On July 25th, British American Tobacco (BAT) released its half-year performance results up to June 30, 2024 on its official website.

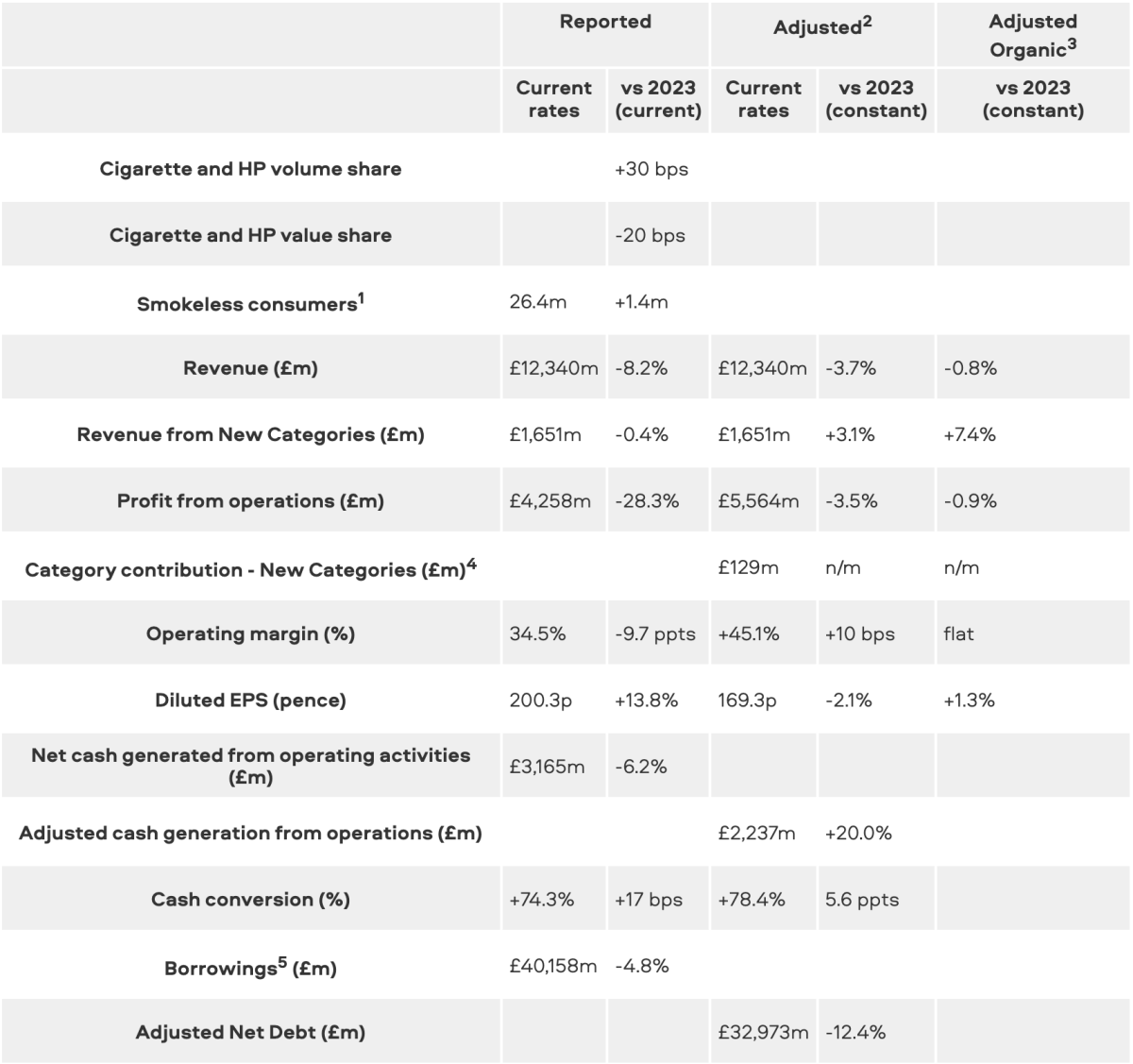

During the six months ending on June 30, 2024, BAT reported a revenue of £12.34 billion, a decrease of 8.2% compared to the same period in 2023; operating profit was £4.258 billion, a decrease of 28.3% compared to the same period in 2023; revenue from new categories was £1.651 billion, with revenue from NGP (such as BAT's smokeless products like Vuse, glo and Velo) now accounting for 17.9% of BAT's total revenue, an increase of 1.4% from the 2023 fiscal year.

The highlights of the report are as follows:

- Reported revenue down 8.2% (-3.7% at constant FX), driven by the sale of businesses in Russia and Belarus in September 2023 and translational FX headwinds

- Expected H2 acceleration, driven by the roll-out of product innovations, our U.S. commercial actions gaining traction in the first-half of 2024 and the unwind of wholesaler inventory movements

- Revenue from Smokeless products now 17.9% of Group revenue, up 1.4 ppts vs FY23

- New Categories contribution increased by £165 million on an organic, constant FX basis

- Robust Combustibles pricing - AME and APMEA volume and value share gains offset by the U.S.

- Reported profit from operations down 28.3% (with reported operating margin down 9.7 ppts to 34.5%), driven by higher amortisation charges related to U.S. Combustibles brands and lapping comparator inclusive of Russia and Belarus

- Adjusted organic profit from operations down 0.9% at constant FX, adjusted organic operating margin flat at 44.9%

- Reported diluted EPS up 13.8% to 200.3p largely due to one-off credits related to ITC monetisation and net finance costs

According to BAT, the company is expected to achieve its full-year performance target in 2024. The company anticipates a decrease of around 2% in global tobacco industry sales, with continued weakness in the United States, France, and Sudan being offset by improved prospects in Turkey and Mexico. The full-year adjusted operating profit will face approximately a 4% headwind from currency conversions. Net financial expenses are expected to be around £1.7 billion due to the impact of currency and interest rate fluctuations. Capital expenditure for 2024 is estimated to be around £600 million. By the end of 2024, the company's adjusted net debt to adjusted EBITDA ratio is projected to be in the target range of 2.0-2.5 times.

BAT CEO Tadeu Marroco stated,

“We are Building a Smokeless World. We added 1.4 million consumers (to 26.4 million1) of our Smokeless brands, now accounting for 17.9% of Group revenue, an increase of 1.4 ppts vs FY23.

“Our H1 2024 performance is in line with our expectations, and we are on track to deliver our full-year guidance.

“Focusing on 'Quality Growth' is delivering better returns on more targeted investments across all three New Categories. In H1 2024, we increased organic New Category contribution by £165 million (at constant rates) and I am particularly pleased with the growth of Modern Oral. We expect to deliver further improvement in revenue and profitability across our New Categories for the full year.

“We welcome the FDA’s marketing authorisation for our Vuse Alto device and tobacco flavour consumables, demonstrating that marketing these products are appropriate for the protection of public health. However, the continued lack of enforcement against illicit single-use vapour products in the U.S., compounded by the sale of our businesses in Russia and Belarus in 2023, means that New Category revenue is likely to be below our £5 billion ambition in 2025.

“Combustibles in AME and APMEA delivered resilient organic performances with solid volume share growth. These were offset by the U.S. where, driven by our commercial investment, volume share is now showing signs of recovery and the rate of value share decline has sequentially improved, led by premium. However, U.S. Combustibles industry volumes remain under pressure, largely driven by macro headwinds and the continued lack of effective enforcement against illicit single-use vapour products.

“While there is more to do, we are making good progress and I am encouraged that our New Category launches and our first-half investments to strengthen our U.S. Combustibles portfolio are gaining traction. Together with the expected unwind of U.S. wholesaler inventory movements, I am confident this will drive an acceleration in our second-half performance.

“BAT is a highly cash generative business, and we are committed to continuing to reward shareholders with strong cash returns. We have made progress in enhancing financial flexibility, enabling the initiation of a sustainable share buy-back programme.

“Guided by our refined strategy, I am confident that we will progressively improve our performance to deliver 3-5% revenue, and mid-single digit adjusted profit from operations growth on an organic constant currency basis by 2026.”

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com