The central focus of this article is the amount of imported electronic cigarettes in the Chinese industry and the price levels of these imported products.

The trade surplus continues to widen.

After years of rapid development, the e-cigarette industry in China has created a comprehensive supply chain centered around Guangdong province. With the increasingly global popularity of vaping, China's e-cigarette exports have surged, resulting in a growing trade surplus. In 2021, China's e-cigarette industry recorded a trade surplus of $15.692 billion.

From January to April 2022, China's electronic cigarette trade surplus was $4.374 billion.

Imports surpass $5.7 billion in 2021.

The domestic electronic cigarette industry in China has a highly integrated supply chain, resulting in a surplus of electronic cigarette production compared to market demand. Therefore, overall, the level of import trade in the electronic cigarette industry in China is not high. In 2021, the total import value of the electronic cigarette industry in China was 5.702 billion yuan, an increase of 8.96% compared to 2020.

In the first four months of 2022, China's electronic cigarette industry has imported products worth a total of $1.794 billion.

The import price of atomization equipment is the highest.

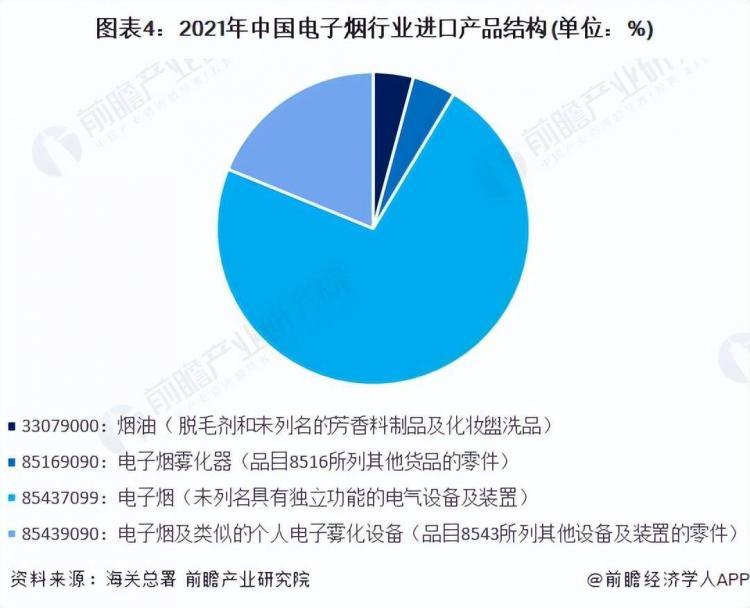

Electronic cigarettes account for 73% of imports.

Japan is the largest source of imported electronic cigarettes in our country.

Looking at the import sources of the electronic cigarette industry in China, Japan is the largest importer of electronic cigarettes to China. In 2021, China imported electronic cigarette-related products from Japan worth over 6.256 billion yuan. Additionally, China imported electronic cigarette-related products from the United States, Taiwan, and Germany, each exceeding 3.5 billion yuan.

This article contains excerpts or reprints from third-party sources, which are copyrighted to the original media and author. If there is any infringement, please contact us to delete it. Any unit or individual who needs to reprint should contact the author, and should not reprint directly.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.