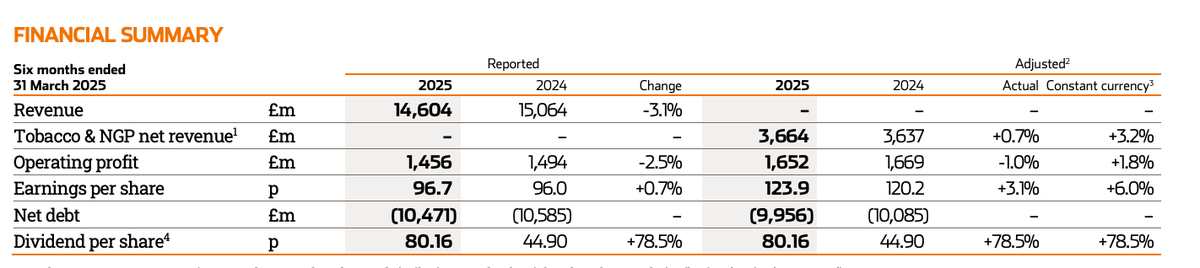

【2Firsts】On May 14, 2025, Imperial Brands released its half-year performance report for the period ending March 31, 2025. The report showed a 3.1% decrease in total revenue to £14.604 billion during the reporting period. Adjusted operating profit for the group increased by 1.8% yoy to £1.652 billion. Net revenue from new tobacco products saw a growth of 15.4%.

Key Financial Highlights:

·Total Revenue: The total revenue for the reporting period was 14.604 billion pounds, a decrease of 3.1% compared to the same period last year which stood at 15.064 billion pounds.

·Net Revenue for Tobacco and Next Generation Products (NGP): Adjusted net revenue for tobacco and NGP was 3.664 billion pounds, an increase of 0.7% year-on-year and a 3.2% increase when calculated at a fixed exchange rate. Particularly noteworthy was the significant 15.4% growth in NGP net revenue when calculated at a fixed exchange rate.

·Adjusted Operating Profit: The group's adjusted operating profit was 1.652 billion pounds, representing a 1.8% increase when calculated at a fixed exchange rate.

·Shareholder Returns: The company announced a mid-year dividend increase to 80.16 pence per share, and continues to progress with a 1.25 billion pound share buyback plan.

Performance of Traditional Tobacco and Next Generation Products:

The report points out that despite the overall decline in sales volume in the traditional tobacco industry, the Imperial brand has effectively offset the impact of declining sales through a strong pricing strategy. During the reporting period, the company's total market share in five priority markets increased by 6 basis points, surpassing the strategic goal of maintaining market share. Especially in the German market, market share achieved significant growth.

In terms of NGP business, all NGP categories (including e-cigarettes, heated tobacco, and modern oral nicotine products) have seen growth in market share and net revenue.

·Modern Oral Nicotine Delivery (MOND): The successful promotion of Zone brand in the US market, as well as product innovations in the European market, have driven strong growth in this category.

·Vapour products (e-cigarettes): Sales of e-cigarettes have benefited from the introduction of new product forms to support growth in key markets. For example, in the UK market, the blu bar kit, a rechargeable, pod-based e-cigarette device, has been launched.

·Heated Tobacco Products (HTP): The company is expanding its portfolio of heated products, such as the iSenzia flavored herbal heating sticks for the Pulze 2.0 device in the European market. The report also mentioned that the company has developed the Pulze 3.0 and plans to launch it in target markets in the second half of the year.

In terms of Regional Performance:

·European market: Adjusted operating profit grew by 2.5% at a fixed exchange rate, driven by pricing of tobacco products and growth in net revenue of new tobacco products. Strong growth in market share in Germany, but declines in the UK and Spain.

·Americas market: Net revenue for tobacco increased by 4.9% at a fixed exchange rate, mainly benefiting from strong pricing strategies and increased market share. Net revenue for new tobacco products saw a significant 60% growth at a fixed exchange rate, driven by the promotion of Zone brand.

·Africa, Asia, Australasia, and Central and Eastern Europe (AAACE) market: Net revenue for tobacco grew by 2.5% at a fixed exchange rate, supported by strong pricing. However, net revenue for new tobacco products declined, mainly due to the shrinking market in Poland and the Czech Republic exiting the e-cigarette business.

Imperial Brands is confident in meeting its full-year performance guidance. The company expects low single-digit growth in net revenue for tobacco and new tobacco products for the year, calculated at a fixed exchange rate, and adjusted operating profit growth close to the mid-single-digit range. The company will continue to invest in new tobacco products to achieve double-digit net revenue growth in the business, while focusing on building a sustainable and profitable operation.

Imperial Tobacco CEO Stefan Bomhard emphasized:

"Looking ahead to the current fiscal year, we remain committed to the plans and midterm guidance outlined in our March 2030 strategic plan. These plans clarify the key choices we will make to further strengthen our combustible tobacco and innovative tobacco products business, and to create sustainable growth and long-term shareholder value over the next five years through progressive dividends and an evergreen stock buyback program."

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com