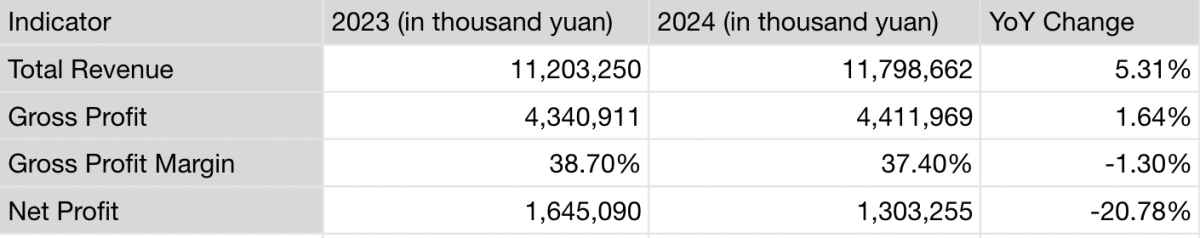

2Firsts, reporting from Shenzhen - Smoore International (06969.HK) reported total revenue of 11.75 billion yuan ($1.63 billion) for 2024, marking a 5.3% increase from the previous year, according to its annual earnings report released on Sunday.

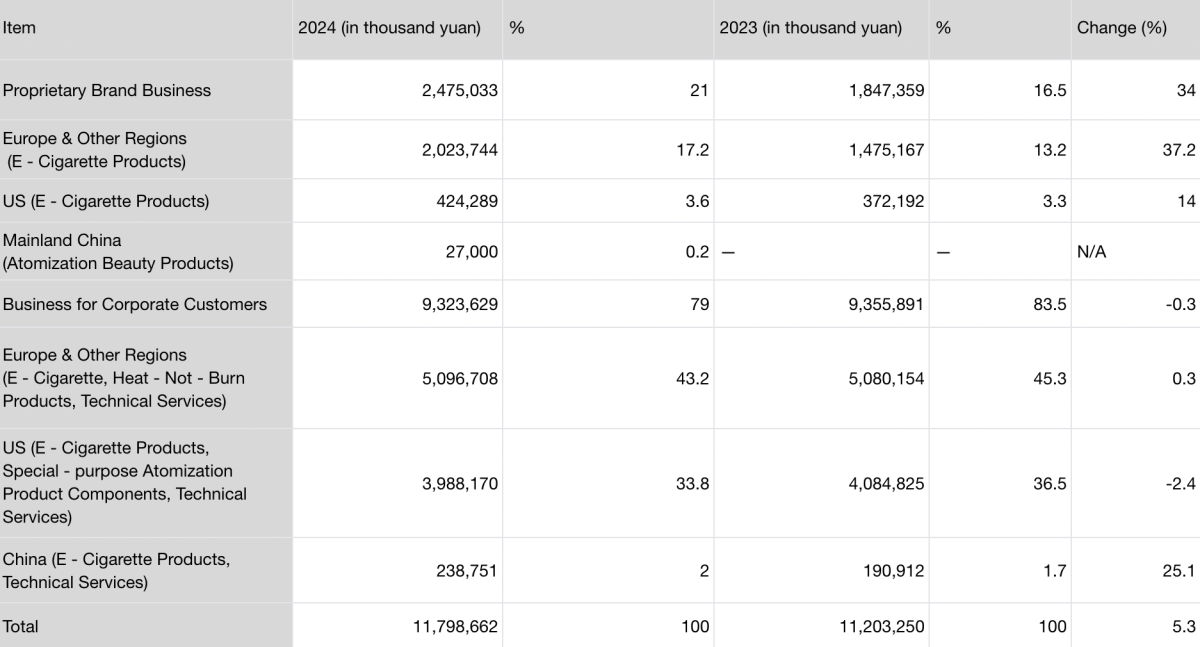

Net profit fell 20.8% year-on-year to 1.30 billion yuan ($180.5 million). Revenue from its self-owned brand business rose 34% to 2.47 billion yuan ($342.7 million), accounting for 21% of total revenue. Meanwhile, Revenue from corporate client oriented business declined 0.3% to 9.32 billion yuan ($1.29 billion), making up 79% of total sales.

Facing challenges in profitability, creating a second growth curve through building our own brand

Smoore is grappling with profitability pressures amid tightening regulations in key markets, particularly in the United States and Europe. Stricter compliance requirements have forced the company, which primarily operates as an original design manufacturer (ODM), to allocate more resources to regulatory adaptation.

Revenue from corporate client oriented business in the U.S. declined 2.4% year-on-year to 3.99 billion yuan ($553.7 million), with its share of total revenue dropping from approximately 36.5% in the previous year to 33.8% in the reporting period.

Meanwhile, shifting consumer preferences have driven the company to refine its product portfolio to adapt to market fluctuations. Smoore’s report highlighted that revenue growth was primarily fueled by its self-owned brand business, which surged 34% year-on-year, increasing its revenue share to 21%. In contrast, revenue from corporate client oriented business showed signs of weakness, edging down 0.3% from the previous year.

Smoore said its revenue mix had improved, with a higher contribution from its self-owned brand business, which it described as experiencing “steady growth.” The company attributed this to an “effective localization strategy, strong channel management, and deep consumer insights that helped launch market-driven products".

Regionally, revenue from its self-owned vaping products in Europe and other markets rose about 37.2% year-on-year to 2.02 billion yuan ($280.2 million). In the U.S., revenue grew 14.0% to approximately 424 million yuan ($58.8 million).

Currently, Smoore's main e-cigarette is the open-system VAPORESSO. On the morning of the 18th, at the 2024 full-year performance conference held in Hong Kong, China, Smoore announced that VAPORESSO has achieved the highest market share in the world.

In addition to the transformation of its own brand in the e-cigarette business, Smoore has also increased its investment in industries such as vaporization beauty.

For example, Smoore's own brand in mainland of China has achieved a revenue of 27 million yuan ($42.8 million), mainly from atomized beauty products. Smoore emphasized the launch of the "Lanzhi" brand.

The report pointed out that the Lanzhi brand "is actively marketing and promoting on top social platforms in mainland China, and gradually establishing brand image and product awareness among consumers through methods such as live streaming and setting up high-end offline store channels," and "its sales performance ranks among the top in the beauty device category on major online platforms during major marketing festivals.

Meanwhile, the Lanji brand adopts a "ToB +ToC dual-engine" business model, which provides sensitive skin repair treatments and post-operative repair treatments to beauty institutions on the B side, and provides home equipment and media combined high-efficiency skincare solutions to consumers on the C side.

Smoore announced on March 3 that Lan Zhi had obtained a Class II medical device certificate and held a ceremony for the launch of the "non-invasive nebulization high-end medical device project" in the Gaoxin District of Hezhou Industrial Development Zone in Guangxi.

Smoore's senior management stated: "The new factory will fully undertake the production and manufacturing of medical devices on the MOYAL Lan Zhi TPS technology platform." Under the "ToB +ToC dual engine" business model, the new factory, in addition to the original household beauty devices aimed at consumers, may also undertake the production and manufacturing of "medical devices".

In the field of atomization medicine, Smoore revealed that it has a research and production center for inhalation drugs near Miami, USA. The center is equipped with complete capabilities for the research, production, quality control, pharmaceutical research, clinical trials, and registration of combined inhalation drug products.

Smoore has "completed the introduction of multiple inhalation drug products for asthma and chronic obstructive pulmonary disease, with key indicators meeting the requirements of relevant guidelines from European and American drug regulatory agencies", but the products are not currently being sold to the market.

It is worth noting that Smoore mentioned the concept of "second growth curve" for the first time in its annual report, stating that "HNB business is the second important business growth curve for the group." In terms of its own vape atomized beauty brand business, Smoore is striving to transition from a traditional OEM model to brand operation.

The main reason for the growth is the increase in marketing expenses in the European and American markets.

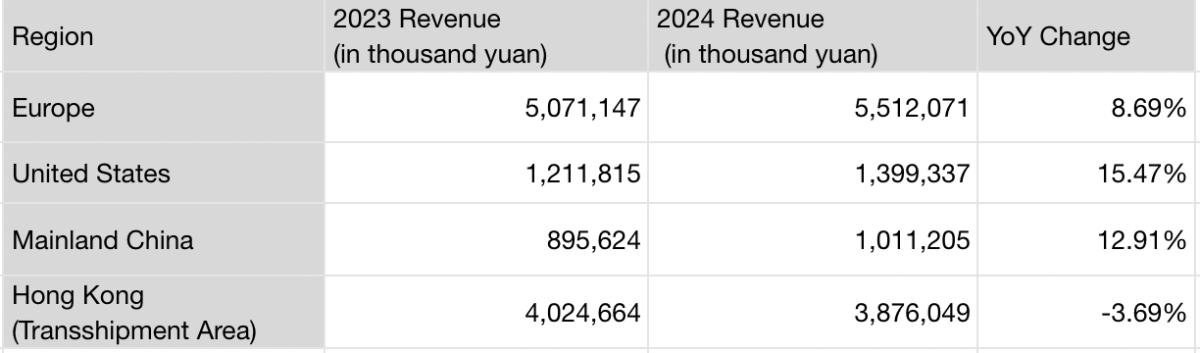

According to Smoore's earnings report, its European and U.S. markets remain the key drivers of growth, with Europe and other regions posting an 8.7% revenue increase to 5.51 billion yuan ($765.8 million), while U.S. revenue grew 15.5% to 1.40 billion yuan ($193.5 million).

Hong Kong, serving as a transit and export hub for the company's products, saw a 3.7% decline in revenue, with sales to the U.S. accounting for 3.01 billion yuan ($418.8 million), approximately 77.7% of Hong Kong's total income.

Although the U.S. market's share of total revenue decreased from about 36.5% last year to 33.8% during the review period, the value of e-cigarette products flowing into the U.S. reached 4.41 billion yuan ($612.8 million), still making the U.S. the largest single market for Smoore.

As previously mentioned, the percentage of total revenue generated in the United States market has decreased from approximately 36.5% last year to approximately 33.8% in the review period. However, the amount of e-cigarette funds flowing into the United States through various means reached 44.12 billion yuan, maintaining its position as the top market among all countries.

Additionally, the mainland Chinese market saw a significant decrease in revenue in 2023, but rebounded by 12.9% in 2024, primarily driven by sales of electronic vaporization products and the provision of technical services.

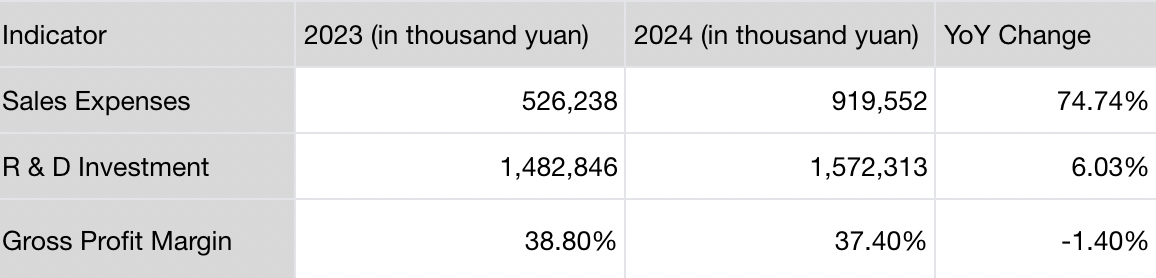

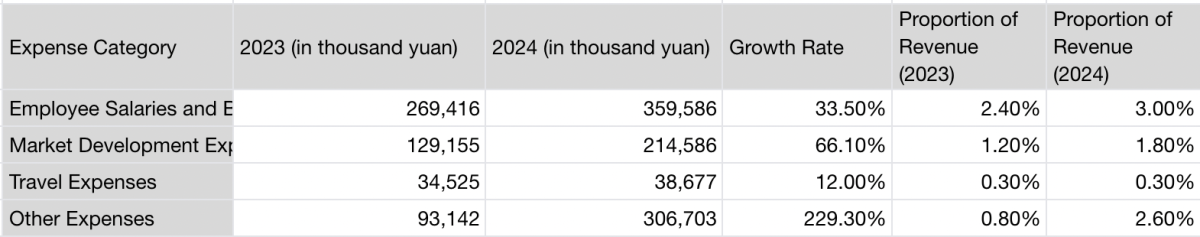

Smoore reported a 74.7% increase in distribution and sales expenses for 2024, reaching 920 million yuan ($127.3 million). Research and development spending rose 6.0% to 1.57 billion yuan ($219.1 million).

However, the company’s gross margin declined to 37.4%, reflecting the pressures from higher operational costs.

The increase in selling expenses is mainly attributed to Smoore's intensified efforts in brand promotion and market expansion, as well as the increased marketing investment in its own brand business globally and the introduction of aerosol beauty products in the Chinese mainland market.

2025: HNB products and vaporized medical products

Finally, the report from Smoore indicates that they will continue to focus on "vaporization technology" as core, and will deepen their presence in areas such as electronic vaporization, HNB, specialized vaporization product components, vaporization healthcare, and vaporization beauty.

In the field of electronic vaporization, Smoore stated that in recent years, major countries around the world have been gradually increasing regulations on non-compliant electronic vaporization products.

This will have a positive impact on the sales of the company's electronic vaporization products. Additionally, they mentioned that they will support strategic clients in submitting PMTA applications for several flavored electronic vaporization products with age verification technology.

Smoore sees HNB as a "second growth curve" and notes that "2025 is a key stage for the business to land." Smoore supports customers in launching HNB products that are expected to be introduced in more markets worldwide.

In regards to medical atomization, Smoore will on one hand follow established product development plans, and on the other hand collaborate with more international pharmaceutical companies to ensure the steady progress of products from research and development, mass production, approval for market launch, to commercialization.

Smoore stated that they will continue to optimize the "ToB + ToC dual-engine" business model for atomized beauty, in order to achieve synergistic development between the brand "Lan Zhi" and both the B-side and C-side markets.

Smoore has stated that in 2025, the company will focus on the research and development of HNB products and vaporized medical products, aiming to continually strengthen technological barriers and accelerate the commercialization process.

In the field of electronic vaporization, the company will concentrate on key technological innovations, create a differentiated technology platform, provide consumers with unique experiences, and plan to launch several competitive new products.

Smoore also said that in addition to independent research and development, the group will also collaborate closely with clients to share research and development achievements and jointly promote industry advancements.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com