Recently, Smoore released its 2024 financial report. As a well-known manufacturer of electronic vaporization devices in the industry, its annual financial report is not only a review of its own business, but also a barometer for the entire new tobacco industry. By analyzing its business layout, market changes, and financial data, one can observe the future trends of the global new tobacco industry.

From the regulatory crisis facing disposable e-cigarettes and other products, to the rise of HTP (HNB) products in recent years, and the decline in the European market, these trends not only represent changes at the level of Smoore company, but also reflect new trends in the industry's future.

Age-gating technology: Increasing global regulations pushing for stricter product innovation

The financial report from Smoore shows that the company has supported "strategic clients" in submitting PMTA applications for several flavor-type electronic vapor products with age verification technology. Smoore believes that in the past year, the FDA has increased enforcement efforts against illegal products, resulting in growth for their corporate clients selling compliant products in the United States.

At the same time, the United States, the world's largest emerging tobacco market, is set to introduce mint-flavored e-cigarettes without tobacco in 2024, as well as the first batch of nicotine pouches. With the entry of new compliant products in the market competition, the FDA is also intensifying its crackdown on the illegal e-cigarette market in the United States.

In 2024, Smoore mentioned that the FDA, along with multiple federal agencies, will take a series of enforcement actions against non-compliant electronic vapor products. This has prompted companies to further invest in technology for PMTA-compliant products to support customers in navigating the U.S. market regulations. With the increasing variety of compliant tobacco products and the collaboration between the FDA and other federal agencies in enforcement, the future trends of the U.S. market include:

- FDA increases enforcement efforts: Sealing off products that have not obtained PMTA (premarket tobacco product application) approval, illegal brand market share rapidly shrinking.

- Age verification technology becomes a must for approval: A scientific policy memo released by the FDA shows that some companies have submitted PMTA with "age-gating technology," which is prioritized due to its potential public health impact.

- Tobacco companies compliant with regulations benefit: With the enforcement against non-compliant products increasing and FDA's normalization of reviewing compliant products, compliant products are expected to gradually gain larger market share in the U.S. market. The 34 products that have already passed PMTA, such as Vuse and other compliant brands, further solidify their dominant position in the market after the cleaning up.

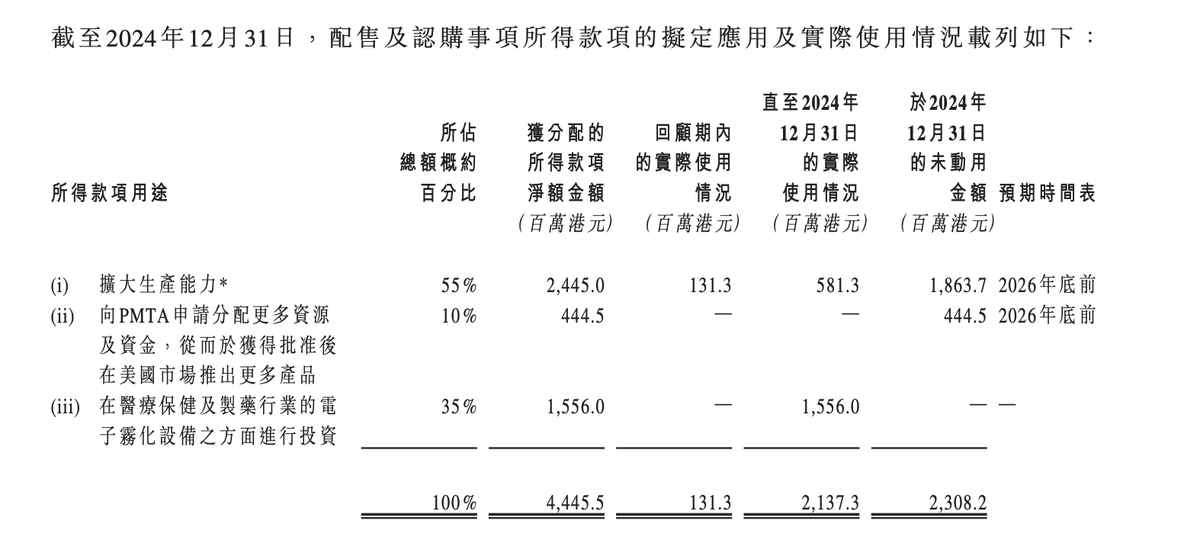

As mentioned earlier, the approval of mint-flavored e-cigarettes and nicotine pouches seems to indicate a clearer path for new tobacco products in the U.S., with industry-related companies potentially facing increased PMTA application fees in 2025. According to information disclosed in Smoore's financial report, the company's "other expenses" saw a sharp increase in 2024, which Smoore attributed to increased provision for product-related expenses in light of expected changes related to regulatory and compliance requirements during the review period.

Furthermore, Smoore also aims to increase the brand awareness of their open brand VAPORESSO in the US and UK. When considering all these factors together, it is possible that VAPORESSO may receive more funding in the future for regulatory applications and research.

HNB: The identified "second growth curve"

One noteworthy aspect of this Smoore financial report is the official designation of the company's HNB business (HTP) as the group's second growth driver in the report.

In 2024, PMI celebrates the 10th anniversary of its IQOS product. After a decade of market education and product iterations, HTP has gained a loyal audience in some regions and countries. With the growing awareness of smoker's health, HTP is seen as a healthier alternative to traditional tobacco products. Its non-combustible design eliminates harmful substances produced by combustion, and its vaping experience is closer to traditional cigarettes than e-cigarettes. In Japan, where IQOS first launched, PMI's latest financial report shows that IQOS has a market share of 30.6% and a global user base of 32.2 million. Market penetration rates in Japan, South Korea, Europe, and other regions continue to increase.

- Regulation is relatively lenient: HTP products are usually dominated by international tobacco companies, benefiting from policy biases and easier market access compared to e-cigarettes.

- Consumer demand is rising: there is an increasing demand for products that provide a more traditional tobacco experience, making HTP products more appealing to long-time cigarette users.

- Technological innovation: new heating systems are continuously optimized to enhance user experience, such as electromagnetic heating technology, infrared heating technology, and intelligent temperature control systems.

Smoore is ramping up its investment in HTP research and development in 2024, with an estimated RMB 15.72 billion spent on research and development throughout the year, representing a 6.0% increase from last year, mainly driven by advancements in aerosol medicine and HNB products. Furthermore, HNB products launched by their partner customers have been successfully introduced to the market, with Smoore stating that they have received positive feedback from consumers and clients, as the product's user experience and taste have been improved compared to existing mainstream products. Building on this success, Smoore has expressed its commitment to continue investing in research and development in the HNB field.

Sales of disposable e-cigarettes in Europe are declining due to a shift in government policies

In another important market for e-cigarettes - the European Union, countries such as the UK, Belgium, and France have all enacted bans on disposable e-cigarettes. Meanwhile, countries led by the Netherlands are advancing the update of the Tobacco Products Directive (TPD) to further strengthen regulation of the e-cigarette market. Although the EU views e-cigarettes as a relatively less harmful tobacco alternative, governments remain concerned about their long-term impact on public health. Some countries are even considering further restrictions on e-cigarette advertising and sales channels to reduce accessibility. In recent years, the popularity of disposable e-cigarettes in the European market has come under policy scrutiny, causing a blow to companies that primarily focus on disposable e-cigarettes.

In the overall tightening of policies, taste restrictions and increased taxes serve as auxiliary adjustment tools. Additionally, with many European countries adopting differing policies, the European market landscape has become more complex. E-cigarette brands need to adjust their strategies to adapt to market changes.

- Increased Regulatory Pressure: European Union Member States are pushing for an update to the Tobacco Products Directive (TPD), which will further enhance regulation requirements for e-cigarettes.

- Economic slowdown: declining disposable income in Europe is impacting sales of non-essential items such as e-cigarettes. High inflation is causing prices to rise, leading some consumers to revert back to traditional tobacco products.

- Flavor restrictions affect consumption: The ban on flavored e-cigarettes in countries such as the Netherlands, Denmark, Lithuania, etc. has weakened the market demand among young consumers.

Due to the factors mentioned above, Smoore's disposable e-cigarette revenue in 2024 is estimated at approximately 3.05 billion yuan, a year-on-year decline of about 9.5%. As user demand gradually shifts towards compliant closed pod and open pod products, it can be seen that "closed pod products showed a significant growth trend in the second half of last year compared to the first half.

In the constantly changing industry environment, there has been a noticeable shift in the innovation model of e-cigarette products. In the past, the industry's main driving force came from technological disruption, such as Smoore's ceramic atomization core technology leading the industry upgrade. However, the current and future direction of e-cigarette product development is gradually shifting from a "technology-driven" model to a combination of "policy-driven" and "user preference" models.

Therefore, it can be observed that Smoore has also adjusted its research and development strategy in line with this trend. Its technology brand, FEELM, has unveiled an e-cigarette that meets the "TPD" requirements of the European Union, focusing on more environmentally friendly and cost-effective pod-type e-cigarettes.

After expanding its TPD product line, Smoore believes that strengthened regulation of disposable electronic vapor products is beneficial for the continued healthy development of the market and also advantageous for the long-term growth of the group.

Key Development Trends in the Emerging Tobacco Industry

Represented by disposable e-cigarettes, e-cigarettes are evolving towards greater regulation and higher standards after experiencing a period of explosive growth. As a well-known e-cigarette manufacturer, Smoore's analysis of its 2024 financial report reveals the following development directions for the new tobacco industry in 2025:

Global market compliance accelerates - tightening regulations will drive the industry towards higher standards, with increased technological innovation and compliance costs.

The US market is entering a period of reshaping - illegal brands are being hit, compliant companies are seeing growth, and e-cigarettes with age verification technology may pass PMTA approval more quickly.

HTP products are on the rise - driven by policy stability and growing market demand, HTP may become a new growth point for the industry.

The European market faces challenges - stricter regulations, a shift from disposable to refillable products, and intensified competition are putting short-term pressure on the market, but it still holds long-term potential.

In 2025, the global new tobacco industry will enter a more mature stage of development, with market consolidation and technological innovation becoming the main themes. Both large and small enterprises need to actively respond to regulatory policy adjustments, optimize their own compliance strategies, and continuously promote technological innovation to ensure a favorable position in the industry. In the e-cigarette market, a minor policy change can sometimes change the entire game, but standing on the shoulders of giants can help anticipate some trends in advance.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com