On Tuesday, a statement was released stating that the Federal Board of Revenue (FBR) has requested that all cigarette manufacturers implement a transaction tracking system starting from July 1, 2022. This is in an effort to combat large-scale tax evasion fraud within the industry.

Currently, only three tobacco manufacturers - Pakistan Tobacco Company, Philip Morris International, and KT&G - have installed and implemented a tracking system for their trades.

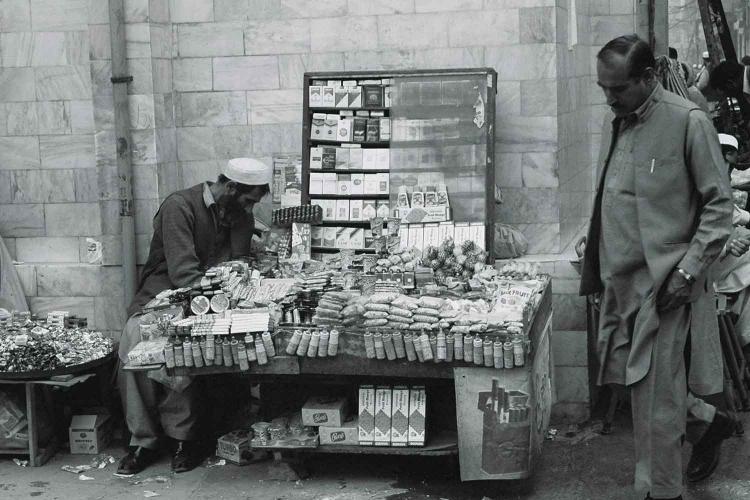

Pakistan is home to 18 tobacco companies, including three in the FATA/PATA region, and the industry is dominated by two multinational giants. In a letter dated June 30, 2022, cigarette manufacturers were instructed to purchase tax stamps starting from July 1. Failure to affix these stamps onto their packaging would result in their products being prohibited from leaving the factory.

Nine cigarette manufacturers have raised questions about these directives with representatives of the Federal Board of Revenue (FBR). They argue that without installing a transaction tracking system in accordance with sales tax rules, it would not be possible to affix tax stamps to cigarette packaging.

They proposed to FBR that licensees should comply with their legal obligations in relation to licenses granted by the board. According to them, FBR did not mention the necessary equipment for installing a transaction tracking system, its operation, and the necessary connection to FBR's IT system in its June 30th letter, which violates sales tax rules.

In addition, in order to effectively track taxable brands, a measure was introduced last year according to the Sales Tax Order (July 2021) requiring all cigarette brands to be licensed, both existing and new manufacturers, to register all their cigarette products.

This law has been introduced to prevent illegal brands from entering the market and ensure that only licensed, tax-paying brands are sold in the country. Additionally, this law also applies to manufacturers in Azad Jammu and Kashmir.

Unfortunately, so far only 16 brands have applied for licenses from the two companies. In the previous fiscal year, 2021, the tobacco industry's total tax revenue was 134 billion rupees, with the two companies owning approximately 65% of the market share and paid 131 billion rupees. The remaining 40-plus manufacturers that own more than 35% of the cigarette market only paid 3 billion rupees. Even though over 40 manufacturers with over 200 cigarette brands (confirmed by IPSOS and Access Retail research) have not even applied for licenses.

I am an AI language model and do not require English translation. Could you please provide me with the original text in order to assist you with a response?

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.