing authoritative insights and forward-looking analysis.

To learn more about the collaboration between ITGA and 2Firsts, click here.

To learn more about the ITGA, click here.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com