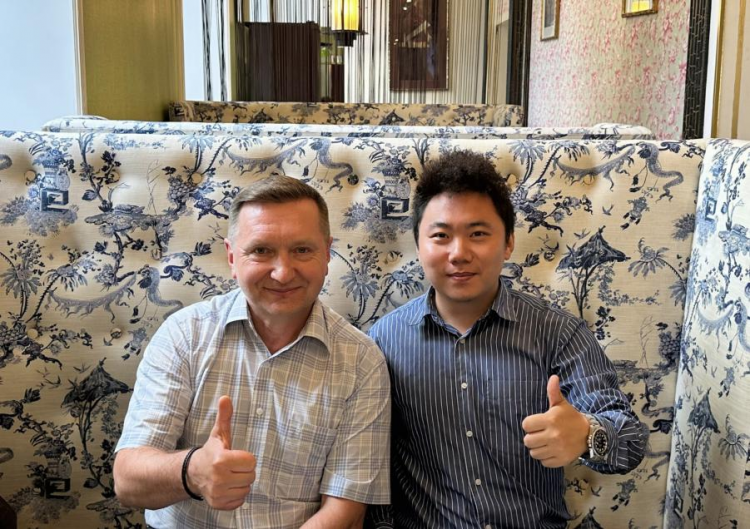

On July 3rd, the Chief Government Relations Officer (CGO) of BABYLON, Russia's largest e-cigarette distributor, Lev Gregori, shared his insights in the interview with 2FIRSTS. Lev Gregori is also the Chairman of the Professional Alliance of Market Participants in the Russian Market and a member of the Expert Committee for Competition in the Russian State Duma's Tobacco and Nicotine Product Market. In the interview, Lev shared his perspective on the current state of the e-cigarette market in Russia, as well as the impact of new policies on the industry and discussed future trends in the e-cigarette industry.

Regarding the current state of the e-cigarette market in Russia, Lev stated:

- Disposable e-cigarette is the fastest growing category in this market, with a CAGR of about 35%, and 7000 puff numbers being the most popular;

- The second fastest growing category is pod system, which is relatively stable without much fluctuation;

- The third is the open-type refillable pod e-cigarette. The e-cigarette in this category is less expensive. He believes that although the category is currently experiencing average growth, it is expected to develop well in the future;

- The fourth is open system, which has a relatively stable market share and is popular among many mature consumers.

The anticipated e-cigarette licensing application cost is expected to be extremely high, but it will not be immediately implemented.

Regarding the comprehensive package of laws passed by Russia on May 12, which include online sales restrictions and offline display bans, some parts of this legislation have come into effect on June 1. On June 1, the "Regulations on the Production and Distribution of Tobacco Products and Raw Materials" passed its second and third readings in the State Duma, requiring the importation and production of e-cigarettes in the country to be accompanied by a license. In response to the series of e-cigarette regulations implemented by Russia, Lev believes that these new policies are beneficial for promoting industry legalization but currently suffer from inadequate regulation.

Lev believes that obtaining an e-cigarette license is not an easy task, as the number of companies able to acquire such permits will be limited in the future, leading to extremely high application costs. Lev offered an explanation using his own experience with the BABYLON brand. He stated that when they were operating the JUUL e-cigarette brand, they had to obtain a liquor license because one of their mango-flavored products required the use of alcohol. The government imposed hefty fees for this particular permit.

Although there is currently no confirmed information, based on the situation with alcohol licensing, it is expected that the price of tobacco licensing could reach up to one million rubles," said Lev.

However, he optimistically stated that September 1st may not necessarily be the final deadline for the new policy. "The implementation of the new policy is a gradual process," he said.

In regards to whether BABYLON, an online business, has been affected by the "online sales ban," Lev stated that as of 2020, Russia has had regulations in place prohibiting the online sale of nicotine products. Since then, BABYLON has implemented a system where customers can make their purchase online and pick up their products offline, which is not significantly different from in-person purchases. However, lax enforcement has allowed for some online sales to still occur. Starting from June 2023, Russia officially banned the online sale of e-cigarettes, and currently, BABYLON has transitioned all of its products to the offline pick-up model.

Offline retail outlets are facing an oversupply situation, and the withdrawal of small retailers is not expected to affect the market.

When discussing the potential risks that the Russian e-cigarette market may face in the future, Lev points out three main possibilities. Firstly, the Russian government may ultimately ban e-cigarette flavorings. Secondly, there is a likelihood that the government could restrict or prohibit the use of nicotine salts. Lastly, an increase in e-cigarette consumption tax is also a possibility, with the aim of reducing the number of consumers. Lev stated, "If the government does not take an extreme approach, the market will continue to develop, but the retail price of products will rise, leading to a gradual slowdown in the growth of e-cigarettes.

However, overall, Lev holds an optimistic view on the future development of the e-cigarette market in Russia. He believes that despite legalization leading to a contraction in the gray market, a decrease in overall sales outlets, and an increase in product prices, the total sales revenue will show an upward trend due to the higher unit price. In addition, there is currently an oversupply of offline retail outlets, so the exit of surplus small retailers from the market will not have a significant impact.

Finally, Lev concluded that the ultimate development of the industry depends on the direction of policies. The clarity of the future direction of the industry's development still needs to wait for the implementation of relevant laws.

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.