At the beginning of 2024, a debt crisis involving the well-known European e-cigarette brand Aroma King surfaced, implicating multiple manufacturing and logistics companies, with the default amount exceeding 100 million RMB.

In Aroma King's response to 2FIRSTS, the company acknowledged suffering economic losses due to quality control issues and stated that it is currently undergoing restructuring efforts.

The e-cigarette industry used to pride itself on its excellent cash flow. An e-cigarette entrepreneur recalled to 2FIRSTS that overseas customers once queued at factory gates with cash in hand, waiting to pick up their goods. The factories would only ship products after full payment was made. Consequently, the industry never lacked funds, did not need loans, and did not require financing.

However, the debt issues, exemplified by Aroma King, have gradually come to light, sounding the alarm for the entire e-cigarette industry. As core entities within the supply chain, any debt problems faced by a "chain leader" company could quickly spread throughout the supply chain, triggering a series of cascading effects.

In addition to the compliance risks already facing the e-cigarette industry, a new debt risk is emerging.

Investment Decline and Profit Shrinkage: Default and Credit Crisis Emerge

Investment Boom Recedes, High Investment Era Ends

In recent years, the e-cigarette market attracted significant capital due to its rapid growth and enormous profit potential, becoming a "gold mine" for investors.

A representative from an investment company that invested in several e-cigarette companies revealed that their initial entry into the e-cigarette industry was primarily due to the market's substantial growth potential, the health benefits of the products, high profit margins, and the relatively lenient regulatory stance of various governments.

However, with changing market conditions, this situation is reversing.

A seasoned e-cigarette industry investor told 2FIRSTS:

"Nowadays, the era of high investment in e-cigarettes has ended. Since last year, there has been a noticeable decline in capital investment in e-cigarettes, and this trend has become even more pronounced this year."

Additionally, informed sources disclosed that some investors had invested in e-cigarette companies two years ago, hoping to profit during the licensing application phase. However, many investments have been withdrawn over the past two years, leading to cash flow shortages for these companies.

A project investment director at a publicly listed company also admitted that compared to e-cigarettes, they prefer to invest in the heat-not-burn sector because e-cigarettes have "low barriers to entry and limited growth prospects."

Profits Halved, High-Growth Era Ends

Besides the "uncertain growth prospects," e-cigarette companies once regarded as "high-profit" are now facing severe profit declines. For example, according to 2023 financial reports from several publicly listed companies, Wulun Technology's net profit dropped by 72.75% year-on-year, while Tianchang Group's net profit fell by over 60%.

At the same time, the profit margins on the e-cigarette supply chain are facing severe compression. A cotton wick supplier revealed to 2FIRSTS that the price of cotton wicks has dropped by nearly 50% in the past year. Similarly, suppliers of other key components such as batteries and oil tanks have also complained about declining profits, stating that "the market is extremely competitive."

Since the beginning of this year, investment and financing activities have significantly decreased, and profits have plummeted. The e-cigarette industry is no longer a guaranteed profitable business.

Selling Factories and Licenses: Forced Exit Under Pressure

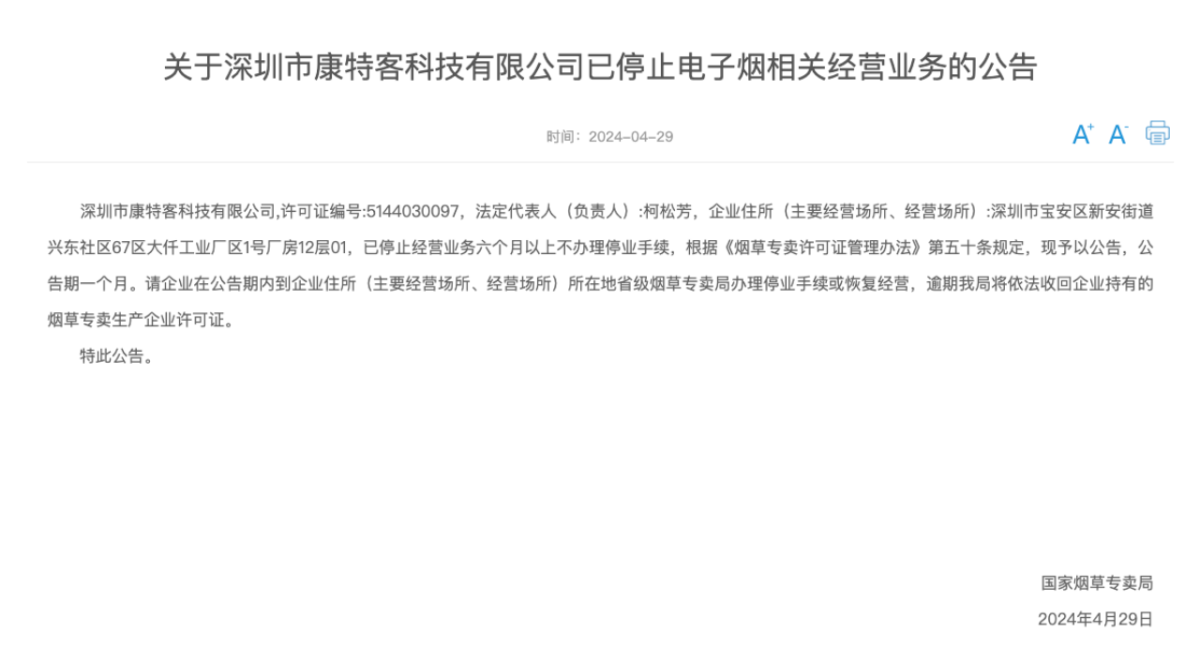

On April 29, the China Tobacco Monopoly Administration issued an official announcement stating that Shenzhen Kangerke Technology Co., Ltd. has not conducted business activities for more than six consecutive months and has not completed the necessary suspension procedures. The company is now required to complete the suspension procedures or resume business operations within the timeframe specified in the announcement. If they fail to comply within the specified period, the China Tobacco Monopoly Administration will revoke their tobacco production enterprise license in accordance with the law.

Not only has the first “license suspension” case emerged, but the e-cigarette industry has also seen a trend of transactions revolving around “licenses,” commonly known as “selling factories and licenses.” Under multiple pressures, some small and medium-sized e-cigarette companies have fallen into financial trouble and have no choice but to exit the market.

A veteran who has been deeply involved in the e-cigarette industry for over a decade told 2FIRSTS that in 2022, the industry saw factories being sold bundled with licenses, and at that time, they could still fetch relatively high prices, allowing early exits. However, since the second half of last year, such bundled sales have not only failed to command high prices but also face the awkward situation of finding no buyers.

"Chain Master" Faces Obstacles, Supply Chain Debt Crisis Emerges

Besides “selling factories and licenses,” some e-cigarette companies are deeply mired in debt, struggling to survive. For instance, Aroma King faces severe debt issues, owing substantial amounts to OEMs, logistics providers, and traders, including an outstanding payment of 80 million RMB to a Shenzhen-based OEM. This massive debt has led the OEM to struggle with paying employee wages on time for several months, severely disrupting its operations.

Moreover, this incident has sparked panic over debt crises within the industry, casting a shadow over the future development and financial stability of the entire e-cigarette sector.

Regulatory Pressure and Market Competition: The Multi-faceted Challenges of Corporate Debt Risk

Once considered a sunrise industry, why is the e-cigarette sector now facing such a predicament?

Consignment and Credit Terms Lead to Increased Cash Flow Risks

The financial report of Wulun Technology accurately identifies the reasons behind the current difficulties faced by e-cigarette companies from a market perspective. It states that the main reason for revenue decline is the impact of e-cigarette policies, with domestic sales of flavored e-cigarettes (except tobacco flavor) being banned, leading to intensified competition in overseas markets.

In Wulun Technology’s mid-2023 report, the reasons are more specific: fierce market competition in the first half of 2023. Some e-cigarette companies adopted a fast-moving consumer goods sales model, supplying products directly to stores and promoting them locally, operating on a consignment basis with payment due after delivery, and offering commissions.

This model, common in the fast-moving consumer goods industry, has placed immense cash flow pressure on many small and medium-sized e-cigarette companies. It not only amplifies financial leverage risks but also makes companies' financial situations fragile, hindering stable progress.

Furthermore, these companies’ limited capabilities in expanding international markets exacerbate their operational pressures. Even when they manage to secure orders, the intense industry competition results in minimal profits, not to mention the difficulties they might encounter in the payment collection process. Therefore, companies face not only fierce market competition (commonly known as “involution”) but also the severe challenge of not being able to achieve profitability in the short term.

Strong Players Enter, Increasing Survival Pressure on Companies

Alongside the massive cash flow pressure, companies must also contend with the entry of strong competitors.

In the second half of 2023, more tobacco giants accelerated their layout in the e-cigarette market, and leading regional distributors also started creating their brands, further intensifying the competitive landscape.

For example, British American Tobacco's e-cigarette brand VUSE has accelerated its expansion not only in major markets like Europe and the U.S. but also actively seized market shares in secondary markets such as Southeast Asia and the Middle East. Meanwhile, KEEKNA, which shares the same controller as AQUIKE, has its brand GEEKBAR dominating the U.S. market. According to U.S. industry insiders who spoke to 2FIRSTS, in some major states in the U.S., stores only sell GEEKBAR products, and other brands “fail one after another upon entry.”

This situation places enormous pressure and challenges on electronic cigarette companies, intensifying competition.

Regulatory Pressure, Shrinking Market Space

The tightening regulatory policies worldwide have imposed heavy compliance pressure on companies. From bans, increased taxation, customs inspections, market enforcement to strengthened measures for youth protection, various policy adjustments have further squeezed the operating space for companies.

The impact of these policies is significant and could even result in the "shutdown" of companies in certain specific regional markets. Taking Australia as an example, the country previously attracted numerous electronic cigarette companies with its "enormous market potential and high profits." However, Australia has now imposed an import ban on disposable electronic cigarettes, leading to a sharp decline in the country's electronic cigarette imports from tens of millions of dollars per month to just one million dollars. This has compelled some renowned electronic cigarette brands in Australia to seek market expansion in other regions.

Furthermore, the industry is known for a significant amount of "gray channel" practices. These practices involve cross-border trade through informal channels, which not only bring compliance pressure to companies but also pose significant risks in recovering payments. Such informal trading methods not only increase transaction uncertainties but also may lead to intercepted or misappropriated payments during the transportation process, affecting the normal development of companies.

These adverse factors, when combined, contribute to the current grim situation in the electronic cigarette industry.

Operational Slowdown, Debt Crisis Looms: How Does Individual Corporate Debt Crisis Escalate into Systemic Risks for the Industry Chain?

Will the individual debt crisis of electronic cigarette companies escalate into challenges at the entire industry chain level? Tang Shunliang, a senior lawyer in the new tobacco legal field at Beijing Tianyuan (Kunming) Law Firm, told 2FIRSTS that individual crises not only severely affect the companies themselves but may also evolve into systemic risks for the industry chain through channels such as supply chains, industry reputation, market competition, and regulatory policies.

Firstly, consecutive debt crises in electronic cigarette companies may trigger pessimism in the supply chain. The production process of electronic cigarettes involves multiple aspects such as raw material procurement, production processing, and outbound logistics. Conservative supply strategies and monthly payment requirements from material suppliers put pressure on the "inventory stocking—sales receivables" cycle of electronic cigarette factories. This makes electronic cigarette companies apprehensive, and if materials, semi-finished products, or finished products are stuck in the factory, the risk immediately multiplies, affecting other companies and reducing the operational efficiency and competitiveness of the entire industry.

Secondly, debt crises lead to liquidation and bankruptcy, triggering an industry trust crisis. The robust development of the electronic cigarette industry relies on overseas customers' trust in brands and products, as well as investors' confidence in the industry's prospects. Once companies encounter difficulties due to debt problems, consumers may doubt the quality and safety of related products, while investors may adopt a cautious attitude toward the industry's future development. Once this crisis of trust spreads, it will have a significant impact on the domestic electronic cigarette industry.

Furthermore, debt crises may exacerbate market turmoil and uncertainty. Against the backdrop of fierce market competition, electronic cigarette companies with weaker foundations are more vulnerable to the impact of debt problems. This could lead to some companies passively exiting the market, triggering pessimism among shareholders in the short term.

Lastly, regulatory policies are a crucial factor influencing the development of the electronic cigarette industry. Individual companies facing crisis due to regulatory violations may further attract the attention and regulation of regulatory agencies. This could lead to the entire industry facing stricter regulatory pressure, affecting the normal operation and development of the industry chain.

Afterword:

Electronic cigarette products are transitioning from niche to mainstream consumption, and the electronic cigarette industry chain has grown from being an "invisible champion" to a globally acclaimed major industry. This transformation brings vast market opportunities but also heralds more challenges. Compliance risks have become a focal point of the industry, and debt issues are gradually coming to the surface.

Corporate debt problems are commonplace in market economies, but we must be vigilant about the possibility of debt crises in "chain-leading" enterprises escalating into systemic risks for the entire industry chain. Similarly, debt problems in enterprises once regarded as "star companies" may become the "last straw" that crushes the industry's credit and confidence.

The impact of debt crises on industries has been deeply reflected in fields such as real estate. At this stage, as debt issues begin to emerge, how to prevent the occurrence of systemic debt crises in the industry, and maintain the momentum of high-quality global industrial development, has become a common concern for stakeholders such as supply chains, brand merchants, channel operators, and regulators.

2FIRSTS will continue to focus on this topic. Stay tuned for further reports.