[By 2Firsts, Dubai]

Ahead of the 2025 World Vape Show, the 2Firsts team arrived in Dubai and visited several vape wholesalers and retailers in Dragon Mart. Their research revealed growing market competition and a gradual decline in Dubai’s traditional role as the Middle East's central distribution hub. At the same time, the city is becoming a key testing ground for the launch of new vape products by many brands.

Signs of Market Decentralization in Dubai: Wholesale Profits Cut in Half

According to the research, Dragon Mart now hosts dozens of vape stores serving two main customer groups: local consumers and tourists, and regional distributors from countries such as Iran, Lebanon, and Syria. However, many store owners reported a noticeable drop in sales. The core reason, they say, is the weakening of Dubai’s role as a transit and distribution center.

On one hand, competition within Dragon Mart has become intense, with a wave of new store openings diluting overall sales. On the other hand, as distribution systems in many countries become more developed, more brands and buyers are choosing to bypass Dubai and build direct local channels. As a result, wholesale profit margins have shrunk from around 50% in the past to roughly 20% today. Some shop owners even stated bluntly that “profits have been cut in half.”

Dubai’s Vape Market Emerges as a Brand Testing Ground

2Firsts has conducted field research in Dubai’s vape market for three consecutive years. This year, we observed a noticeable increase in the number of brands in the Dragon Mart wholesale area compared to previous years. Store displays have also become more diverse and experimental—many shops now showcase seven or eight major brands alongside several new products that haven’t yet launched widely.

This trend suggests that more brands are viewing Dubai as a strategic testing ground for new products. The city’s diverse customer base and high retail turnover make it ideal for quickly gauging market response. Several innovative products tracked by the 2Firsts Product section—such as SKE’s fog-free devices and ZAR’s leaf-shaped nicotine pouches—were spotted in multiple stores throughout Dragon Mart.

Regulation in Name Only: Fines Replace Oversight as Industry Norm

Although UAE regulations clearly limit the nicotine concentration in e-cigarette products to a maximum of 20mg/ml, 50mg high-nicotine products remain widely available in Dubai. As one store manager bluntly put it: “If you get caught, you’ll be fined—but as long as you pay, you can keep selling.”

Beyond nicotine violations, untaxed products also circulate heavily in the Dragon Mart market. According to multiple local retailers, there exists a loosely tolerated “fine-for-pass” system. Shops selling non-compliant or untaxed products are reportedly allowed to operate by paying significant monthly fines to enforcement authorities, essentially in exchange for continued business. These annual fines can range from AED 3 million to over AED 20 million (approximately RMB 6–40 million), with the amount fluctuating based on monthly revenue—higher sales mean higher payments.

Inspectors typically conduct regular audits, calculate fines based on recorded sales, and collect payments. Because paying a full year’s fine upfront is financially burdensome, most stores opt for monthly installments. In practice, compliant products are displayed prominently, while non-compliant ones are sold discreetly—often under the counter.

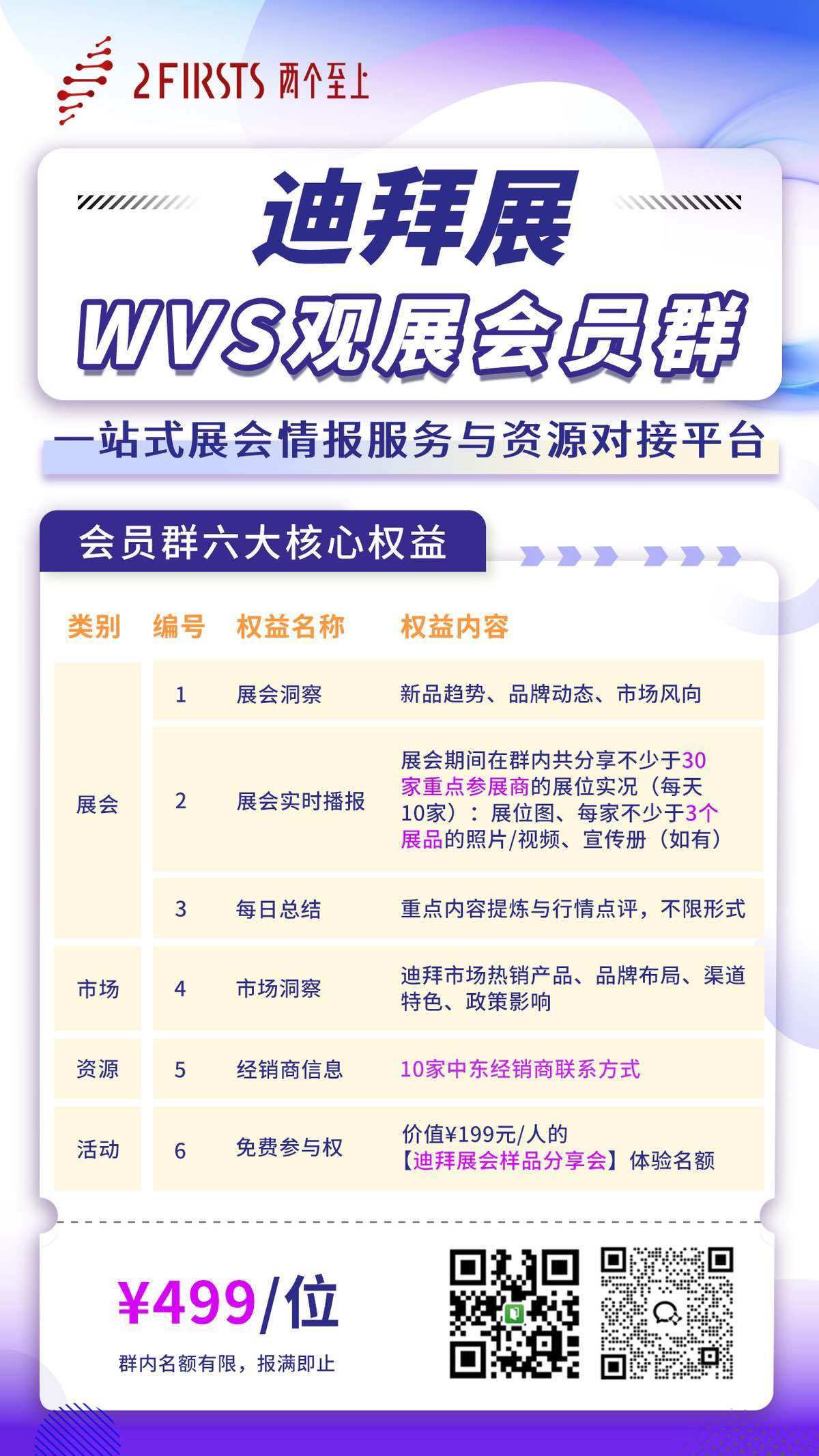

To further enhance the efficiency of exhibition participation, 2Firsts has specially established an online WVS exhibition member group. More in-depth content and high-value information will be continuously shared within the group. Industry colleagues who are interested are warmly welcome to join.