By Jerusalem Post - Among 25 OECD countries, Israel is the only one to levy heavier on HTP and vaping products than traditional tobacco products, the difference is 6%.

Odd, isn't it? According to the editorial by Jerusalem Post, Israeli tax regulation is standing in the way of the shift to healthier nicotine to stop smoking cigarettes, and move toward alternatives like vaping.

photo credit: ILLUSTRATIVE PEXELS

According to the Health Ministry, the percentage of smokers in Israel has remained at a static 20% for years, despite the steady growth of the population. That means that the number of smokers in Israel is rising hand-in-hand with the number of people living in the country.

Israel’s reliance on combustible cigarettes is slightly bizarre at a time when dozens of other developed nations around the world are making the switch to more innovative methods of tobacco consumption; namely vaping. Why is it that Israel – otherwise known for its innovative approaches to widespread issues – is lagging so far behind the rest of the developed world when it comes to smoking reduction?

All tobacco use is harmful — but smoke is the worst part

However, vaping nicotine is not good for you either. It is empirically bad for your health.

With that said, vaping might have a marginal advantage over smoking, in that, according to some studies, it can reduce the risk of nicotine poisoning and the amount of harmful chemical intake and second-hand inhalation for those around the user.

INDEPENDENT STUDIES performed by the English government public health agency Public Health England and the Tobacco Advisory Committee of the UK Royal College of Physicians, say vaping is as much as 95% healthier than smoking. Other experts claim that vaping is just as dangerous as regular smoking.

The vaping tax situation

In Japan, the overall taxation on combustible cigarettes as of 2020 was 61%; the taxation on heated tobacco products (HTP) was 52.14%. That 9% difference in the taxation on cigarettes vs HTP has played a significant role in over 22% of adult male smokers making the switch to the less unhealthy option.

Similarly, in Denmark (which boasts a 154% difference in favour of HTP), the UK (73%), Germany (123%), Italy (107%) and a bevvy of other nations, the number of cigarette smokers has fallen in concert with the more favourable taxation of heated tobacco products.

As previously established, Israel’s percentage of smokers has remained stable (and therefore the number of smokers in the country is rising with its population count). Why?

In a list of 25 (out of 39) OECD nations, Israel is the only country which taxes HTP at a higher rate than it does combustible cigarettes, by 6%.

“In order to be successful on the journey [to a smoke-free world], a lot of things need to happen which, in other countries, are happening; but in Israel, they are not,” said Amit. In that sense, he pointed out, “Israel has failed where other countries have been successful.”

New Zealand was there, too

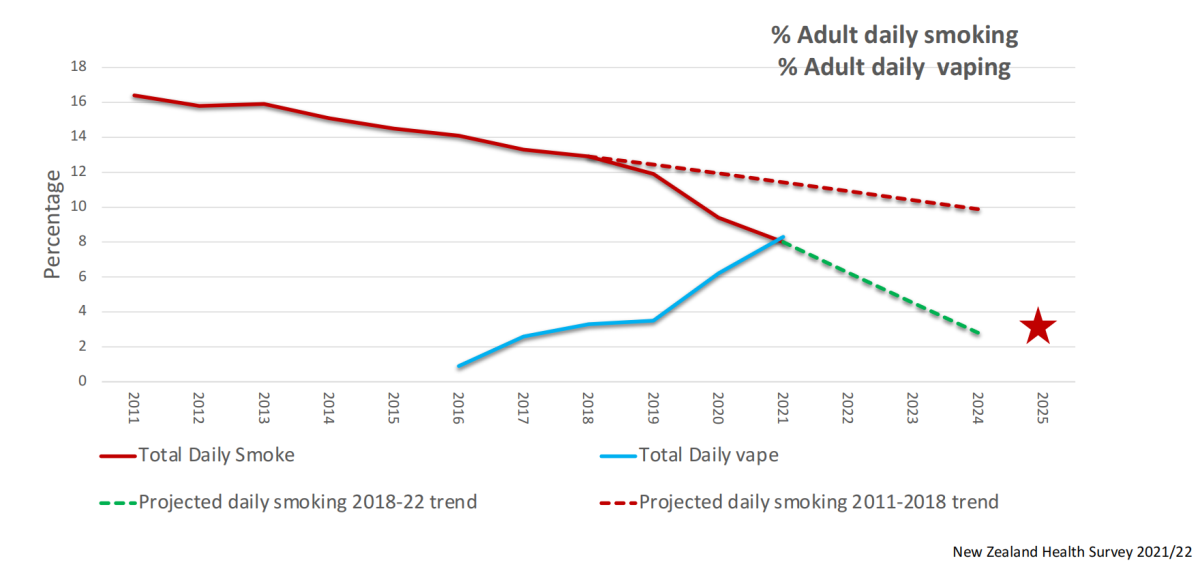

Aotearoa New Zealand’s government has tabled some of the world’s most aggressive tobacco control policies with an explicit focus on smoked tobacco. Endgame legislation proposes to remove nicotine from all smoked tobacco, drastically reduce supply by 95%, and ban the sale of smoked tobacco to anyone born after January 2009. But the country is pro-vaping so the converting rate is high, and today New Zealand's total smoking rate is a record-breaking 8%.

source: NewZealand Health Survey 2021/22

2FIRSTS will present a review on how New Zealand has made this progress.

Also read:

South Africa’s Proposed Vape Tax Will be a Set Back For Local Stop Smoking Efforts

Tobacco tax may be associated with higher e-cigarette use among young people

*The content of this article is written after the extraction, compilation and integration of multiple information for exchange and learning purposes. The copyright of the summary information still belongs to the original article and its author. If any infringement is found, please contact us to delete it.