Nicotine pouches, originally produced by a Swedish company and first introduced in the US in 2016, are no longer a novelty. However, in the past two years, this product category has gained popularity among e-cigarette companies in China. Recently, an industry insider revealed to 2FIRSTS that several domestic leading e-cigarette companies have been consulting on nicotine pouch-related businesses, with the intention of adding this service as a new project. Could nicotine pouches become another growth driver for e-cigarette companies? Which companies are already or planning to enter this market? What is the international market situation for this product category? 2FIRSTS conducted an investigation on these matters.

Domestic atomization companies have recently entered the nicotine pouch market. TACJA, a product of IMiracle (Heaven Gifts) (parent company of ELFBAR), has been launched in the United Kingdom and the Nordic countries. The company claims that this product is produced in Sweden and is available in eight different flavors, categorized into two taste series: "MELLOW" and "FROZEN". As a oral tobacco brand, TACJA offers three options for nicotine concentration: 20mg/g, 18mg/g, and 12mg/g.

Insiders have revealed to 2FIRSTS that IMiracle (Heaven Gifts) is currently in the process of submitting an MRTP application to the U.S. FDA, aiming to enter the American market. Unlike PTMA, the MRTP application specifically declares the harm reduction capabilities of the product compared to combustible cigarettes.

Not only IMiracle (Heaven Gifts), but also Chinese vaping companies are actively entering the nicotine pouch market. 2FIRSTS has obtained project information from a vaping company management consulting firm based in Shenzhen, China.

Hengxin Group has established factories in both China and Indonesia to produce nicotine pouches. The factories in both locations are operating smoothly and consistently meeting shipment demands.

E-cig Giants to Produce Nicotine Pouches

According to industry insiders, it has been revealed that although IMiracle (Heaven Gifts) claims that its TACJA nicotine pouches are produced in Sweden, the product is actually manufactured by a domestic biopharmaceutical factory and then rebranded in Sweden. 2FIRSTS sought confirmation from IMiracle (Heaven Gifts) regarding this matter, but did not receive a direct response from the company.

Global Nicotine Pouch Market Holds Great Potential

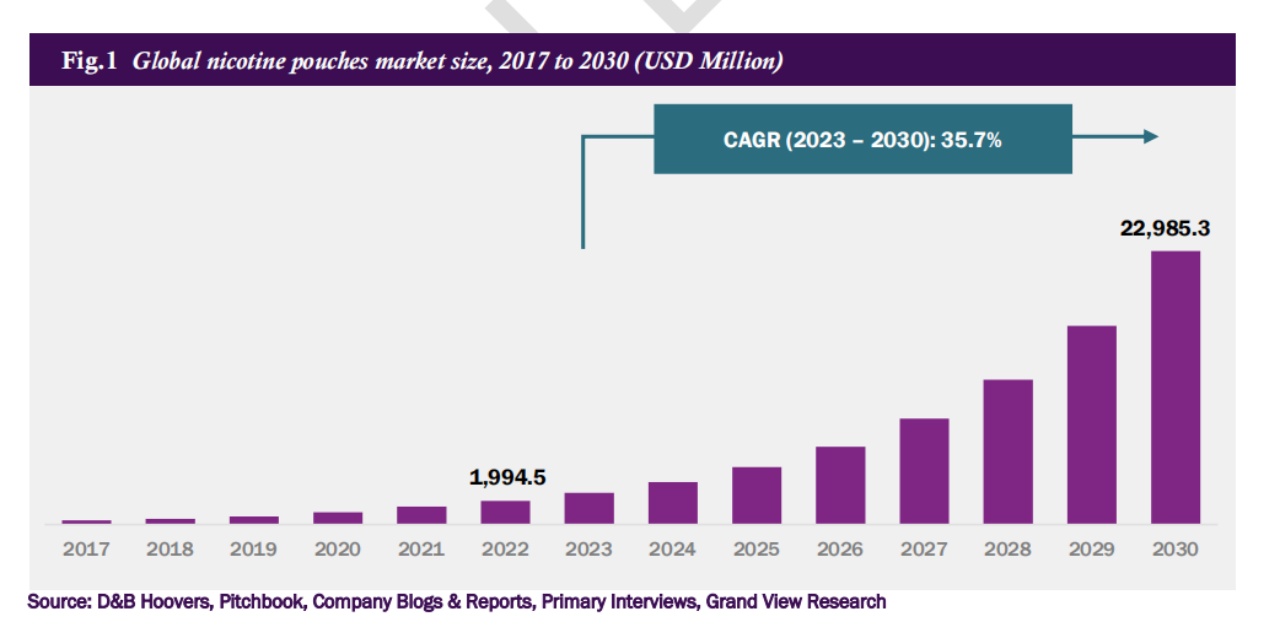

A recent research report provided by the US-based research firm, Grand View Research, to 2FIRSTS reveals that the global nicotine pouch market reached a size of $1.995 billion in 2022, with a projected compound annual growth rate (CAGR) of 35.7% expected between 2023 and 2030.

According to reports, nicotine pouches are highly popular among young smokers and individuals attempting to quit smoking. The increased demand for harm reduction alternatives is expected to drive market growth within the forecast period. The report predicts that the Middle East and Africa will emerge as the fastest-growing markets for nicotine pouches, with an annual growth rate of 48.0% during the forecast period.

In 2022, nicotine pouches derived from tobacco extraction have emerged as the dominant player in the global nicotine pouch market, capturing over 97.8% of the total revenue share. Non-tobacco nicotine pouches, offered by leading global brands, are rapidly gaining popularity in the global market, boasting a variety of flavors. Manufacturers in the global market are focusing on mergers and acquisitions to enter the tobacco-extracted nicotine pouch category and target specific international markets. It is anticipated that synthetic nicotine pouches will experience a staggering compound annual growth rate of 45.5%, driven by an increase in the volume of products in this field.

In 2022, flavored nicotine pouches have taken over the global market, occupying more than 90.3% of the total revenue share. Manufacturers are capitalizing on the continuing trend of consumption of nicotine pouches with various flavors and tastes. Brands like "On!" by Ochea's subsidiary, Helix Innovations, and "ZYN" by Swedish Match are experiencing rapidly increasing sales. The unflavored nicotine pouches submarket is expected to grow at a faster compound annual growth rate, estimated to reach 38.1%, due to the growing focus of nicotine pouch companies on launching new products in China.

In 2022, high concentration nicotine pouches have emerged as the market leader in terms of product concentration, capturing over 43.4% of the global market share. In response to the growing demand, major brands have introduced high concentration nicotine pouches. Among the popular products with high concentrations are the LYFT X-Strong series (16mg/g), Skruf Super White Fresh (26mg/g), and Ace X Cool Mint Slim (20mg/g).

In 2022, offline channels have emerged as the dominant force in distribution, accounting for over 93.5% of global revenue. The availability of nicotine pouches in various flavors has been steadily increasing, with supermarkets, pharmacies, and convenience stores serving as key suppliers.

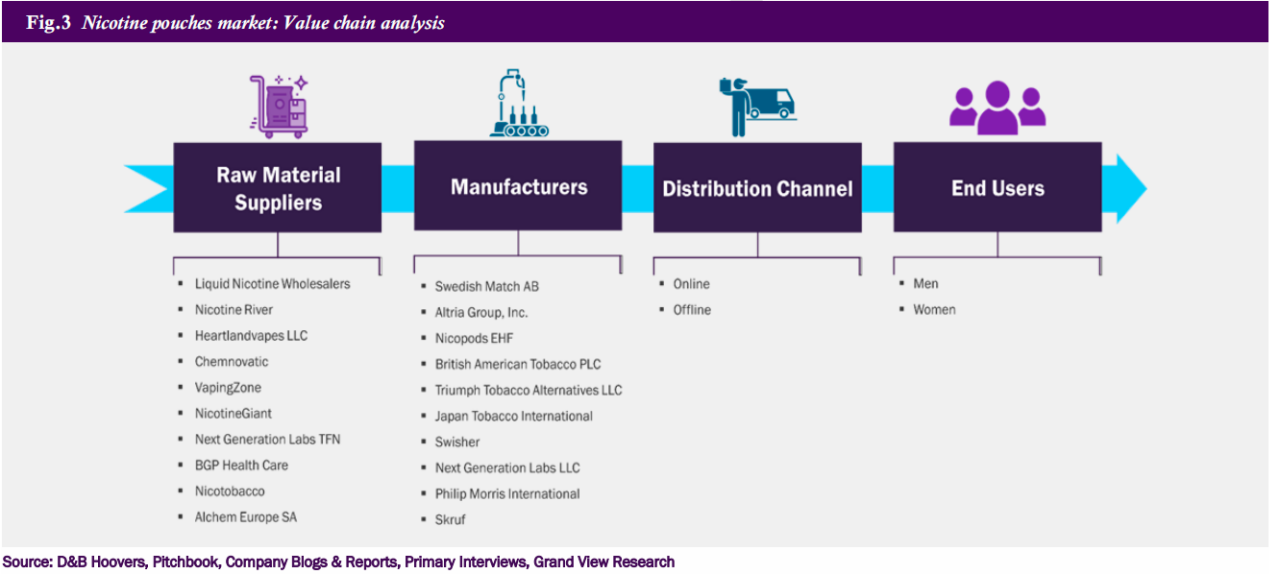

In terms of the industry chain, the main raw materials for nicotine pouches include nicotine liquid, nicotine salts, white powder nicotine, non-caloric sweeteners, and flavors. Some well-known raw material suppliers in the market include Liquid Nicotine Wholesalers, Nicotine River, Nicotobacco, VapingZone, and NicotineGiant.

Ambiguous Regulation of Synthetic Nicotine Pouches

According to the 2FIRSTS survey, nicotine pouches are permitted in 24 out of the 36 countries covered by the Tobacco Transformation Index. In 2021, sales of nicotine pouches exceeded 10 million boxes in seven markets among these 24 countries, including the United States, Sweden, the United Kingdom, Germany, Ukraine, Switzerland, and Poland.

In certain countries, products known as nicotine replacement therapy (NRT) require a pharmaceutical license and are typically not regulated by tobacco companies. Nicotine pouches are sold as consumer products.

In Poland, without a national regulatory policy on nicotine pouches, British American Tobacco Poland, Imperial Tobacco Poland, Philip Morris Poland Distribution Company, and Swedish Match have signed market monitoring guidelines for the non-tobacco nicotine pouches. These guidelines establish standards for non-tobacco nicotine pouches.

However, in some countries, the laws and regulations are still unclear. Despite the German Federal Consumer Protection and Food Safety Agency (BVL) acknowledging that these products are not regulated by tobacco laws and should not be sold, the state of Bavaria prohibits the sale of non-tobacco nicotine pouches. According to the BVL, nicotine pouches are considered food products and contain unauthorized novel food ingredients (nicotine), hence their sale is prohibited.

Nicotine pouch products are divided into two categories: extracted nicotine and synthetic nicotine. The definition of tobacco products under the TPD regulations in EU countries includes those containing tobacco extracts, and the majority of nicotine pouch products use synthetic nicotine, which currently falls into a regulatory gray area. Synthetic nicotine is also not regulated by the TRPR regulations in the UK. However, the EU country Czech Republic has already started requiring TPD registration for oral tobacco products that use synthetic nicotine.

The use of tobacco-extracted nicotine falls under the category of oral tobacco products as defined by the Tobacco Products Directive (TPD). Currently, oral tobacco products are only permitted to be marketed in Austria, Finland, and Sweden, while other European Union countries have banned their sale.

Co-founder of domestic synthetic nicotine pouch brand "Boltbe," Jiang Wentao, informed 2FIRSTS that in China, there is still a regulatory gap regarding synthetic nicotine pouches, allowing for online sales but prohibiting product promotion and marketing. Furthermore, regulations in the UK stipulate that the outer packaging of oral tobacco products must feature warning labels, with specific requirements regarding the placement and size of these labels.

Chinese Companies Prefer Synthetic Nicotine Pouches to Evade Regulations?

Founder of Shenzhen Tuwu Enterprise Management Co., Ltd., Li Youqiang, expressed to 2FIRSTS that nicotine pouches are experiencing explosive growth and have a higher profit margin compared to e-cigarettes. Currently, domestic vaporization companies primarily produce synthetic nicotine pouches. Regulatory control over synthetic nicotine pouches is relatively relaxed in most countries, with some even experiencing regulatory gaps. The market demand for nicotine pouches is significant, but production capacity is insufficient. Domestic e-cigarette companies can take advantage of their strong e-cigarette distribution channels built over the years, making it a golden period for investment.

According to Li Youqiang, the development of the nicotine pouch market can be categorized into three main lines. The first line involves the penetration from Northern Europe into Western and Eastern Europe. The second line focuses on the penetration from the United States, with South America as the primary target. The third line represents emerging markets, primarily referring to the Middle East, Southeast Asia, and Africa. These emerging markets often go unnoticed by investors, despite the fact that places like Southeast Asia (such as Thailand) and Africa (such as Kenya) are popular vacation destinations for Europeans and Americans, which can generate significant demand.

Regarding the doubts from the public regarding the nicotine pouch's sustained-release technology, Li Youqiang stated that domestic brand manufacturers in China are currently collaborating with biopharmaceutical companies, which have stringent standards. Furthermore, the sustained-release technology of nicotine pouches is undergoing innovation and has virtually no safety issues. The main current concern is that compared to e-cigarettes, the transportation requirements for nicotine pouches are relatively strict. Improper transportation or changes in humidity could result in changes in product concentration or even mold formation.

Co-founder of "Boltbe," Jiang Wentao, expressed that in recent years, many domestic companies in China have been entering the nicotine pouch market. His company, which used to produce e-cigarettes, switched to nicotine pouches last year and has already begun selling them in Europe, offering eight different flavors. He believes that the reason for the surge in popularity of nicotine pouches among Chinese companies in the past two years is due to the conditions for their production being established domestically last year. Additionally, with the new national standards banning certain e-cigarette flavors, nicotine pouches remain unaffected and can offer a variety of flavors, thereby complementing the market.

Jiang Wentao stated that the biggest challenge currently faced in business operations is channel expansion, specifically with regards to synthetic nicotine products. Although there are still no regulations governing these products domestically, strict advertising regulations apply to the promotion of nicotine-containing products. This applies to outdoor advertisements, elevator advertisements, and short-video platforms, all of which are not permitted. Similarly, overseas promotion of nicotine products on social media also faces similar obstacles.

According to Liu Qizhou, CEO of WONU, tobacco-extracted nicotine and synthetic nicotine are completely different products. Nicotine extracted from tobacco is relatively safer and more controllable because it is supported by clinical data and scientific research. On the other hand, synthetic nicotine is a new phenomenon, and there is currently no clinical data internationally to prove its absolute safety. The motivation behind the emergence of synthetic nicotine is to bypass different countries' legal policies. International giants like Swedish Match produce nicotine pouches using 100% tobacco extraction, as these large companies have no need to evade regulation. Furthermore, some nicotine pouch companies are collaborating with major pharmaceutical companies not only for their technology and strict standards, but also to gain access to legal channels, as these pharmaceutical companies have qualifications to import nicotine legally.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.