Key points of focus:

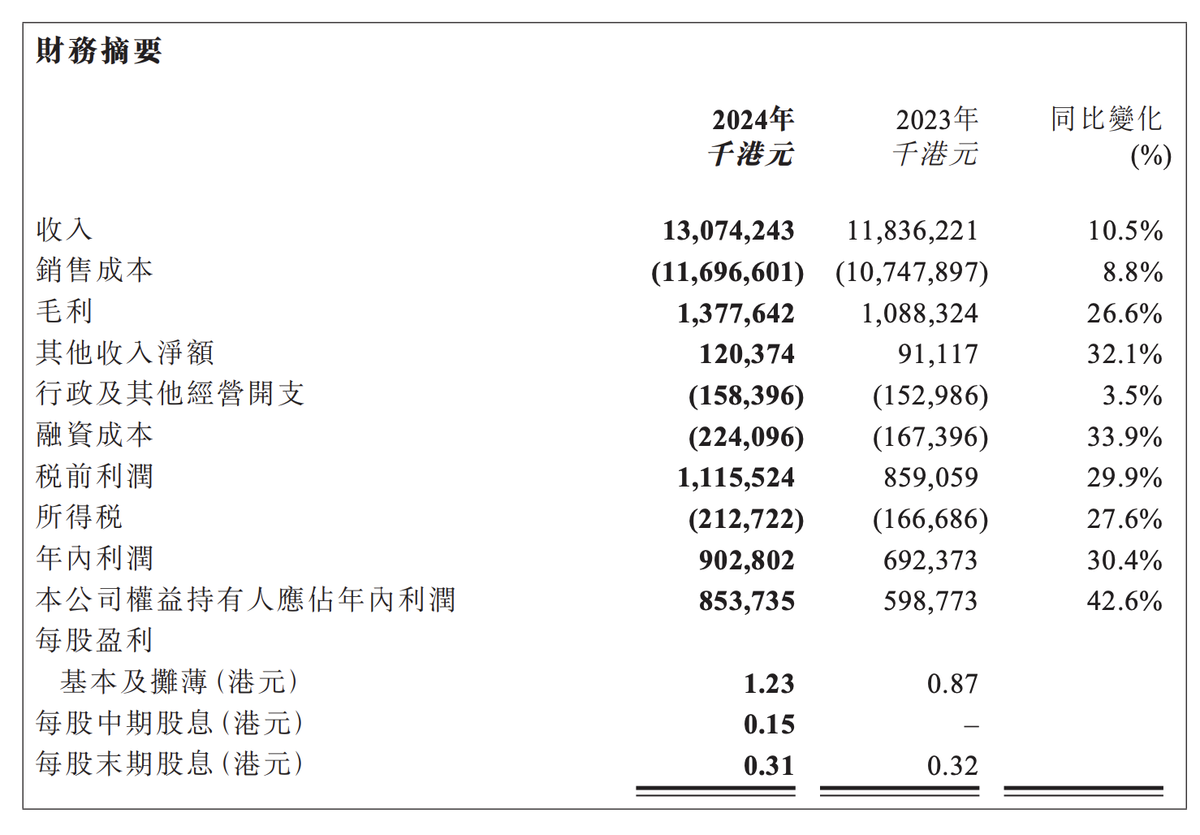

1. In 2024, the revenue was 13.074 billion Hong Kong Dollars (HKD), a year-on-year increase of 10.5%, with a net profit attributable to shareholders of 854 million Hong Kong dollars, a year-on-year increase of 42.6%.

2. Profit increased by 26.6% to HK$1.378 billion, driven by cost optimization and business expansion.

3. Exports of new tobacco products reached 760 million units, a year-on-year increase of 12.5%.

On March 6th, China Tobacco International (HK) Limited (6055.HK) released its annual financial report for the year ending December 31, 2024.

The data shows that the company achieved a revenue of 13.074 billion Hong Kong dollars, a year-on-year increase of 10.5%; and a net profit attributable to shareholders of 854 million Hong Kong dollars, a year-on-year increase of 42.6%.

During the reporting period, the company's gross profit increased by 26.6% to HK$1.378 billion, benefiting from cost optimization and business expansion.

The board of directors has proposed a final dividend of HKD 0.31 per share, in addition to the interim dividend of HKD 0.15 per share, for a total annual dividend of HKD 0.46 per share, representing a year-on-year growth of 43.8%.

Tobacco product imports and exports: The company imported 112,000 tons of tobacco leaves, a decrease of 4.5% compared to the previous year; however, due to optimized supply chain and product structure, revenue still increased by 2.2% year-on-year.

On the export side, driven by increasing international market demand, the company exported 83,500 tons of tobacco leaves, a significant increase of 18.4% compared to the previous year.

Cigarettes: The Group's cigarette export volume reached 3.3 billion units, an increase of 535 million units compared to the previous year, representing a growth rate of 19.1%.

operating income was 1.574 billion Hong Kong dollars, an increase of 365 million Hong Kong dollars compared to the previous year, representing a growth rate of 30.2%; gross profit was 277 million Hong Kong dollars, an increase of 113 million Hong Kong dollars compared to the previous year, representing a growth rate of 69.1%.

New Generation Tobacco: The export of new tobacco products reached 760 million units, an increase of 135 million Hong Kong dollars, or 520 million Hong Kong dollars, representing a growth rate of 8,460 million units or 12.5% compared to the previous year.

Operating income increased by 4.0%. Gross profit was 70 million Hong Kong dollars, an increase of 130 million Hong Kong dollars, representing a growth rate of 22.9%.

The performance growth was driven by two factors: a focus on key brands, expanding market channels, and securing more orders from major markets and customers; and ongoing business model optimization, product diversification, pricing adjustments, and profitability improvements.

Brazilian Business: Brazil's tobacco exports reached 31,627 tons with a revenue growth of 37.0%.

China Tobacco Hong Kong stated that it will continue to promote the development of new tobacco innovations in order to increase the international recognition of its brand.

The company will deepen cooperation between production and sales, promote technological innovation in tobacco and upgrade product iterations to enhance competitiveness. It will also optimize business expansion models and product pricing strategies in key markets, with a focus on enhancing the international influence of the brand.

As of the deadline of the 2Firsts publication, China Tobacco International (HK) stock price was reported at 24.85 HK$, dropping 9.14% after the market opened today and reaching a total market value of 171.88 billion Hong Kong dollars.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com