Note from Editor: As of July 2022, the core regulatory framework for China's e-cigarette market has basically been settled. As the final links, the formulation of e-cigarette tax policy is still in progress, this article aims to provide readers with thoughts on the taxation of e-cigarette in China by comparing the taxation and market of tobacco vs e-cigarette products in other countries.

1. Core Findings

The diversification and modernization of nicotine intake is a worldwide trend. Along with that trend, the tax burden of new nicotine products such as electronic nicotine delivery system(ENDS) are generally lower than that of traditional cigarettes.

Using representative countries, like Russia, Japan, the United States and the United Kingdom, imposes the combined taxation of specific duty and ad valorem tax on all kinds of tobacco/nicotine products. We find that a common theme of regulation and taxation is to gradually increase the duty of these the products.

2. The basis of selecting samples

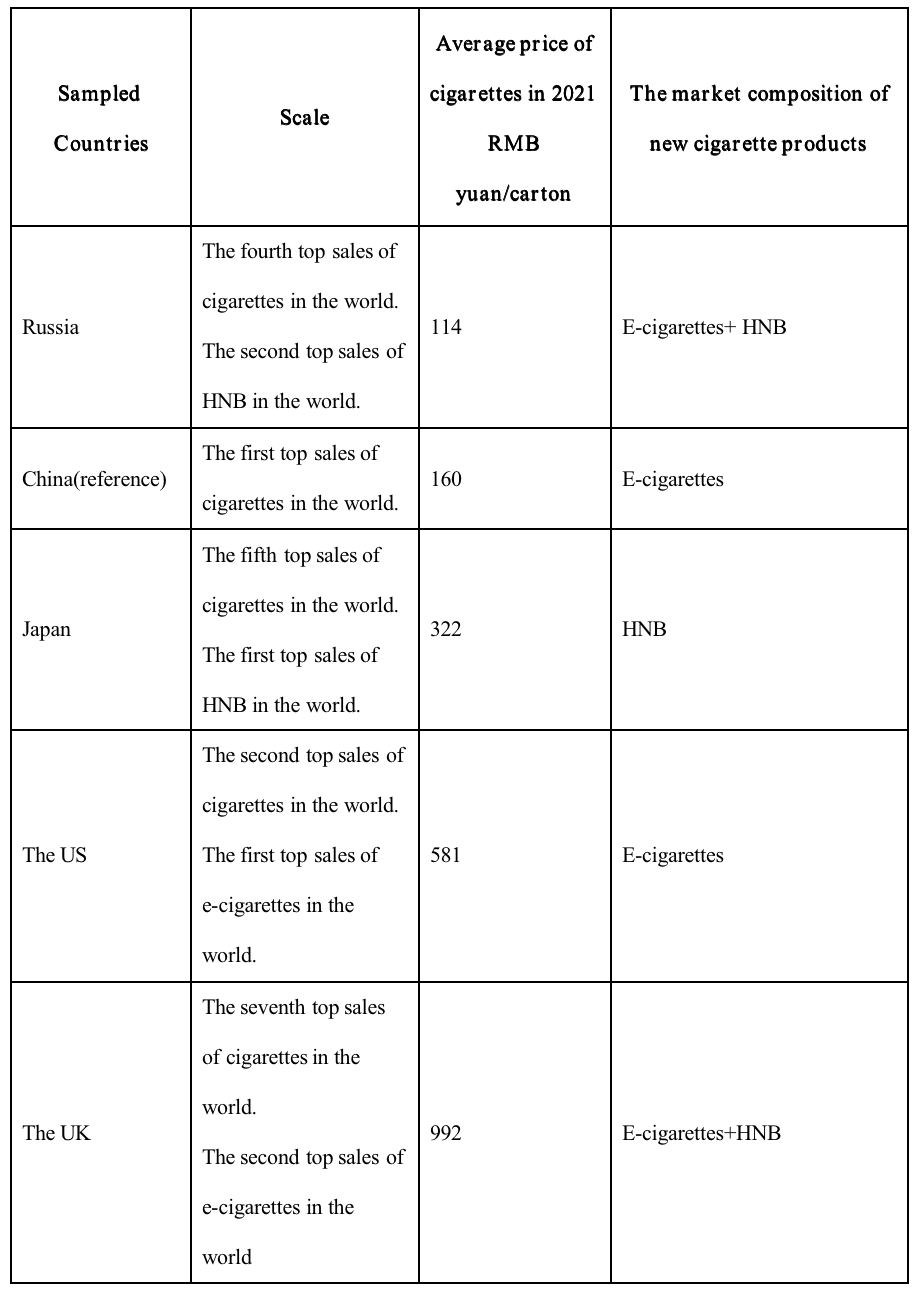

a) A market scale that is big enough.

The samples selected are top countries of cigarettes, e-cigarettes, and Heat-not-burn(HNB) use.

b) Countries with different attitudes towards tobaccos for comparison.

Taking the “average price of cigarettes” as the core index, the samples selected ranges from high, medium, and low cost to consumers. High prices, high taxes equates to strict attitudes while low prices, low taxes, equates to lenient attitudes.

c) The different market composition of ENDS.

The sample selection covers three cases: both sale of e-cigarettes and HNB allowed, only sale of e-cigarettes allowed, and only sale of HNB allowed.

3. The Russian Market

a) Cigarette

Russia adopts the combined taxation of ad valorem and specific duties on cigarettes. In recent years, the ad valorem tax on cigarettes had increased many times. The current tax is 16% ad valorem tax plus the specific duty of 2,454 rubles/1000 pieces. If the sum is less than 3,333 rubles/1000 pieces, the tax will be levied at 3,333 rubles/1000 pieces.

Using the the average price of cigarettes in Russia as an example, 4,711 rubles/1000 cigarettes. According to the tax formula, the tax should be 3,208 rubles. Since it is less than 3,333 rubles, the actual tax will be 3,333 rubles/1000 cigarettes.

b) E-Cigarettes

In Russia, a specific excise tax is levied at 17 rubles/milliliter on e-cigarettes containing nicotine.

If we use the conversion that 1 cartridge of 2ml e-liquid equals 40 cigarettes, 17 rubles/milliliter equates to about 850 rubles/1,000 cigarettes. This is 74% lower than the minimum tax for cigarettes.

However, the proportion of vapes that have gone through the necessary legal route and tax system are very low. We can even temporarily categorize Russian e-cigarettes as “0 rubles/1000 cigarettes.”

c) HNB

The tax of HNB packs in Russia are levied by the weight of raw tobacco materials, at the rate of 7,536 rubles/kg.

If we go by an average weight raw tobacco material in a HNB stick of 0.3g, the 7,536 rubles/kg tax will equate to 2,261 rubles/1,000 units. This is 32% lower than the minimum 3,333 rubles for cigarettes.

d) Others

Russia imposes a uniform duty of 54 rubles/piece on e-cigarette (including disposable e-cigarette) and HNB cigarette. For comparison, the retail price of disposable e-cigarettes are about 900 roubles/unit, pod system vapes are about 1,700 roubles, and HNB cigarettes are about 4,490 rubles. We can see that the proportion of 54 rubles per/unit is not high.

e) Conclusion

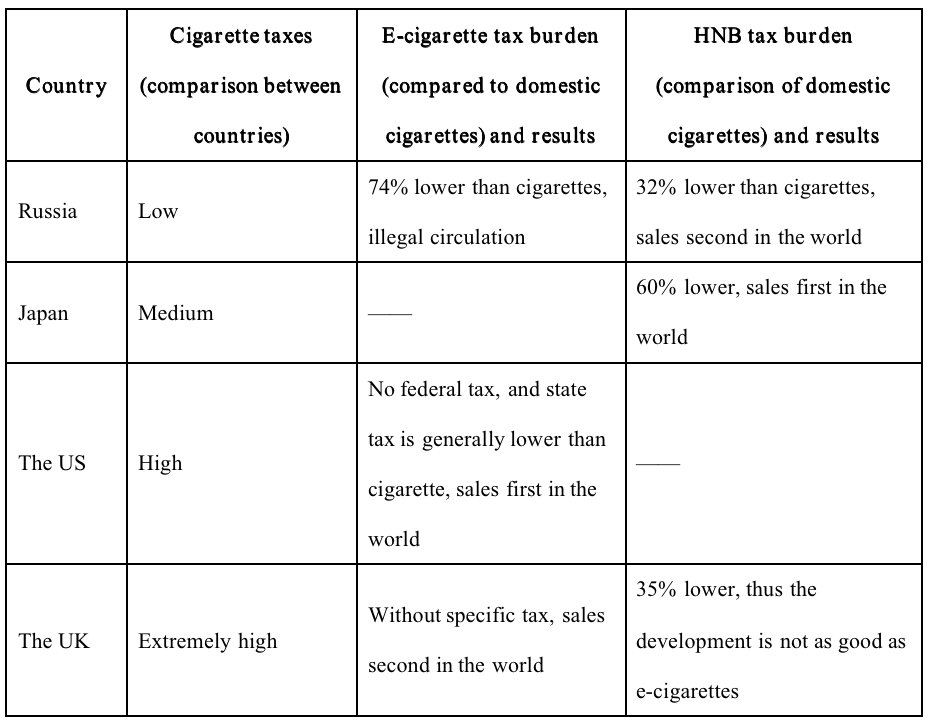

The HNB market in Russia exceeded $3 billion USD in 2021, just over one-sixth of the $17.8 billion for cigarettes. The tax burden of e-cigarettes is more favorable, however, since there is a large amount of illegal circulation, further observations are needed.

4. The Japanese Market

a) Cigarettes

Cigarette sales in Japan have been on a steady decline for nearly two decades, while the government has steadily increased taxes to keep cigarette taxes revenue relatively stable.

The current value-added tax rate for cigarettes in Japan is 8%, the ad valorem consumption tax rate is 30% of the retail price, plus a tobacco consumption tax levied on the weight of the tobacco raw material at 16,555 yen/kg.

b) HNB

The value-added tax rate rate of HNB packs in Japan are exactly in line with those of cigarettes, but the tobacco consumption tax is calculated and levied at 80% of the tobacco consumption tax of cigarettes equating to 13,244 yen/kg.

At first glance tax on HNB has a nominal 20% discount over cigarettes in terms of tobacco consumption tax. But based on the actual tobacco weight of 0.6g per cigarette and 0.3g per stick for HNB the actual discount is about 60% depending on the weight of cigarettes. HNB tools are subject to value-added tax as a normal electronic products, no burden tobacco consumption tax.

c) Conclusion

In 2021, the HNB market in Japan had exceeded 10.3 billion USD, nearly half of the 23.6 billion USD for cigarettes. The popularity can attributed to the 60% discount of tobacco consumption tax.

5. The US Market

a) Cigarettes

Cigarette taxes in the United States are separated by state and federal level tax:

1) A uniform federal consumption tax is $1.01/20 cigarettes applied, but a draft to double the tax is being discussed.

2) Each states also have their own tax system for tobacco. For example, in 2021, the tax in California is $2.87/20 cigarettes, Texas is $1.41/20 pieces, and Kentucky is $1.10 /20 pieces.

The state taxes on cigarettes in the three states seems to negatively correlate with the local smoking rate. According to data from United Health Foundation, the smoking population is 10.0% in California, 14.7% in Texas, and 23.6% in Kentucky.

b) E-Cigarettes

The US federal government has yet to implement a tax on e-cigarettes, but a drafting to charge $0.0278/milligram of nicotine, or about $1/36-milligram cartridge is in discussion.

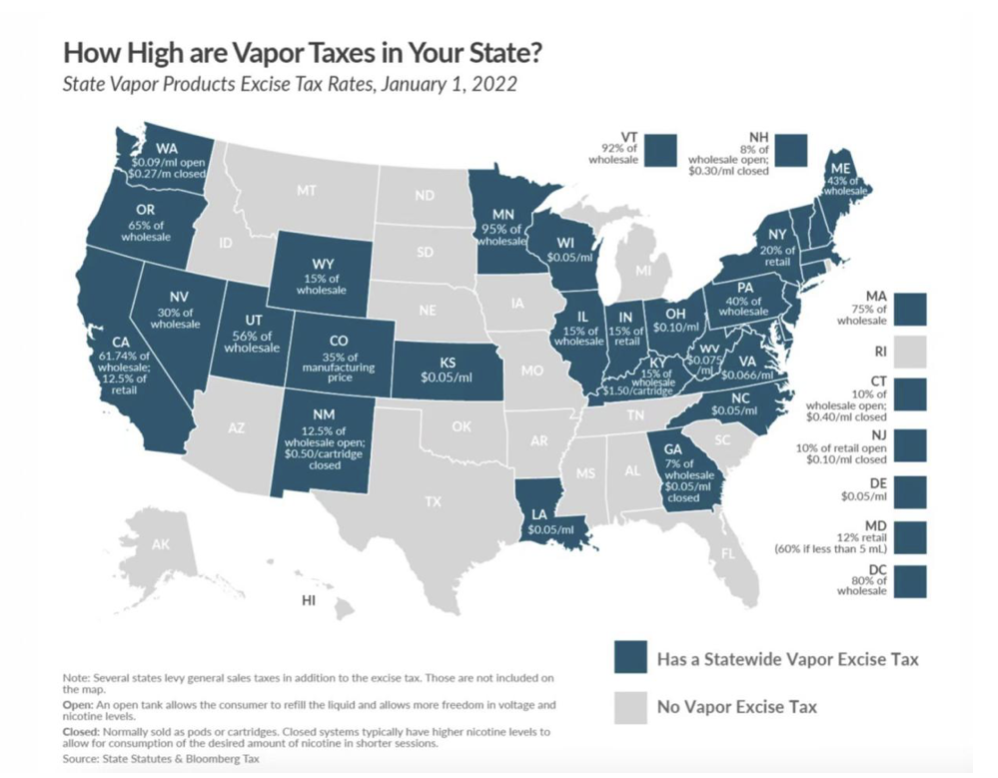

Similar to cigarettes, state taxes on e-cigarettes vary between states. California has implemented an ad valorem tax of 12.5% on e-cigarettes since 2021, Texas has no such tax, Kentucky has implemented an ad valorem tax of 15% on open system or $1.5 per unit on closed system since 2021, and for North Carolina a tax of $0.05/unit since 2015. No states have any tax on the electronic tools for e-cigarettes as all such taxes are imposed only on containers of e-liquid.

The following chart from the Tax Foundation shows the e-cigarettes tax system in the United States, and states that levy taxes on e-cigarettes are in blue.

(Source: Tax Foundation)

c) Conclusion

In 2021, the US e-cigarette market size of more than $10.3 billion, over a tenth of the $96.8 billion in cigarettes. The growth is driven by the fact that the tax burden on e-cigarettes is generally lower than the tax burden on cigarettes in all states.

6. The UK market

a) Cigarettes

The UK has a population of 62 million with sales of 473,000 cartons of cigarettes in 2021. By comparison it is far fewer than the 18 million population and 558,000 cartons of cigarettes sold in Shenzhen, China. A sign of UK’s smoking population’s consumption habits.

The British government has implemented two strict regulations on cigarettes:

1) The UK tax burdens on cigarette are high and ever-increasing. The the total tax from cigarette includes a duty of 16.5%, adding on a flat 20% consumption tax on normal goods, and an ad valorem tobacco tax of £5.26 per 20 cigarettes. The ad valorem tobacco tax has been increased four times since October 2018, from £4.57 to £5.26 at a moderately high frequency.

2) A relatively light tax policy is given to cigarette substitutes to encourage smokers to shift. A normal 20% or 5% consumption tax applied without any additional tobacco taxes for substitutes.

b) E-Cigarettes

Vape accessories, cartridges, and vaporizer, only has the normal consumption excise tax 20% , no additional tobacco related tax.

c) HNB

A uniformed consumption excise tax of 20% and a specific duty of £302.34/kg on tobacco are levied, equipment sets are exempted since they do not contain tobacco. The estimated amount of tobacco is 6.11g of tobacco/20 sticks, which is around £1.85 tax, 35% of the cigarette’s tax of £5.26/20 sticks.

d) Conclusion

The method in UK is to covert rather than suppress. After equalizing approximate consumption, British smokers have choices between e-cigarette cartridges with an average retail price of £4.5/each, HNB at £12.0/40, and cigarettes at £23.1/40. Ultimately forming the market that where e-cigarettes sales are second highest in the world, HNB lukewarm reception, and cigarettes are high-priced low volume.

7. Conclusion

8. International Organization’s Attitudes Toward Tobacco Excise Taxes

According to China Tobacco Science and Education Network, April 19, 2021: The World Health Organization(WHO) released a new handbook on tobacco tax policy and management to provide suggestions to governments, also an effort to reduce the huge government public health expenditures caused by tobacco consumption.

The report states that increasing tobacco tax rates could reduce tobacco consumption and recommended level of tobacco taxation at 75 percent of its retail price.

Also according to the China Eastern Tobacco Network report on June 7, 2022: In response to the rapid growth of new type of tobacco products, the WHO has released studies such as "Standard Operating Procedures for Testing Electronic Cigarette Oil Components" and "Case Studies of Litigation Related to New Type of Tobacco Products".

The report states that stakeholders are calling for the Framework Convention on Tobacco Control (FCTC) to include provisions that encourage consumers to use safer tobacco products. Currently, the FCTC states that tobacco control includes "harm reduction" strategies, but the text does not specify the measures to reduce tobacco harm.

In summary, the international organizations that are represented by WHO recommend a tobacco tax rate of 75%. WHO has concerns over new type tobacco products such as e-cigarettes, but has not yet explicitly provided guide on how to promote "tobacco harm reduction" strategies through tax rate settings.

To read more articles by Li Min, please scan the QR code below.

About the Author:

Li Min, Tobacco Engineer, Compliance Expert

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.